Forming a Partnership

It is important to know what business structure is suitable for your business

One of the first decisions you will make as an entrepreneur is to identify your business structure. There are 4 business entities: sole proprietorship, partnership, corporation, or cooperative. Each structure has its own registration process.This article discusses partnership in depth and discusses:

- What a partnership is.

- How it compares to the other structures.

- Its benefits and disadvantages.

- How to file it.

Let’s start with what it is.

What is a Philippine partnership?

Partnership is the equal sharing of liability and assets

A partnership is a business organization that is an association of at least two or more persons who agree to place money, property or industry in a common fund with the aim of sharing the profits among themselves.

The Civil Code of the Philippines also defines partnership as a juridical entity with a lawful object or purpose for the common benefit or interest of the partners.

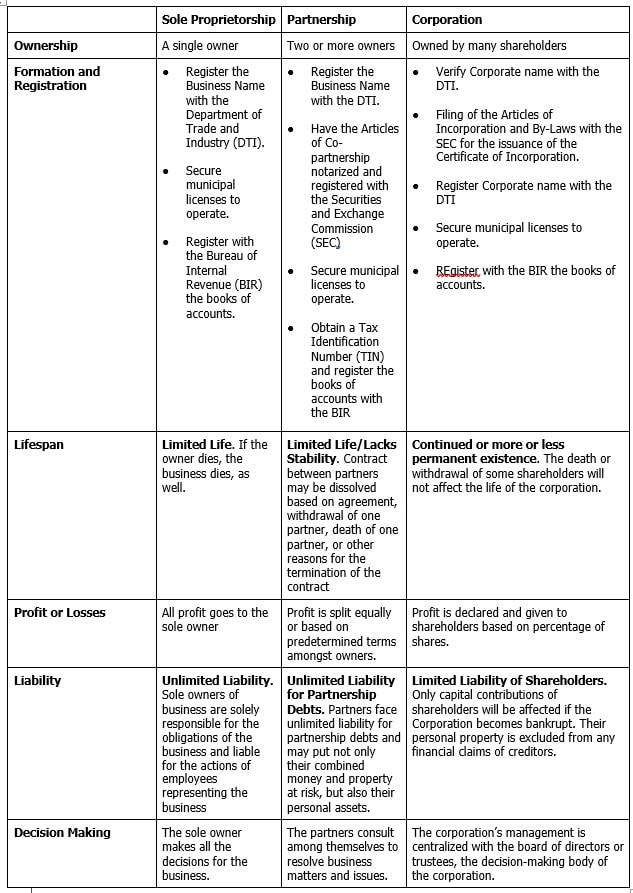

How does a partnership differ from a Sole Proprietorship and Corporation?

The differences between sole proprietorships, partnerships, and corporations are illustrated in the table below.

What are the benefits of a partnership?

There are several advantages to partnership

Take note of the following benefits if you are considering putting up a partnership:

- Partnerships are easy to form. The requirements are largely the same as for a sole proprietorship, the only difference is the creation of the Articles of Partnership. Compared to a corporation, there are fewer requirements to form and maintain a partnership business.

- There is the flexibility of operation. As there are only a few owners in a partnership business, certain concerns that need to be addressed can easily be solved by the partners. Agreements and resolutions as to business matters are immediately decided by the partners.

- Operations are efficient. Simply put, “Two heads are better than one.” There can be better managed because of the pooling of resources. With the presence of the partners, more ideas will also be applied in the operation of the business.

- Partners are expected to have great interest in the operation of the partnership. Partners have their own areas of interest and responsibility, which helps in the smooth operation of the business. The unlimited liability of the partners also encourages their interest in participating in the venture.

- The possibility of bigger resources. Financial institutions may extend bigger loans to partnerships considering the combined resources of the partners. Thus, more capital can be used in production.

What are the disadvantages?

A partnership is not a perfect structure. It also has some disadvantages

We should also recognize the disadvantages of a partnership, which are the following:

- Partners have unlimited liability for partnership debts. Partners face unlimited liability for partnership debts. Partners may not only put their combined money and property at risk but also their individual assets as well.

- It has a limited life or it lacks stability. Partnership is unstable. Being a contract between the partners, it is dissolved based on their agreement, or upon the withdrawal, incapacity, or death of a partner, or for other causes which terminate a contract.

- Limited ability to raise capital. The capital is based on how much can be contributed by each partner upon registration at the Securities and Exchange Commission.

Where is a partnership filed?

Registering a partnership may partly be done online.

In registering a partnership, there are four government agencies you need to visit. These are: the Department of Trade and Industry, the Securities and Exchange Commission, the Bureau of Internal Revenue, and the Business Permit and Licensing Office in the City/Municipal Hall of the city or municipality where your business will operate.

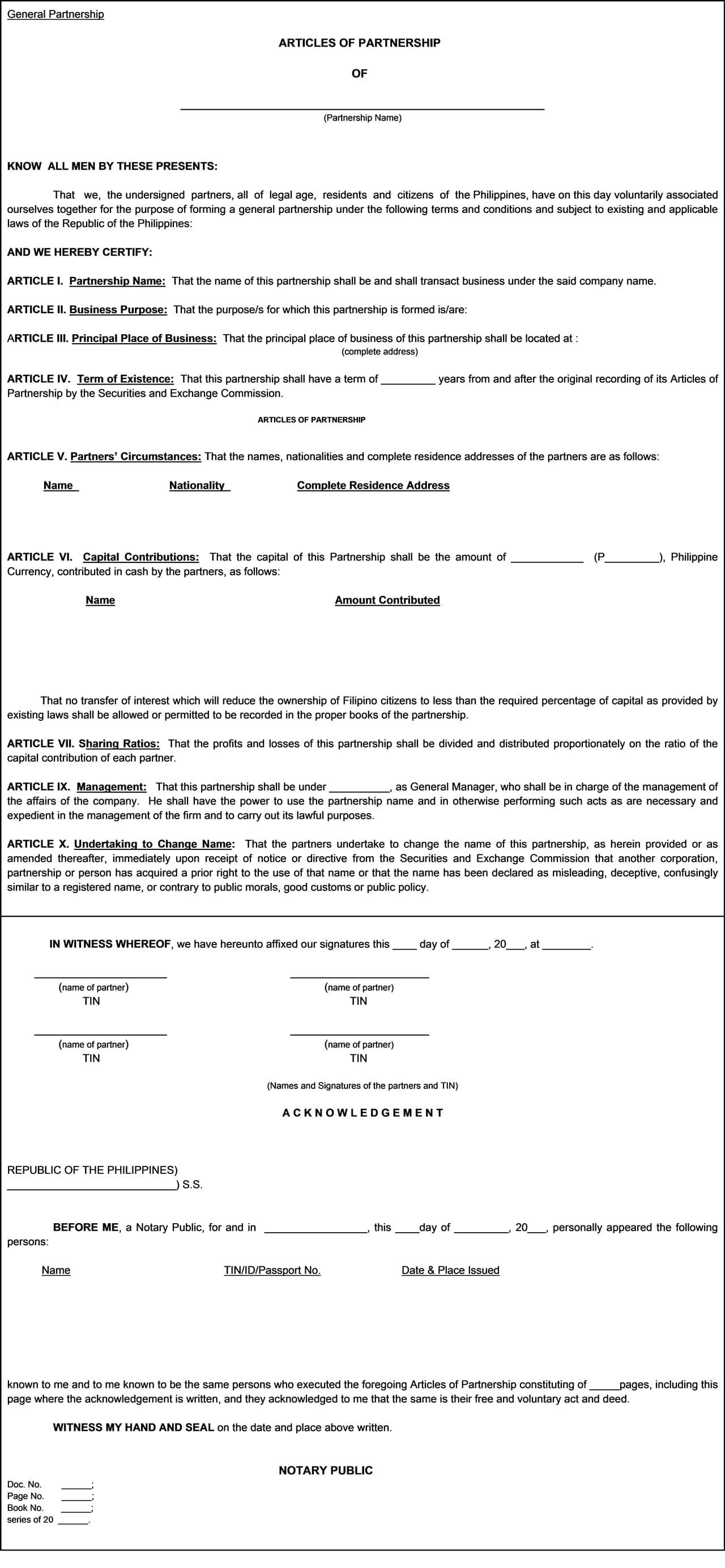

The first step of the process is to begin writing the Articles of Partnership with the assistance of a lawyer. This is the basic requirement for the whole process of registering your partnership business. Here are sample Articles of Partnership:

The Articles of Partnership must be complete, including the partners’ circumstances and capital contributions, signed by them, and duly notarized. This Articles of Partnership will form an integral part of your application to the SEC.

The Articles of Partnership must be complete, including the partners’ circumstances and capital contributions, signed by them, and duly notarized. This Articles of Partnership will form an integral part of your application to the SEC.

This is the process of registering your partnership:

Step 1: Register the business name (Department of Trade Industry).

Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC.

Step 3: Obtain a Tax Identification Number for the partnership from the BIR.

Step 4: Obtain pertinent municipal licenses from the local government.

What are the requirements to form a partnership?

Before filing for registration, you must complete and double-check all the documentary requirements first.

The requirements to form a partnership, include:

- Notarized Articles of Partnership

- Computer generated Cover Sheet from the SEC Online Registration System

- Photocopies of the valid IDs of the partners (to be attached)

- Completion of the SEC Online Registration system

- Secure the Payment Assessment Form (PAF) and payment of the relevant fees

- Submission of hard copies of documents to SEC

Can you file a partnership online?

You may begin the process online.

The process of registering a partnership can be done both online and offline. There are parts of the process, however, which require physical transactions with the government office. This is for the purpose of submitting hard copies of your requirements, submitting the signed government forms, paying the necessary fees to the cashier, and obtaining the licenses and permits at the end of the process.

Filing the initial documents is done online.

The first two steps in registering the partnership are

- Registering the business name with the Department of Trade and Industry

- Filing using the SEC Online Registration System.

What is the step-by-step process of filing a partnership online?

Be aware of the process. This will save you some time if properly followed.

This is the process of registering your partnership:

Registering the business name with the Department of Trade Industry.

-

- Business Name Registration System of the DTI – https://bnrs.dti.gov.ph/registration

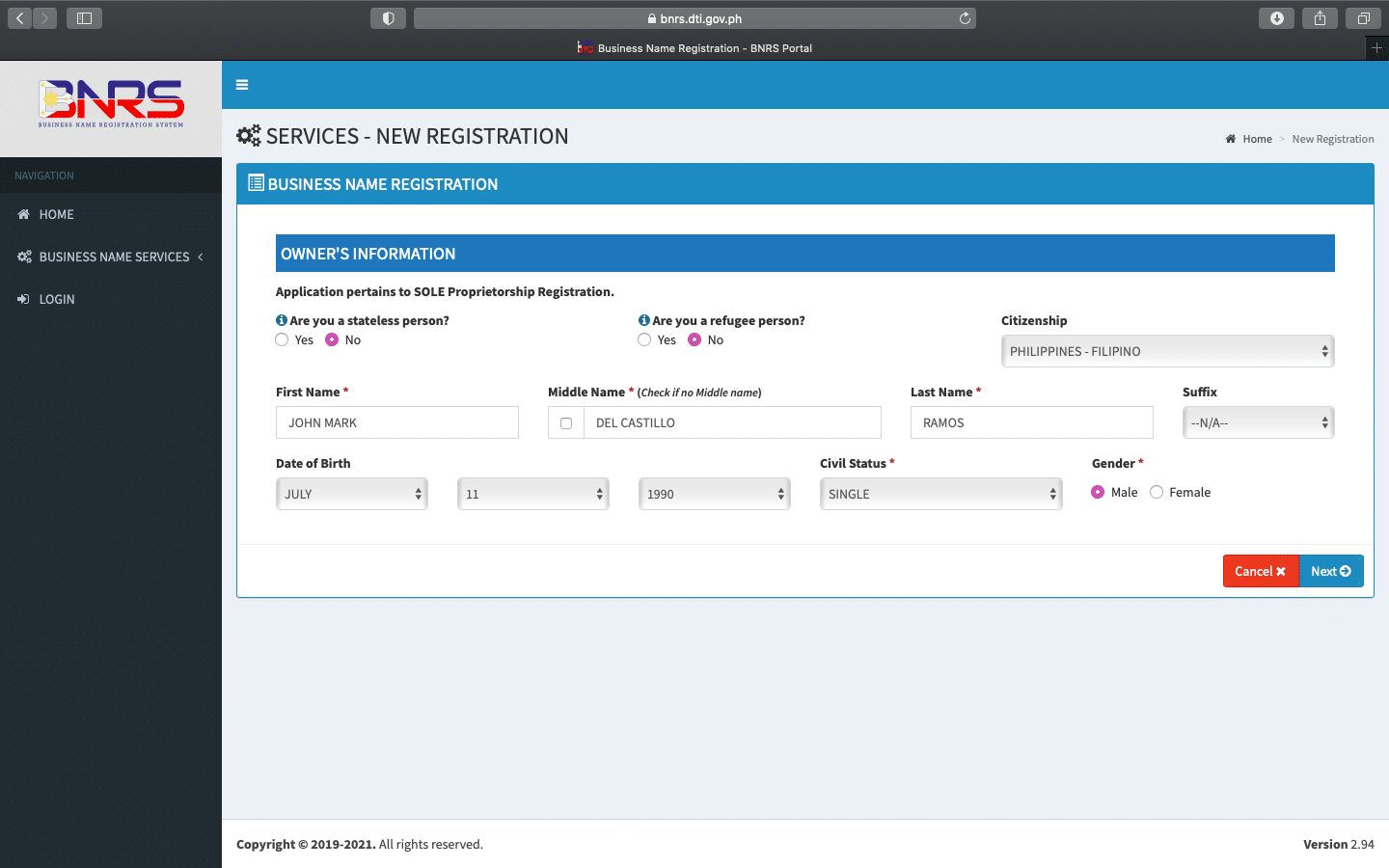

Step 1: Providing the Owner’s Information in the Application for Business Name Registration

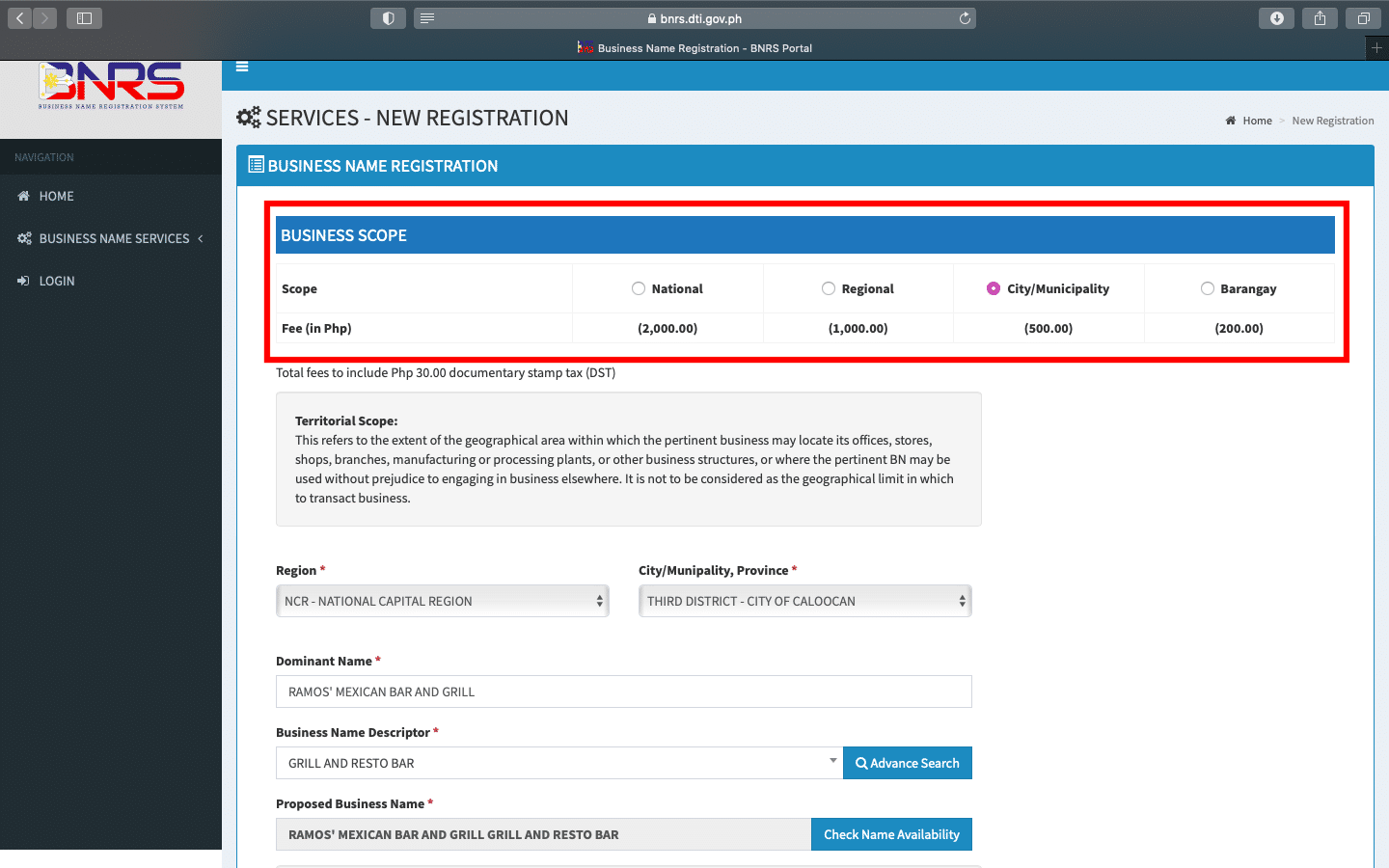

Step 2: Selecting the Scope of the Business to determine the corresponding Fees.

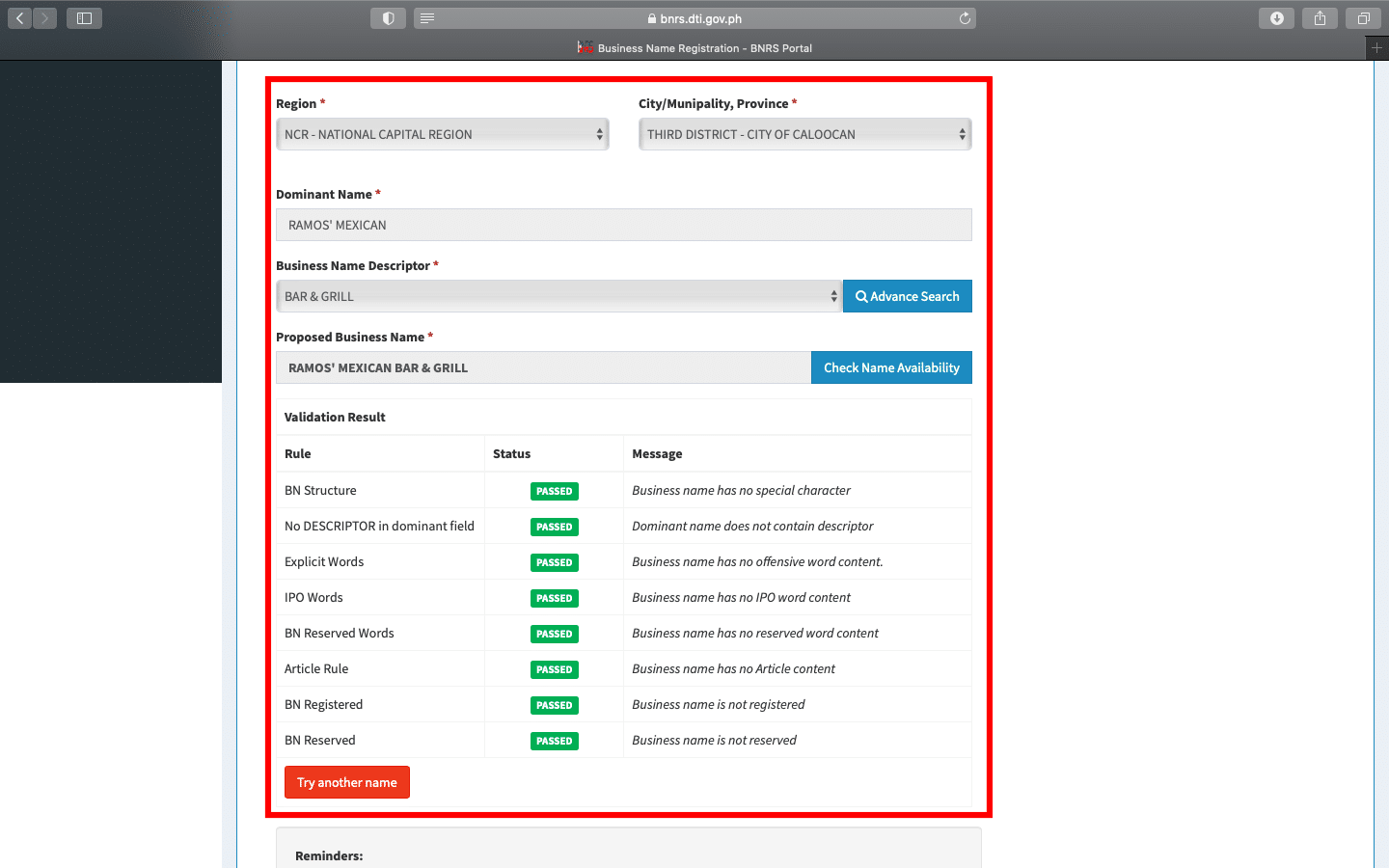

Step 3: Verification of the name of the business. You must have a “PASSED” status at every RULE to proceed to the next step.

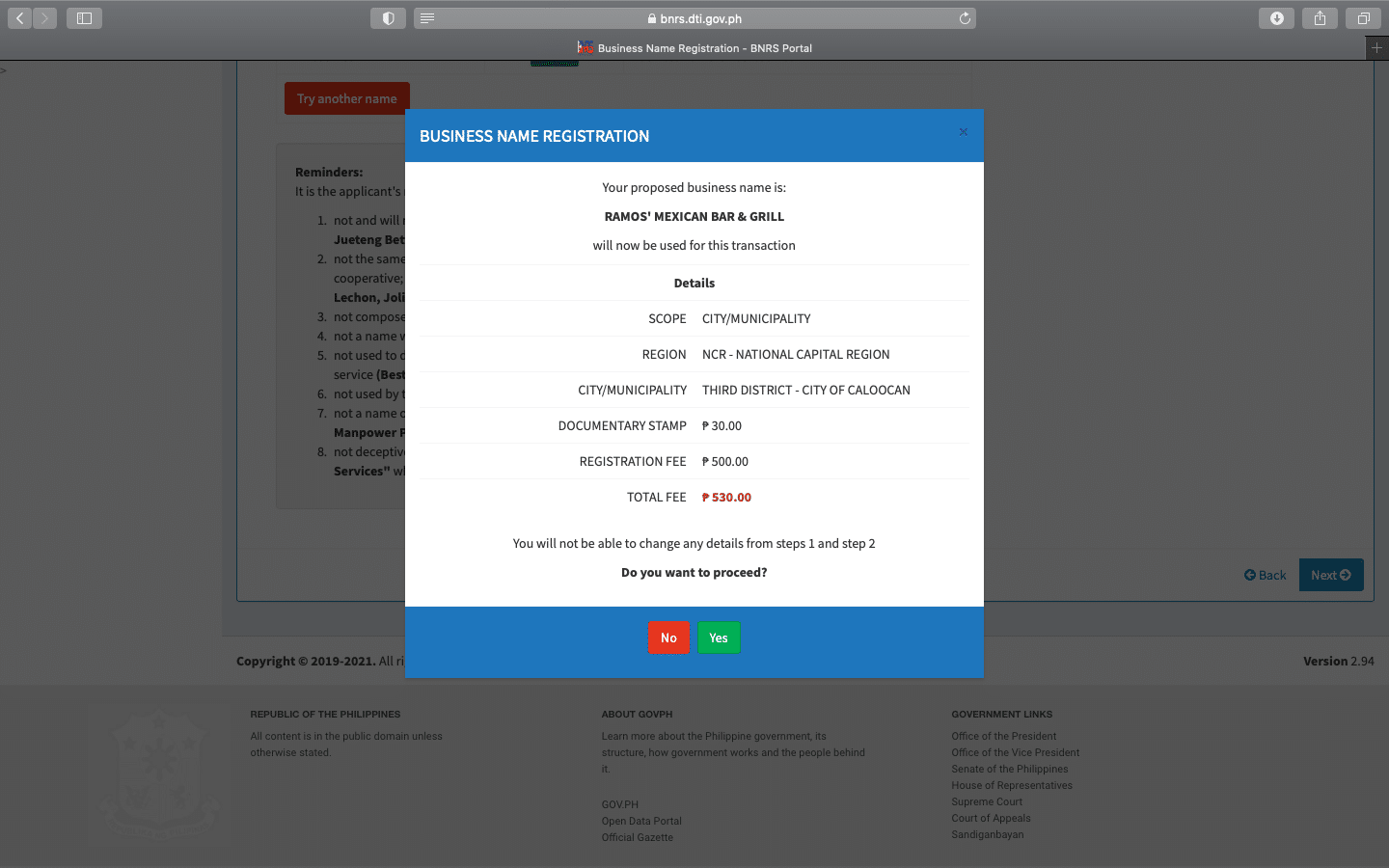

Step 4: Business Name Registration and Payment of Fees

Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC.

SEC Online Registration System: https://www.sec.gov.ph/online-services/sec-company-registration-system/

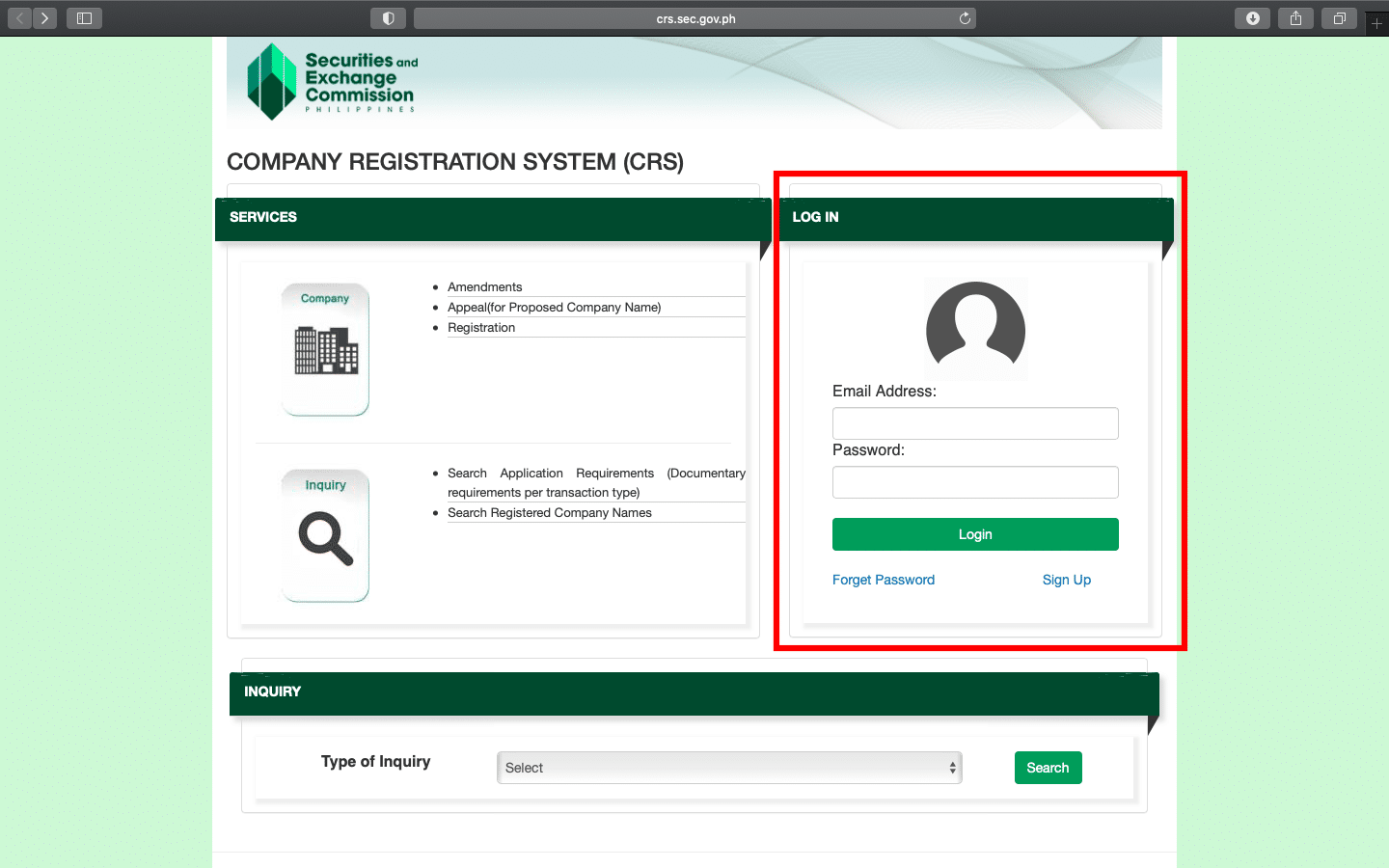

Step 1: Sign-up and Log in to the SEC Company Registration System (CRS)

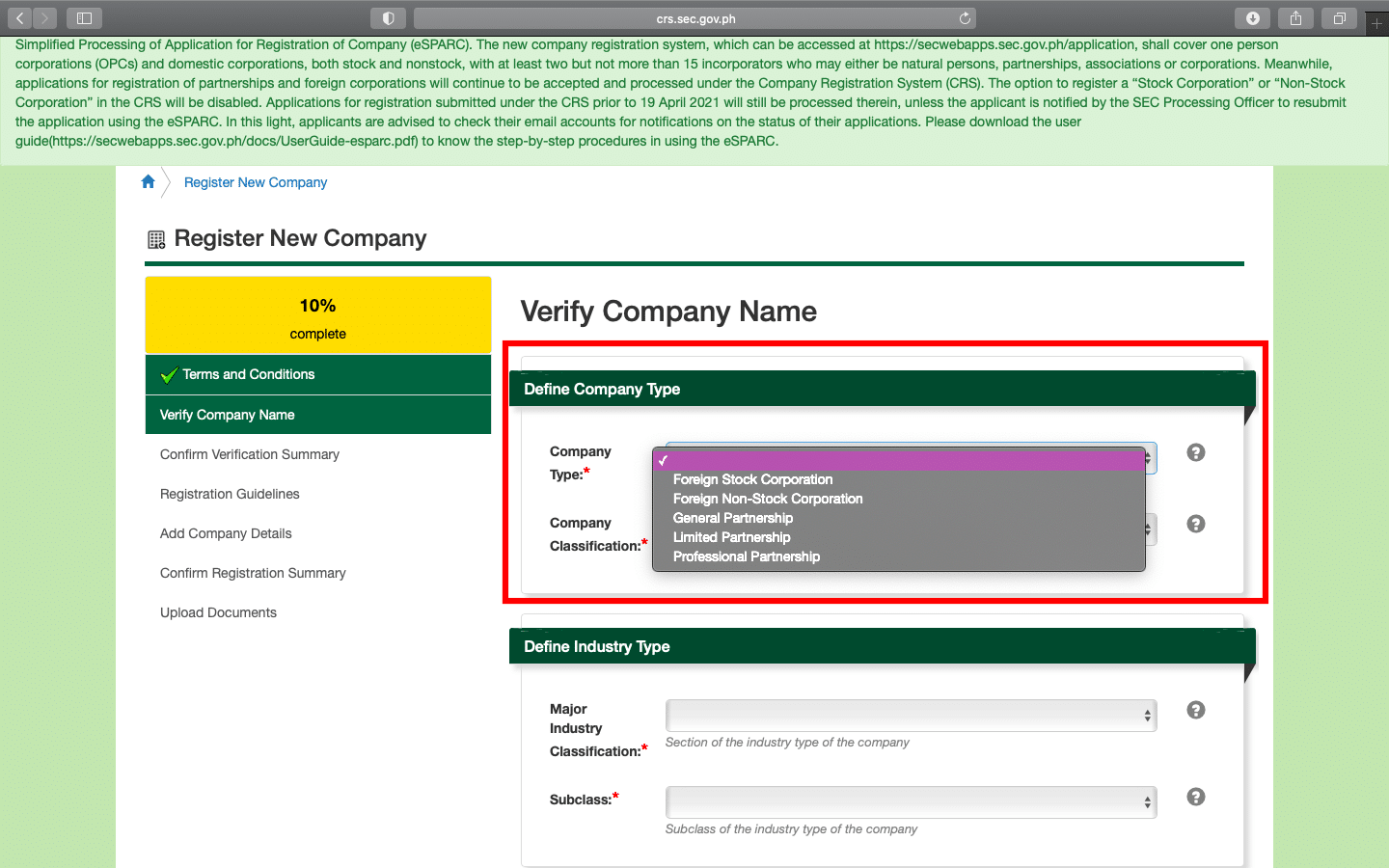

Step 2: Define your Partnership Type and Classification which may be General Partnership, Limited Partnership, or Professional Partnership

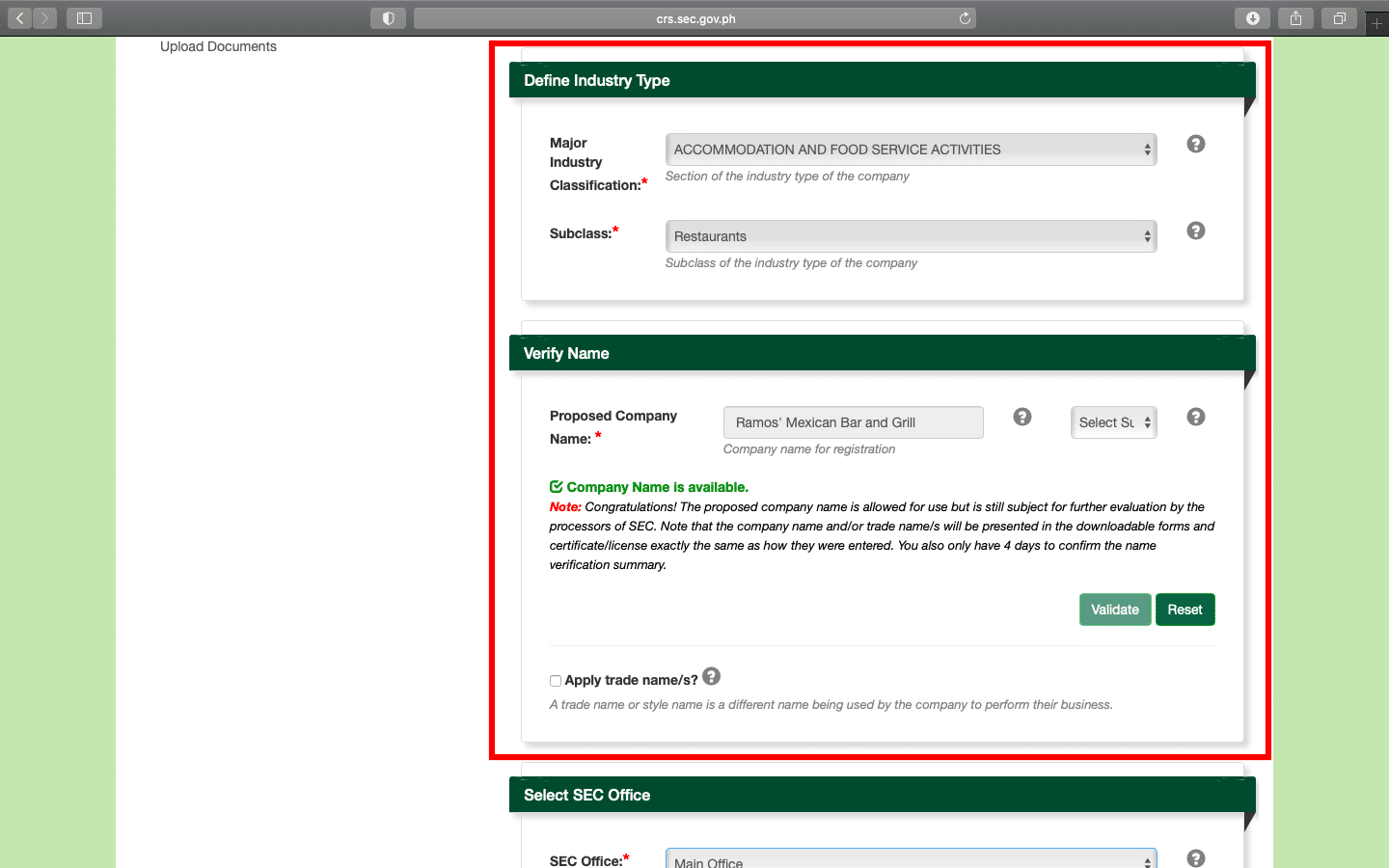

Step 3: Define your industry type and verify the name of our business. Take note that you cannot proceed unless the Company Name is available.

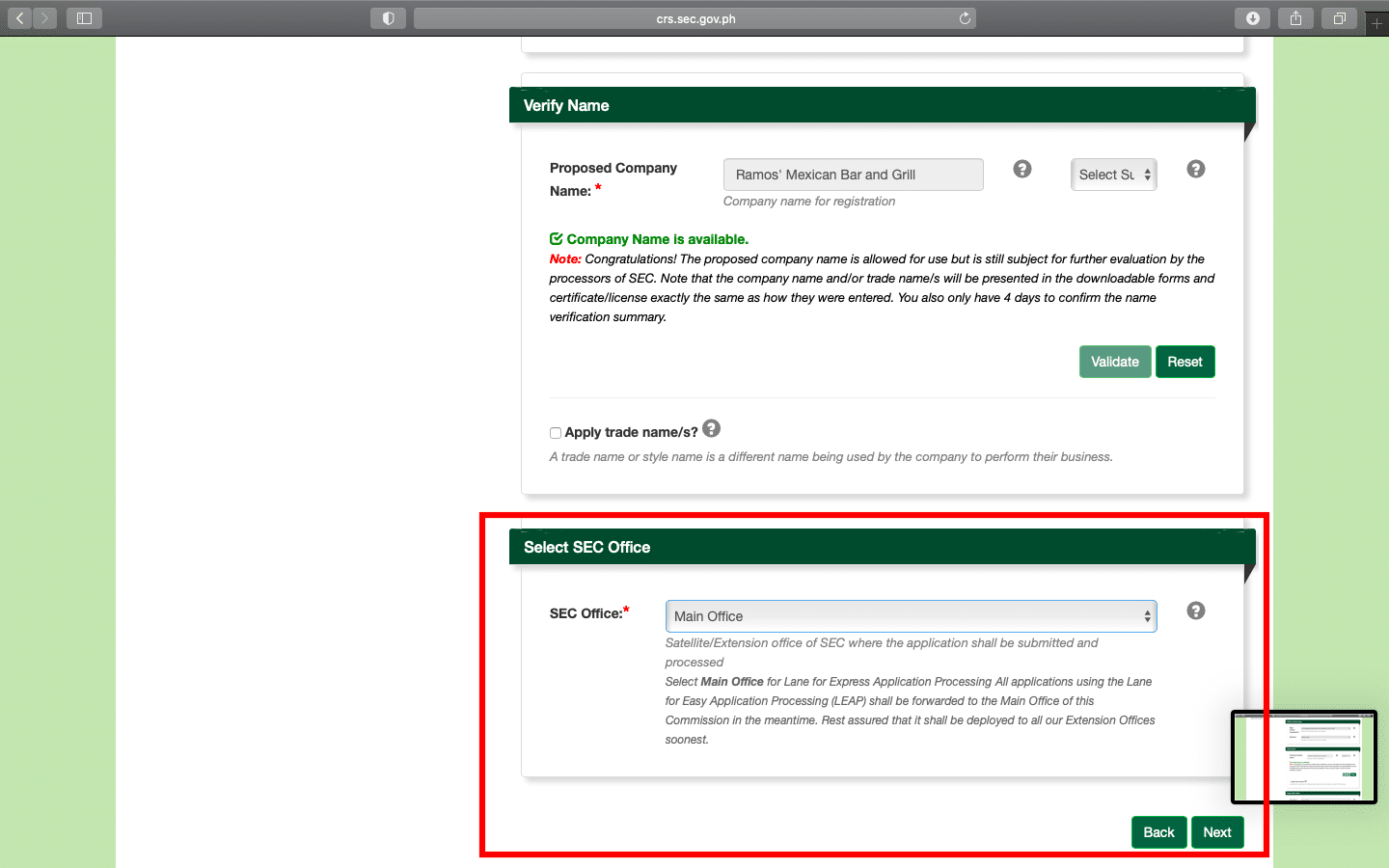

Step 4: Select the SEC Office where you will lodge your application and click “Next”

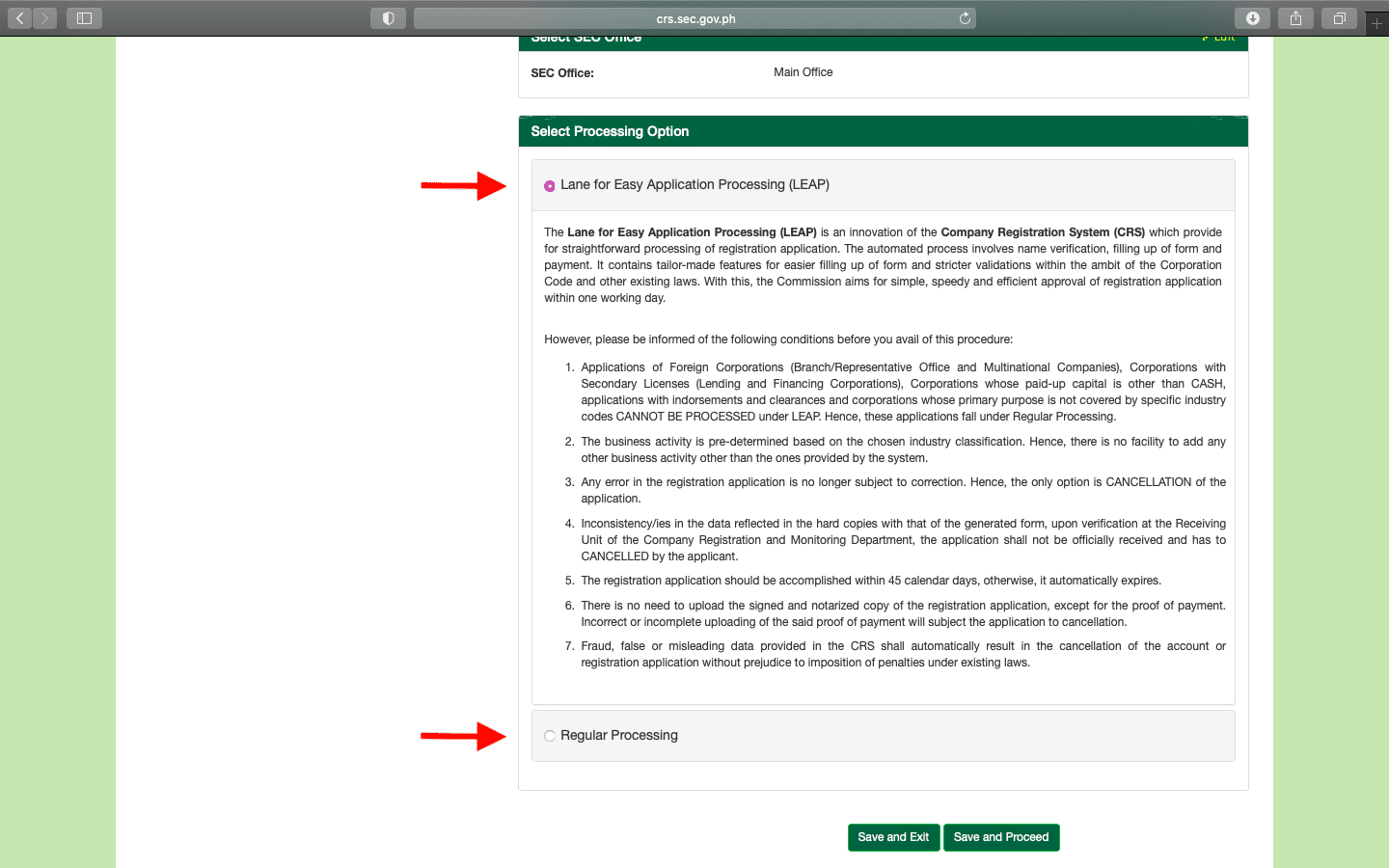

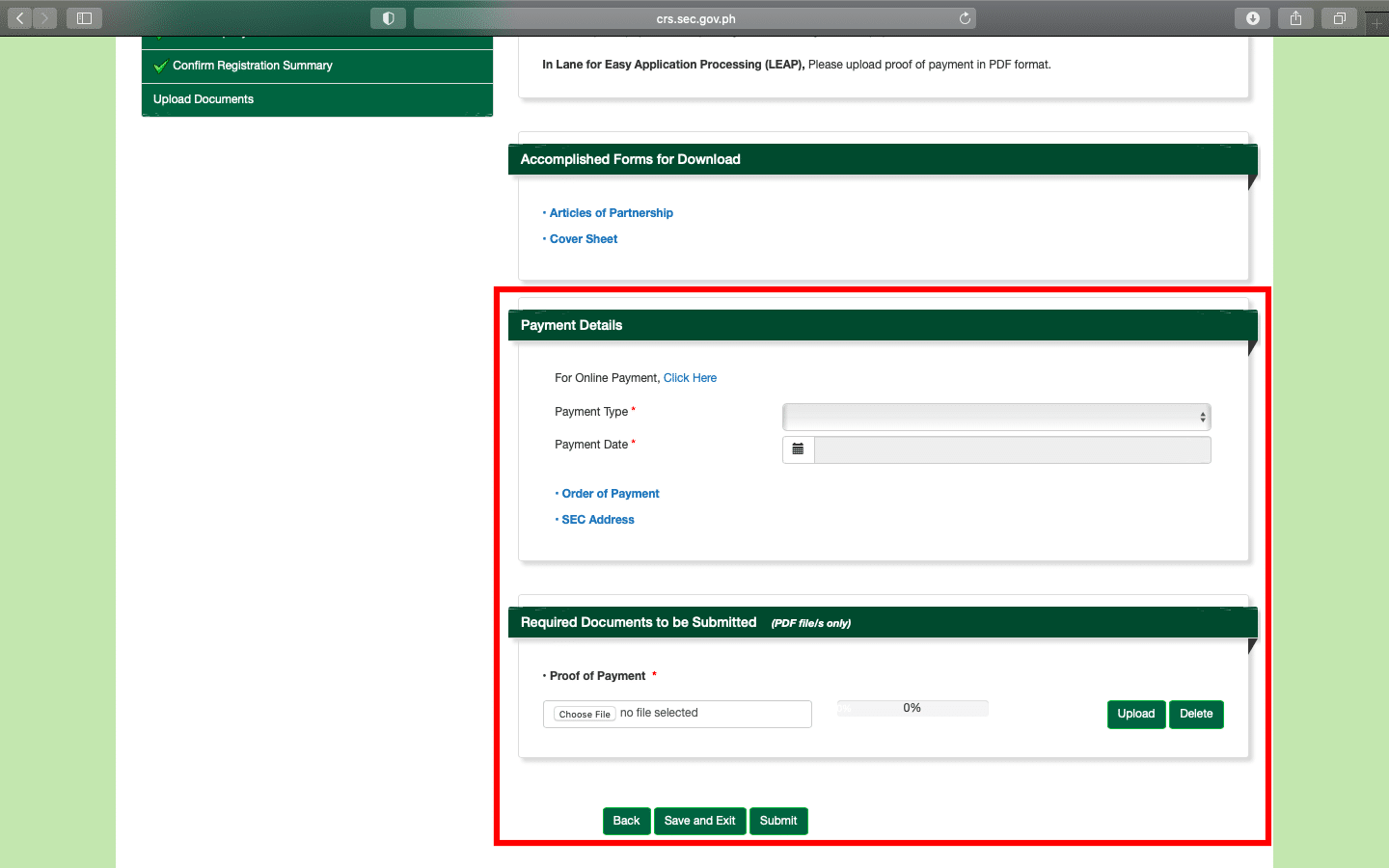

Step 5: Select the processing option which you prefer, which is either Lane for Easy Application Processing (LEAP) or the Regular Processing.

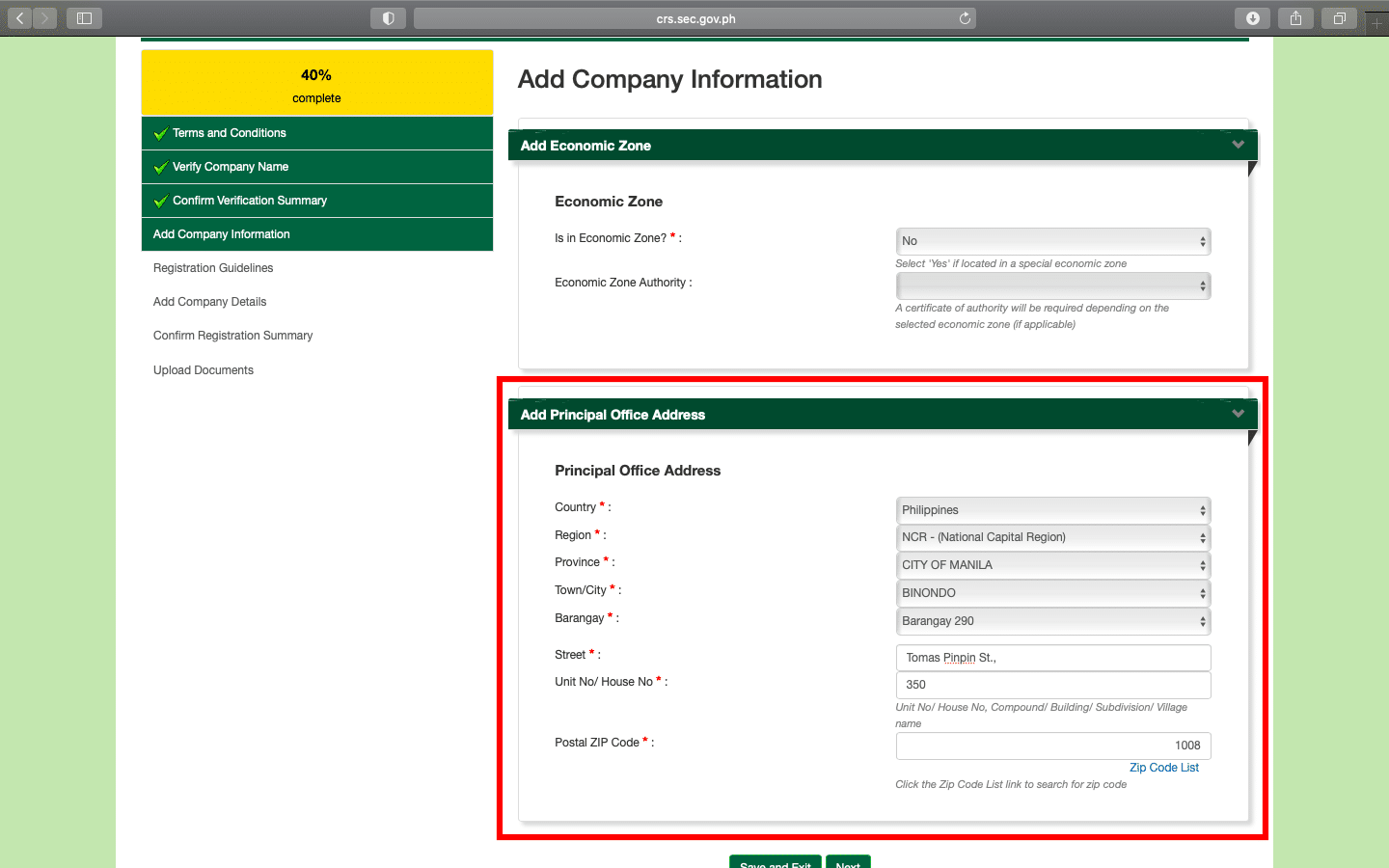

Step 6: Indicate your business’ information including the principal office address.

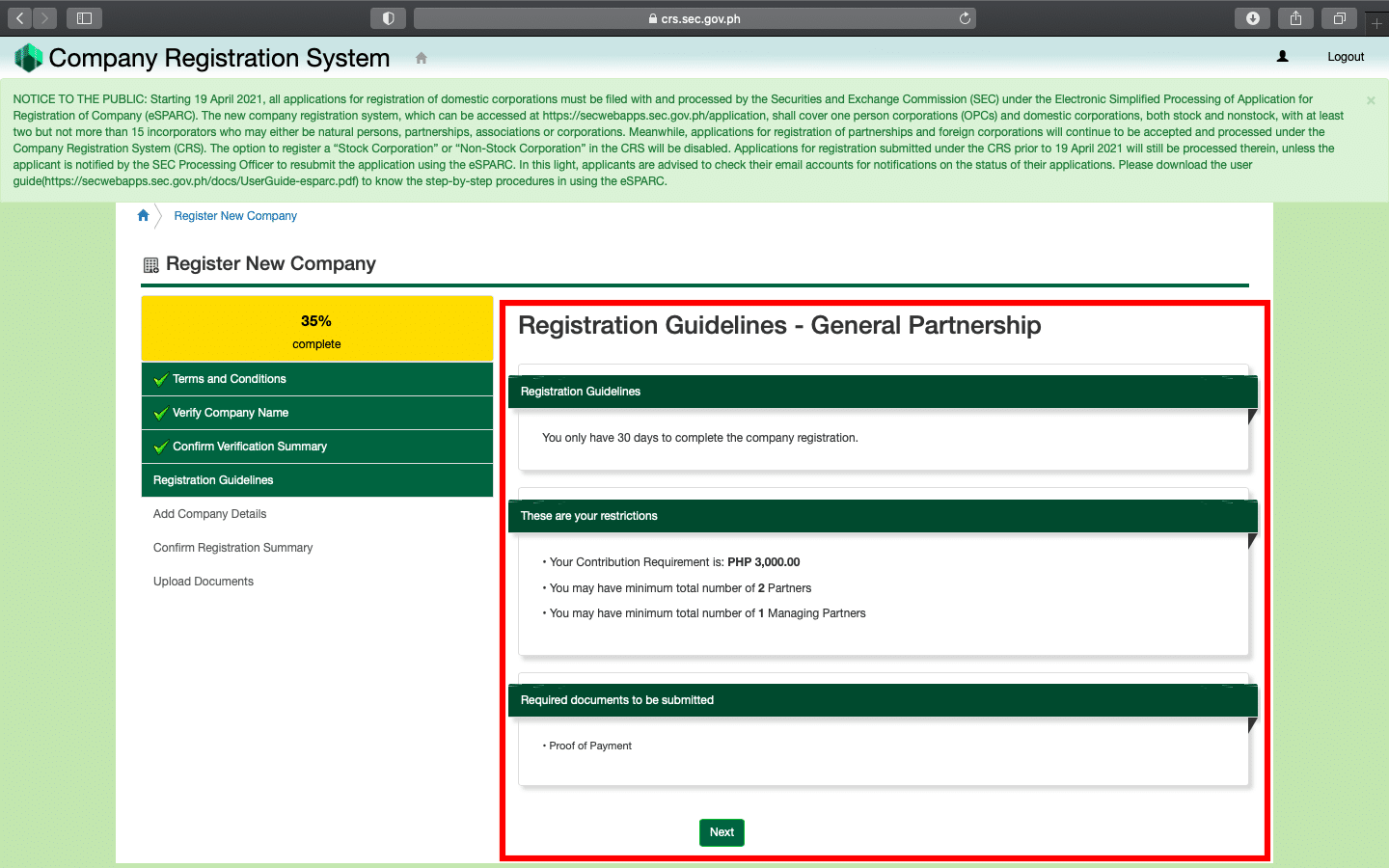

Step 7: The registration guidelines are provided along with the restrictions and required documents to be submitted. Take note of the contribution requirement, the minimum number of partners, and minimum number of managing partners.

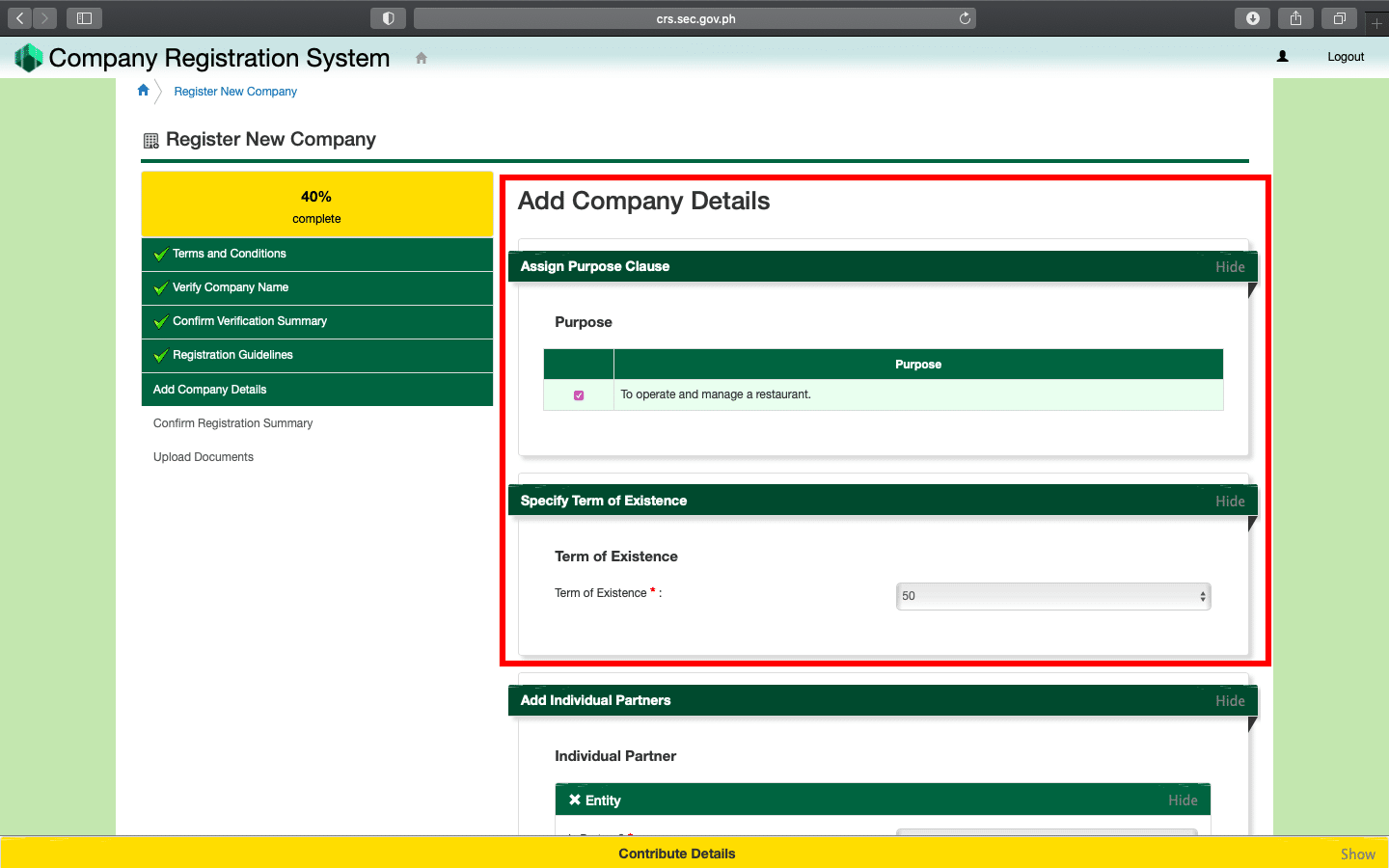

Step 8: Add company details including the purpose of the business and specifying the terms of existence (maximum is 50 years)

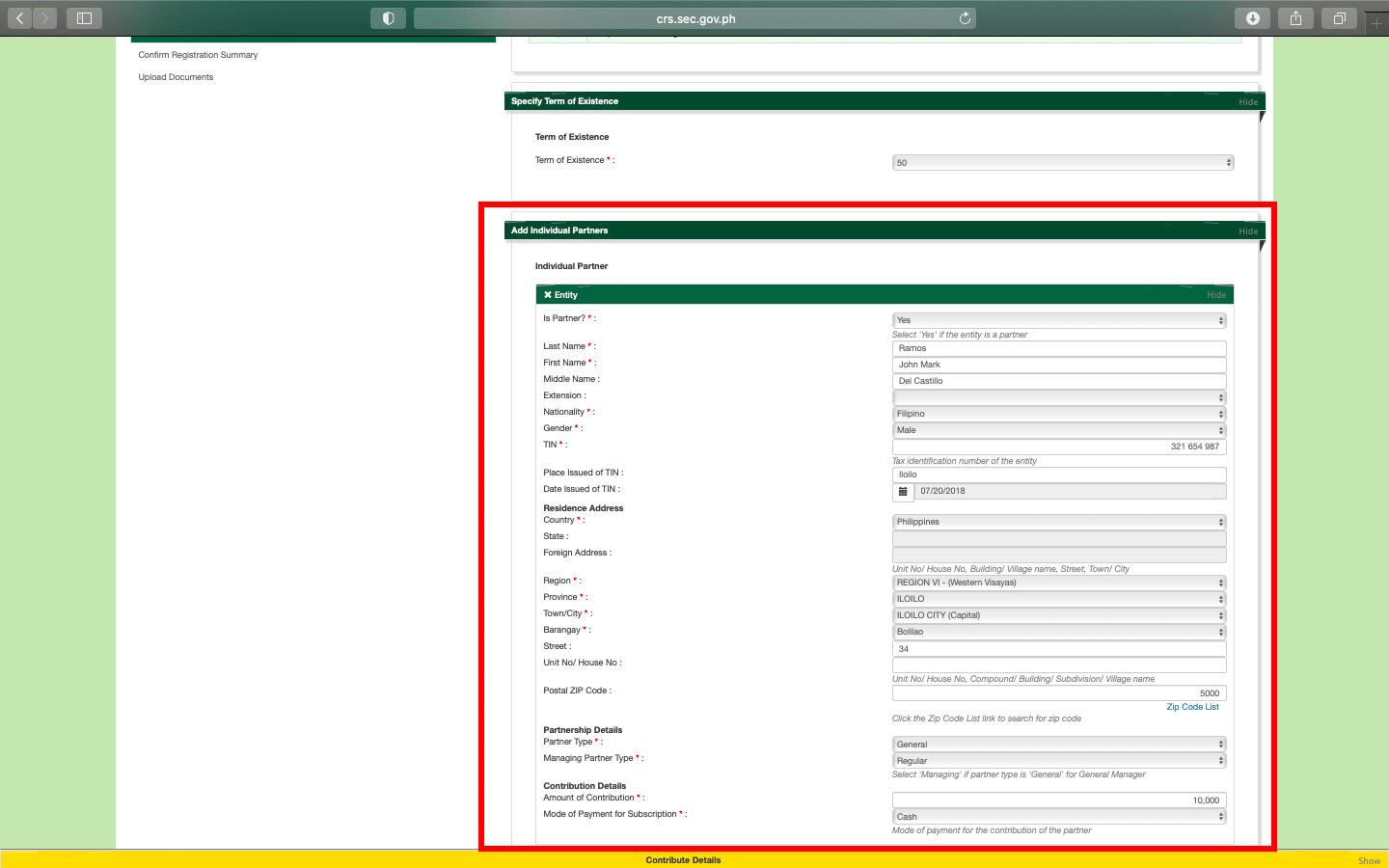

Step 9: Add the individual partners of the business. Each partner must indicate their personal TIN number, residential address, partnership details (whether regular or managing partner), and contribution details (amount and mode of payment).

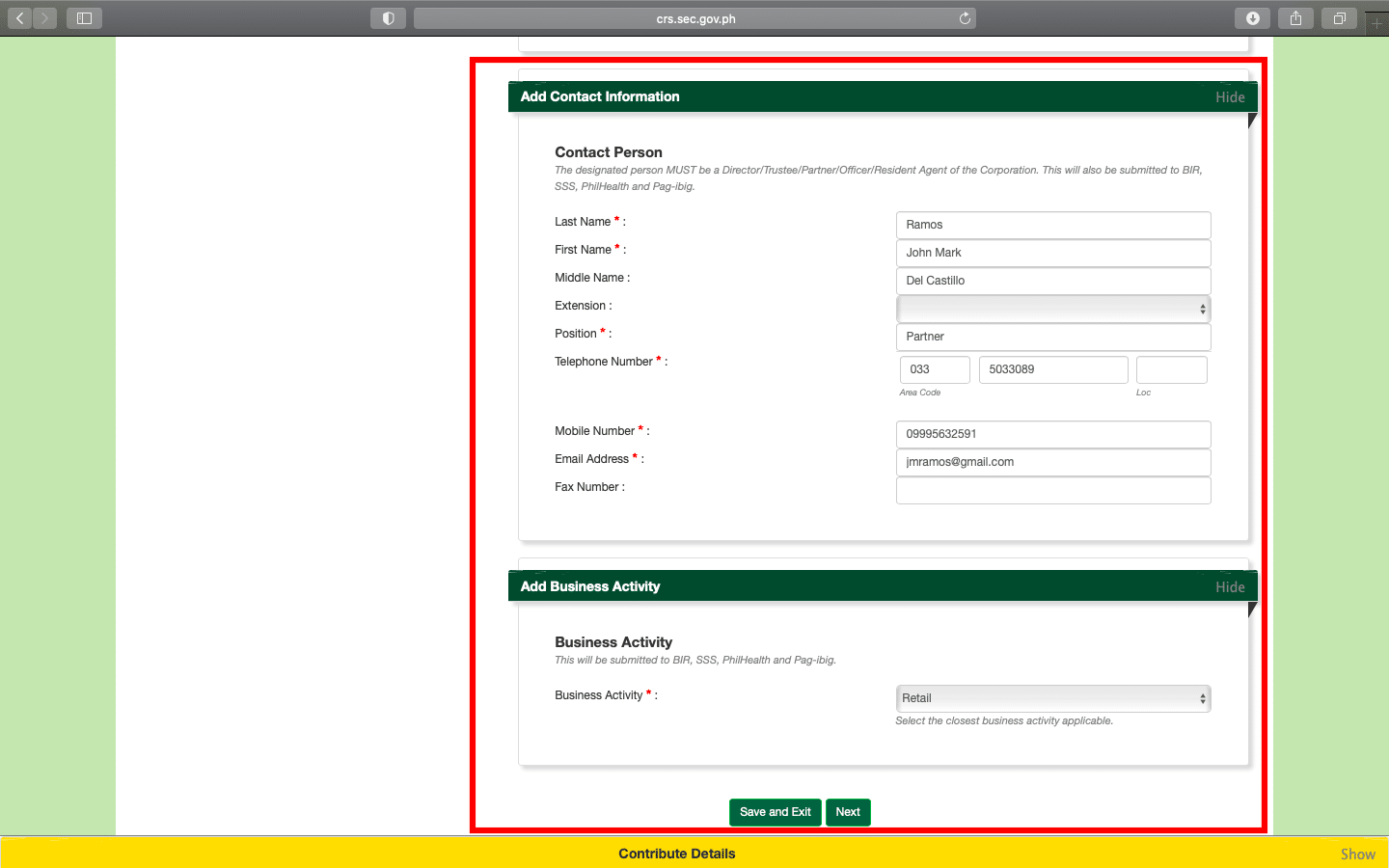

Step 10: Add the contact information of the designated person who represents the business and indicate the business activity that will be conducted. Proceed “Next”.

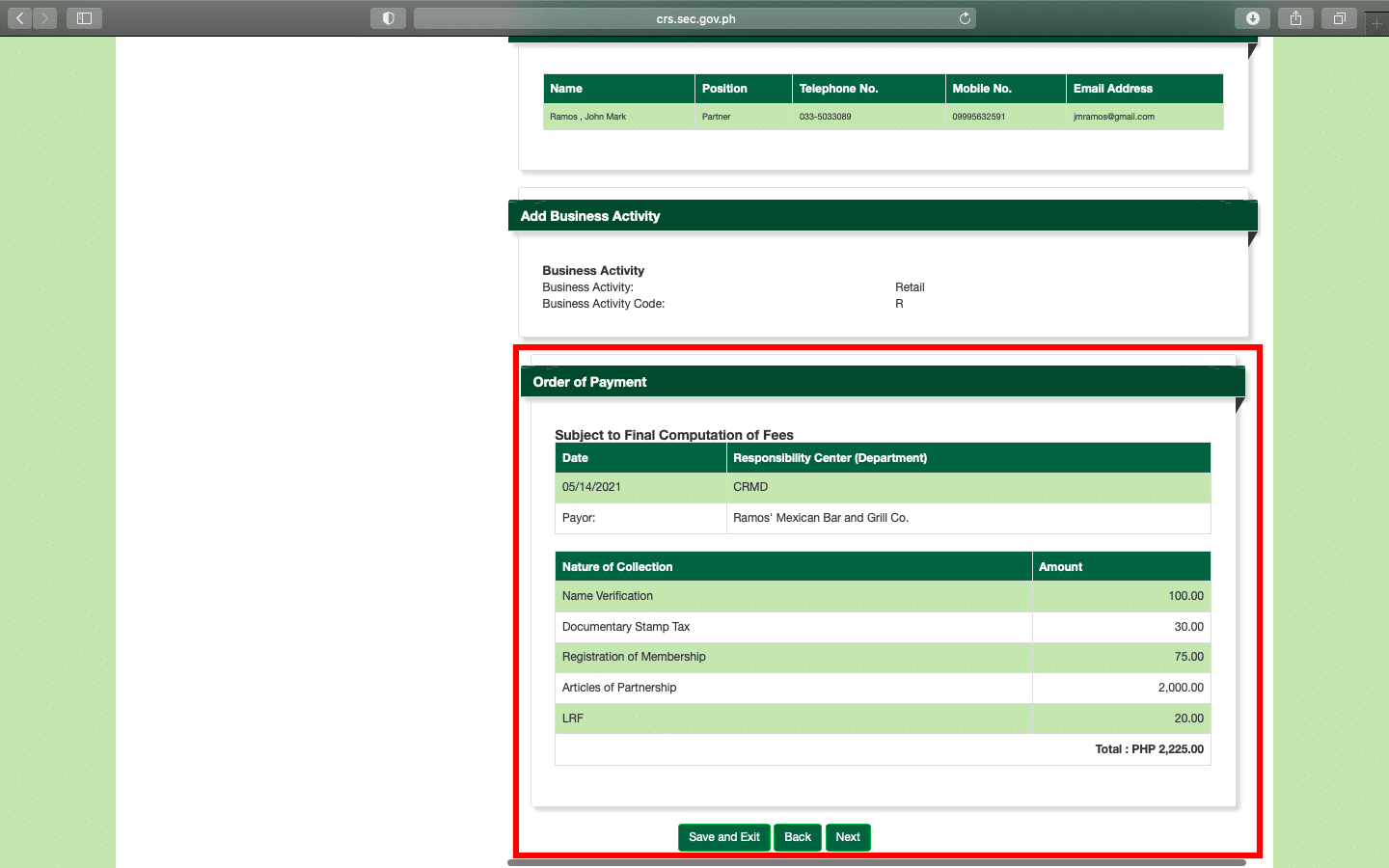

Step 11: An order of payment will be generated showing the total amount of the fee to be paid to the SEC. Proceed “Next”.

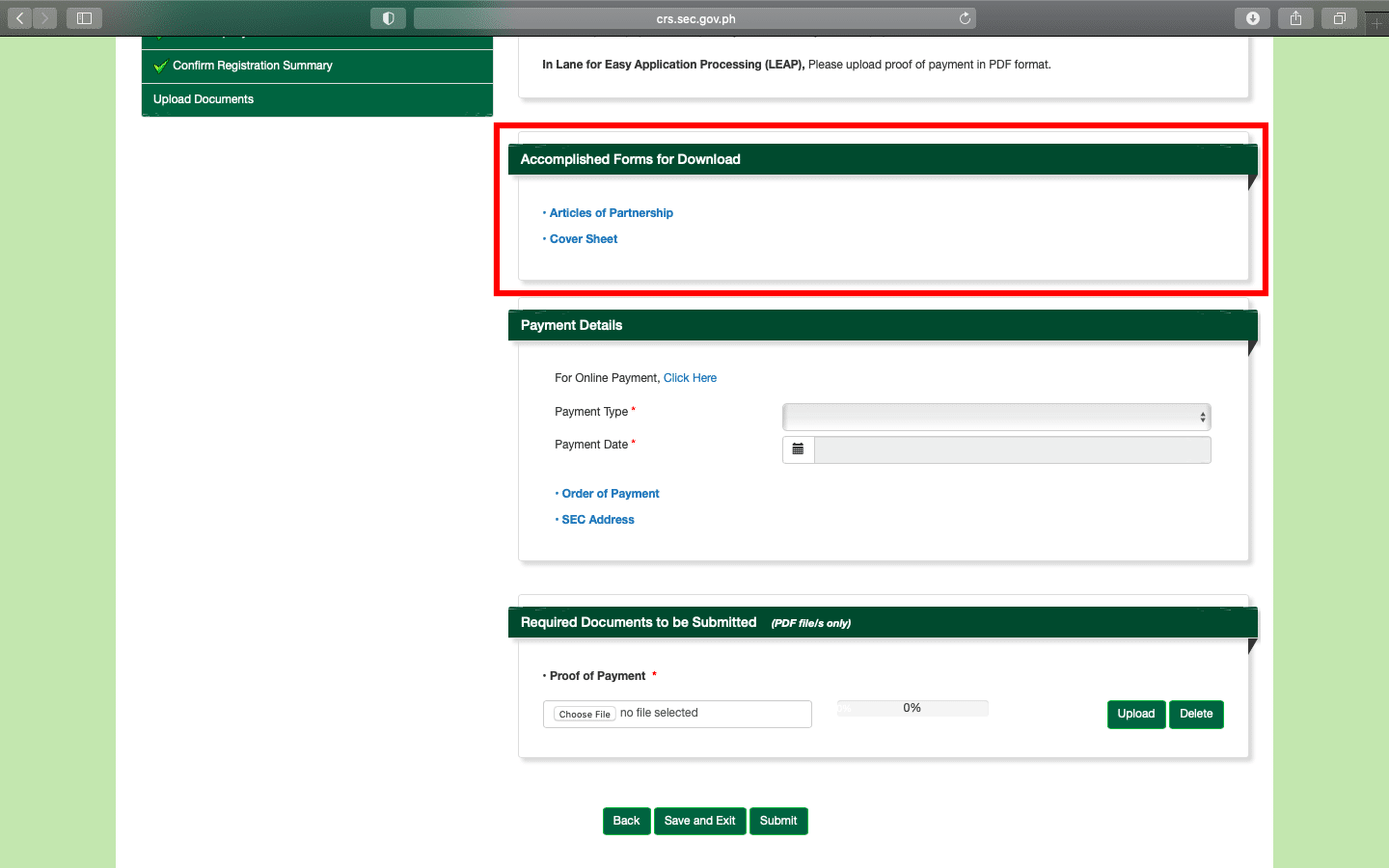

Step 12: Download the system-generated Articles of Partnership and Cover Letter. Hold on to these copies as they will be needed for processing. Print copies of the Articles of Partnership and Cover Letter, as needed.

Step 13: Choose your preferred mode of payment either online or through over-the-counter bank payment. Download and print the “Order of Payment”, if you choose the over-the-counter mode of payment, before paying at a Landbank of the Philippines branch.

Please check out this link for additional information on the SEC Payment Portal: https://www.sec.gov.ph/apps/payment-portal/home

After you have paid, upload “Proof of Payment” (receipt or deposit slip). Note it must be uploaded as a PDF file. After uploading, click “SUBMIT”

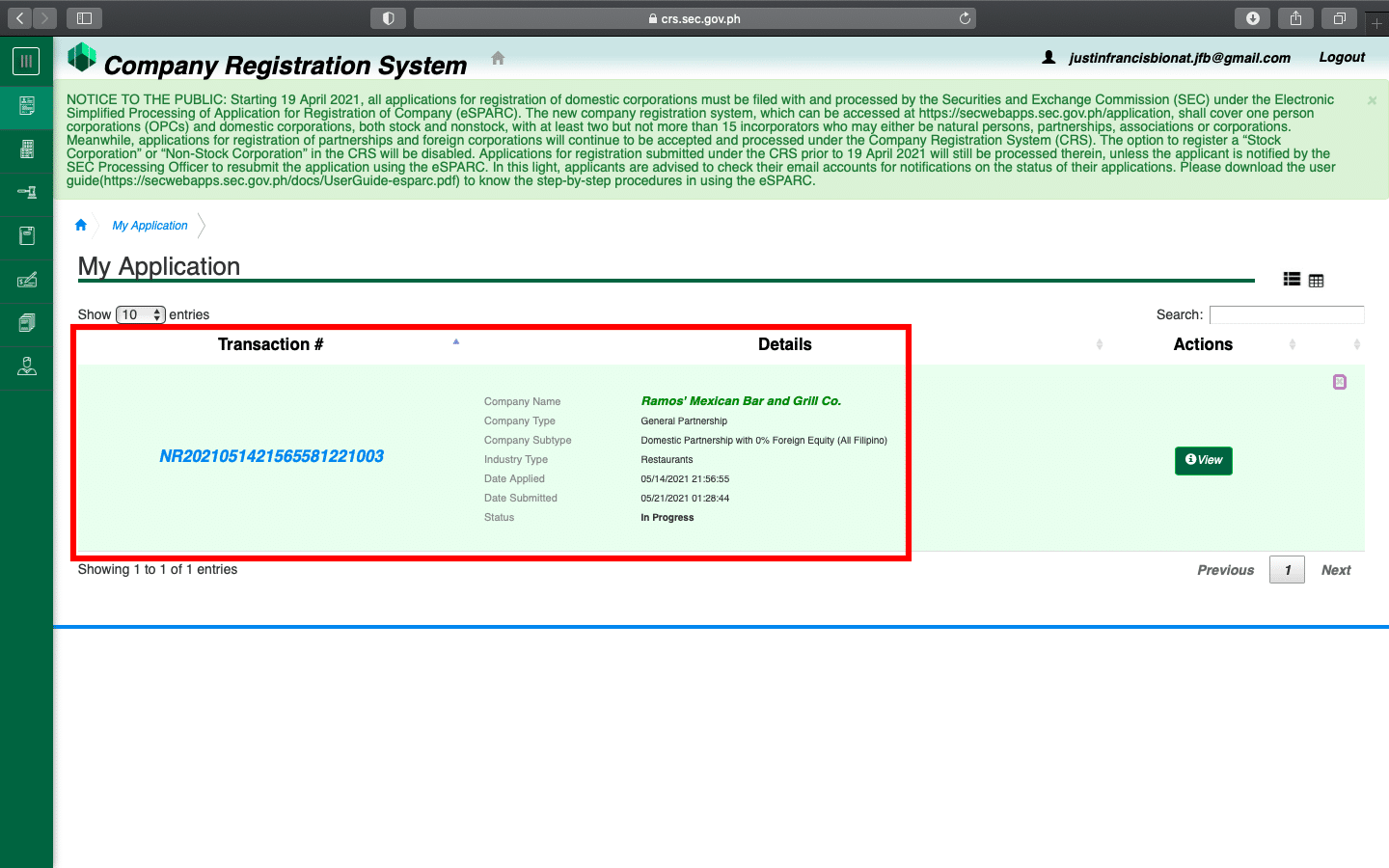

Step 14: Once you have completed the form and clicked “SUBMIT”, you will be redirected to the home page. You have to then await for the approval of the SEC. They will verify if payment has been made and approve the online registration of your partnership. Make sure to take note of your Transaction Number.

Assuming that your application is approved and payment is verified, you will be notified via email regarding the status of your application.

That ends the online application process. However, to complete the whole process you must physically visit the SEC office where you lodged the application. When you visit you will need to:

- Bring printed copies of “Cover Sheet” and “Articles of Partnership” to the SEC office.

- Ensure that the Articles of Partnership have been signed by your partners and notarized by a notary public.

- Bring printed copies of your proof of payment (this may be asked at the SEC office).

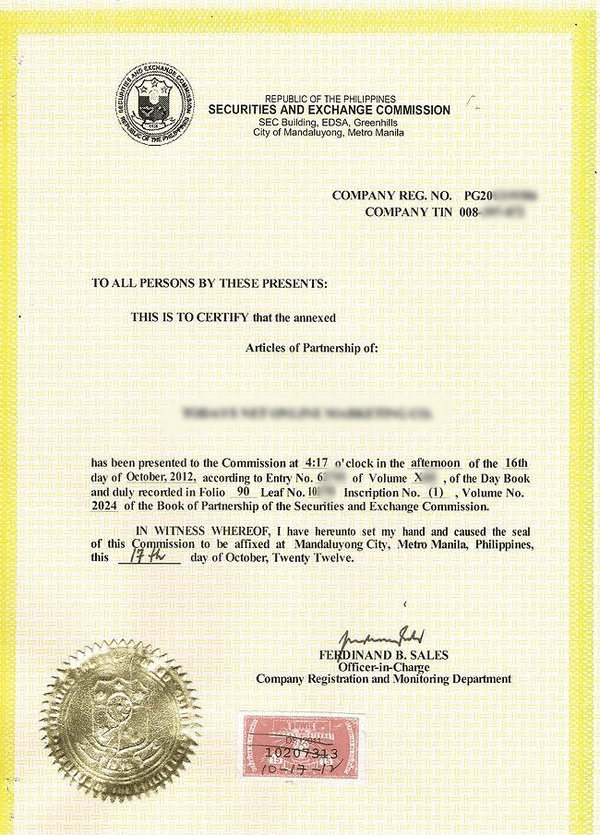

Once fully informed of the approval by the SEC, you can visit the SEC office again to get hard copies of your Certificate of Registration.

Normally the process of registration will take about one month.

Here is a sample of a Certificate of Registration:

0 Comments

Trackbacks/Pingbacks