How to transfer land title to heirs in the Philippines (Extrajudicial Settlement)

This article discusses an Extrajudicial Settlement in the Philippines.

An extrajudicial settlement is the process though which we transfer a land title to a family member in the Philippines. An estate must be settled and estate taxes paid before a new owner can transfer it to his own name.

Without it, a new owner will not be able to put the Philippine land title in his name.

In this article you’ll find:

- Documentary requirements for the transfer of land titles in the Philippines

- Common issues in gathering documents and filling up bureau of internal revenue forms.

- A good understanding of the ENITRE process up to Certificate Authorizing Registration CAR (this is when the transfer title from a deceased person to new owners becomes possible).

An extrajudicial settlement is the easiest and cheapest process available.

However, you and your co-heirs MUST agree and pay the estate and transfer fees at the BIR and the Registry of Deeds.

If the heirs cannot agree, then you must go to court for a Judicial Settlement of Estate to address the family’s grievances.

Contents

- Why do you need to settle an estate to transfer a land title to a family member in the Philippines?

- A Death Certificate is one of the required documents to settle an estate

- An Estate Tax TIN is also needed when you settle an estate and transfer a land title to a family member in the Philippines

- What are the other required documents to transfer a land title to a family member in the Philippines?

- Do all the heirs have to agree to process an EJS and complete the land title transfer in the Philippines?

- What should be present in an Extrajudicial Settlement of Estate?

- How do I process the Extrajudicial Settlement of Estate at the BIR?

- How do I pay Philippine estate taxes?

- Extrajudicial Settlement of Estate: IMPORTANT POINTS

Why do you need to settle an estate to transfer a land title to a family member in the Philippines?

If you have inherited real estate, stocks or vehicles you will need to settle the estate. For example, this must be done to sell the assets or even if you just want to transfer a land title to a family member in the Philippines.

Why?

The family member or the buyer will want the property title in his name.

A document called an electronic Certificate Authorizing Registration CAR is needed to transfer a land title from a deceased person to a new owner.

A CAR will only be given to when the estate has been settled.

An estate can be settled through a deed of extrajudicial settlement or though court.

So, to transfer a land title to a family member in the Philippines or to a buyer, you must settle the estate.

The cheapest way to transfer a land title to a family member in the Philippines is called an extrajudicial settlement.

Take note that you should try to settle the estate within the BIR deadline of a year from the date of death. The reason is that the penalties beyond this period can be enormous:

- 25% annual tax on the amount due

- 20% surcharge on the amount due

The longer an estate is not settled, the more expensive it will become.

Pay estate taxes within 1 year of the death, or fees and penalties can be onerous!

As you can see, it is best to file with the BIR as soon as possible (even just a partial return) in order to forestall some penalties.

A Death Certificate is one of the required documents to settle an estate

The death certificate is a primary document needed to transfer a land title to family members in the Philippines.

The death certificate is presented at the banks, insurance office, BIR – basically, everywhere.

Caption Several copies of the death certificate are needed as they are presented at all steps of the Philippine land title transfer process.

If the death took place in a hospital, the hospital will release the death certificate. If the death took place in a home, the attending doctor or the barangay health officer will help you accomplish the death certificate.

A certified true copy is needed, but I advise you to get more copies.

There is a slight delay in the national civil registrar when a death happens.

The local civil city registrar records the death first, but the national civil registrar may take a few weeks to a few months.

The process takes time.

The death certificate, like the entire Philippine extrajudicial settlement of estate process, takes time.

First, the local civil registrar will record the death. Then, it will send this to the Philippine Statistics Authority (Office of the Civil Registrar General). Then the PSA records, processes and encodes the document into the national database of the main civil registrar.

This means that the PSA-certified death certificate will not be immediately available after the death. Your recourse will be to call on the local civil registry where the death was registered and get a certified true copy. (Note that you will also need the PSA to certify it.)

In any case, with the death certificate in hand — whether local or PSA-certified — you can begin to address the tax issues as well as other immediate concerns.

An Estate Tax TIN is also needed when you settle an estate and transfer a land title to a family member in the Philippines

This Estate TIN number is different from the TIN number of the person who passed away.

It is specifically for the Philippine estate settlement and is only used one decides to transfer a land title to a family member in the Philippines (or to a buyer).

Above, I explained how to get a Death Certificate.

The information on the Death Certificate is needed to fill up the BIR form 1904 and get the estate’s TIN.

I will go through BIR form 1904 and how to fill it up below.

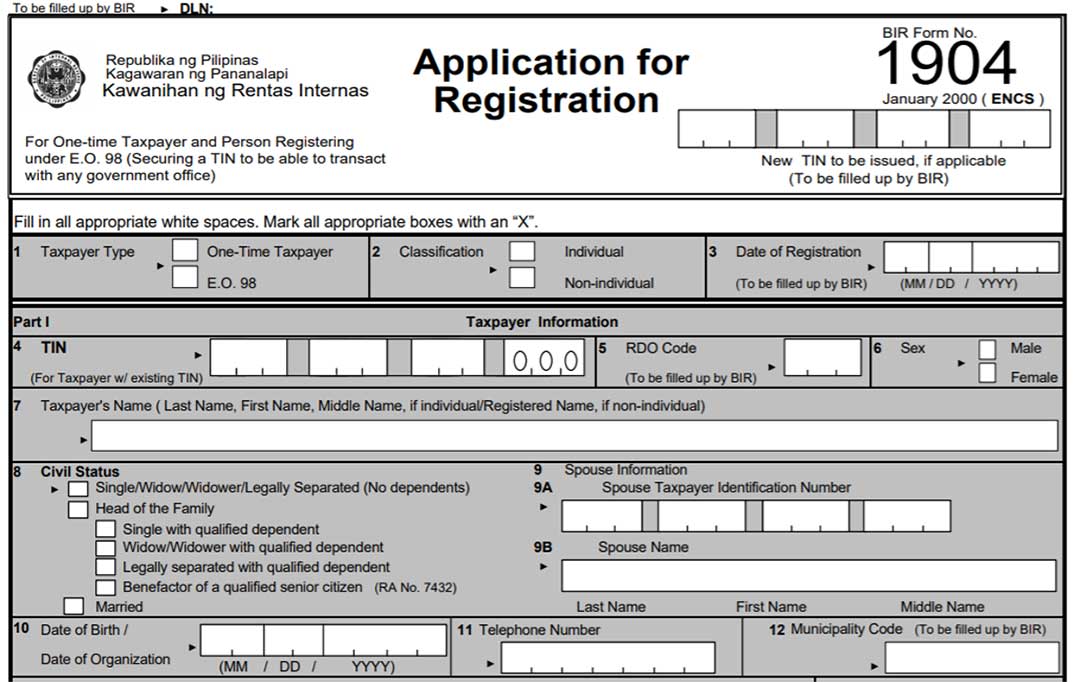

BIR requirements for transfer of land titles in the Philippines include an Estate Tax TIN, for which you file BIR Form 1904.

First, download BIR Form 1904 from the BIR’s website.

BIR 1904 Form – Part 1

Let’s go through some of the fields for the first part of BIR Form 1904:

- Taxpayer Type should be One-Time Taxpayer.

- Classification should be Non-Individual here.

- Write “Estate of [Name of the Deceased]” for the taxpayer’s name

- Date of Birth should be the Date of the Death as it appears on the death certificate

- I think that sex, civil status, spousal information and telephone number are pretty clear.

BIR Form 1904 is fairly easy to complete, unlike other requirements for the transfer of land titles in the Philippines

Almost there!

We’ll go through some of the other fields for the rest.

- Local Address and its corresponding telephone number should be the address as it appears on the death certificate

- One Time Transactions should be Transfer of Properties by Succession

- Tax Type should be Estate Tax

You then submit the form at the BIR Regional District Office (RDO) where the deceased lived.

You shouldn’t submit at any other location.

Later on, you will need to pay Philippine estate tax at the BIR office for which the TIN will be needed as it tracks transactions needed to settle an estate in the Philippines.

Philippine estate taxes are levied on all taxable estates.

An inescapable part when you transfer a land title to a family member in the Philippines is the payment of Philippine Estate Tax.

There are some estates that are taxable and some that are not taxable.

Estates whose valuation exceeds certain thresholds are taxable. On the other hand, estates that fall below these thresholds will not be subject to estate tax.

You will need to pay the estate tax using the estate’s TIN number after completing all the requirements for Philippine Extrajudicial Settlement of Estate (these include the EJS itself and all the required documents for property and other assets.)

What are the other required documents to transfer a land title to a family member in the Philippines?

While knowing the process of how to transfer a land title to a family member in the Philippines is important, successfully doing this requires that you complete all required documents.

An estate is composed both of its assets and liabilities.

You have to prove ownership of the property before you are able to do a land title transfer in the Philippines.

An estate’s assets can be:

- Real estate such as family home, condominiums or land titles

- Shares of stock or shares of memberships, such as a country club

- Motor vehicles

What are the estate’s liabilities?

- Are there any loans that the deceased took out?

- Are there any unpaid taxes?

For real properties, you will need certificates of title. You will need both the original copy as well as the certified true copy of all titles. For land, you will also need tax declarations and improvements from the city assessor. Lastly, you will need to get a tax clearance.

Sometimes, even supporting documents as to how you acquired the title, such as the Deed of Donation or the Deed of Sale (and even supporting documents such as the payment of capital gain tax), might also be needed.

For stocks, you will need stock certificates.

For vehicles, you will need the registration for all vehicles. (Yes, you will have to settle an estate just to transfer ownership of a car after a death in the Philippines.)

It is the same for loans and obligations. You will need to gather promissory notes and other obligations.

You need a lot of documents when you transfer a land title to a family member in the Philippines through an EJS.

Philippine land title transfer requires so many documents – and might even include documents such as a Deed of Donation or Sale to show how you acquired the property.

Due to the documents, Philippine title transfer can be very difficult.

It can be tough to figure out where documents are.

Very often, only the deceased knew where the papers were kept.

Conferring with family can be an important first step.

It is also possible to track down the land information by painstakingly working with the pertinent government agency. It is a detailed process and requires a lot of patience. It may require visiting the Register of Deeds where the land is located as well.

You might need to investigate where the documents are, as these are needed for the EJS and to process the land title transfer in the Philippines.

Another option is to hire private investigators to determine the actual extent of the property and then work towards reconstructing a complete picture.

What you end up doing to reconstruct the estate will depend on the information you have.

You might also want to hire an accountant.

An accountant can help you understand what you’ll have to pay and what you might be able to save at the BIR.

BIR fees can be very expensive; it’s best get expert advice.

BIR fees are a requirement, however; you must pay them before transferring a land title (yes, even for sale, or donation).

Do all the heirs have to agree to process an EJS and complete the land title transfer in the Philippines?

Yes, all the heirs have to agree to do a Philippine land title transfer through an EJS.

An Extrajudicial Settlement of estate is an agreement between heirs.

It itemizes the estate’s assets and attaches certificates of title, tax clearances, and other supporting documents.

It also summarizes the agreement between the heirs as to which property goes to whom and in what shares.

It must be signed by each heir, and it is absolutely necessary that the heirs agree.

Heirs who cannot agree may have to go to court and do a judicial settlement of estate in the Philippines.

Court is much more expensive and takes much longer.

For that reason, it is always preferable to do an extrajudicial settlement in the Philippines instead.

However, it can be very difficult to get people to agree and sign the extrajudicial settlement of estate document.

A Philippine land title transfer through an EJS will require that all the heirs agree.

For example, think about your family.

In the event that a parent dies, you will need to settle the estate so that transferring ownership of land from the parent to the children is possible.

Imagine how difficult it might all be for you all to agree on how to divide the estate so that you can complete the land title transfer to family members in the Philippines.

Your sister might want the family home, but your brother might actually be living in it. Or there might be 2 properties, but one sibling wants to keep them while the others want to liquidate. You will all have to reach an agreement about what will be done.

Estate taxes must be paid to transfer a land title to family members in the Philippines through an EJS.

Often, you and your co-heirs may have to shoulder the burden of estate taxes.

The process of land title transfer in the Philippines requires settling the estate taxes and the transfer fees BEFORE any transfer, and these taxes and fees can be costly.

Estate taxes are 6% of the property value.

Estate taxes account for most of the cost of transferring a land title in the Philippines or of other assets like stocks.

Additionally, there are also transfer taxes at the Registry of Deeds and at City Hall.

Intermediaries can often help in reaching this all-important agreement, as this agreement between the heirs is the basis of the extrajudicial settlement.

A failure of the heirs to agree on how to settle the estate and on how to pay the estate taxes will make extrajudicial settlement impossible.

What should be present in an Extrajudicial Settlement of Estate?

If an agreement is made or brokered between the heirs, they will then create the extrajudicial settlement (or the Deed of Adjudication, if you are the sole heir).

An extrajudicial settlement is a legal agreement detailing the partition of an estate.

An extrajudicial settlement is a legal agreement detailing the partition of an estate and should have the following:

- That the deceased left no will and no debt, or that his debts have been paid

- You and your co-heirs relationship to the deceased and that there are no other heirs

- Description and details of the properties and how they are to be divided

- Often, SPA for extrajudicial settlement might also need to be prepared if heirs are abroad or need help settling the estate.

Afterwards, everyone should sign and notarize the document.

A notice will then be published in a newspaper of general circulation for 3 weeks.

You will present the proof of publication along with the extra-judicial settlement to the BIR.

How do I process the Extrajudicial Settlement of Estate at the BIR?

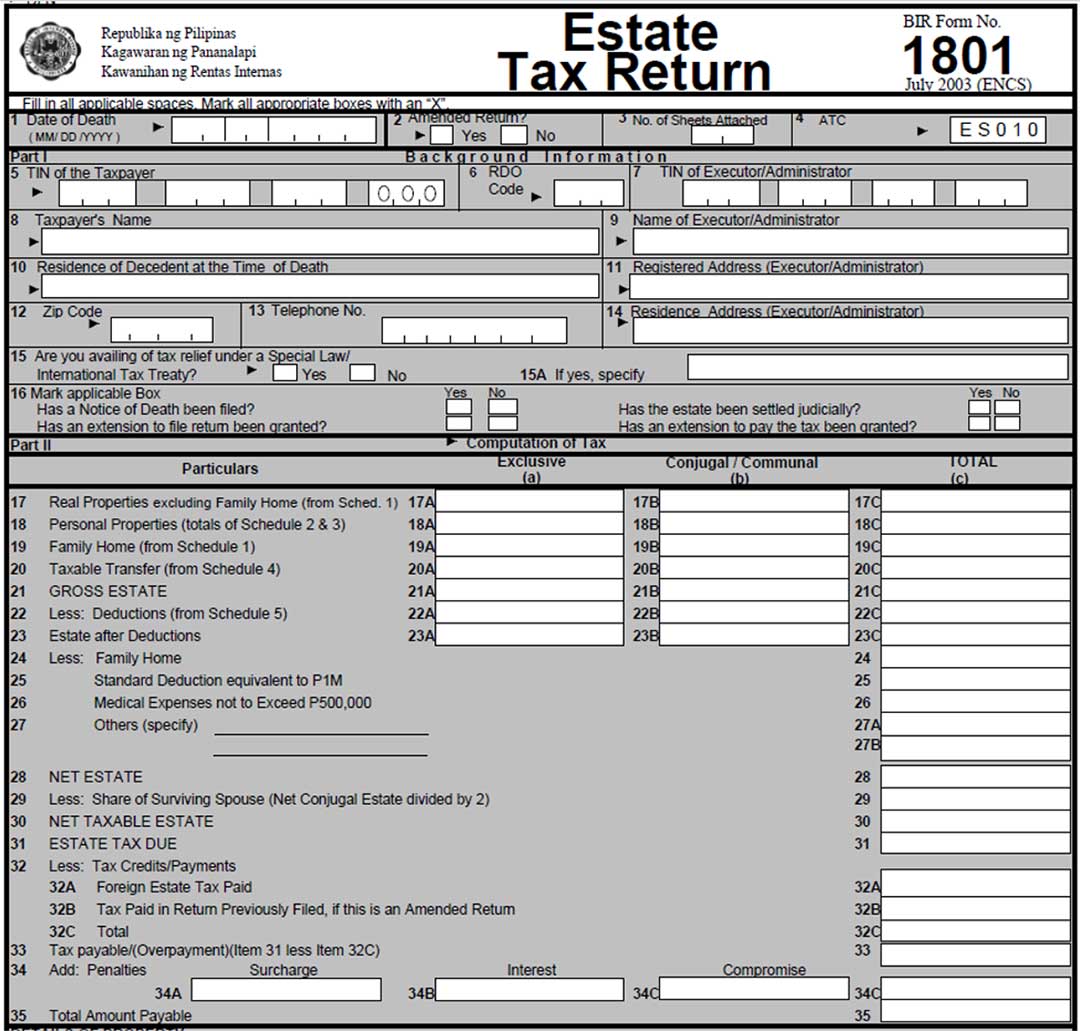

If you’ve accomplished all the items on the list, you can easily file your BIR 1801.

You need to do this within a year after the death to avoid those heavy penalties we talked about earlier.

BIR 1801 is filed to pay the taxes to finally settle the estate.

It is deceptively simple and is currently supported by 5 schedules.

Filing an EJS at the BIR requires filing up BIR 1801 which summarizes the estate’s assets.

With all the work you’ve already put in, you are in a really good position to fill this up.

Work with your accountant to fill up the information and verify and minimize your estate taxes.

There are some pretty straightforward deductions:

- Php 5,000,000 for Philippine citizens and resident aliens

- Php 10,000,000 for the family home

However, there may be tax treaties and there are other possible tax exemptions applicable to your situation that only an accountant or lawyer would know.

Consulting an expert can reduce Philippine estate taxes!

Then, armed with your calculation and all your documents, you should head to the appropriate BIR RDO (where the permanent home of the deceased was located).

You’ll need to talk to the One Time Transaction Officer (ONETT) and go through the calculation with him.

ONETT officers are rotated, but if you like the ONETT officer you are working with, try to figure out his schedule and his personal contact information. ONETT officers vary slightly how they deal with estate issues so it’s best to stick to one throughout the process.

If all your documents are in order, you should be able to do this relatively quickly.

How do I pay Philippine estate taxes?

So, you’ve made it this far!

One of the last big steps in transferring land titles is paying the estate tax.

After you’ve calculated the Estate Tax to be paid, you will need to pay it at the Authorized Agent Bank (AAB).

Estate taxes can only be paid at an Authorized Agent Bank.

An Authorized Agent Bank is a bank that accepts payments on the BIR’s behalf.

You may choose to pay the bank in cash or through a manager’s check.

If you do choose a manager’s check, call the bank so that you know exactly how they want the payee to be written on the check.

Make sure you get the banks machine validation on the proof of payment.

Now make a trip to the BIR to present this and receive your Certificate Authorizing Registration CAR.

A CAR is proof that you were able to settle the estate at the BIR, and you can now go to the Registry of Deeds and City Hall to complete the rest of the land title transfer in the Philippines.

Extrajudicial Settlement of Estate: IMPORTANT POINTS

estate settlement has many parts.

We handle inheritance all the time in our practice.

Sometimes we just give advice when someone wants to know if they can transfer a land title to a family member in the Philippines.

Sometimes we settle estates ourselves, for example, when a client wants to transfer a house title after the death of a parent.

We’ve noticed that most people end up never completing a land title transfer in the Philippines, despite knowing the process.

- Incomplete information on the deceased’s or other family member’s death, marriage and birth dates

- Incomplete BIR requirements for transfer of land titles, such as missing property documents

- Disagreement on how the estate is divided

- Inability to pay for estate taxes and transfer taxes

Most estates are never settled because of these reasons.

And some estates settlement efforts are started and then abandoned since transfers of title in the Philippines can become costly and difficult.

Those that succeed and complete the full process up to the land registry (where the transfer of title from the deceased actually happens) are usually determined, put a lot of work into it, can pay the estate taxes, and have good advice from a lawyer or an accountant.

They are often able to convince the heirs to agree on how to divide the property.

They are also able to raise enough money to pay the estate taxes.

They also have complete BIR requirements for transfer of land titles (or can get them).

And finally, if they find they cannot agree or need to go to court to get the land title, they have both the determination and money to go to court until it is done.

Philippine land of titles transfers through an EJS can be done, but you’ll have to make a commitment to having uncomfortable discussions with your co-heirs about the estate division and the cost.

If you are able to do that, then transferring is very feasible and we hope this step by step guide helps.

Please reach out to us if you have difficulties because even though I’ve tried to cover everything, there are a lot of intricacies in trying to do a land title transfer in the Philippines and it is best to consult if you need additional help.

335 Comments