Value Added Tax in the Philippines

Registered businesses in the Philippines should be aware of the VAT

This article discusses basic concepts regarding Value Added Tax of which businesses operating in the Philippines should be aware.

It also discusses recently decided tax cases in the Philippines.

Contents

- Value-Added Tax

- Who should file Value-Added Tax Returns?

- Value-Added Tax Rates

- What is the VAT payable to the Bureau of Internal Revenue?

- What is a VAT-exempt transaction?

- Is a VAT exempt transaction the same as a 0% VAT (zero-rated) transaction?

- What are VAT credits?

- How are VAT credits applied?

- Recently decided cases on applications for VAT credits or refund

Value-Added Tax

VAT is an example of indirect tax

Value-Added Tax (VAT) is a form of sales and consumption tax. Any person who, in the course of trade or business, sells barters, exchanges, leases goods or properties, or renders services, and any person who imports goods is subject to VAT.

It is an indirect tax because it is effectively passed on to the buyer, transferee or lessee of the goods, property or service.

VAT-registered businesses must issue a VAT invoice for each sale or lease of goods or properties, or a VAT official receipt for each service rendered.

In addition to the annual tax returns, VAT declarations must be filed monthly and VAT returns are filed quarterly.

Who should file Value-Added Tax Returns?

Small businesses are not obligated to file VAT returns

- Any person or entity who, in the course of his trade or business, sells, barters, exchanges, leases goods or properties and renders services subject to VAT, if the actual amount of gross sales exceeds P3,000,000.0

- A person required to register as a VAT taxpayer who failed to register

- Any person who imports goods into the Philippines whether or not in the course of business

Value-Added Tax Rates

12% tax rates is applied to all sales except to some business activities like export sectors and non-renewable energy service providers

- On the sale of goods and properties – 12% of the gross selling price or gross value in money of the goods or properties sold, bartered or exchanged, such tax to be paid by the seller or transferor;

- On the sale of services and use or lease of properties – 12% of gross receipts from the sale or exchange of services, including the use or lease of properties.

- On the importation of goods – 12% based on the total value used by the Bureau of Customs in determining tariff and customs duties plus customs duties, excise taxes, if any, and other charges. This is to be paid by the importer prior to the release of such goods from customs custody: Provided, That where the customs duties are determined on the basis of the quantity or volume of the goods, the value-added tax shall be based on the landed cost plus excise taxes, if any.

- Subject to 0% VAT are export sales and other transactions such as services rendered to a person engaged in business conducted outside the Philippines, and the sale of power or fuel generated through renewable sources of energy, along with other zero-rated transactions as listed in the tax laws.

12% VAT rate is deducted from the gross receipts

“Gross receipts” here means the total amount of money or its equivalent representing the contract price, compensation, service fee, rental or royalty, including the amount charged for materials supplied with the services and deposits and advanced payments actually or constructively received during the taxable quarter for the services performed or to be performed for another person, excluding value-added tax.

What is the VAT payable to the Bureau of Internal Revenue?

BIR is the government office in charge with tax related activities

The amount is essentially the Output VAT minus the Input VAT. A VAT-registered business can use the Input VAT from its own purchases as a credit to offset against the Output VAT from its sales.

Output tax is the value-added tax due on the sale or lease of taxable goods or properties or services by any person registered or required to register under Section 236 of the National Internal Revenue Code.

Input tax is the value-added tax due from or paid by a VAT-registered person in the course of his trade or business on importation of goods or local purchase of goods or services, including lease or use of property, from a VAT-registered person. It also includes the transitional input tax determined in accordance with Section 111 of the National Internal Revenue Code.

What is a VAT-exempt transaction?

One example of a VAT exempt activity is the sale of drugs and medicines for diabetes, high cholesterol, and hypertension.

Some transactions on which no VAT is imposed are referred to as VAT-exempt. A VAT-exempt transaction is a sale of goods, properties or service and the use or lease of properties which is not subject to output tax and whereby the buyer is not allowed any tax credit or Input tax related to such exempt sale.

Is a VAT exempt transaction the same as a 0% VAT (zero-rated) transaction?

There is a difference between a VAT exemption and zero-rated transactions.

They are not the same. Although both VAT exempt and zero-rated VAT transactions do not cause an obligation to pay VAT, they have different implications with regard to the Input and Output VAT.

Input VAT cannot be credited against Output VAT for VAT exempt transactions. However, input VAT can be credited against output VAT for zero-rated VAT transactions.

What are VAT credits?

Qualified business transactions are given ample time to file for a VAT refund or Tax Credit Certificate.

The Output tax is usually more than the Input tax so that the difference was properly remitted to the BIR, but this is not always the case. For example, if the business’s own sales are taxed at 0% because it is engaged in export or outsourcing services, then there is an Input VAT credit in excess of the business’s Output VAT liability.

In such a case, the business can carry over the excess to succeeding quarters or apply for a refund or a Tax Credit Certificate.

How are VAT credits applied?

Several documentary requirements must be submitted to the appropriate tax office for VAT refund.

Applications for the tax refund or issuance of a TCC are made with the appropriate office of the BIR. They are filed with either with the local Revenue District Office (RDO)/Large Taxpayers District Office (LTDO) or with the BIR’s VAT Credit Audit Division (VCAD).

Documentary requirements must be complied with in order for the application to accepted.

If the BIR finds no merit in the application or fails to act on it in a timely manner, its effective denial can be appealed to the Court of Tax Appeals. The decision of the Court of Tax Appeals may itself be appealed to the Supreme Court as provided by Rule 43 of the Rules of Court.

Recently decided cases on applications for VAT credits or refund

Business activities that involve harnessing renewable energy sources are considered as zero-rated transactions

EDC BURGOS WIND POWER CORPORATION v. COMMISSIONER OF INTERNAL REVENUE, Case 9446, March 12, 2021, decided by the Third Division of the Court of Tax Appeals

The EDC Burgos Wind Power Corp. commenced operations in 2014.

In 2016, the company filed an Application for Tax Credits/Refunds in the amount of P33,903,404.70 representing its unutilized input VAT for the 1st and 2nd quarters of 2014 attributable to its zero-rated sales of power generated from renewable sources of energy.

Its application was denied by the BIR. The company appealed its case to the Court of Tax Appeals.

The CTA denied the appeal.

Reasons

- The CTA is an appellate court. It is imperative for the taxpayer to show the appellate court that not only is he entitled under substantive law to his claim for refund or tax credit, but also that he satisfied all the documentary and evidentiary requirements for an administrative claim with the BIR. It is crucial for a taxpayer in a judicial claim for refund or tax credit to show that its administrative claim should have been granted in the first place.

The CTA found that EDC Burgos Wind Power Corp. failed to do this because it presented its case as if its administrative claim had never been acted upon or that there was no decision for the Court to review on appeal per se. In other words, the company presented its case as if it was an original action, despite the fact that the BIR had explicitly denied its administrative claim.

The CTA denied the company’s appeal due to several procedural inadequacies.

The company did not specifically assail the reason or basis why its administrative claim was denied in the first place. It never argued or proved that the said reason or basis was not justified in law.

The BIR had made a finding that no zero-rated sales were made during the taxable quarter, and therefore there was no creditable input tax attributable to such zero-rated sales.

The company should thus have specifically argued and proven that these findings of no zero-rated sales during the period were erroneous and had no leg to stand on. The CTA ruled that the company had failed to do this.

- Nonetheless, the company had argued on appeal that since its sales pertained to energy generated through wind, a renewable source of energy, the same should be considered zero-rated.

Still, the CTA upheld the denial of the Application for Tax Credits/Refunds.

The appellant company failed to secure one of the documentary requirements to qualify as zero-rated.

The CTA ruled that to qualify for VAT zero-rating in the sale of power generated through renewable sources of energy such as wind, the law required that the seller must have secured the following:

(1) Certificate of Registration issued by the Department of Energy (DOE);

(2) Certificate of Registration issued by the Bureau of Investments (BOI);

(3) Certificate of Endorsement issued by the DOE; and

(4) Certificate of Compliance (COC) issued by the Energy Regulatory Commission (ERC), secured before actual Commercial Operations by the generation company.

The CTA ruled that the company failed to prove that a Certificate of Endorsement was issued to it by the DOE, through the Renewable Energy Management Bureau (REMB), for any of its transactions.

Also, while the company had secured a COC from the ERC in its favor, this was issued only on April 13, 2015, or after the commencement of its commercial operations on November 11, 2014.

Thus, for the failure to present the required DOE Certificate of Endorsement, and to secure a COC from the ERC before its actual operation, the company’s reported zero-rated sales/ receipts in the aggregate amount off P384,474,309.49 could not qualify as VAT zero-rated sales.

Exemptions are construed against the taxpayer and in favor of the government.

Actions for tax refund or credit are in the nature of a claim for exemption and the law is not only construed in strictissimi juris against the taxpayer, but also the pieces of evidence presented entitling a taxpayer to an exemption is strictissimi scrutinized and must be duly proven. The burden is on the taxpayer to show that he has strictly complied with the conditions for the grant of the tax refund or credit. Since taxes are the lifeblood of the government, tax laws must be faithfully and strictly implemented as they are not intended to be liberally construed.

THERMAPRIME DRILLING CORPORATION (formerly known as THERMAPRIME WELL SERVICES, INC.) v. COMMISSIONER OF INTERNAL REVENUE, Case EB 2155, March 2, 2021, decided by the Court of Tax Appeals En Banc

Thermaprime is a VAT-registered corporation engaged in the drilling and workover of exploratory or development wells and other related services. Its only client since 2011 has been EDC, an entity providing energy through renewable energy sources.

Thermapine argues that it is entitled to a tax refund and/or credit since its transactions with EDC are VAT zero-rated.

Thermaprime claimed that their business sales were zero-rated thus entitled to VAT refund.

In 2012, Thermaprime filed Amended Quarterly VAT Returns for the 3rd and 4th quarters of taxable year 2011. It claimed unutilized input taxes totaling to P11,095,990.56.

On September 24, 2013, the company filed with RDO 43A in Pasig City an application for tax credits/refund of input VAT for the 3rd and 4th quarters of 2011.

From February into April 2014, the BIR sent the company notices and requests for documents required to process their application.

In September 2014, their application still not having been ruled on by the BIR, the company appealed the case to the CTA.

The CTA Division and En Banc dismissed the company’s appeal for lack of jurisdiction. The CTA ruled that the appeal was not filed on time and could not be received.

Companies are given 2 years to complete and submit all the necessary documents to support tax credit claims.

For claims for tax credit or refund filed prior to June 11, 2014 such as this case, the taxpayer should have submitted the documentary requirements sufficient to support its claim within 30 days from the date its administrative claim was filed, unless given further extension by the CIR.

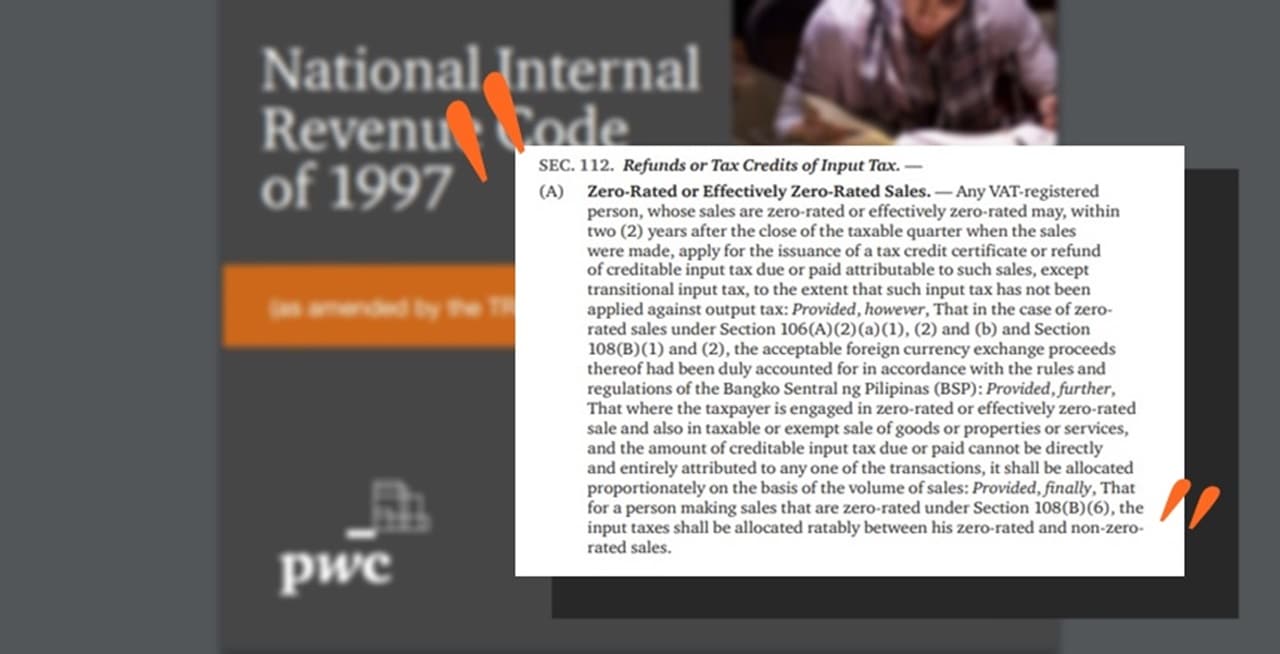

Upon filing by the taxpayer of the complete documents to support its claim, or expiration of the period given, the BIR has 120 days within which to decide the claim for tax credit or refund. In all cases, whatever documents a taxpayer intends to file to support his claim must be completed within the two-year period under Section 112(A) of the National Internal Revenue Code (NIRC) of 1997.

Under Section 112(A), a taxpayer has 2 years, after the close of the taxable quarter when the sales were made to apply for the issuance of a tax credit certificate or refund of creditable input tax due or paid attributable to such sales. Thus, before the administrative claim is barred by prescription, the taxpayer must be able to submit his complete documents in support of the application filed.

The law is very clear as to the time given to file the claims and it’s supporting documents

Since this case pertains to an application for tax credit/refund of input VAT for the 3rd and 4th quarters of 2011, which closed on September 30, 2011 and December 31, 2011, respectively, Thermaprime had until September 30, 2013 and December 31, 2013, respectively, or two years after the close of the taxable quarters when sales were made, to submit all pertinent supporting documents to respondent. Thus, the company’s submission of documents on April 22, 2014 was already beyond the two-year period and could not be considered in the counting of the 120-day period.

Following the rules laid down in the Pilipinas Total Gas case, the 120-day period within which the BIR should act on the administrative claim was reckoned from September 24, 2013, the date of filing of the administrative claim. Counting 120 days from September 24, 2013, the BIR had until January 22, 2014, within which to act on the claim for refund.

When the BIR instead issued notices dated February 24, 2014 requesting Thermaprime to present or produce accounting books/records, the 120-day period within which the BIR could act on the company’s claim for refund had already expired. By that time, the company should have already deemed the BIR’s inaction as a denial of its administrative claim and elevated the matter to the CTA.

Thermaprime should have elevated the case to the CTA for the ground of failure of the BIR to issue a TCC on time.

The period already having lapsed, the CTA ruled it had no jurisdiction to entertain the appeal.

One Justice dissented from the ruling of the CTA En Banc, voting to give due course to the appeal and for the CTA to decide the case on its merits.

He disagreed with the majority’s interpretation of the counting of the period, arguing that according to Section 112 (C), the 120-day period should be reckoned from the date of submission of complete supporting documents and it was upon its lapse that the taxpayer must file an appeal with the Court.

NORTH LUZON RENEWABLE ENERGY CORP. v. COMMISSIONER OF INTERNAL REVENUE, Case 9886, February 19, 2021decided by the Third Division of the Court of Tax Appeals

NLREC tax credit claims are partially granted by the BIR.

NLREC is a VAT-registered domestic corporation engaged in the business of generation and distribution of energy from renewable sources. It operates the 81 MW Wind farm facility located at Pagudpud, llocos Norte. It is registered as a Renewable Energy (RE) Developer with the Department of Energy (DOE)

On March 26, 2018, NLREC filed an Administrative Claim for refund of its unutilized input VAT attributable to its zero-rated sales for taxable year 2016 in the amount of P9,276,440.27. The BIR granted refund only to the extent of P957,986.03, and disallowed the amount of P8,318,454.24.

There are two matters which must be proved before the CTA upon appeal of an unsuccessful administrative claim: first, the taxpayer’s entitlement to the claim for refund or tax credit under substantive law, and second, all documentary and evidentiary requirements for an administrative claim were satisfied at the BIR level. The first matter entails a determination of the company’s compliance with the requisites established by law; while the second matter involves a review or determination whether the BIR basis in fact and/or in law for the denial of the administrative claim.

A claimant must first prove its entitlement to the claim by showing the required documents

The CTA upheld the BIR’s denial of the refund.

Certain requisites must be complied with by the taxpayer-applicant to successfully obtain a credit/refund of input VAT. These may be classified into certain categories, to wit:

As to the timeliness of the filing of the administrative and judicial claims:

- the refund claim is filed with the BIR within 2 years after the close of the taxable quarter when the sales were made;

- in case of full or partial denial of the refund claim, the judicial claim is filed with this Court, within 30 days from receipt of the decision;

There are substantive and procedural laws to comply with.

With reference to the taxpayer’s registration with the BIR:

- the taxpayer is a VAT-registered person;

In relation to the taxpayer’s output VAT:

- the taxpayer is engaged in zero-rated or effectively zero-rated sales;

- for zero-rated sales under Section 1 06(A)(2)( 1) and (2); 1 06(8); and 1 08(8)(1) and (2), the acceptable foreign currency exchange proceeds have been duly accounted for in accordance with the Bangko Sentral ng Pilipinas (8SP) rules and regulations;

As regards the taxpayer’s input VAT being refunded:

- the input taxes are not transitional input taxes;

- the input taxes are due or paid;

- the input taxes claimed are attributable to zero-rated or effectively zero-rated sales. However, where there are both zero-rated or effectively zero-rated sales and taxable or exempt sales, and the input taxes cannot be directly and entirely attributable to any of these sales, the input taxes shall be proportionately allocated on the basis of sales volume; and

- the input taxes have not been applied against output taxes during and in the succeeding quarters.

The government appreciates businesses focusing on improving technological advancement of the country and harnessing renewable resources given that they comply with all the required processes and documents.

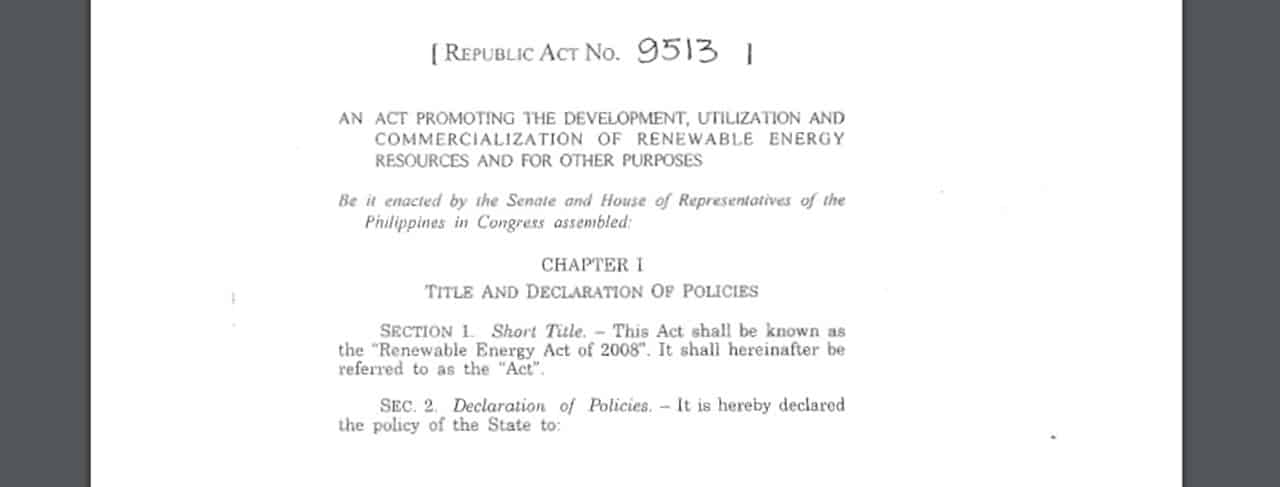

For transactions pertaining to renewable energy, the essential elements for the grant of VAT zero-rating under Section 15 (g) of the Renewable Energy Act of 2008 or RA No. 9513 vis-a-vis the special laws and regulations are:

1) The seller is an RE Developer of renewable energy facilities;

2) It sells fuel or power generated from renewable sources of energy, such as wind;

3) The said seller is a “generation company”, i.e., a person or entity authorized by the ERC to operate facilities used in the generation of electricity; and

4) Such authority is embodied in a COC issued by the ERC which must be secured before the actual commercial operations of the generation facility.

In order to qualify for VAT zero-rating as contemplated under RA No. 9513 and its Implementing Rules and Regulations, RE Developers must have secured the following:

1.) Department of Energy (DOE) Certificate of Registration;

2.) Registration with the Bureau of Investments (BOI); and

3.) Certificate of Endorsement by the DOE.

Having a well documented business activity means being complete with all the requirements.

The foregoing documents must all be shown. Otherwise, the transaction cannot be treated as subject to VAT zero-rating under the law.

In this case, while it may be undisputed that the DOE has issued its Certificate of Registration, as did the BOI, there was no showing that the company has been issued a Certificate of Endorsement by the DOE. Thus, NLREC’s sales could not qualify for VAT zero-rating.

The denial of the refund was upheld by the CTA.

0 Comments