When an Heir Waives His Share of the Inheritance

Sadly, inheritance is one of the reasons families fighting.

It can happen that an heir to a Philippine inheritance might want to waive his share of the estate. A waiver may be total or partial.

These two scenarios have different requirements. They also have different tax implications.

When an heir makes a total waiver of inheritance

Some heirs waive their inheritance as they are no longer interested in the property.

One or some of the heirs can make a total waiver and decide to have no part of the inheritance at all.

This can be put in writing as an extrajudicial settlement with waiver of rights. This is a formal, sworn document, approved by all the heirs, where one or more confirm that they waive their entire inheritance with the others agreeing on how the estate is to be divided.

Perhaps one sibling is well off enough compared to others whom he feels would benefit from the inheritance much more than he would. Or he no longer lives in the country and does not want to be responsible for a property here. Or the sibling does not want to worry how to sell inherited property in the Philippines. For these or other reasons, an heir might not want to inherit.

Donor’s tax can apply depending on the situation.

For tax purposes, this scenario is treated as one of pure inheritance among the remaining heirs. The estate is simply liable for the 6% estate tax before the assets can be distributed to them.

However, if one of the heirs makes only a partial waiver, then that is treated as a mix of donation and inheritance for tax purposes. The partially waiving heir becomes liable for a donor’s tax.

The latter scenario happens more often than people realize.

When an heir partially waives his inheritance

In the absence of a will, intestate succession takes place

When someone dies without leaving a last will and testament, the heirs can decide among themselves how to partition the inheritance.

The law, of course, provides for the default shares of inheritance. For example, if three legitimate children are the only heirs, then they will inherit in equal shares.

But there can be practical reasons for heirs to forego equal shares. They can agree on a different partition.

Take a situation where a parent dies, leaving only three legitimate children as the surviving heirs.

Donor’s tax applies in a partially waived inheritance.

Let us say that the parent’s estate is comprised of three separate real estate properties. Since the children each have their own lives and priorities, they may find it practical to agree that each inherits one of the properties instead of all becoming co-owners of three undivided properties.

They can agree to each accept a house each — for convenience and because of personal preferences — not minding that the appraised value of one property might be more or less than another’s. This agreement is itself embodied in an extrajudicial settlement.

In such a situation, one or two heirs will effectively be making a partial waiver of their share of the estate in favor of another heir.

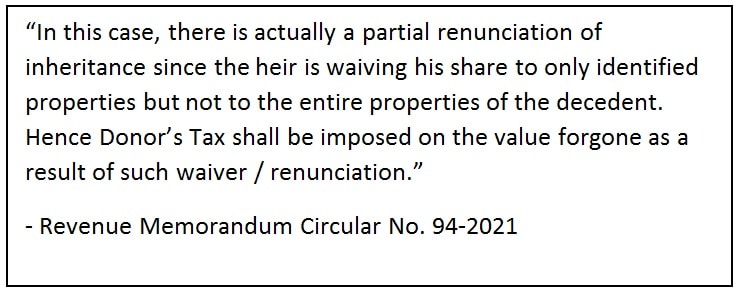

The BIR has decided to treat this partial waiver as a donation from one heir to another.

This qualifies an earlier BIR circular which provided that a total renunciation by an heir of his/her share in the estate is not subject to donor’s tax unless done in favor of specific heir/s to the exclusion or disadvantage of the other co-heirs.

So, an heir’s total waiver of inheritance is not subject to donor’s tax. However, a partial waiver – to the extent that it favors another heir – is further subject to the donor’s tax.

I can’t quite agree with the BIR’s interpretation. A distinction between a total and partial waiver does not seem to justify burdening the latter with a further tax. But we must come to grips with its consequences since it is imposed by the tax bureau.

Estate Tax and Donor’s Tax can be paid through any BIR accredited bank

Even though donor’s and inheritance taxes are both set at 6%, the distinction between the two is not merely academic. Aside from being levied on different parties, the estate and donor’s taxes are subject to their own distinct exclusions and periods within which they must be paid, thus affecting the final computation of the total tax.

The estate tax should be filed and paid within a year of the person’s death. The donor’s tax, on the other hand, should be filed and paid within 30 days from the act of donation. Failure to pay either within the period results in distinct penalties, surcharges, and interest. These consequences can be substantial.

For this reason, the taxes due on an extrajudicial settlement with a partial waiver by some heirs should be readied at the time of the signing of the settlement so that the donation incorporated in the document does not become subject to penalties, surcharges, and interest.

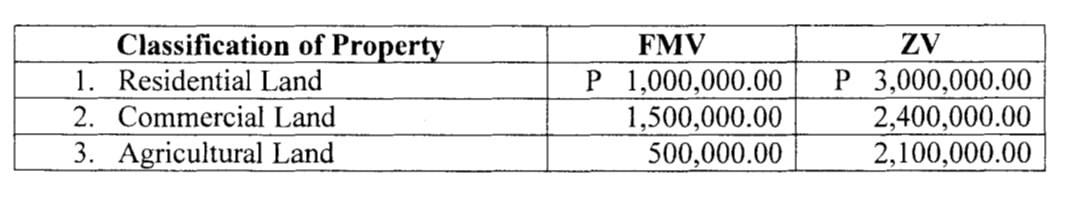

The BIR has provided an illustrative example of how the donor’s tax is computed in the settlement of an estate with partial waiver of shares.

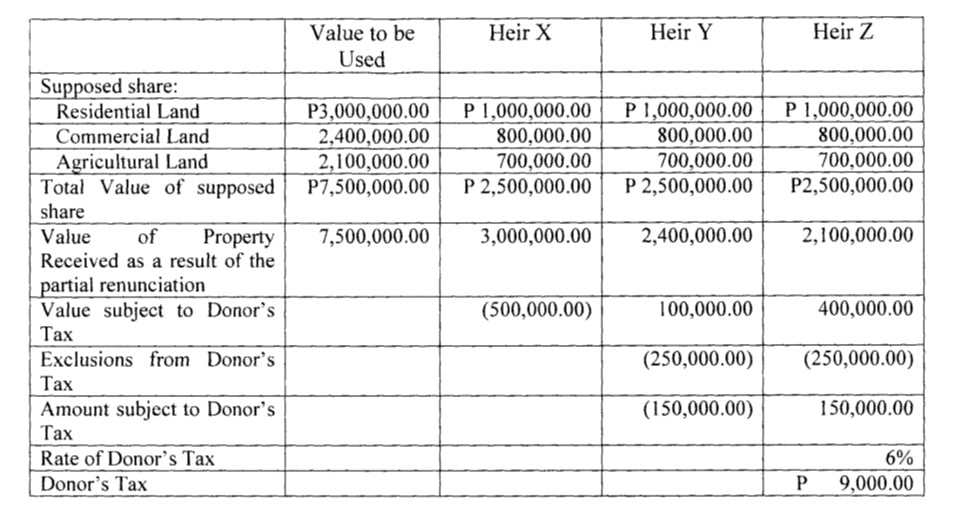

In the BIR’s example, the estate has three heirs who stand to inherit property comprised of three separate properties: Residential Land valued at P3 million, Commercial Land valued at P2.4 million, and Agricultural Land valued at P2.1 million.

Rather than crowding as co-owners of three undivided properties, the three heirs decide to allot one property to each of them. Heir X gets the Residential Land, Heir Y gets the Commercial Land, and Heir Z gets the Agricultural Land.

As a result, they each get more or less than the equal shares that the law on inheritance allotted them in default.

Considering that the donor’s tax is 6% of total donations in excess of P250,000, the BIR computes the donor’s tax in this scenario as follows:

Although very manageable in this example, the additional donor’s tax can be significant enough in other cases that the heirs should take it into account as they decide on how to divide an estate.

When a parent waives in favor of the children

Conjugal property is not included in the computation of the total estate if one of the spouse is still alive.

A scenario with similar implications for the donor’s and inheritance taxes is the case of a widowed mother whose children also survived their father.

Half of the conjugal property – those properties she and her husband had owned in common under Philippine law – would be hers outright.

Because of how conjugal property is defined under Philippine law, the husband’s half comprise his entire estate. This estate would be divided among his heirs, including her. Thus, if there were three children and the total assets are worth P48 million, the legal division may be as follows:

P24 million – mother’s share of the conjugal property

P6 million – mother’s share of the estate

P6 million – Child 1’s share of the estate

P6 million – Child 2’s share of the estate

P6 million – Child 3’s share of the estate

But it often happens that a mother wants to spare her children of having to again go through the estate settlement process when she herself passes away. For this reason, she might choose to transfer her share of the estate and even half of the conjugal property to the children in the same act. That amounts to P30 million.

The document drawn up for this would, in effect, be an extrajudicial settlement with waiver and deed of donation.

A living spouse can waive her inheritance share and half of her conjugal share to her children subject to donor’s tax

In this situation, the mother’s donation to the children of her P24 million share of the conjugal property is subject to the 6% donor’s tax, but the total waiver of her P6 million inheritance is not.

It would be different if the mother donated her entire P24 million share of the conjugal property, but retained half of her P6 million inheritance. The latter would be a partial waiver in favor of the other heirs. In that case, her P3 million donation would also be subject to the 6% donor’s tax.

If you wish to consult on your inheritance issues, fill out our form on www.lawyerphilippines.org or contact us at admin@lawyerphilippines.org.

We will be happy to help you with estate planning or settlement of properties in the Philippines.

Atty. Francesco Britanico

Dear Attorney Francesco,

I live in the United States for 22 years and I’m already a US Citizen. We have a property in Marikina, Philippines. My mother and my older brother lives there. I am not interested to the property. I would like to waive any rights, share/interest. I would like to ask your advise what should I do.

Sincerely,

Franklin

You may have to sign a formal renunciation of inheritance if it is inherited property.

can u send the requirement of transferring extra judicial settlemet with waiver of rights

We would need to know considerably more about the situation to address it properly.

Can the heirs execute a waiver/renunciation of rights in favor of the grandson of the deceased (grandson’s father is one of the heirs)

Yes.

Dear Atty .3siblings .A B C. 4lots undivided.. A executed a waiver of rights to all her properties to B in 2014. But april 2022 B went home to revoke the waiver she executed and will just give 1 parcel to B .B refused as she paid partially the taxes..what’s remedy as the properties are still undivided.C keeps putting up his buildings encroching As property witbout B consent

The ultimate remedy would be to go to court if the siblings truly cannot agree among themselves, but it would certainly be more costly and difficult.

Title is still under the name of deceased parent.

ABCD are legitimate children, A and B waived their rights over their share by signing a waiver. But after the title was transferred to C and D. Sibling A and B changed their mind and decided to reclaim their share of the property, C and D already constructed a property on the land in question. What would be the best resolution for this. Do A and B still has rights even if they already signed a waiver?

If the waiver was validly executed after the death of the parent, then it is probably valid. They would have no rights, but the family may consider coming to agreeable accommodation.

Atty Britanico,

Thank you for a very informative and clear presentation. My question is, can an heir who is now a foreigner benefit from a waiver by any of the heirs?

Thank you.

Typically, yes. Particularly as former Filipino citizens can also acquire land as an exception to the general rule that foreigners cannot.

Good day Atty.Britanico,

Do the Courts believe an Extra Judicial Settlement with Waiver of rights whose transfer were out of Love?

Thanks

Heirs can make choices like this.