Estate Tax Amnesty

If you haven’t been able to transfer the title to inherited property because of late estate tax penalties, then RA 11213 is the answer to your prayers.

RA 11213 makes previously difficult transfers possible:

- It removes late estate tax penalties

- It uses a low estate tax of 6%

These are large concessions and heirs can now easily transfer properties to their name.

Which estates are covered by the estate tax amnesty?

RA 11213 covers estates whose decedents died on or before December 31, 2017.

Estates whose decedents died after December 31, 2017 follow the TRAIN Law.

Which estates are excluded from the estate tax amnesty?

Yes, estates that have involved unlawfully gained wealth or the illegal concealment of money are excluded from the estate tax amnesty.

Specifically, these estates are:

- Estate tax cases that have become final and executory.

- Properties falling under the jurisdiction of the Presidential Commission on Good Governance.

- Properties considered as unexplained or unlawfully gained wealth.

- Properties acquired through illegal concealment of money or banking or commercial transactions.

- Crimes involving properties committed by public officers under the Revised Penal Code.

- Tax evasion cases and other criminal acts involving payment of taxes under the Tax Code.

When is the estate tax amnesty law in effect?

Act fast!

You can avail of the Estate Tax Amnesty from June 15, 2019 to June 15, 2021.

After June 15, 2021, previously suspended late estate tax penalties will be applicable and the costs to transfer will be very high.

UPDATE:

This period is to be extended until June 14, 2023.

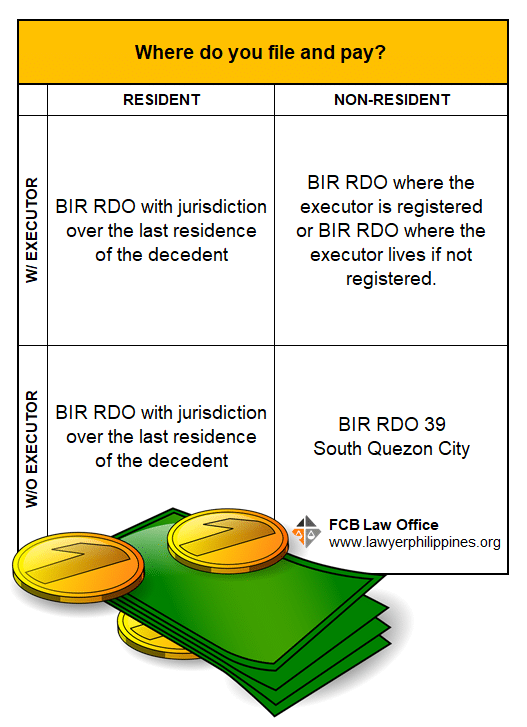

Where do you file for the Estate Tax Amnesty?

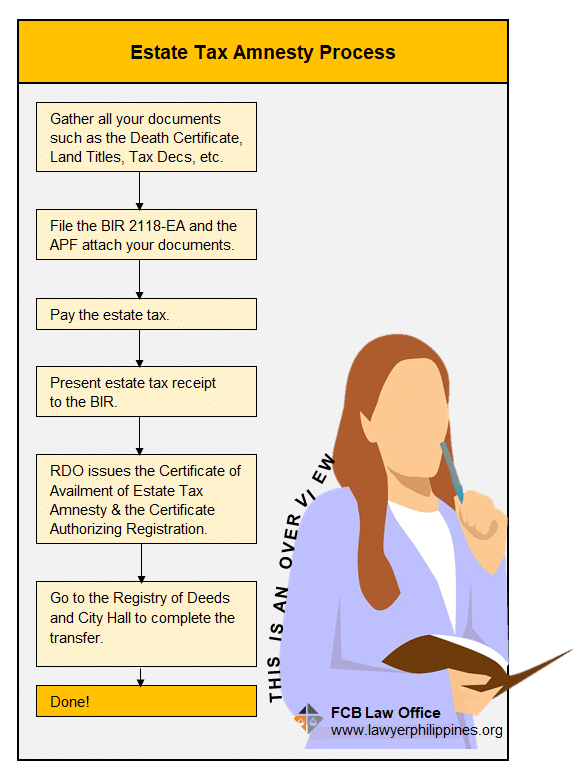

How do you file of the Estate Tax Amnesty?

The table below gives a good general idea of how to file for the Estate Tax Amnesty.

The steps include gathering the documents, filing the BIR 2118 and APF, paying the estate tax, and then transferring the property.

This is just meant to give you a general idea.

If you need clarification or your case is complicated, remember that there is no harm in asking.

You can always call the BIR.

The BIR officers will attend to your questions as much as they can.

What documents will you need?

You’ll mainly need documents that are proof of the property of the decedent’s property and BIR forms 2118-EA and the APF.

This is the first step in availing of the estate tax amnesty.

Now, that sounds simple.

It’s actually a long, long list.

You need to complete the documents applicable to the estate of the decedent but this can be tough.

Often, no-one knows where the documents were kept. Other times, they are well and truly lost.

Replacing them can be difficult, especially in the case of lost owner’s land titles.

But still, try your best to get them – they are important so that your case can be successfully processed.

I’ve listed several documents you are generally required to have in applying for estate tax amnesty.

I suggest that you make your own list of the things that are applicable to your circumstances to guide you better.

Mandatory Requirements:

- Certified true copy of the Death Certificate (DC)

- Taxpayer Identification Number (TIN) of decedent and heirs

- Estate Tax Amnesty Return (ETAR)

- Estate Tax Acceptance Payment Form (APF) and Revenue Official Receipt (ROR), if paid to Revenue Collection Officer (RCO).

- Affidavit of Self Adjudication, Deed of Extra-Judicial Settlement (EJS) or Court decision when settled judicially or if there was a last will and testament.

- Certification of the Barangay Captain for the last residence of the decedent and claimed Family Home, if any.

- Notarized Promissory Note, for “Claims Against the Estate” arising from Contract of Loan, if applicable.

- Proof of the claimed “Property Previously Taxed”, if any.

- Proof of the claimed “Transfer for Public Use”, if any.

- At least one valid government ID of the executor, heirs or authorized representatives.

Requirements for Real Estate Property, if any:

- Certified true copy of the Owner’s Property Title;

- Certified true copy of the Tax Declaration of real property and improvements issued nearest to the time of death of the decedent, if none is available at the time of death.

- Certificate of No Improvement issued by the Assessor’s Office at the time of death of the decedent, if there are no improvements.

Requirements for Personal Property, if any:

- Certificate of Deposit/Investment/Indebtedness owned by the decedent alone or jointly with others.

- Certificate of Registration of vehicles and other proofs showing the correct value of the same.

- Certificate of stocks and proof of valuation of shares of stock at the time of death

- Proof of valuation of other types of personal property

Other Requirements, as applicable:

- A duly Notarized Original Special Power of Attorney (SPA), if the person processing the transfer is the authorized representative

- A Sworn Statement, if one of the heirs is designated as executor or administrator

- Certification from the Philippine Consulate if a document is executed abroad

- Location Plan/Vicinity map if zonal value cannot be readily determined from the documents submitted.

You’ll need 1 is the original and 2 photocopies which should be submitted with the Revenue District Office (RDO) of the Bureau of Internal Revenue (BIR).

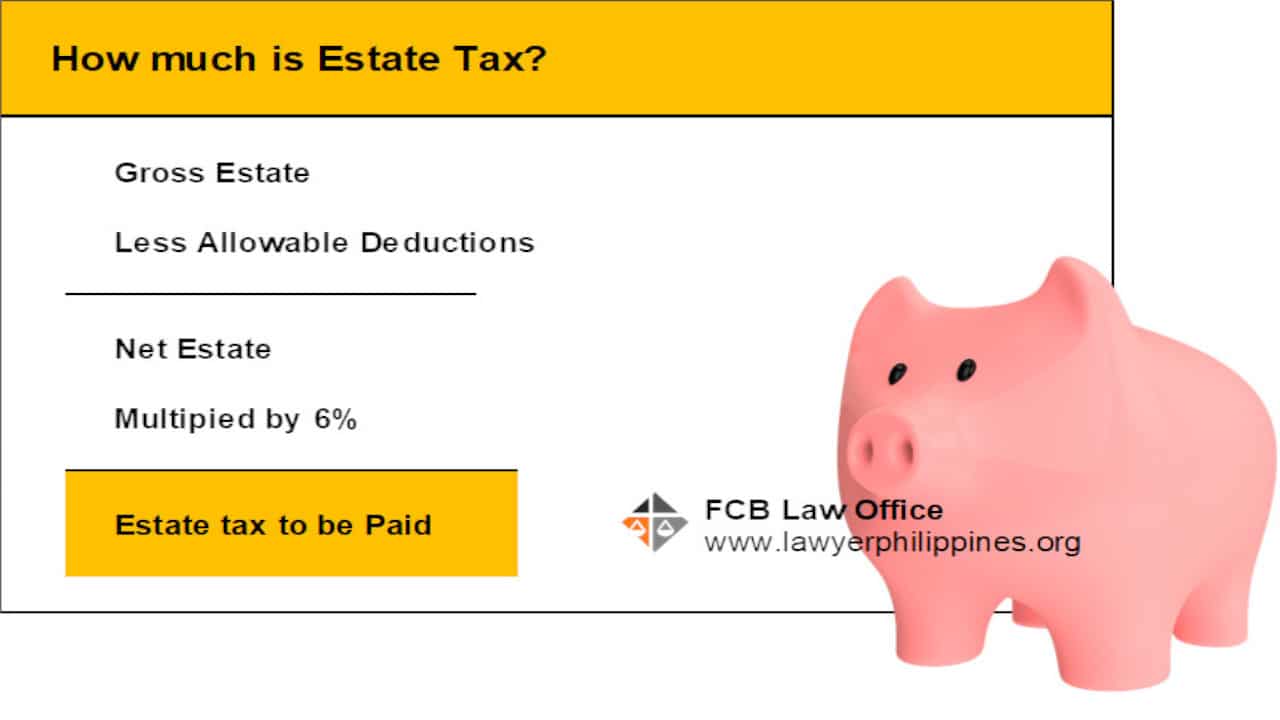

How much is estate tax under the estate tax amnesty?

Estate tax is 6% on the net estate.

The estate tax amnesty only removes the tax penalties but you are still required to pay taxes, albeit at a much lower rate.

I get asked how much estate tax is all the time.

In general, it’s really simple.

To go into specifics of how much it is in your situation, you’ll need to answer several questions.

To go into specifics of how much it is in your situation, you’ll need to answer several questions.

You’ll also need to show the estate’s documents.

If you wish to try to do it yourself, you’ll first need to figure out what the decedent’s gross estate is.

The gross estate is just all the property that the decedent owned.

That could be real estate, stocks, bonds or vehicles.

Note: A Filipino would be required to report all the properties he owns.

A non- resident alien would only need to report all Philippine properties.

Then, you will need the value of the property at the time of death.

This is usually zonal value or the city assessor’s fair market value.

Apply the standard deductions, the spouse’s share and any debts and obligations to get to the net estate.

Multiply this by 6% to get the estate tax.

Now, what happens if the estate is small enough that there is no estate tax?

In that case, you pay Php 5,000 which is the minimum allowed to transfer an estate.

What are the Immunities and Privileges under the Estate Tax Amnesty?

Aside from tax amnesty the law also gives some other benefits for the taxpayers who will apply the law in their favor. They are as follows:

- Immunities from all penalties for taxable year 2017 and prior years for estate taxes that are not yet paid and the penalties for non-payment thereof.

- Immunity from criminal, civil and administrative cases and penalties under the Tax Code.

- Final and irrevocable. Once the RDO-BIR will issue the CAETA the estate tax amnesty already paid will be final and not subject not changes.

Is this applicable in Extrajudicial settlement with deed of absolute sale?

Yes, it can be.

If there are many heirs gor instance there are 11 children of the Decedent plus the wife and most of their children are dead. The children of each direct heirs inherits, how can we arrange that the inherited properties titles would only appear to at least one representative of each family heir in the new title.

The others will have to sign a waiver or authorize the representative to sign on their behalf.

Question:

My parents (now both deceased) were only issued “Rights” not Land Title on the piece of land where our familial home is built. Is the property in question included in the Tax Amnesty? Can we apply for the Tax Amnesty?

Thanks,

Jean

Yes, it may be included in the estate and subject to the tax amnesty even if not titled.