Tax Incentives Philippines: What Decision Makers need to Know

Tax Incentives in the Philippines were rationalized with the passage of RA 11534 or the CREATE law.

This incentive is given to certain enterprises which the Philippine government is promoting.

Major changes are:

- Fiscal Incentives Review Board (FIRB) an oversight agency

- One menu of tax incentives across all Investment Promotion Agencies such as the BOI, PEZA, etc.

- Sunset provisions for tax incentives

I’ll discuss the various possible Philippine tax incentives in detail below.

Income Tax Holiday

It is a strategic schedule of income tax holidays under the Priorities Investment Plan of 2022.

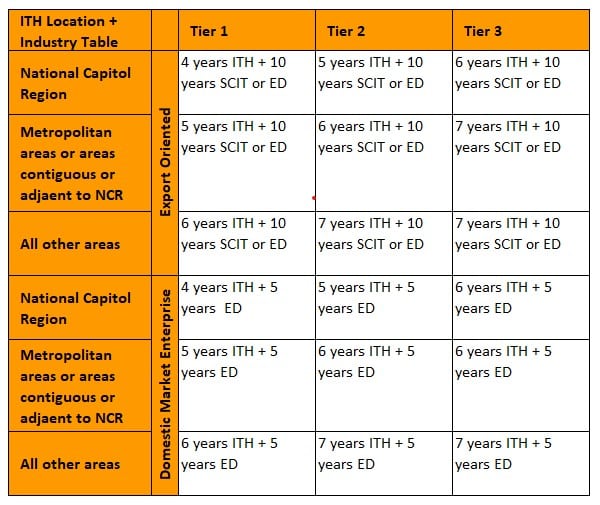

An income tax holiday is available for 4 to 7 years depending on the location and whether it falls under the Strategic Investment Priority Plan or SIPP.

The SIPP was last published on May 27, 2022, and was effective from June 11, 2022.

The SIPP – along with the location of the business – helps determine the length of the income tax holiday and attached incentives.

In Tier One all the activities are in the 2022 Strategic Investment Priorities Plan.

Agriculture is one of the dying industries the Philippines is trying to promote desperately.

Tax Incentives Philippines: Tier One

- Activities against the COVID-19 fight

- Manufacturing Activities including Agro-Processing (if Metro Manila, only modular housing components)

- Agriculture, Fishing, and Forestry (if Metro Manila, only agricultural infrastructure, support services, and urban agriculture can qualify)

- Strategic Services such as Integrated Circuit design; Creative and Knowledge-based industries; aircraft maintenance; alternative energy charging stations; telecoms; design, procurement, and construction;

- Healthcare and disaster risk management

- Mass housing

- Infrastructure and logistics

- Innovation drivers for new and emerging technologies inclusive of those under RA 11337 or the Innovative Startup Act

With the growing concern of losing fishing grounds due to the West Philippine Sea dispute, many Filipino fishermen are leaving their boats to find work elsewhere.

- Inclusive Business Models in the Agri or Tourism sectors that include SMEs as part of their value chains. These may qualify for Pioneer Status

- Environment or climate change Projects (except those under RA 11285 or Energy Efficiency or Conservation Act)

- Energy generation and battery storage

- Export Activities

- Special laws such as Industrial Tree Plantation PD 705; Mining RA 7942; Printing of books RA 8047; Petroleum products RA 8479; Rehabilitation and Self-Reliance of the Disabled RA 7277; Renewable Energy RA 9513; Tourism RA 9593; Energy Efficiency RA 11285

- Bangsamoro has its own investment priorities plan, which is fairly broad

Burgos Wind Project is the largest in the Philippines and is located in Ilocos Norte.

Tax Incentives Philippines: Tier Two

- Green vehicles such as EV assembly and parts manufacture, energy efficient maritime vessels, smart grid and renewables, energy efficiency and conservation products, bioplastics and biopolymers, integrated waste management

- Healthcare such as vaccine manufacturing or other health-related programs endorsed by the Department of Science and technologist (DOST) and Department of Health (DOH)

- Defense-related activities endorsed by the Department of National Defense (DND), Armed Forces of the Philippines (AFP), or National Security Council (NSC)

- Industrial Value Chain gaps for steel, textiles, chemicals, green metals, crude oil refining, and lab-scale wafer fabrication

- Food Security projects endorsed by the Department of Agriculture (DA), Philippine Council for Agriculture, Aquatic and Natural Resources Research and Development (PCAARRD)

National Immunization Program is one of the priority programs of the country to combat the COVID19 Pandemic.

Tax Incentives Philippines: Tier Three

- Research and Development for robotics, Artificial Intelligence, data analytics, nanotechnology, and the like

- Highly technical manufacturing such as full-scale wafer manufacturing of parts and equipment, Internet of Things, full-scale wafer fabrication, advanced materials, aerospace, medical devices, IP

- Innovation Support Facilities such as R&D hubs, centers of Excellence, Science and Tech parks, incubation, and startup hubs

Special Corporate Income Tax (SCIT)

It is hard to believe that the largest Philippine export is electronic products, not fruits despite being a tropical country.

Special Corporate Income Taxes are a 5% tax on the gross income earned for 10 years after the end of the Income Tax Holiday.

An export enterprise can elect to avail of either of the 2 Philippine tax incentives – either the Special Corporate Income Tax or Enhanced Deductions – during the application process. This option is irreversible so you must be sure of your choice.

SCIT has specifically allowable to come up with gross sales and direct costs used to calculate it.

Choosing between the two tax incentives is irreversible!

Gross sales are defined as gross sales of the registered activity net of:

- Sales discounts

- Sales returns

- Allowances

Direct costs are:

- Direct labor and Supervisory labor

- Service supervision salaries

- Direct materials, supplies, and raw materials used to produce the product

- Goods in process and finished products

- Supplies and fuels used in product

- Depreciation of equipment used in production as well as the portion of the building used in production

- Rent and utility charges in the production and handling of the goods

- Financing charges for those fixed assets used in production

There are several factors to consider when computing SCIT.

Excluded in these costs are the costs for sales and administrative expenses.

Just a note – SCIT is only available for export enterprises.

A Domestic Market Enterprise cannot avail of SCIT.

Enhanced Deductions

Enhanced Deductions are available after the end of the Special Corporate Income Tax (SCIT) and its function is to reduce taxable income so that less income tax is paid.

There are several allowable enhanced deductions qualified registered business enterprises may avail.

Tax Incentives Philippines: Enhanced Deductions allowed:

- 10% additional deprecation on buildings and 20% on equipment

- 50% additional labor expense excluding managerial, administrative, support and indirect labor

- 100% additional research and development expense related to the project/activity

- 100% additional training expense related to the project/activity for Filipino employees. This excludes onboarding, team building, executive education, professional and legal training, safety training and quality training

- 50% additional domestic input expense

- 50% additional power expense

- 50% reinvestment into any of the projects of the SIPP, within a period of 5 years from investment.

- Net Operating Loss Carryover can be deducted from 5 years immediately following the year of loss

Customs Duty Exemptions

Pursuant to Bayanihan to Heal as One Act, the Bureau of Customs issued the Customs Administrative Order No. 07-2020.

Customs Duty Exemptions are possible for capital equipment, raw materials or spare parts that are needed in production.

They must only be sourced from abroad if they are not available at a reasonable price and quality domestically.

To avail of this, a registration process must be completed.

For example, a BOI entity would submit an application with the BOI for a Certificate of Authority. There are several documentary requirements and it takes some time and effort, but it is well worth it.

Without going through this registration, the corresponding duties would apply.

VAT Exemptions

Newly registered export enterprises can enjoy the VAT exemption for a maximum of 17 years under CREATE Act.

VAT exemptions exist to remove the 12% on certain sales for those who have been granted incentives for the registered activity.

The Investment Promotion Agency (IPA) that a company registered with should annually issue a VAT zero percent certification to the Registered Export Enterprise.

This Certification will list the Registered export activity, the Tax incentives entitlement and its period, and the applicable goods and services. Note that the IRR restricted this VAT exemption only to Registered Export Enterprises.

A certificate of VAT Exemption is issued by a proper IPA.

This Certification is generally required when you ask your local vendor for a VAT-free sale, along with some of the below common documents

- Securities and Exchange (SEC) Registration

- Investment Promotion Agency (IPA) Registration

- IPA VAT Certification for the current year

- Sometimes, an Affidavit may be required as well as other documents to prove the transaction is legitimate

Your vendor will have to run this by the BIR so as to ensure that the sale will be a VAT zero percent sale. Otherwise, the vendor runs the risk that the sale will be considered by the BIR to which VAT should have been applied.

A copy of the Certificate of VAT exemption must be submitted to the BIR for the application of VAT zero rate.

Note that now, it is not their location in the freeport or ecozone that entitles the enterprise to a VAT-free transaction.

Instead, it is now the fact that the enterprise has been granted Philippine tax incentives under the SIPP. The VAT Exemption is only for the registered activity – so in practice, you might have to use an allocation to determine the correct amount that is VAT zero-rated.

So, a vendor for water may require you to state the percentage allocation to be applied on the bill for the VAT exemption.

VAT Exemption is not for all!

Note also –

Specific enterprises were not allowed VAT zero ratings even if they are accredited by the IPAs as per RMC No. 24-2022.

These are:

- Customs brokerage;

- Trucking services;

- Forwarding services;

- Janitorial services;

- Security services;

- Insurance;

- Banking and other financial services;

- Consumers’ cooperatives;

- Credit unions;

- Consultancy services;

- Retail enterprises;

- Restaurants; and

- Others as stated by the FIRB

IPA Registration does not guarantee a VAT Zero Rate for certain services like trucking services.

As VAT exemptions under the CREATE Act become standard practice, it will be interesting to see how the BIR will consider these things under an audit.

BIR audits are very bureaucratic – any deviation from the norm or any grey area can become very contentious.

Foreign Investments in the Philippines in a Nutshell

Setting up business in the Philippines is very attractive, mainly due to the large, English-speaking population.

With tax incentives, investment in the Philippines is on for a great start.

Income Tax Holidays or other tax incentives assist as the company sets up. They can make the first few years easier and less difficult.

Admittedly, RA 11534 or CREATE is a big change from the various tax incentives of the previous system.

Aside from harmonizing the tax incentives, there is an emphasis on incentivizing the registered activity. There is also a sunset provision now, on all Philippine tax incentives.

Despite this, foreign investment continues to thrive.

However, the CREATE Act included sunset provisions depending on the tax incentives availed.

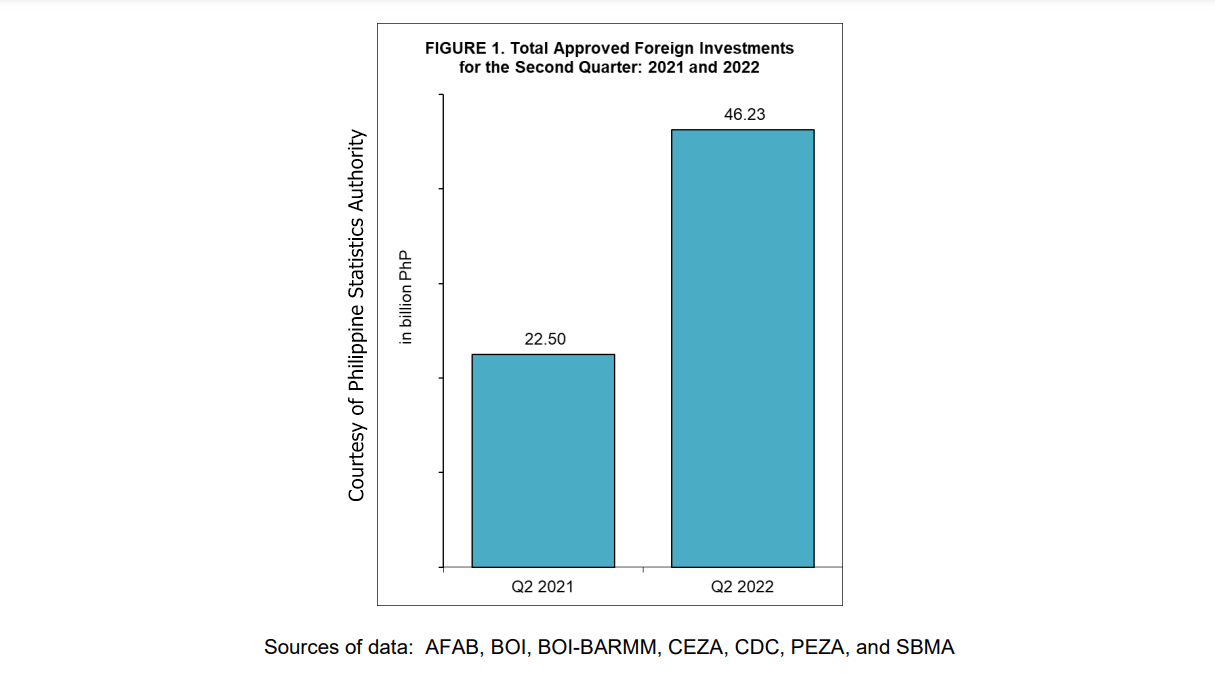

Foreign investment in the Philippines in 2Q 2022 improved to 46.23B vs 22.5B in 2021 – after the CREATE law was implemented.

Let me give you a quick snapshot of the highlights:

Still, many countries are holding back investments in the Philippines due to political uncertainties largely affected by the latest election result.

Investments from 3 countries mostly drove the activity:

- Netherlands PHP 19.04 billion at 41.2%

- Singapore PHP 15.89 billion at 34.4%

- Japan at PHP 6.51 billion 14.1%

In terms of industry – Real estate and transportation received PhP 19.30 billion or 41.7 percent while Transportation and Storage received PhP 14.52 billion or 31.4 percent. Manufacturing was 3rd at PhP 6.15 billion (13.3%).

73.4% of the investment mostly went to projects in Central Luzon with the remainder concentrated in Central Visayas and CALABARZON.

Application processes for tax incentives in the Philippines vary depending on the type of RBEs.

So, yes, the CREATE law does not seem to have adversely impacted foreign investment in the Philippines.

In terms of applying for the incentives, the various IPAs are not entirely the same in the process.

It does consist of mainly submitting SEC documents and various requirements, but it can be tedious and time-consuming to do – we’ve done it often for our clients, and there can be a lot of back and forth.

0 Comments