Philippine Inheritance Laws for Foreigners, Filipinos and Dual Citizens

If you have inherited Philippine property, then you may want to know what Philippine inheritance laws are applicable in your situation.

When a foreigner has a Philippine inheritance, certain considerations apply.

Some common situations are:

- You are/became a US citizen and inherited from Filipino parents/relatives who passed away in the Philippines

- You are a Filipino who inherited from former Filipinos/foreigners who passed away abroad

- You are a Filipino who inherited from Filipinos

If this describes you, below are the legal and practical considerations that you need to consider before claiming your inheritance.

For a step by step discussion on what you need to claim your inheritance when there is no will, then go to: How to transfer land title to heirs in the Philippines (Extrajudicial Settlement).

Contents

- First read this

- No 1 – How does the deceased’s citizenship affect inheritance?

- No 2 – If there is a will, you will need a copy

- No 3 – If there is a will, you will need to go through probate

- No 4 – How does the citizenship of the heirs affect inheritance?

- No 5 – What asset documents will you need?

- No 6 – What happens when the owner listed on the Title/Stock Certificate is not the deceased?

- No 7 – Now what do I do?

First read this

The discussion below clarifies the most important considerations when dealing with Philippine inheritances.

Family facts, citizenship, wills and the property location – all these details are needed to assess what should be done.

But in general, what you need to know is this:

- If the deceased is a foreigner, then his laws apply to the inheritance. So, if he is from the US, then US law will apply. However, if the property is in the Philippines, you will need to work with the courts and other Philippine government organizations to distribute the estate.

- If the deceased is Filipino, then Philippine laws on wills and compulsory heirs must be obeyed (this is for both estates with wills and estates without wills).

- If there is a will, you will need a copy and it should follow the deceased’s national law on wills.

Wills must be validated through a court case called probate before the property can be distributed.

- If there is a will, it will have to be brought to court.

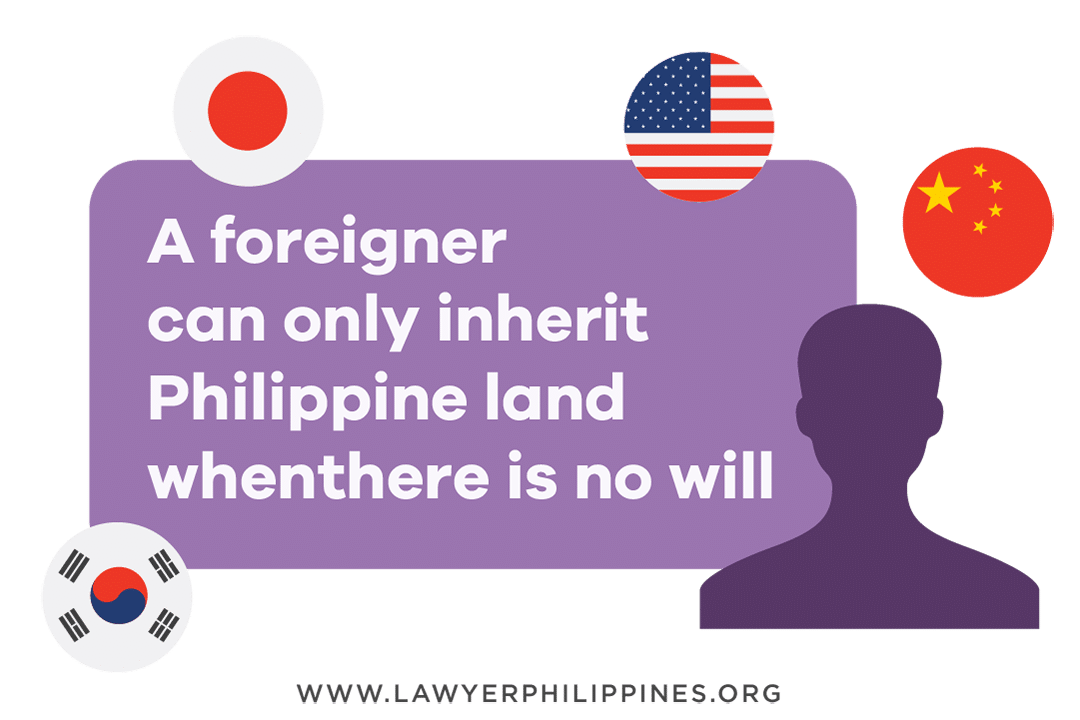

- If the heirs are foreigners, they cannot receive Philippine land inheritances through a will. They can inherit Philippine land if there is no will.

- You will need to gather documents proving the ownership of the property/stock. If the property/stock is in someone else’s (i.e. grandfather’s, uncle’s) name, then that estate must first be settled.

These main points are further discussed below. There can be complications based on your particular situation, so I have written in detail about each of these items to address common issues that frequently occur.

No 1 – How does the deceased’s citizenship affect inheritance?

The deceased’s citizenship determines what inheritance laws will be followed.

- If the deceased is foreign, then the foreign inheritance laws will dictate how the will is to be probated and who the heirs are. The foreigner’s Philippine properties can be transferred to the new heirs following Philippine probate in cases where there is a will.

- If the deceased is a Filipino/dual citizen, then Philippine inheritance laws on wills, compulsory heirs and other inheritance matters will apply.

The citizenship of the deceased dictates which national laws apply

What are some of the most significant Philippine inheritance laws? Those that deal with wills and compulsory heirs.

If you have inherited from a Filipino/dual citizen, then the estate must comply with applicable rules below:

First, there are rules about the form of the will.

A holographic will must be written in the estate owner’s hand and must be dated and signed by him. A notarial will be signed by 3 witnesses in the presence of the testator.

In addition, it must be notarized and comply with a whole list of requirements.

A notarial will must be signed by at least three witnesses.

Second, a will must comply with the laws on compulsory heirs. Philippine law defines the heirs and the amount they receive, even if there is a will.

The will can be overturned or challenged if the rights of these heirs are not respected. The order in which the heirs are prioritized are:

Compulsory heirs are determined by law.

1. Legitimate children and descendants (grandchildren, great-grandchildren)

2. If there are no legitimate children or descendants, legitimate parents and ascendants of legitimate

children and descendants

3. Surviving legal spouse

4. Illegitimate children

Now, you might wonder exactly who receives what amount. I’ve written a comprehensive guide here, which can be used to look up your situation.

No 2 – If there is a will, you will need a copy

You’ll need a copy of the will to start.

If you inherit through a will, you will need a copy of the will to be able to start. Clients have asked me how to find the will. There are a few possibilities.

- You can go to court and request the court to compel that the will be brought to you. However, this is very tough to enforce and is not suggested.

- You can discover the contents if you are informed in the course of probate proceedings.

In general, it is very difficult to discover the contents of a will that is lost or withheld from you. However, it is important to find the document or to encourage the person holding it to turn it over to the family.

The will is a primary and very important document, so all effort must be made to find it.

No 3 – If there is a will, you will need to go through probate

When there is a will, laws usually require that it is brought to court in a process called “probate”.

Probate means that the will goes to court for the courts to determine if the will is valid and to enforce the will.

Probate is a usually a requirement for transferring the property to another’s name.

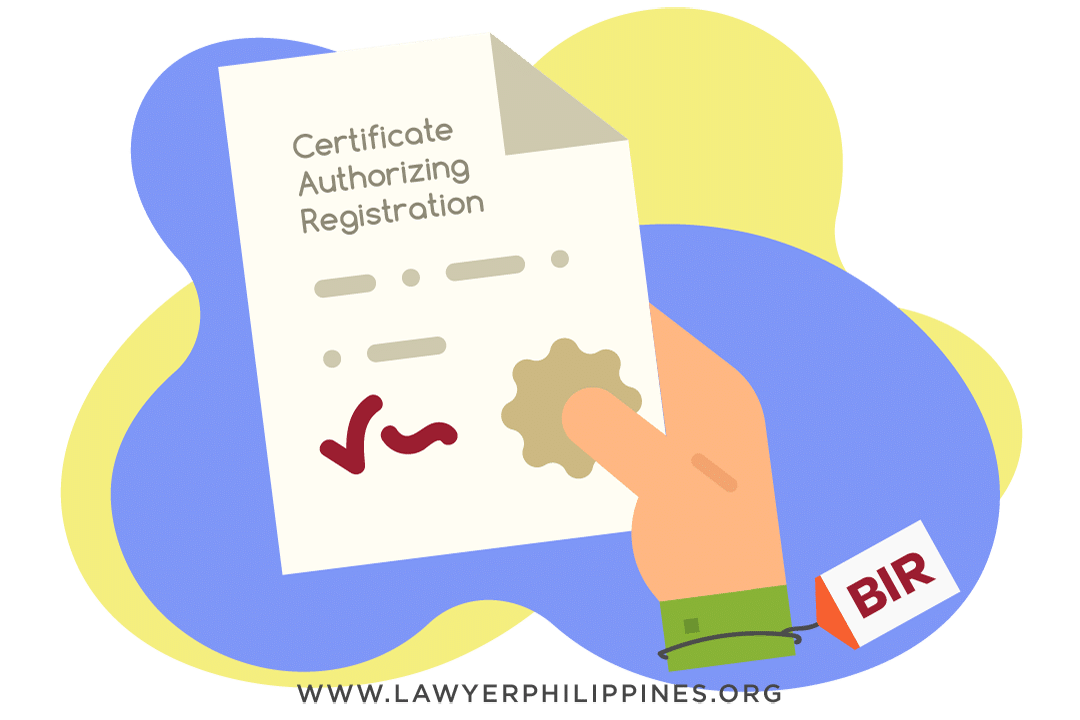

In the Philippines, the final court decision of the probate case is sent to the BIR.

Probate is requried to enforce the will created by the deceased.

The BIR will process the estate and release a Certificate Authorizing Registration so that the property can then be transferred.

1. If the deceased is foreign, the will can be probated abroad and then reprobated in the

Philippines. It is reprobated in the Philippines so that it can be used to transfer Philippine

property to the heirs.

2. It can also be probated here directly and does not need to go to be probated abroad first.

3. If the deceased is Filipino/dual citizen, then the will should be probated in the city or

municipality where the deceased resides at the time of his death or where the property is

located if he lived in a foreign country.

The BIR will issue a certificate based on the order allowing probate.

No 4 – How does the citizenship of the heirs affect inheritance?

All too often, a foreigner or former Filipino citizen will make a will bequeathing land to one of their children. However — A foreigner cannot inherit Philippine land through a will. A foreigner can only inherit Philippine land when there is no will.

The foreigner inherits Philippine property if there is no will.

This is an absolute rule – there are no exceptions. As such, the properties and assets that can be inherited when there is a will must comply with this requirement for it to be enforceable.

All other types of assets can be inherited by a foreigner however so condominium units, stocks and other types of assets can be disposed of in a will.

No 5 – What asset documents will you need?

Aside from the death certificate, documents relating to the assets are most needed. But very often, heirs don’t have the documents for these assets.

The documents are required for any inheritance because you have to prove that the deceased owned the asset before anything can be distributed to the heirs.

If property is involved, the heirs must have the owner’s duplicate certificate of title. If the Original Owner’s Title is missing, then the heirs must go to court to have the owner’s duplicate Certificate of Title re-issued to them.

A photocopy of the Owner’s Title or the tax assessment can help support the ownership claim but only the Owner’s Title will allow transfer of the title to the heirs. If stocks are involved, the heirs must have the stock certificate.

If it is missing, the company may be able to restore it to you if requested.

You’ll need lots of documents!

Although it is possible to replace the documents if they are missing with the help of a professional, it is time consuming and takes some effort. It is far better to search for the documents you need than to try to replace it.

No 6 – What happens when the owner listed on the Title/Stock Certificate is not the deceased?

Say your father passed away and you and your sister inherited Philippine property from him.

The property is your father’s rightful share from the estate of your grandfather but was never transferred to your father.

The title is still in the name of your grandfather. For it to be transferred to you and your sister’s names, you’ll have to go through the following:

- the estate taxes on your grandfather’s estate must be paid

- the heirs of your grandfather have to sign a document called an extrajudicial settlement agreeing to the allocation of the property to you and your sister.

To transfer property to new heirs, the estate of the title owners must be settled.

This requires that all of the heirs of your grandfather agree and are willing to state that in writing. This also requires that outstanding estate taxes be paid.

Usually, if estate taxes are not settled in a few years, the fees can balloon and be worth as much as the property itself. There is an upcoming estate tax amnesty that can help in this situation.

Even if estate taxes were not paid for many years, this amnesty reduces estate taxes to 6% on the total net estate. This removes all penalties and makes the transfer much cheaper.

It is also possible to negotiate with the BIR for some situations and explain the problem.

No 7 – Now what do I do?

You’ll see from above that the most important considerations are citizenship and documentation.

You’ll need to understand Citizenship and what property documents exist.

- The national inheritance laws of the deceased apply. So, if the deceased is a German, then the inheritance law to follow is German. However, if the property is in the Philippines, some work may need to be done with the Philippine courts or other government bodies.

- If the deceased was Filipino, then the Philippine national laws regarding wills and compulsory heirs which must be followed.

- Wills must be probated in court for them to be enforced.

- Documents such as the will, Owner’s Title, Stock Certificates have to be gathered.

So, if you are considering trying to get the inheritance, it is first best to gather the documents you’ll need such as the will, the Owner’s Title, the stock certificates and death certificate.

These can then be submitted to a lawyer/accountant to start the process of settling the estate.

47 Comments

Trackbacks/Pingbacks

- Top 5 Things You Should Know When an Estate is Subject to Philippine Inheritance Laws - Daayri - […] Rules of Court for laws on inheritance govern how the value of the estate is handled. This means that…

- Philippine Last Will and Testament (Plus Foreign Wills and Wills of Filipinos Abroad) - Lawyers in the Philippines - […] More: This article discusses Philippine Inheritance Laws and how foreign citizenships or wills can affect […]

- What happens to a foreigner’s assets when he dies in the Philippines? - Lawyers in the Philippines - […] there was a last will and testament makes a big difference. Foreigners in particular are accorded a wide latitude…

My mother was a natural born Filipino who married a British born man. I and my siblings are British born. My parents bought a property in the Philippines. Both my parents are now deceased. My siblings and I are trying to sell the property through a agent in the Philippines. We are told (a) we cannot receive the full selling price in one lump sum due to anti-laundering laws and (b) there are restrictions on the property due to our British nationality, and (c) we cannot own the land due to the law. Is it correct? Thanks for your comments

If your mother was a Filipino at the time of your birth then you are yourself a Filipino.

Hello,

My wife is Filipino and her family are sub dividing land owned by her now deceased parents. We live in New Zealand and my wife now has NZ citizenship but has not attained dual Philippines – NZ citizenship. Can she legally gain her share of the sub divided land or does she need to obtain dual citizenship first?

She does not. Former Filipinos and persons who were never Filipinos can acquire land by inheritance. See also our post here: https://lawyerphilippines.org/filipinos-foreigners-and-real-estate-in-the-philippines/

My uncle passed away but left a handwritten will and testament. He was gay and has no wife and children. Both parents are already gone. In his handwritten will, he wants to give Php 500,000.00 to each of his three siblings and P300,000.00 to the adopted daughter of his third sibling. He also wants his house and lot, which cost millions, to be divided equally between his only nephew and 4 legitimate nieces. He has one niece from his eldest sibling; and a nephew and three nieces from his second sibling. Is this against the law on compulsary heirs? for the nephew and nieces to receive more than their parents who are his siblings? Is it also against the compulsary law that the property he left be divided equally between the 5 children of his two other siblings?

He has no compulsory heirs. He can choose how his estate should be distributed.

Since there is no divorce in the Philippines, I filed my divorce in another country where there is a divorce, and we never annulled our marriage in the Philippines. When myself and my spouse were still together we acquired an asset and I was named in the title, ” married to”… We have 1 child and he has 2 illegitimate children. He passed away. My question is, is that asset be called a conjugal and if it was sold, how is the division between 1 legitimate and 2 illegitimate children. I have no interest at all but i am just curious whether I’m I still entitled to a share?

why did you change the word “OR” to “AND” in the following:

1. 1. Legitimate children and descendants (grandchildren, great-grandchildren)

In intestacy, children are first in line to succeed intestate, and they exclude the more distant ones. Using the word

“AND” wrongly tells your readers that children and grandchildren are equal. They are not in intestate cases.

You may be reading too much into that.

I am a Filipino citizen living in America. I have a home in the Philippines. Can my children who are US born living in the US inherit my home in the Philippines?

Yes, they can.

My father was born in the Philippines and born naturalized US citizen. Married my mother who is a National Filipino. I have 5 siblings who are also born in the Philippines Naturalized US citizen. My father is deceased, mother still living 99 yrs old. My mother has agricultural land and house and lot. I am my mothers Power of Attorney filed in the Philippines. Being I am the Power of Attorney of my mother. if my mother was to pass on, will the property go to me? and I?m I allowed to own/inherit my mothers land and house and lot being I am naturalized born citizen. What can I do?

You and your siblings would be equal heirs to the estate of both your mother and father.

Good morning Po,

I am a Filipino Candian citizen, residing here in Canada, but planning to stay in the Philippines 5 months Ang here in Canada for 5 months since I am retired already, My parents died 22 years ago ,they have a property in the Philippines which was occupied by my brothers;s family since it was built , because me Ang my other siblings have each own property, Now me and my mother siblings who are still alive wants to sell this property , but they

are not in favor for the selling. The property is still under my parents name . What is the best thing to do?

Thanks

Coming to a common agreement would be simplest. A court case can be resorted to if this is not possible.

Both my parents died. We are seven children. Three of the children passed away, one is a naturalized British citizen, single with no heirs died in US. The other sibling is married with 3 children. Two of the living heir sibling are US citizen living abroad, After our parents died, we had a written agreement all seven of us on which property to own. Since two sibling died, no will, single, without heirs, I understand we the living siblings are the heirs to their identified property.? how about the children of our sister who died? are they entitled to a share of our deceased heir sibling?

I appreciate any information.

Omie

Yes, the children of the deceased sibling are entitled to inherit in representation of their mother.

Both my parents passed away. My father was a Dual Citizen of the US/Philippines, My mother was a naturalized US Citizen. They have a condo in Manila. There is not will. What are my next steps? I am a naturalized US Citizen born in Manila.

If they both passed away and you are the only heir, you can execute an affidavit of self-adjudication, have the paperwork seen to, and pay the taxes and fees to have the property registered to your name.

We will be happy to help you with this if you’d like to contact us through our form on https://lawyerphilippines.org

Good morning. My Mom, a Filipino citizen died in the Philippines recently, She owned property in her town. Can they be inherited by her US citizen children without a will? Also, how do we find out if the property taxes have been paid? As in, what is the property tax office called? Would it be located in her town or somewhere else? To make matters more interesting, I don’t believe there are any locatable documents showing her ownership of the property. Is there a recorded copy that can be located using her name rather than a property address or legal description (as it’s called in the US)?

Thank you,

Chris

Yes, the foreign heirs of a Filipino or a former Filipino can inherit properties in the Philippines.

You’d have to look into the local tax records and the register of deeds of the town to find specific information.

If this is something you need assistance with, please fill out our form on https://lawyerphilippines.org and we’ll be happy to discuss it with you.

Hi! Thank you for writing this helpful article! My mom is a dual Filipino-American citizen, living in the U.S. I was born in the Philippines, now a U.S. citizen. I am her only child and she is unmarried, so I would be the primary legal heir. As I understand from your article, she should NOT write a will regarding her property, so that I can inherit it as a naturalized U.S. citizen. Is that correct? I just need to have a copy of the property title?

If her ascendants are still living at the time of her death, then they would inherit together with you if there is no will.

Note though that former Filipino citizens can still acquire land in the Philippines.

Good day , am a former Pilipino Citizen now a German Citizen. I have a son, legal age and German Citizen to be my Heir to my 2 hectares Land. Can he legally inherit it alone?

Yes, he can inherit it alone if he has no other siblings and you have no spouse.

I am a British citizen, married to a Filipina. We have no children and will not be having any. We are buying a house and lot in the Philippines. My questions are:

1) Can my name be included on the deed of sale and on the land and property title?

2) If my wife dies before me, will I inherit the house and lot or will it go to her natural family?

Thanks in advance for your advice.

We’ve discussed a situation like that here:

https://lawyerphilippines.org/2016/03/28/can-a-foreigner-inherit-land-in-the-philippines/

Hi.

My father is of swedish citizenship and married to a filipina citizen.

They have both land and condominium in both theyr names in the Phillipines.

He has several children of swedish citizenship from a previous marriage. What will they lawfully be able to inherite from the land and condoes in the Phillipines?

He likely does not own the land in the Philippines and will not unless she predeceases him and he inherits from her.

His children can inherit his real estate properties from him.

My dad is 87 years old and inherited agricultural lands from his deceased parents. He received Deed of Adjudication and Partition. We were advised that my dad needed to work on getting property title under my dad’s name from his deceased parents, and then he can transfer his property title to me and my siblings here in the US.

My dad is in good mental health, but his physical health can no longer do long distance flights and long stay in extreme hot weather.

I am wondering if there is such service for senior citizens to process property title documents here in the US, so my dad doesn’t require him to go back home and do this kind of work.

It will be great for him to do all these documents in his presence here in US and not to jeopardize his health.

Please, we appreciate your advice.

Stay Safe and God Bless!

Sincerely,

Rowena

This is possible provided the necessary documents are retrieved or drawn up. We will send you an email.

My father passed away, he was a US Citizen. He willed his house in Las Pinas to my step mother (who is also a US Citizen). My father has 5 children (we are all US Citizen too, I have 3 half siblings from different mothers, but no child from my current step mother). My mother was married to my father in the Philippines, they divorced when my father left for the US, he was still a Filipino Citizen then (no annulment was ever filed nor he refiled divorce as a US Citizen). My step mother wants the house. My father purchased it before he married my step mother. My step mother said she can have the will validated here in California and that she can take it to the Philippines, and that the court will give her the property.

Do we, the children, have any share from the house?

Does my mother have any part in this situation?

There are a number of facts to clarify in this situation, among them your stepmother’s citizenship at birth.

Note that since your father was a US citizen and California resident, the rules for the division of his estate in the Philippines can be governed by California law.

i am a naturalized American citizen but born in the Philippines. My grandmother died 26 years ago and my mother dies 25 years ago. My mother has one brother and he has five chidden. My Uncle dies approx.. 10 years ago. His chidden claimed that my mother waived her rights to her inheritance. No documentation copy was given to me nor did any will that were provided to me. I am living in the US and have not been home since my grandmother’s passing. My cousins are dividing any assets and properties among themselves without letting my brother and I. how can I claim my share? We were communicating among among ourselves, but recently, they refused to answer my phone calls and text messages.

You’d have to settle your mother’s and your grandmother’s estates in the Philippines. The latter may require a court case under the circumstances.

Hello Sir : what if a former filipino died in the US and an extra judicial settlement here was made among the children in favor of his wife –

Is he entitled to avail of the estate tax amnesty – the title is in his name and he resided here more than he stayed in the US before he became citizen n died there !

The tax amnesty can apply if availed of within the period granted by law we can’t say at this point whether Congress will extend the period.

Im a huge fan already, man. Youve done a brilliant job making sure that people understand where youre coming from. And let me tell you, I get it. huge stuff and I cant wait to check out more of your websites. What youve got to say is important and needs to be read.

Thank you!

Hello,

I am a US citizen who recently inherited a property in the Philippines from my mother and I have a question regarding property taxation. Am I required to pay taxes on the property even though I Iive in the US? How does it work? I am still trying to get familiarized with the Philippine Inheritance Law.

Thank you!

There are both annual real property taxes which have to be maintained as well as inheritance taxes which must be settled in order to effect the transfer.

My auntie(sister of my father) and her husband both US citizen ,died in the Philipines and left 1 house and lot and 2 land titles in the Philippines with no compulsary heir. My aunt was survived by her sister and nephews and nieces. My auntie left a last will and testament to my US citizen cousin and the will had been probated. Can a US citizen inherit a property through last will and testament? If not, what can the family do so the the properties of my auntie and uncle can be saved?

Sent an email.

My aunt is a dual citizen. She left a house in the US and properties here in the Philippines. She is also a co-owner in the family business here in the Philippines. She left no will, and a husband who is also a dual citizen. How will her properties be divided? Do we also get a share in her property in the US if he decided to sell it? What happens to her share in the family business?

The properties in the Philippines may be subject to our laws of inheritance, in which case her siblings – or their surviving children – would be co-heirs with her spouse. We cannot speak for the inheritance laws of the US in this instance.

Me & my sister are both Canadian citizens we both along with our brother & brothers children will inherit a few agricultural land in the Philippines but we decided to sell these properties. Does me & my sister needs to be dual citizens to sell these properties. Theres no Will left behind by our mother.

Apparently your response.

Thank you.

Sincerely,

Rosena

A former Filipino citizen should be able to carry out these transactions.