Setting Up Your Business in the Philippines: Key Steps and Considerations

Aspiring business owners must do their part by researching and understanding the fundamentals of business registration in the Philippines

Business registration in the Philippines can be complicated, especially for foreigners. Making sure to understand the legal framework for business registration in the Philippines is important for ensuring a smooth and successful application.

A business can only be registered as one of four kinds: Sole Proprietorship, Partnership, Corporation, or Cooperative. Each of these business types is governed by separate legal codes and has different requirements for registration.

Most small foreign businesses register as Sole Proprietorship, although this can have significant disadvantages. The Company Corporation Code defines Corporations as juridical persons and regulates them as such. Registering a company as a Corporation can be quite beneficial in the long run.

Business Registration Process

A lawyer explains to his businessman client the process of business registration in the Philippines

The first step in the business registration process is determining what type of business entity you are looking to set up. Your business entity will determine the laws and regulations you will need to follow. For instance, a foreign-owned corporation, a very popular choice among foreign investors, will need to follow certain requirements before being able to set up a business in the Philippines.

Determine what is the best possible solution for your business, taking into account future growth, potential liabilities, and the necessity of capital. Once you have determined what type of entity is best for your business, you will need to choose a name for it. This may seem trivial, but your business name is an important branding tool, and you will undoubtedly want to choose something that will attract customers and be marketable.

Your business name will also need to conform to Philippine regulations. This law requires all entities, whether domestic or foreign, to have a business name that is not already in use and registered with the DTI, NTC, or SEC. An entity shall not be allowed to register a name that is already in use by a different entity. This process can be somewhat difficult, as there is not one central registry for looking up business names that are already in use. To be certain, you should ask your attorney to search through SEC records and other government agencies and offices to ensure the availability of the name you have chosen.

Once you have chosen a business name, you will need to secure the necessary permits and licenses. This is where requirements may vary depending on your city’s local laws, but generally, you will need to obtain a Barangay clearance, followed by a business permit from your city or municipality. These permits will also require you to have official receipts and invoices and to pay the corresponding percentage taxes. A business permit must be renewed annually, and failure to do so will result in penalties and surcharges.

Now you are ready to register with the appropriate government agencies. These agencies may include, but are not limited to the Social Security System, the Department of Labor and Employment, PhilHealth, the Pag-IBIG Fund, and the BIR. Here, you will need to make various reports and registrations, and there may be some regulatory requirements involving employees.

Consulting a lawyer during the business registration process is crucial for ensuring legal compliance, minimizing risks, and making informed decisions. Lawyers specializing in business law can provide valuable guidance on choosing the right business structure, understanding legal obligations, and navigating complex regulations. They can assist in drafting contracts, protecting intellectual property, and handling various legal aspects of company formation. By seeking legal advice early on, entrepreneurs can prevent costly mistakes, safeguard their interests, and establish a strong legal foundation for their business, ultimately contributing to long-term success and sustainability.

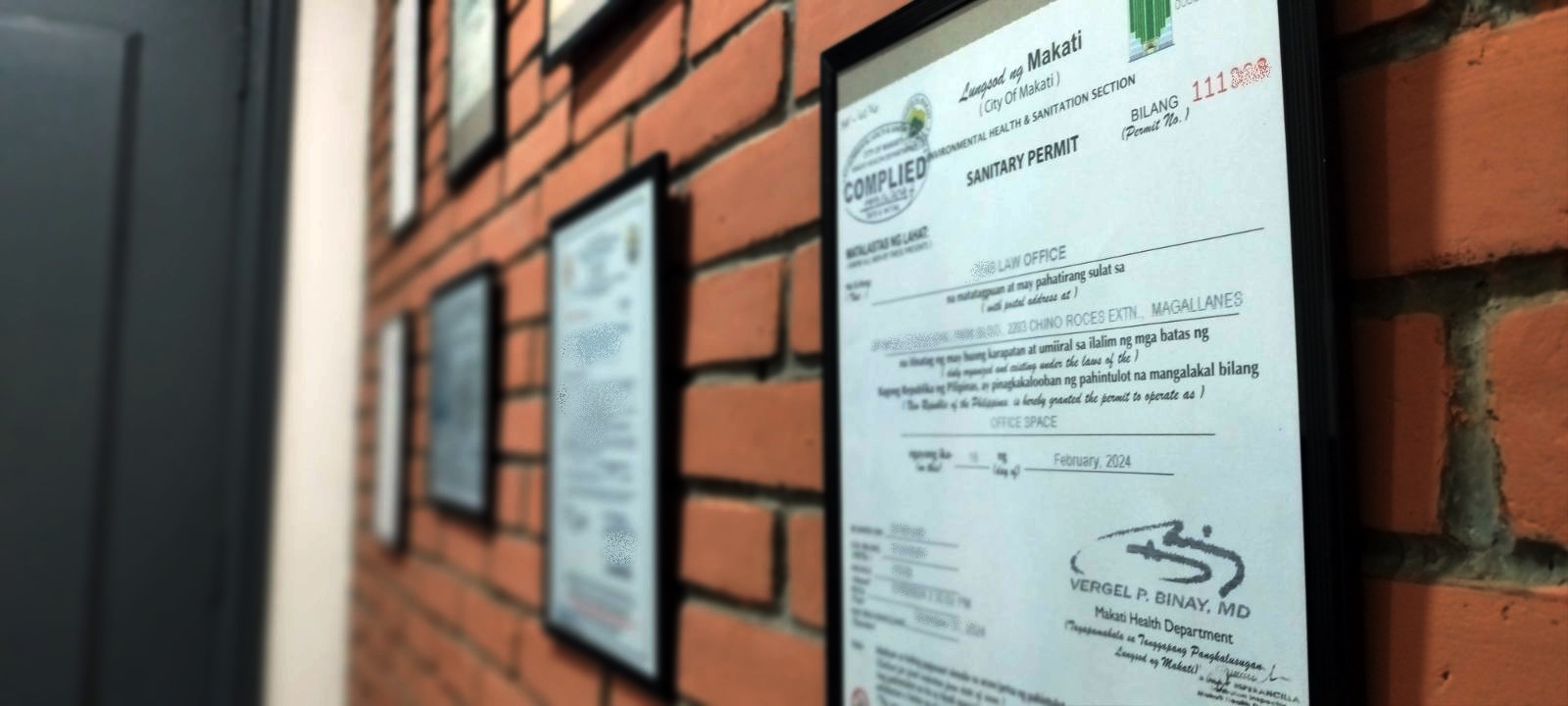

Securing Necessary Permits and Licenses

Permits and licenses must be posted on business premises that can be easily seen, like bulletin boards

To ensure compliance with local laws and regulations, all entrepreneurs should complete the business registration Philippines process before starting operations. Permits and licenses are required in order to start a business in the Philippines.

A list of possible permits and licenses is extensive. It can range from barangay clearance to permits from the local government, such as the mayor’s permit, to national government permits and licenses, such as but not limited to SEC registration, DTI registration, BIR registration, SSS, PhilHealth, and HDMF registration.

Usually, the permitting process is one of the more strenuous tasks of setting up a business. It is recommended to hire a professional to help find and secure all necessary permits and licenses for your business. Usually, professionals who specialize in these tasks know the fastest way to acquire them and can offer services from acquiring the permit to legal assistance if any problems arise with the permit in the future.

The time and effort required to acquire permits and licenses vary depending on the type of business and location of the business. Usually, a service-oriented business may take less time compared to a production or manufacturing business that may have to undergo a thorough inspection before a permit is issued. Location also has an effect on the availability of permits and licenses.

Usually, in some provinces or rural areas, certain permits may not be available at all. In some cases, alternative permits may have to be found to substitute for the non-existing permits.

Registering with the appropriate government agencies

Usually, businesses are registered with the SEC, DTI, BIR, local city halls, and barangay halls.

Register with the Securities and Exchange Commission (SEC) for corporations and partnerships or the Department of Trade and Industry (DTI) for sole proprietorships. Registering with the SEC would mean making an application to reserve a corporate name and depositing the minimum paid-up capital stock with the designated government depository bank.

This will be followed by the submission of the articles of incorporation and by-laws to the SEC. The SEC will then issue the certificate of incorporation. At this point, the company is considered to be a juridical entity.

The company is then required to obtain a local government permit from the city it intends to locate in, along with a community tax certificate and the authority to print receipts and invoices.

The next step is registering for the tax identification number and the registered books of accounts and receipts with the Bureau of Internal Revenue, and finally, registering with the Social Security System and the Department of Labor and Employment for the employees’ SSS, ECC, PhilHealth, and HDMF numbers and/or IDs. This process would generally take 1–5 months, excluding the months it takes to reserve the corporate name.”

Obtain a Tax Identification Number (TIN)

All businesses in the Philippines must have a TIN 30 days prior to the operation of the business.

A TIN is a unique 9-digit number generated by the BIR to identify the taxpayer. TIN is to be obtained when one is employed, if he/she starts a business, if you are going to file returns on income, and for the purpose of getting official documents too.

For Corporation and Partnerships, the TIN is different from the owners because a Corporation and a Partnership is a separate and distinct personality from the owners. The process involves filling out forms, and it can usually be accomplished when one registers his business with the BIR. Usually, the TIN is also used by the business to import and export goods.

Keep in mind that the TIN is a requirement for all businesses in the Philippines, and not having one may lead to penalties, fines, or the cessation of your business. TIN is needed at every step of the way when your business is conducting transactions with the different government bodies, agencies, and banks and is required when the business is paying tax.

Start-ups are required to bring a valid ID and a photocopy of said ID when applying for a TIN. Corporate businesses require a photocopy of the SEC certificate and a certificate of registration. TIN is relatively easy to obtain, and usually you can walk in and out of the BIR in a day with a newly obtained TIN.

Seek professional assistance if needed

Doing the process and document preparation yourself is not advisable for beginners.

In seeking professional assistance for registering your business or the complexities of business registration requirements, it is important to put things in the correct perspective.

You should consider whether it would be cost-effective considering the size, type, and nature of your business. Give due consideration to the importance of the registration process for your business.

If it is a large foreign investment or an IT business, for example, the speed and efficiency of the registration process may be of utmost concern to you. A consultation with lawyers or professionals who have expertise in this area can provide the clarity of action that you seek.

Remember that it is easier to make the right decisions at the outset than to have to retrace your steps to correct mistakes.

0 Comments