How to incorporate in the Philippines from abroad

While there are several requirements, it is possible to incorporate in the Philippines from abroad.

Furthermore, foreigners – not just Filipinos – can incorporate a company even if some or all of the incorporators are overseas.

Prior to the pandemic, the Securities and Exchange Commission allowed some corporate affairs to be conducted remotely or online. The SEC has continued to introduce steps to improve the ease of doing business in the Philippines since then.

The Philippines is considered one of the most business-friendly economies due to policies that provide greater economic access to foreign entrepreneurs.

In this article, I will focus on how to incorporate in the Philippines from abroad for foreigners as well as general FAQs on the process of incorporation in the Philippines.

Contents

- Who can be incorporators in the Philippines?

- Can a foreigner or a Filipino incorporate in the Philippines from abroad?

- How do you determine whether a corporation is engaged in a nationalized activity?

- Export oriented companies

- What is the consequence of failing to maintain the ratio?

- Can foreigners serve on the board of directors of a corporation?

- Can foreigners serve as officers of a corporation?

- What are the requirements when deciding to incorporate in the Philippines from abroad?

- Treasurer-in-Trust

- How do you sign/prepare documents when deciding to incorporate in the Philippines from abroad?

Who can be incorporators in the Philippines?

The Articles of Incorporation is the highest governing document of a corporation as it establishes the company’s ownership structure.

Incorporators are the stockholders or members named in the articles of incorporation. They sign its articles and by-laws, being the persons who organized and originally formed it. Each incorporator of a stock corporation must own or subscribe to at least 1 share of the capital stock.

The old Corporation Code required that a majority of the incorporators must reside in the Philippines, but the Revised Corporation Code of 2019 dispensed with this residency requirement.

The old law also set a minimum of 5 and a maximum of 15 incorporators who must all be natural persons of legal age. Juridical persons such as other corporations could be transferees of the shares of stock only after incorporation.

The new law is a breakthrough for all OPC as it fills the gap of an almost four-decade-old law that was a stumbling block in a rapidly changing and competitive environment.

These were changed by the new law. Now, a partnership, association, or corporation can also be an incorporator. The minimum number of incorporators has also been brought down. The law now allows the formation of even a

The restrictions are designed as security for economic value of the domestic market and the welfare of Filipino consumers while encouraging businesses to significantly expand livelihoods and employment opportunities.

One Person Corporation (OPC), is a corporation with only a single stockholder.

However, because an OPC is its own category and subject to specific requirements, and because a primary benefit of incorporation is the pooling of resources, it more often remains preferable to form a corporation with at least 2 incorporators.

Can a foreigner or a Filipino incorporate in the Philippines from abroad?

Yes, a foreigner or a Filipino may incorporate into the Philippines from abroad.

Not only may incorporators of Philippine corporations begin setting up a business from overseas, but they also need not be Filipino citizens.

Corporations incorporated in the Philippines may be entirely foreign-owned.

SEC upholds the interest of Filipinos by limiting foreign business ownership in the Philippines.

However, some industries are wholly or partially reserved for Filipinos by law.

For example, the Retail Trade Liberalization Act of 2000 prohibits foreign enterprises with a paid-up capital of less than $2,500,000 from engaging in the retail trade business,

Business registrants can now pay and register their company from the comfort of their offices.

reserving retail trade below that threshold to Filipino citizens and corporations owned by Filipino citizens.

The restrictions are consolidated in the Negative List, an oft-revised issuance by the Office of the President, on its 12th iteration as of June 2022. This Negative List should be considered when foreigners are considering incorporation into the Philippines.

The Negative Investment List is segmented into List A and List B.

List A covers industries where restrictions on foreign ownership are imposed by the Philippine Constitution or statute.

List B covers industries restricted for reasons such as national security and defense, the risk to health and morals, and the protection of local Small and Medium Enterprises (SMEs).

How do you determine whether a corporation is engaged in a nationalized activity?

The country recognizes the importance of small retail businesses owned by Filipinos.

The company’s articles of incorporation are crucial to this.

The primary purpose of the corporation as found in the articles — as well as in how it actually conducts its business — must be examined.[1]

If these fall within the Negative List, then the concomitant restrictions apply.

[1] SEC-OGC Opinion No. 19-57, 26 November 2019.

Export oriented companies

Another salient consideration for domestic companies formed by foreign incorporators is whether or not is an export-oriented enterprises.

In order to attract foreign investors, the laws accord privileges to export-oriented companies which serve international markets more than the Philippine domestic market.

Among these privileges are a lower minimum capitalization requirement, helpful for a company still finding its footing.

All information about the company is written in its Articles of Incorporation.

The Foreign Investments Act relevantly defines export and domestic market enterprises:

An export enterprise is defined as a manufacturer, processor or service which exports 60% or more of its output, or a trader which purchases products domestically and exports 60% or more of those purchases.

A domestic market enterprise produces goods for sale, or renders services to the domestic market entirely or fails to consistently export at least 60% of its output.

Believe it or not, the Philippines exports more electronic products than fruits.

Export-oriented corporations enjoy privileges such as a lower minimum capitalization requirement, tax holidays, duty-free importation of equipment and raw materials, and streamlined visa processes for the employment of foreign nationals.

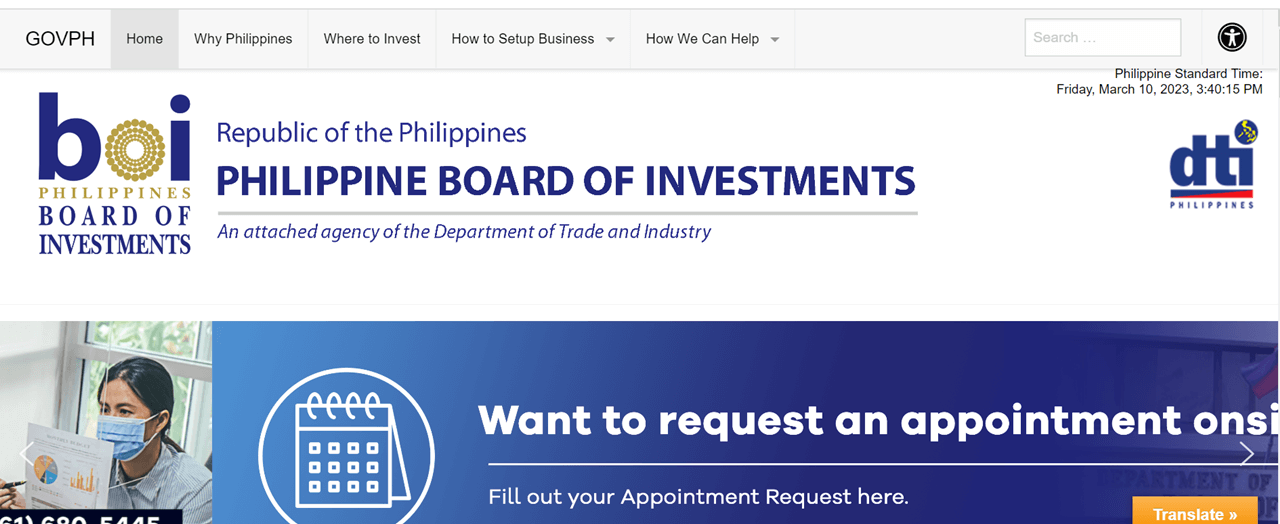

Export enterprises that are non-Philippine nationals must register with the Board of Investments and submit the reports required to ensure the company’s continuing compliance with its export requirement. The BOI shall advise of any export enterprise that fails the meet the export ratio requirement.

SELECTA, known as one of the best ice cream producers in the Philippines, started its domestic ice cream making in Manila way back in 1948 and is now exporting to 40 countries.

Exports mean the volume or the Philippine port F.O.B. peso value of products exported directly by an export enterprise or the value of services sold by service-oriented enterprises to

Registration with the PBOI usually takes 10-20 days depending on the type of business.

non-resident foreigners or the net selling price of export products sold by an export enterprise to another export enterprise that subsequently exports the same. Sales of export products to another export enterprise will only be counted as exports when actually exported by the latter. On the other hand, even without actual exportation, the following are considered exported for purposes of the law (1) sales of products to bonded manufacturing warehouses of export enterprises; (2) sales of products to export processing zone enterprises; (3) sales of products to export enterprises operating bonded trading warehouses supplying raw materials used in the manufacture of export products; and (4) sales of products to foreign military bases, diplomatic missions and other agencies and/or instrumentalities granted tax immunities of locally manufactured, assembled or repacked products whether paid for in foreign currency or pesos funded from inwardly remitted foreign currency.

Sales of locally manufactured or assembled goods for household and personal use to Filipinos abroad and other non-residents of the Philippines as well as returning overseas Filipinos under the Internal Export Program of the Government and paid for in convertible foreign currency inwardly remitted through the Philippine banking system are also counted as exports.

The Philippine Statistics Authority said that of the total external trade in August 2022, 65.9 percent were imported goods, while the rest were exported goods.

Export enterprises must maintain an export ratio of at least 60% to continue to be so classified. The export ratio is computed through the:

(1) the percentage share of the volume or peso value of goods exported to the total volume or value of goods sold in any taxable year if the export enterprise is engaged in manufacturing or processing;

(2) the percentage share of the peso value of services sold to foreigners to total earnings or receipts from the sale of its services from all sources in any taxable year if the export enterprise is service-oriented; the Value of services sold shall refer to the peso value of all services rendered by an export enterprise to foreigners that are paid for in foreign currency and/or pesos funded from inwardly remitted foreign currency as properly documented by the export enterprise; or

(3) the percentage share of the volume or peso value of goods exported to the total volume or value of goods purchased domestically in any taxable year if the export enterprise is engaged in merchandise trading.

What is the consequence of failing to maintain the ratio?

Dried fish is among the locally produced cravings of OFWs in the US, Australia and Qatar.

The SEC will order the non-complying export enterprise to reduce its sales to the domestic market to not more than 40% of its total production.

Failure to comply with this order, without justifiable reason, will subject the enterprise to the cancelation of its registration and other penalties.[1]

[1] Section 6 of the FIA in relation to Section 14.

Can foreigners serve on the board of directors of a corporation?

Non-complaints are given another option to reduce its category to a domestic one.

Yes, provided the corporation is not engaged in a nationalized business activity under the Negative List. For corporations engaged in a partly nationalized business activity, the number of foreigners allowed on the board of directors is determined as a proportion of the foreign equity to the total number of directors.

Can foreigners serve as officers of a corporation?

There are certain conditions that must be met before a foreigner is allowed to be a board director in the Philippines.

Yes. Immediately after the election of the board of directors, they must formally organize and elect the president, treasurer, secretary, and such other corporate officers as may be provided in the bylaws.

The president may be a foreign non-resident. However, he must also be a director of the corporation.

The corporate secretary must be a citizen and resident of the Philippines.

The treasurer must be a Philippine resident.

When considering incorporation in the Philippines, it is best to determine who the officers should already be.

For Filipinos or foreigners who want to incorporate in the Philippines from abroad and who may not know anyone residing in the Philippines, consider asking your corporate lawyer to act as corporate secretary and your accountant as treasurer.

What are the requirements when deciding to incorporate in the Philippines from abroad?

It is best to consult a corporate lawyer to help you determine the proper officer for a particular position.

The requirements when deciding to incorporate in the Philippines from abroad are broadly similar when incorporating in the Philippines itself, but there may be additional documentary requirements as well as differences in how the documents are prepared.

Here is the list of initial documents which must be prepared for incorporation in the Philippines:

- Notarized Articles of Incorporation, must be signed by the Incorporators;

- Notarized Bylaws, must be signed by the Incorporators;

- Notarized Form F-100, signed by the authorized representative;

- Special Power of Attorney authorizing the representative to sign for and on behalf of the incorporators, if necessary;

- Scanned copies of enumeration Nos. 1-3, to be submitted online;

- Physical copies of Nos. 1-3, to be submitted personally;

- Payment, in the allowed form, with the SEC.

- Additional industry-specific requirements can be discussed with a corporate lawyer.

Note that apostille or authentication may be required if the incorporators are choosing to incorporate in the Philippines from abroad.

Treasurer-in-Trust

You might want to hire an Authorized Representative in the Philippines to do your transactions easily.

It is also necessary to have a designated treasurer-in-trust – who must be a Philippine resident – attest in writing to the subscriptions and paid-up capital from the incorporators which are in his keeping and which shall be deposited to the company’s account.

The treasurer-in-trust must create a bank account for this purpose. It is to this account that payment for the subscriptions of the company stocks is deposited until the nascent corporation is created. The designated treasurer-in-trust must be authorized by the incorporators and is answerable for the amount deposited.

How do you sign/prepare documents when deciding to incorporate in the Philippines from abroad?

Treasurer in trust is best to be a corporate lawyer.

When deciding to incorporate in the Philippines from abroad, documents must be authenticated/apostilled so that they are accepted by the SEC.

The Articles of Incorporation (AOI) and Bylaws must be signed by the incorporators abroad.

Then, they may either have them notarized at the Philippine consulate or before a foreign notary and then have the document apostilled abroad in accordance with the Hague Apostille Convention. If their country of residence is not part of the Hague Apostille Convention, then they must authenticate them.

The hard copy of the AOI and the Bylaws will ultimately need to be sent to the Philippines for submission to the SEC.

Documents signed abroad must be authenticated and apostilled first before they can be used to incorporate in the Philippines.

Another important document when choosing to incorporate in the Philippines from abroad is the Special Power of Attorney.

The SEC and other government institutions will only allow your Philippine liaison to transact with them on your behalf if this is presented.

Just like the AOI and the Bylaws, this must also be notarized and apostilled/authenticated.

There necessarily remain certain physical requirements such as having an intended, specific corporate address in the Philippines. Arrangements for the physical place of operations must also be made ready.

It is really best if you already have the actual office address.

Some companies use a virtual office as a temporary address and then choose to amend the address later on. However, please take note that amending an address can be extremely painful and time-consuming.

Upon incorporation at the SEC, the consequent registrations with the Bureau of Internal Revenue and other government offices may be done and company operations can commence.

These other registrations at the BIR, City Hall, SSS, Pag-ibig and Philhealth also take time and should be taken into account.

If you are a foreigner or a Filipino that is choosing to incorporate in the Philippines from abroad, it might be best to talk to a corporate lawyer so that the correct expectations are set for what happens when you open a business in the Philippines while abroad.

0 Comments