Philippine Estate Taxes 2018

This post answers those questions as I explain the current 2018 Philippine TRAIN estate taxes and provide sample computations.

Estate Tax Introduction

Simply computed, this is:

Gross estate less Allowable Deductions equals

Net Proceeds multiplied by 6%

Seems simple, but the confusion lies in what makes up the gross estate and the allowable deductions.

Add in foreign holdings, dual citizenships, and foreigners and most people are ready to thrown in the towel.

While we don’t go into complicated estate tax issues here – and trust me, every case is different – I try to provide enough information to point you in the right direction.

What is a gross estate and how is it valued?

For non-resident aliens however, gross estate are properties only located in the Philippines and include intangible personal property subject to the rule of reciprocity.

Now, here comes the hard part – how do you value the gross estate?

1 Land. Higher of the Fair Market Value given by the Commissioner or the provincial and city assessors.

2 Stock. As per the stock exchange but if not listed then it is the book value for unlisted common shares and the par value for unlisted preferred shares.

3 Club membership. Most recent bid price near date of death published in a newspaper.

So, now we have half the puzzle.

Allowable Deductions for Citizens

The definition of these items are a bit more involved and need to be supported by substantial documentation.

Below is a simple summary of the allowed deductions.

There are some restrictions around some of the deductions and the details are best discussed with your lawyer.

- Standard deduction of Php 5,000,000

- Claims against the estate

- Claims the estate might have against insolvent persons

- Unpaid mortgages, taxes or casualty losses not covered by insurance or already claimed in an income tax filing

- Previously taxed inherited property has exceptions at graduated rates if the previous decedent died within 5 years from the decedent in question. Other considerations are also applied.

- Transfers to the Philippine Government for public use

- Value of family home in excess of Php 10,000,000 will be taxed

- Amount received by the heirs from the employer under R.A. 4917 Act Dealing with Retirement Benefits provided that the separation benefit is included as part of the gross estate.

- Net share of the surviving spouse

Allowable Deductions for Non Resident Aliens

It’s a shorter list.

- Standard deduction of Php 500,000

- Proportion of indebtedness his Philippine Gross Estate bears in relation to his entire Estate for

- Claims against the estate

- Claims the estate might have against insolvent persons

- Unpaid mortgages, taxes or casualty losses not covered by insurance or already claimed in an income tax filing

- Previously taxed inherited property has exceptions at graduated rates if the previous decedent died within 5 years from the decedent in question. Other considerations are also applied.

- Transfers to the Philippine Government for public use

- Net share of the surviving spouse

So that’s what the law says.

Remember that these are subject to considerations and you’ll have to work out with your accountant and lawyer.

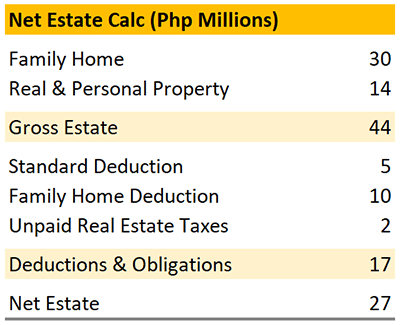

Computation Unmarried Decedent, 30M Family Home

Say your unmarried Filipino uncle has a family home of 30M and other property worth 14M.

He has some unpaid real estate taxes of 2M.

Simple so far.

Just remember that the 10M deduction is only used when for a family home and when that home is 10M and above.

If the family home is less than 10M, then the deduction is only up to the value of the home and not the entire 10M.

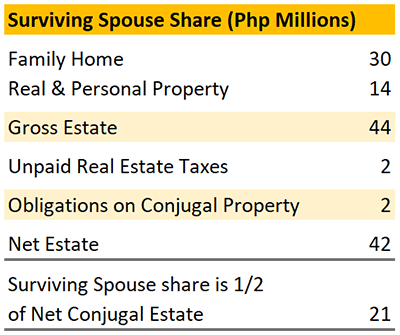

Computation Married Decedent, 30M Family Home

The only difference between this and the above scenario is that there is a surviving spouse.

Based on the law, we need to reduce the estate by the surviving spouse’s portion.

So, below is how we calculate her portion.

Surviving Spouse share:

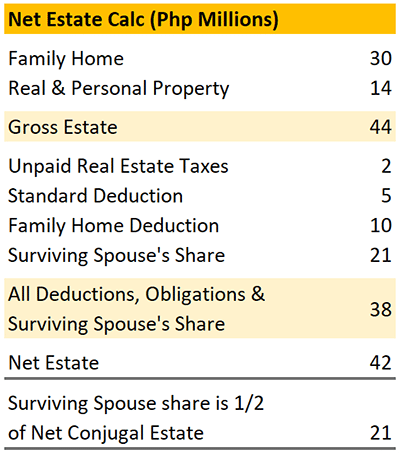

Estate tax is now calculated as:

This works when the estate is composed of conjugal property.

If there are exclusive properties, then these have to be excluded from the surviving spouse’s calculation.

Exclusive properties are enumerated by the law and depend on what type of property regime governed at the time of your marriage.

Good Day, Atty. I would like to ask if the standard 5.0M allowable deduction is applicable regardless the amount of the estate/property? what if the value of the estate is lesser than the standard deduction? Also, my father died year 2018, we are sure that penalty due to late payment will be imposed, with regards to that, is there a standard penalty rate? or how will estate tax be computed? Thank you.

The estate would benefit from the deduction so that no taxes may be due save for nominal penalties. We cannot say more without knowing the particulars.

good day atty. how inheritance tax it works?, my father died last january this year, he have land property together with my mothers name, and he have also land property under the name of my father and her sister ( live). and also they have land property under the name of my grandparents..

Hi Agustin:

The estate of your father and grandparents must be settled as otherwise the land titles will not be transferred to the names of the heirs.

There will be estate taxes. These must be paid to settle the estate. There are late penalties for this that increase every year if unsettled which is why it is best to settle this asap. If your grandparents’ estate can be settled within the estate tax amnesty, money can be saved as no late penalties will be charged.

Re the process, it is as above. Please note that you will need to gather many documents and fully comply.

Without a title, you will not be able to attract serious buyers for the land and you will have problems recognizing the full potential of the property. Challenges to your ownership can also occur.

Hello, my mom and her 4 siblings are heirs of a property, a farm land in Mindanao. My grandmother died in 2003. We are wondering how much is the estate tax, and if they can apply for the tax amnesty? They want to settle it so they can transfer the property to their names. Thank you in advance.

Yes, you can likely apply for the estate tax amnesty.

Studying the documents is needed to compute the estate tax since this differs based on the value of the land and the family situation.

Settle the estate immediately. It can take several months to settle an estate because families often struggle with the requirements.

hello. we plan to avail of tax amnesty under the train law. our property is located in baguio city. would be kind enough to recomend a lawyer we can engage?

Sent you an email?

Hi Atty. Is the standard deduction of 5M and 6 percent tax applicable to those who died before the TRAIN law? We are now processing our estate tax to avail of the amnesty. My mother died June, 1997. Thank you.

Yes, the 6% tax rate can be availed of.

Hi atty.. Asking for your advice on this matter.. my father died last January 5,2014 we are planning to pay estate taxes hopefully this June 2019. the market value of the property under the name of my parents are worth 7.8 Million based on aggregate land holdings issued by municipal assessor (Agricultural and Residential Lot) my mom is still alive. Please help me on the old computation more or less how much will be our estate tax? Thank you

Sent an email.

My mother died in 1993 and her property which is our family home which is on a 170 sq.m. land in makati city. My sister and i are the heirs to this property and we are planning to transfer the ownership of this property to our name? Can you give me an estimate of the estate tax that we need to pay? Can we apply for tax amnesty?

Sent you an email.

I claimed our land from the bank (clear) !!.. Then financially in need again so our relative got the collateral our land then I claimed again coz my mother always insisting to claim the title before it’s too late but I don’t have any black and white to be the proof I was the one who claim it. But for the back I have the proof! Therefore do I have the right to own the Deed of Sale of our residential land for the rest of the sublings !!

I am not certain what the situation is and would need clarification to give an opinion.

Dear Atty. My Mom died April 8, 2018. She left 2 properties under her maiden name. During the processing of documents for her Estate tax, BIR noticed our Extra Judicial Settlement which didnt include my father who died 1994. Now BIR is asking us to file my fathers estate tax also and pay penalty based on my Mom’s properties as they are considered conjugal. Is that correct?

Please enlighten me. Thank you

If these are your mother’s exclusive property then these properties would not be considered conjugal.

As this can be a bit complicated, I sent you an email.

hi..my mom died June 2017…her name is on 2 property titles along with my dad’s name. she also had an individual bank account with 200k+ which is now on hold with the bank…….i’ve been told that my dad has to still pay estate tax for the bank account & for both properties (before he can sell them or transfer titles to our, his children’s names)…..but i’ve also been told by others that my dad doesn’t have to pay the estate tax for the properties since he is a co-owner, and needs only to pay for estate tax on the bank account……which is it really? i appreciate your help in figuring this out as i’ll be doing most of the leg work

I am assuming that your father is still alive.

Estate tax will be paid on your mother’s portion.

thank you for the clarification

also, since my mom passed away on June 2017 and only now are working out the requirements….are we under the new regulations for estate tax (TRAIN law) or older regulations?

You are under the old regulation.

Good day atty.! We are planning to buy a lot owned by a daughter (who is now married, a mother and father.their names appear on the title.the mother died last april 2018..now,how do we start the purchase process? will the daughter need to fix-up for the estate tax first before we enter into Deed of absolute sale? How to start the purchase? Thanks and God bless you.

Hi Jan:

Estate taxes would need to be paid for the title to be transferred to your name.

It is important that all the heirs agree to sell the property to you as a sale can be challenged by another heir who was not included in this deal.

Dear Atty, Is the notice of death still required by BIR? What if there is no estate left, is the estate tax return still required to be filed by BIR? What is the exemption now on filing estate tax return? Before Train Law it is 200K or less.

Thanks in advance and God Bless you all!

Under the Train law, a notice of death is no longer needed.

Everyone now has a 5M deduction. If a family home is owned, another 10M deduction applied to the deceased share can apply.

The post above discusses it in some length as well as other considerations.

Meron po bang time table ang pagbabayad ng Estate Tax na katulad ng pagpapayad po ng Capital Gain Tax?

Ex.

Kung namatay po ang land owner ng January 1, 2018 meron po bang dead line na 30 days para bayaran ang Estate Tax?

Kung meron po, Saan at Ano po ibinabase yung start ng dead line para magbayad?

Yes, the normal deadline is that estate tax must be paid within a year’s time.

If it exceeds this period, then penalties may apply.