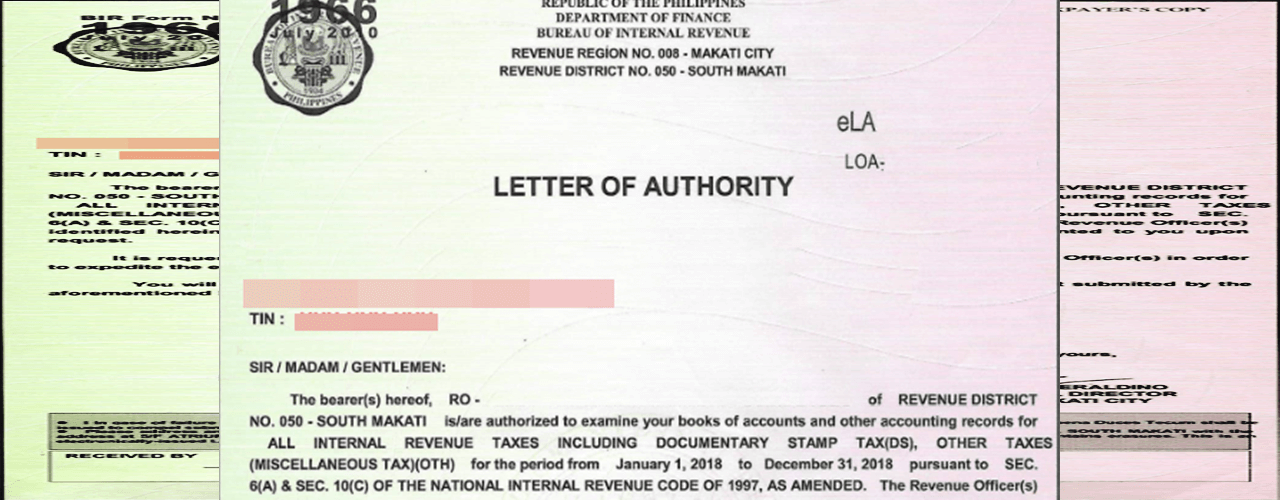

Letter of Authority for the Audit of Taxpayers in the Philippines

In the case of tax assessments, examination without a valid Letter of Authority are void and may be withdrawn in court.

The Letter of Authority from the BIR is a pivotal document in the audit and assessment of a taxpayer’s liabilities.

It can be the hinge upon which the case turns upon litigation at the Court of Tax Appeals.

Contents

- Letter of Authority BIR: What is it?

- What does a Letter of Authority from the BIR empower the revenue officer to do?

- Letter of Authority BIR: Effectivity Period

- Letter of Authority BIR: Period Covered for Audit

- What is the consequence of an audit conducted with an invalid Letter of Authority?

- How does a taxpayer raise the defense of invalid Letter of Authority?

Letter of Authority BIR: What is it?

It is the Commissioner’s power to interpret tax laws and adjudicate tax cases.

It is the written authority issued to a revenue officer for him to examine a specific taxpayer’s books of account and other accounting records and determine the taxpayer’s correct tax liabilities for the purpose of collecting the correct amount of tax. A Letter of Authority is the first step in the government’s audit of a taxpayer.

This authorization from the Commissioner of Internal Revenue (or her authorized representative) is a statutory requirement. A revenue officer must have a LOA for him to conduct an examination or issue an assessment. [i]

The LOA also formally informs the taxpayer that it is under audit for possible deficiency tax assessment.[ii] It notifies the taxpayer that it is under investigation and designates a revenue officer to examine the taxpayer’s books and records with respect to internal revenue tax liabilities for a specific period.[iii]

A thorough understanding of general BIR audit rules and procedures is very important to avoid pitfalls on tax.

This is the only grant of authority sufficient to authorize conduct of an audit. Only a Letter of Authority is sufficient for this purpose. A mere memorandum or other documents from the BIR is not enough to grant a revenue officer the power to conduct an audit/examination.

Only the CIR or her duly authorized representative may issue the LOA. Her authorized representatives include the Deputy Commissioners, the Revenue Regional Directors, and such other officials as may be authorized by the CIR.

Audits of taxpayers cannot be made unless authorized by the CIR herself or her duly authorized representative. Other tax agents cannot validly conduct any of these kinds of examinations without prior authority. There must be a grant of authority, in the form of an LOA, before any revenue officer can conduct an examination or assessment.

If the jurisdiction is under the National Office, it is within the authority of the Commissioner of Internal Revenue`s authority to issue LOAs, while Regional Directors are authorized under the Regional Office.

The revenue officer must exercise the conduct of the audit only within the scope of the authority given. An audit that goes beyond or is without such authority is a nullity.[iv]

The assigned revenue officers must be named in the Letter of Authority. The law specifically requires that the revenue officers be named in the LOA. Revenue officers not indicated in the LOA cannot audit a taxpayer. Any audit or assessment they make without a valid LOA is void.

Further validation of tax audits or assessments may be required because it is only valid if served by according to LOA.

Thus, if a LOA specified which revenue officers would audit the taxpayer, but a BIR later issued a Memorandum of Assignment replacing them without also issuing a new LOA for the new revenue officers, any assessment made or concluded by those new revenue officers is void.[v]

[i] Section 6 and 13, National Internal Revenue Code of 1997.

[ii] CIR v. De La Salle University, Inc., G.R. No. 196596, November 9, 2016.

[iii] CIR v. Lancaster Philippines, Inc., GR No. 183408, July 12, 2017.

[iv] CIR v. McDonald’s Philippines Realty, Corp., G.R. No. 242670, May 10, 2021.

[v] Montalban Methane Power Corp. v. CIR, CTA Case No. 9408, October 18, 2019.

What does a Letter of Authority from the BIR empower the revenue officer to do?

The initial audit report is prepared by the tax officer assigned in the LOA. No substitutions are allowed as this is a process where discrepancies may be discovered upon investigation.

The BIR LOA allows the assigned revenue officer to perform assessment functions. It empowers the officer to examine the books of account and other accounting records of a taxpayer for the purpose of collecting the correct amount of tax.

That an audit conducted did not require a taxpayer to turn over its books of account does obviate the necessity for a BIR LOA. The requirement of authorization is not dependent on whether the taxpayer was required to physically open his books and financial records, but on whether the taxpayer is made subject to examination.

Thus, in a case involving a VAT deficiency assessment against a taxpayer, which specific documents were actually examined by the BIR officials was deemed beside the point.

As LOA serves as preliminary steps it must abide accordingly because audit is very crucial to every taxpayers.

A Letter of Authority could not be dispensed with in any event. It was necessary even if the audit did not involve BIR officials going to the taxpayer’s place of business and bodily examining its records. What was crucial was whether the proceedings that led to the issuance of the deficiency assessment against the taxpayer had the prior approval and authorization from the CIR or her duly authorized representatives.

In that case, the revenue officers who conducted the audit had not been authorized by a LOA. Because they had no authority to examine the taxpayer in the first place, the assessment those officers subsequently issued against the taxpayer was declared void. [i]

[i] Medicard Philippines, Inc. v. CIR, G.R. No. 222743, April 5, 2017.

Letter of Authority BIR: Effectivity Period

The entire audit process must be completed within 180 days for RDO cases or 240 days for Large Taxpayer cases from the issuance of the Letter of Authority. Non-observance of this period is counted as gross neglect of duty by the Bureau.

To be equitable for the taxpayer, the revenue officer will hold liable if fails to comply within the period.

The BIR directs is officers to serve the Letter of Authority on the taxpayer as early as possible, but its recent Circular[i] categorically states that the authority to audit remains valid and enforceable if the 180-day/240-day period to complete the same has not expired.

This changes the previous rule that the LOA should be furnished to the taxpayer within 30 days from its date of issuance or else it becomes invalid. Under the old rule, the government’s failure to furnish the LOA on the taxpayer within those 30 days could render the examination and resulting assessment of the latter ineffective.[ii]

[i] Revenue Memorandum Circular No. 82-2022, June 28, 2022.

[ii] RAMO No. 1-2000; Saga Casting and Productions vs CIR, CTA Case No. 8484, May 28, 2015.

Letter of Authority BIR: Period Covered for Audit

A revalidated LOA will have no impact on its validity if the entire audit process is within 180 days upon issunce, and administrative liability will only accrue on the erring RO.

The Letter of Authority must itself provide the period during which the revenue officers shall audit. Assessments on periods beyond the scope of the LOA are deemed without force and effect.

Revenue Memorandum Order (RMO) No. 43-90 provides that the LOA shall cover a taxable period not exceeding one taxable year.

In CIR v. De La Salle University, Inc., the Supreme Court upheld as valid the BIR LOA authorizing the examination of DLSU for “Fiscal Year Ending 2003 and Unverified Prior Years” with respect to the assessment for the year 2003.

However, the Court declared void the assessments for taxable years 2001 and 2002 because these were not specified on separate LOAs as required under RMO No. 43-90. Assessments of periods beyond those specified in the LOA are void.

What is the consequence of an audit conducted with an invalid Letter of Authority?

To avoid problem in tax matters you must remember to comply with BIR due process and requirements.

Notices to taxpayers which resulted from an audit investigation made with an invalid Letter of Authority BIR are null and void.

Because notice is an indispensable part of due process, all subsequent actions against a taxpayer which proceeded from an invalid Letter of Authority (invalid notice) are likewise invalid.

This has staggering consequences for the government’s case against a taxpayer.

Years of tax litigation, involving many millions of pesos, brought all the way to the Supreme Court can come to naught when the court dismisses a tax suit for lack of valid authority to make an audit in the first place.

How does a taxpayer raise the defense of invalid Letter of Authority?

Failure on the procedure done by the tax authority may affect the validity of an assessment can be serve as defense for the taxpayers.

An invalid Letter of Authority can be raised as a defense at the Court of Tax Appeals.

A taxpayer’s active participation in its own audit does not estop it from raising as a defense an absent or invalid Letter of Authority at the CTA.

This was the CTA’s ruling in CIR v. BASF Philippines, Inc..[i]

BASF was a company engaged in the importation and sale of basic chemicals and chemical products and providing services to foreign entities.

In December 2015, the CIR issued a Letter of Authority authorizing revenue officers to audit BASF. In April 2016, the RDO informed BASF that a different set of revenue officers would continue the audit.

In November 2016, BASF received Preliminary Assessment Notices from the Bureau to which it filed a reply. In December 2016, it received Formal Assessment Notices assessing deficiency taxes and penalties.

In January 2017, BASF’s counsel duly protested the Assessment Notices.

The following month, the counsel’s request for reinvestigation was granted by the Regional Director. BASF’s counsel met with the new revenue officers several times pursuant to the reinvestigation.

In December 2017, BASF received the Bureau’s Final Decision on Disputed Assessment, prompting its recourse to the Court of Tax Appeals.

Notice of Assessment is calculated based on the information you provide regarding your tax transactions.

The CTA ruled that the new revenue officers had acted with an invalid Letter of Authority and that the tax assessments of the Bureau were therefore null and void.

The CTA rejected the CIR’s argument that BASF having participated in the audit estopped it from questioning the new revenue officers’ authority before the CTA.

As a result, the CIR’s assessment of over 41 million pesos in deficiencies on the part of BASF was declared invalid and thrown out by the CTA.

[i] CTA EB No. 2323 (CTA Case No. 9747), August 2, 2021.

0 Comments