PHILIPPINE ESTATE TAX AMNESTY EXTENSION UNTIL JUNE 2025

The payment of estate tax is one of the final steps to transferring the property

The Philippine Estate Tax Amnesty extension allows transfers of inherited land to new owners for a fixed 6% estate tax at reduced requirements.

Paying estate tax is necessary so that a title can be transferred to the new heirs or owners.

Without paying the estate tax, property will remain in the name of the original owner.

In this article we discuss:

- Why filing for Estate Tax Amnesty is important

- Estate tax amnesty coverage

- When, Who and Documentary Requirements to file Estate Tax Amnesty

- Installment payments and Payment of Estate Taxes prior to Settlement

Let’s start.

Why is filing for Philippine Estate Tax Amnesty important?

Transfer of ownership will not be allowed if the estate tax is not paid

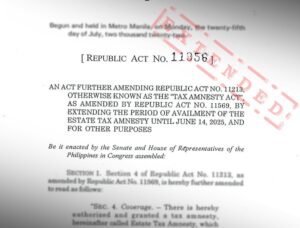

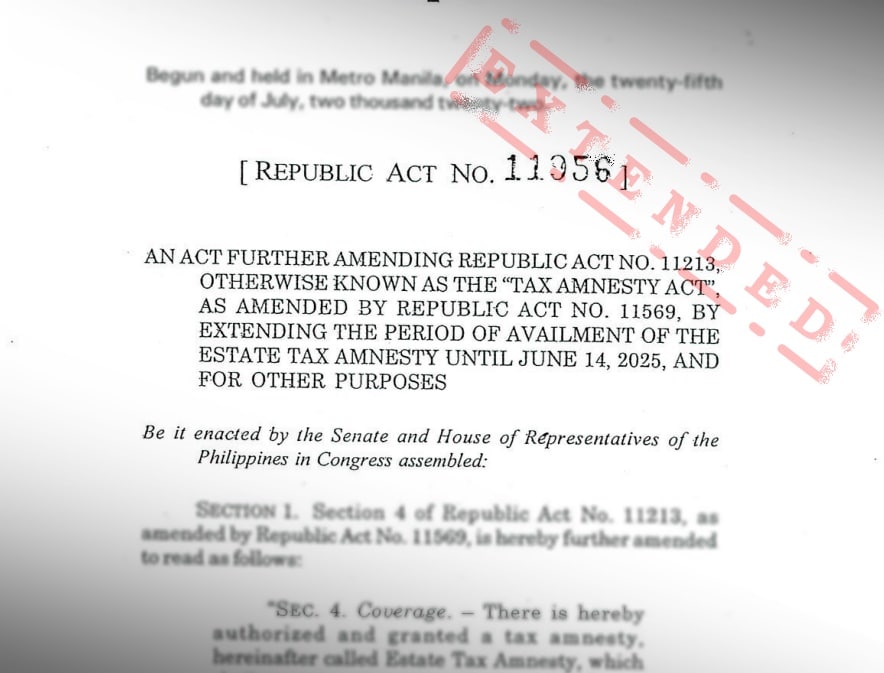

The Philippine estate tax amnesty law has been extended for a second time.

Republic Act No. 11956 became law on August 5, 2023.

It extends the inheritance tax amnesty until June 14, 2025. It also reduces Philippine estate tax amnesty documentary requirements and provided other important amendments.

The Philippine estate tax amnesty law fixes at 6% the rate at which qualified estates are taxed. It also relieves them from the interest, surcharges, and penalties for failure to pay the inheritance tax in the past.

The Philippine estate tax amnesty offers a real solution to a problem that many Filipino families face.

It is very common, when the parents pass away, for the children not to pay the inheritance tax nor complete the steps to transfer legal title to the family properties. Instead, the children reach an informal arrangement on who will use the family property without really settling their parents’ estates.

For many Filipino families, the amnesty provides a workable solution to a dilemma.

Although convenient in the short run, this arrangement ultimately becomes a problem. This is because the estate tax is incurred upon the death of the owner. Payment of that tax is a prerequisite to transfer title. New ownership of the properties cannot be registered until the tax is paid.

If unpaid, the estate tax becomes subject to interest, surcharges, and penalties, which accrue year after year. In time, the math of these penalties makes it impossible for the families to ever settle the estate and sell or dispose of the properties, effectively locking these assets away from the economy.

The extension gives Filipino families this last chance to avail of an amnesty from these accrued interests, surcharges, and penalties.

What is covered by the Philippine estate tax amnesty extension?

This benefits estates whose unpaid penalties have exceeded the actual value of the property involved

Estates of decedents who died any time on or before May 31, 2022, with or without assessments, whose estate tax has remained unpaid or accrued as of that date are covered by the amnesty.

What properties are not covered by the Philippine estate tax amnesty extension?

Estates with pending court cases not due to corruption are still covered by the Philippine estate tax amnesty

There are certain properties which were excluded by R.A. No. 11213, the original estate tax amnesty law. The law extending the Philippine estate tax amnesty continues to exclude those properties.

Those are properties involved in pending court cases on allegations of corruption, as follows:

- Properties falling under the authority of the Presidential Commission on Good Government (PCGGG).

- Properties deemed unexplained or unlawfully acquired wealth under the Anti-Graft and Corrupt Practices Act (R.A. 3019) or the Plunder Law (R.A. 7080);

- Properties involved in violations of the Ant-Money Laundering Act (R.A. 9160);

- Properties subject to tax evasion and other criminal cases under the National Internal Revenue Code;

- Properties involved in frauds, illegal exactions and transactions, and malversation of public funds under the Revised Penal Code.

These properties are not covered by the estate tax amnesty.

When should the application for Philippine estate tax amnesty be filed?

It is advisable to start the process with the BIR as early as possible.

The sworn application for the Philippine estate tax amnesty should be filed on or before June 14, 2025.

Who can file the application for Philippine estate tax amnesty?

If the heirs are foreign based, they should authorize a representative by executing a duly notarized and apostilled special power of attorney

The following can apply for Philippine the estate tax amnesty on behalf of the estate:

- Executor or Administrator of the estate

- Legal heirs

- Transferees or beneficiaries

This last is of particular interest. This means that the application to avail of the amnesty can be filed even by third parties.

For example, if the heirs previously executed an extrajudicial settlement with deed of sale – but never paid the inheritance taxes – the buyer of the property can now avail of the Philippine estate tax amnesty under the new law. In this way, the buyer can spare the property from prohibitive inheritance taxes and penalties left unpaid by the heirs from whom they purchased it.

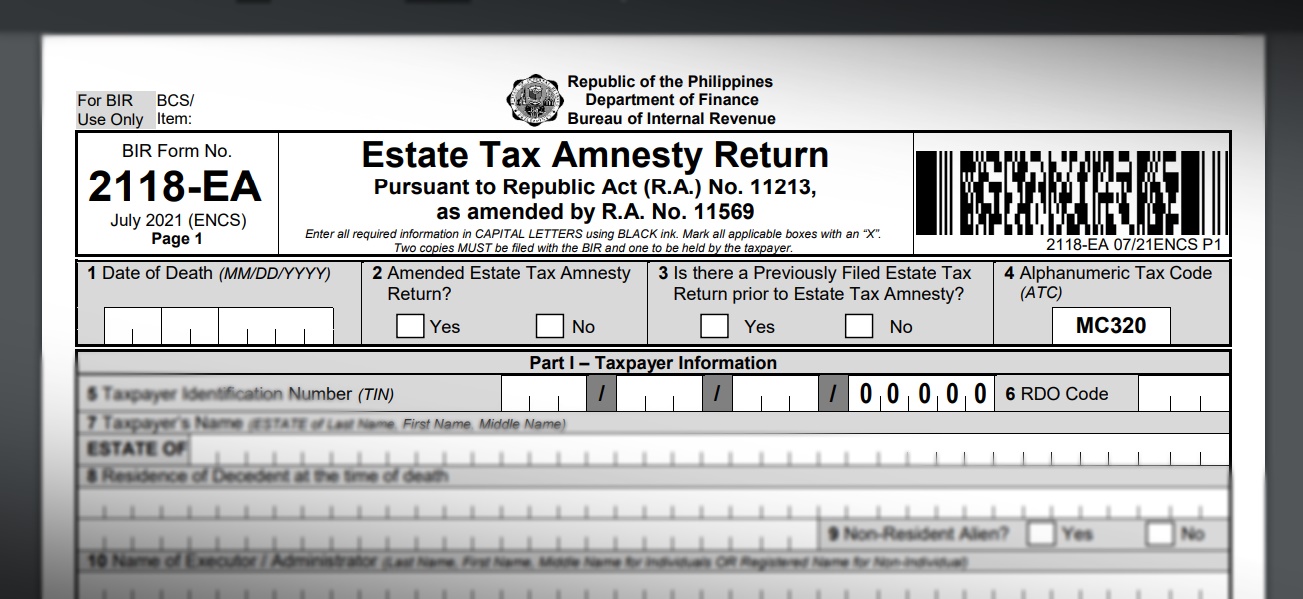

What do you file to avail of the Philippine estate tax amnesty?

The filed BIR form 2118-EA must be submitted to the ONETT along with the rest of the documents and receipts for the processing of eCAR

The applicant must file a sworn Philippine Estate Tax Amnesty Return (ETAR) which may be filed with an Authorized Agent Bank, the Revenue District Office (RDO), or through an Authorized Tax Software Provider.

What are the documentary requirements to avail of the Philippine estate tax amnesty extension?

There can be additional requirements and processes if the original documents have errors specially with the names, dates and places.

The duly accomplished and sworn ETAR, together with the Acceptance Payment Form and the complete documents, shall be presented to the appropriate Regional District Office of the Bureau of Internal Revenue (BIR).

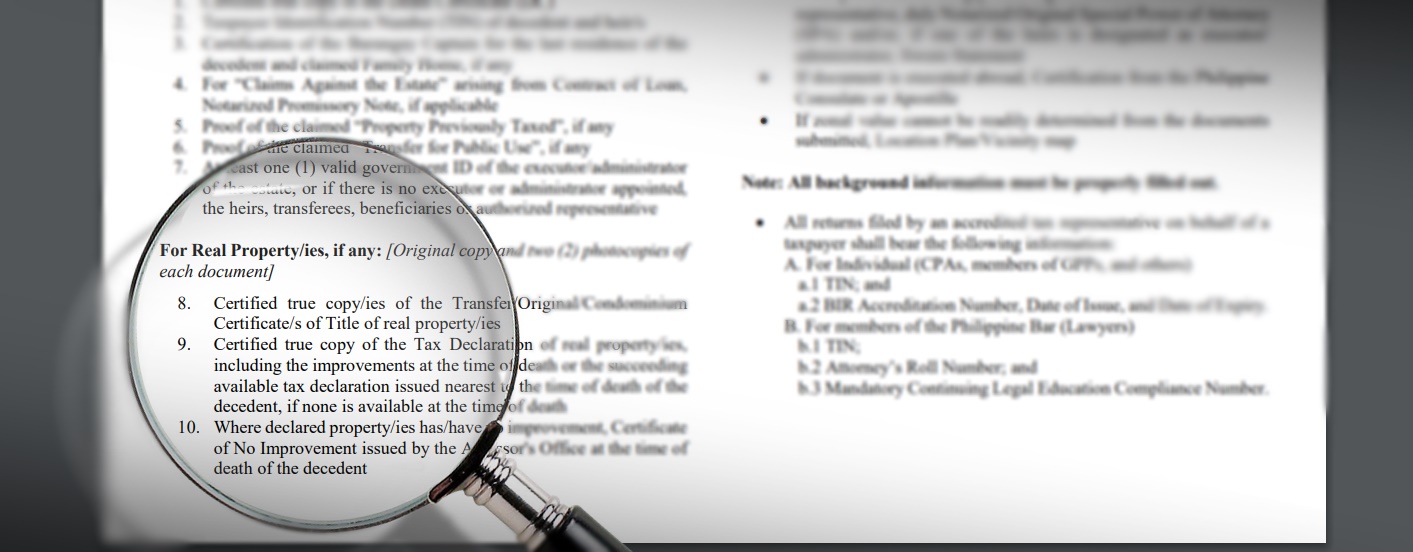

To make the Philippine estate tax amnesty as accessible as possible, the Implementing Rules of the new law limits the required documents to the following:

Mandatory Requirements:

- Certified True Copy of the Death Certificate (DC) or if not available, the Certificate of No Record of Death from the Philippine Statistics Authority and any valid secondary evidence including but not limited to those issued by any government agency/office sufficient to establish the fact of death of the decedent;

- Taxpayer Identification Number (TIN) of decedent and heir/s;

- For “Claims Against the Estate” arising from contract of loan, notarized promissory note, if applicable;

- Proof of the claimed “Property Previously Taxed”, if any;

- Proof of the claimed “Transfer for Public Use”, if any; and

- At least one (1) government issued identification card (ID) of the Executor/Administrator of the Estate, or if there is no executor or administrator appointed, the heirs, transferees, beneficiaries or authorized representative.

Some cities and municipalities require the full payment of delinquent real property taxes before they issue the certified copies and certifications.

For Real Property/ies, if any:

- Certified true copy/ies of the transfer/original condominium certificates of title of real property/ies;

- Certified true copy of the tax declaration of real property/ies, if untitled, including the improvements at the time of death or the succeeding available tax declaration issued nearest to the time of death of the decedent, if none is available at the time of death; and

- Certificate of No Improvement issued by the assessor’s office at the time of death of the decedent, if applicable

- For Personal Property/ies, if applicable

- Certificate of Deposit/Investment/Indebtedness owned by the decedent alone or decedent and the surviving spouse, or decedent jointly with other;

- Certificate of Registration of vehicle/s and other proofs showing the correct value of the same;

- Certificate of Stocks;

- Proof of valuation of shares of stock at the time of death; or

- Proof of valuation of other types of personal property.

Authorization letters or a Special Power of Attorney is needed if a representative will do transaction

Other Requirements, if applicable

- Duly notarized original Special Power of Attorney (SPA), if the person transacting/processing the transfer is the authorized representative or one of the heirs, designated as executor/Administrator;

- Certification from the Philippine Consulate or Apostille, if the document is executed abroad; or

- Location Plan/vicinity map if the zonal value is not readily available.

Provided, however, that in the absence of the abovementioned documents, the Commissioner may request for alternative documents, as may be deemed appropriate.

Within five (5) working days from the receipt of complete documents, the concerned RDO shall either endorse the APF for payment of the Philippine estate amnesty tax with the Authorized Agent Banks (AABs), Revenue Collection Officers (RCOs), or authorized tax software provider, or shall notify the taxpayer in case there is any deficiency in the application. Only the duly endorsed APF shall be presented to and received by the AAB, RCO or authorized tax software provider.

Proof of settlement of the estate, whether judicial or extra-judicial, need not accompany the ETAR if it is not yet available at the time of its filing and payment of taxes, but no electronic Certificate Authorizing Registration (eCAR) shall be issued unless such proof is presented and submitted to the concerned RDO.

Does the estate have to be settled before the BIR will accept payment of the taxes?

Estate Tax and property distribution planning must be done with the advice of a professional estate lawyer.

The Philippine estate tax amnesty extension allows the estate tax to be paid even without a judicial or extrajudicial settlement of the estate in which the decedent’s properties are distributed among the heirs.

Under the first iteration of the Philippine estate tax amnesty, the heirs had been required to resolve the distribution of the estate among themselves before they were allowed to pay the tax. This was a serious obstacle to availing of the amnesty because the heirs often could not agree on how to divide the properties.

The current law allows an applicant for the Philippine estate tax amnesty to pay the taxes even if the distribution of assets has not yet been agreed among the heirs. It allows the government to issue an assessment of the estate tax and to receive the tax payment even without the estate having already been settled. Thus, the Philippine estate tax amnesty can be availed of to pay the estate tax and avoid fines in the meantime.

Under the Philippine estate tax amnesty, the Application for Payment of Estate Taxes is distinct from the Application for Transfer of Properties. The settlement of the estate is required only for the issuance of the electronic Certificate Authorizing Registration (eCAR) for the transfer of properties and not to avail of the Philippine estate tax amnesty itself.

This means that the problem of the Philippine estate tax and looming penalties can be disposed of. It leaves room for the heirs to subsequently resolve the distribution as well as the reimbursement from the estate of the one who paid the taxes on its behalf. The estate settlement will still need to be done, but it can at least be undertaken knowing the tax issues of the estate have already been resolved.

Is payment of the estate tax by installment allowed?

The first payment must be paid using BIR Form 0605

One of the innovations of the Philippine estate tax amnesty extension law is that it allows payment of the estate tax by installment.

Installment payments on the estate tax are allowed within 2 years from the statutory date for its payment without civil penalty and interest. So long as the heirs apply for the amnesty by June 14, 2025, they may potentially have until 2027 to pay the full amount of the inheritance tax assessed on the estate.

This will allow heirs and other parties to avail of the Philippine estate tax amnesty even if the estate may yet lack the liquidity to settle the inheritance tax in full.

0 Comments