Transfer of business address in the Philippines

The company address provides information about the course of the company. Since it impacts operational accessibility to your audience and marketplace, you may want to know how to process it conveniently.

Contents

- How to Transfer Business Address in the Philippines

- Transfer of Business Address – IMPORTANT Things to know

- SEC Requirements for Change of Business Address Philippines

- Barangay Change of Business Address should start with Retirement

- Business Permit Change of Address must also start with Retirement

- How to change business address in BIR

- Transfer of Business Address to new Barangay

- Transfer of Business Address to new City Hall

- Change of Business Address: Summary of Important Points

How to Transfer Business Address in the Philippines

The process of how transfer business address in the Philippines starts at the SEC but must also be accompanied by registering that change at the Barangay, City Hall and BIR Revenue District office.

Process/requirements for change of address:

- SEC Amended Articles of Incorporation with a change of address

- Retirement at Barangay Level

- Retirement at City Hall Level

- Closure at the current Bureau of Internal Revenue (BIR) office

- Opening at the Barangay

- Opening at the City Hall – this is the business permit change of address

- Opening at the new BIR RDO office

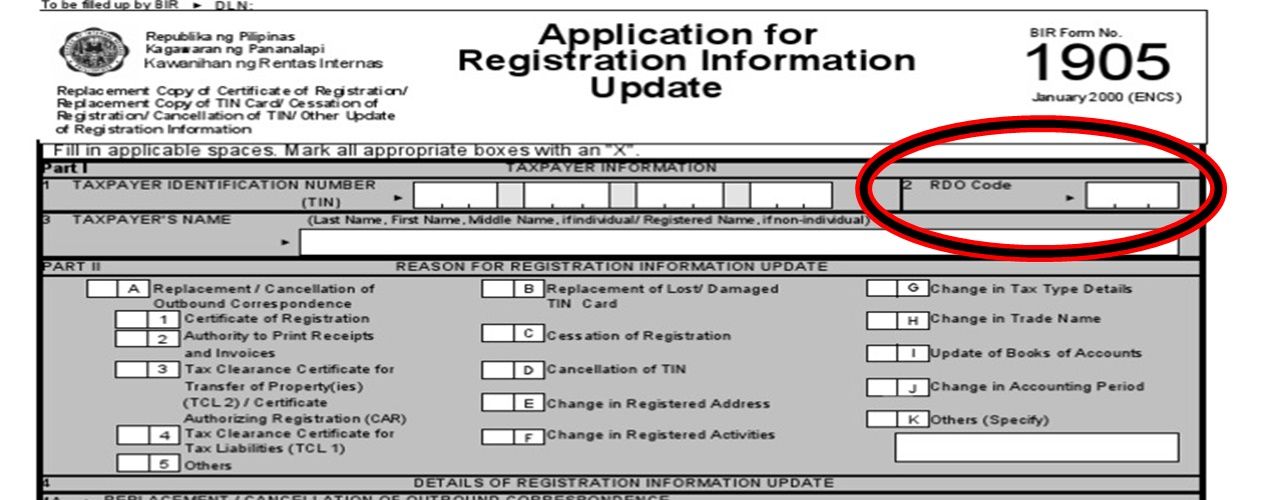

There are a few steps in transferring your business address and you might be needing documents such as form 1905 for transferring to a new RDO.

In terms of timeline, expect that it will take about 6 months or longer if the company has open cases in the BIR.

Let’s go through each step in detail.

Transfer of Business Address – IMPORTANT Things to know

Foreign clients are shocked at the amount of work it takes for a change of business address when they realize that it is more work than the actual process of incorporation in the Philippines.

That is because a transfer of business address is double the work of incorporating in the Philippines.

Not only do you have to do registration at all the barangay, city hall and BIR, but you also need to retire the business at each of those levels – and that BIR includes a BIR audit.

In most cases, BIR is the most demanding agency along the process because of its tough nut-to-crack process of validation.

The BIR Audit is triggered because the BIR will only allow you to retire the business when you have settled all your pending issues with the BIR.

What if you have fully complied?

Well, the BIR may have incomplete record keeping and may say that some of your company reports were missing.

In that case, print proof that it was submitted and present it to them.

Or they may say that the tax remitted was wrong.

Sometimes, they may decide to open a full audit and check everything.

When this happens be ready to present a Philippine tax lawyer so that they can present your side in the best possible light.

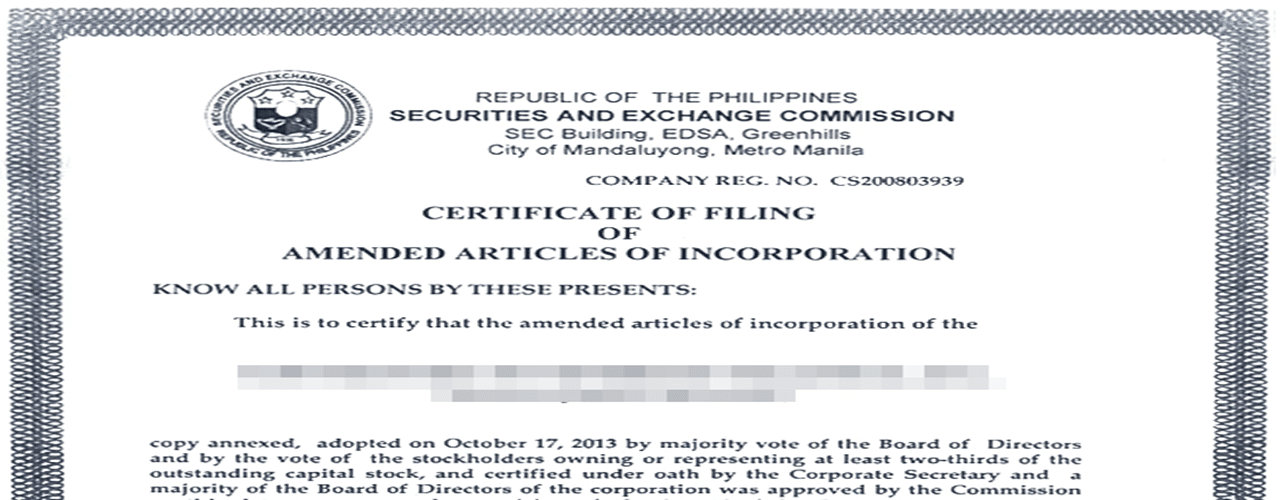

SEC Requirements for Change of Business Address Philippines

SEC requirements for change of business address Philippines just is an amendment to the Articles of Incorporation.

Articles of Incorporation are legal proof that a company is established within the state, and failure to do so is subject to penalize by SEC for violating state law.

Note please that this should be done even if the transfer of business address is merely a move to another building in the same city.

It should be done within 15 days of the company moving to the new location, as otherwise, the company may face fines.

Full list of SEC Requirements for Change of Business Address Philippines

- Amended Articles of Incorporation and By-Laws

- Board Resolution signed by the majority of the directors/trustees certifying and identifying the amendments, with the date and place of the stockholder’s meeting and each signatory’s TIN

- Notarized Secretary’s certificate

- Certificate of Incorporation

- General Information Sheet

- 1st Page of Registration of Stock and Transfer Book

- Latest Original Certified True Copy (CTC) Financial Statements and Income Tax Returns with BIR stamp

- Other government agencies’ clearances, as applicable

These SEC Requirements for Change of Business Address Philippines can be submitted to the SEC online for preprocessing and computation of the exact amount to be paid.

The fee can be paid through the SEC cashier, online or at an accredited landbank branch.

Then, the hard copies of the documents and the proof of payment can be submitted to an SEC branch or office.

After the SEC has processed everything, the SEC will inform as to the date of pickup of the Certificate of Amended Articles of Incorporation.

In general, expect that the process at the SEC will take 3 or so weeks.

(Remember that the processing of all these requirements for change of address is still mostly manual, so the process can be very slow.)

Barangay Change of Business Address should start with Retirement

Application for business retirement is easy as ABC!

You must retire the business at the Barangay as part of the transfer of business address.

This is generally quite easy.

The Barangay requirements for retirement are:

- Original Barangay Clearance, and several copies

- Letter of Request for Retirement

- Special Power of Attorney

The Barangay process is simple – there are very few requirements really needed and processing can be quick.

It is basically presenting your documents and paying the Retirement fee.

It is possible to receive the Certificate of Closure on the same day.

It can also be however that you may need to come back for the Certificate of Closure.

Business Permit Change of Address must also start with Retirement

The City Hall Business Permit change of address also starts with retirement.

It is a must-do if you want clean records and to avoid incurring penalties despite the hassle.

This is a more involved process than at the Barangay because more documents are needed and the process is longer.

Also, note that this must be done 30 days after amending the articles of incorporation to start the Business Permit change of address. If not done during this time, you will face a penalty.

You will need to prepare the following requirements for the change of address at City Hall:

- Certification from the Barangay of the Retirement of the Business

- Notarized Application Form

- Letter request for retirement

- Original Mayor’s Permit and associated receipts

- Notarized Board Resolution if corporation or affidavit of closure if sole prop/partnership

- Articles of Incorporation, amended if any amendments

- Gross Sales certified by an accountant for the current year

- BIR VAT Returns and Income Tax Returns for the current year

- Audited Financial statements and income tax returns for the past 3 years.

- BIR Certificate of Registration

- Cedula/CTC for the past 3 years

- Affidavit of no operation, if the business is not operating

- Special Power of Attorney for the liaison

- Contract of Lease

- Books of Account

- If you have branches in other cities, you will need to show proof that the tax was paid to the LGUs in those cities

You must ensure that the company address used for incorporation is a commercial address. Otherwise, it may take you to a tight spot.

Comparing the barangay process and the business permit change of address process, it’s obvious that the process is much more involved at this stage.

As with the barangay, there is also a retirement fee.

At the end of the process, you will get a Certificate of Closure.

This City Hall process can take 3 or so weeks.

How to change business address in BIR

BIR Requirements for change of business address are lengthy – not because just because there are several documents, but because the process kicks off a BIR audit.

And as anyone who has ever been involved in a BIR audit knows, the BIR is very bureaucratic.

It is possible to process this like clockwork! You just need to prepare any documentation you may need to provide as evidence when audit issues arise.

This bureaucracy tends to make an audit a long and arduous process for which it is best that a Philippine tax lawyer is called.

(And for which your record keeping must be impeccable.)

BIR Requirements for a change of business address are first geared toward retiring or closing the business at the current BIR branch.

These requirements are:

- BIR Form 1905, 2 copies

- Inventory of unused sales receipts, invoices, and all unutilized accounting forms such as vouchers, credit memos, POs and the like and the actual sales receipts etc., etc.

- Original of Business Notices and Permits such as the Authority to Print, Accreditation and Permit to Use for POS, Notice to Issue Receipt/Invoice, and Certificate of Registration

- Board Resolution or Notice of Dissolution

- Special Power of Attorney

- Accounting records

The process of how to change business address in BIR is this:

You can do it in the nick of time if you have operated smoothly the government transactions of your business.

- Fill out 2 copies of BIR 1905 and gather all above listed BIR Requirements for change of business address

- Go to the RDO branch with jurisdiction over the business

- Submit the documents at the Registration Counter.

- BIR Assessment Division will compare sales invoices and receipts to all unused sales invoices and receipts and do the same for the other document inventories you have. These will be forwarded to the Committee on Destruction and Disposal so that they can be disposed of.

- BIR will also check for open tax cases for which you must either present proof that these were settled or pay the liability.

- BIR will check at the local level and also at the national level.

- If there are no other liabilities, you can get the Tax Clearance

When this process is complete, you can head off to the new BIR RDO that has jurisdiction over your new business address and you can register your business there.

Depending on the circumstances of your retirement, it may take a year or more, especially if you have an “open-case” at the BIR level.

However, expect that the BIR change of business address will likely take months or in some cases years.

(Yes, even if you have perfect accounting records. I’ve seen businesses with really excellent accounting teams undergo the same process.)

When the BIR alleges a missing report, show them the report and proof of payment.

When the BIR alleges an incorrect filing, present your evidence and ask a Philippine tax lawyer to represent you.

Just keep going – make sure your files are in order, get good advice, and work with a Philippine tax lawyer.

It will make life simpler.

At the end of the process, you will have been transferred to a new RDO branch.

(This is why I always say that a change of business address is much harder than incorporation in the Philippines, which can really shock my foreign clients.)

Transfer of Business Address to new Barangay

The clearance fee is Php 25 but it may vary for every barangay but usually less than Php 100 only.

You must also register your business at the Barangay where the new corporate address is located in.

The Barangay Clearance Requirements are very simple:

- Application form

- DTI Certificate

- Community Tax Certificate

- Special Power of Attorney

- Fee

The process also is pretty simple.

Submit the documents.

Pay the business clearance fee.

Receive your Barangay Business Permit. Each Barangay has a different look for the Barangay Business Permit. There will be a different letterhead or seal.

But the information should be the same – the business owner, the business name, the address and date and the certification.

This process may only take a few days.

Transfer of Business Address to new City Hall

Once you have your closure certificate in your barangay, you can go directly to City Hall if you have met all the requirements.

After you have the Barangay Clearance, you can now complete the business permit change of address process by registering at the new City Hall for a new Business Permit.

Business Permit List of Requirements:

- Original Barangay Clearance

- Notarized Application form for New Business

- DTI Registration / SEC Registration

- Lease Contract / Tax Declaration if owned

- Cedula

- Public Liability Insurance

- SPA for Authorized Representatives

- Zoning Clearance

- Fire Safety Inspection Permit

- Sanitation Permit

- Registration Fee

Registering for a BIR business permit takes a lot of work because you will have to get the zoning clearance, fire safety inspection and sanitation permit before the mayor’s permit.

This takes a bit of work.

Yes, they are usually in the same building and that does help. Just be prepared to do a lot of legwork and processing.

The process itself is fairly straightforward in that you gather all the requirements at each office.

Then submit the requirements to the Business Permit and Licensing Office.

If the retirement took you so long over a year, your business is considered legally operational and should renew your permits until it’s officially closed.

If you have fully complied, the release of the Mayor’s Permit will be ready in a few days.

Congratulations! You’ve completed the full business permit change of address process, from retirement to registration at the major entities.

Please remember to complete a transfer of business address also at Pag-ibig, Philhealth and SSS to fully transfer all employee accounts.

Change of Business Address: Summary of Important Points

A transfer of Business Address is not just changing an address – it’s actually closing a business at local units and then transferring BIR RDOs through a BIR Audit.

Don’t put your business to be in deep water you can seek the guidance of corporate lawyers who already know the ropes!

You don’t just change the line where it says “Address”.

And as you can see from above, a transfer of Business Address is so much more work than just incorporating in the Philippines. It’s best to have a business address that is a permanent address.

A couple of things also to keep in mind – find a building that has complete documentation such as occupation permits and is actually for commercial or business use.

Don’t use a residential address.

Don’t use a condo address.

In many cases, these cannot be used for business and your Mayor’s Permit will be held up because of it.

And if you cannot get a Mayor’s Permit, you may have to find a new business address which would mean going through all of the processes I’ve listed down.

0 Comments