Philippine SEC Business Registation

panies interested in setting up business in the Philippines have 5 options for entry.

panies interested in setting up business in the Philippines have 5 options for entry.

- Domestic Corporation

- Branch Office

- Representative Office

- Regional Headquarter

- Regional Operating Headquarters

The right business entity depends on the incorporator’s nationality, the level of liability, ease of incorporation and operation, capitalization, taxes, industry and whether or not the company generates income in the Philippines.

The below post explains these considerations and options in detail.

Comparison Between the Philippine Registration Options

Below is a brief run-down of the most salient points.

Domestic Corporation

Domestic Corporation

- 100% foreign ownership, subject to the negative list and either USD 200,000 capitalization or USD 100,000 capitalization if hiring 50 people or using advanced technology.

- No minimum capitalization if 60% Filipino owned or 60% of sales are export oriented

- Liability is limited to domestic corporation

- Any line of business

- Required Philippine resident Treasurer and Philippine citizen Corporate Secretary

- Can derive income in the Philippines.

Representative Office

Representative Office

- Liability extends to foreign parent

- USD 30,000 initially and every year thereafter.

- Same line of business as foreign parent

- Must have Philippine resident agent

- No Philippine derived income

- No income taxes, VAT or PEZA/BOI tax incentives

Branch Office

- 100% foreign ownership, subject to the negative list.

- Liability extends to foreign parent

- USD 200,000 initially

- Same line of business as foreign parent

- Must have Philippine resident agent

- Can have Philippine derived income

Regional Headquarters

- 100% foreign ownership, subject to the negative list.

- Liability extends to foreign parent

- USD 50,000 initially and every year thereafter

- Same line of business as foreign parent

- Must have Philippine resident agent

- No Philippine derived income

- No income tax, VAT and offers incentives for foreign personnel.

Regional Operating Headquarters

Regional Operating Headquarters

- 100% foreign ownership, subject to the negative list.

- Liability extends to foreign parent

- USD 200,000 initially

- Same line of business as foreign parent

- Must have Philippine resident agent

- Can have Philippine derived income

- 10% VAT, 10% income tax and branch profit remittance tax.

- Offers available incentives for foreign personnel.

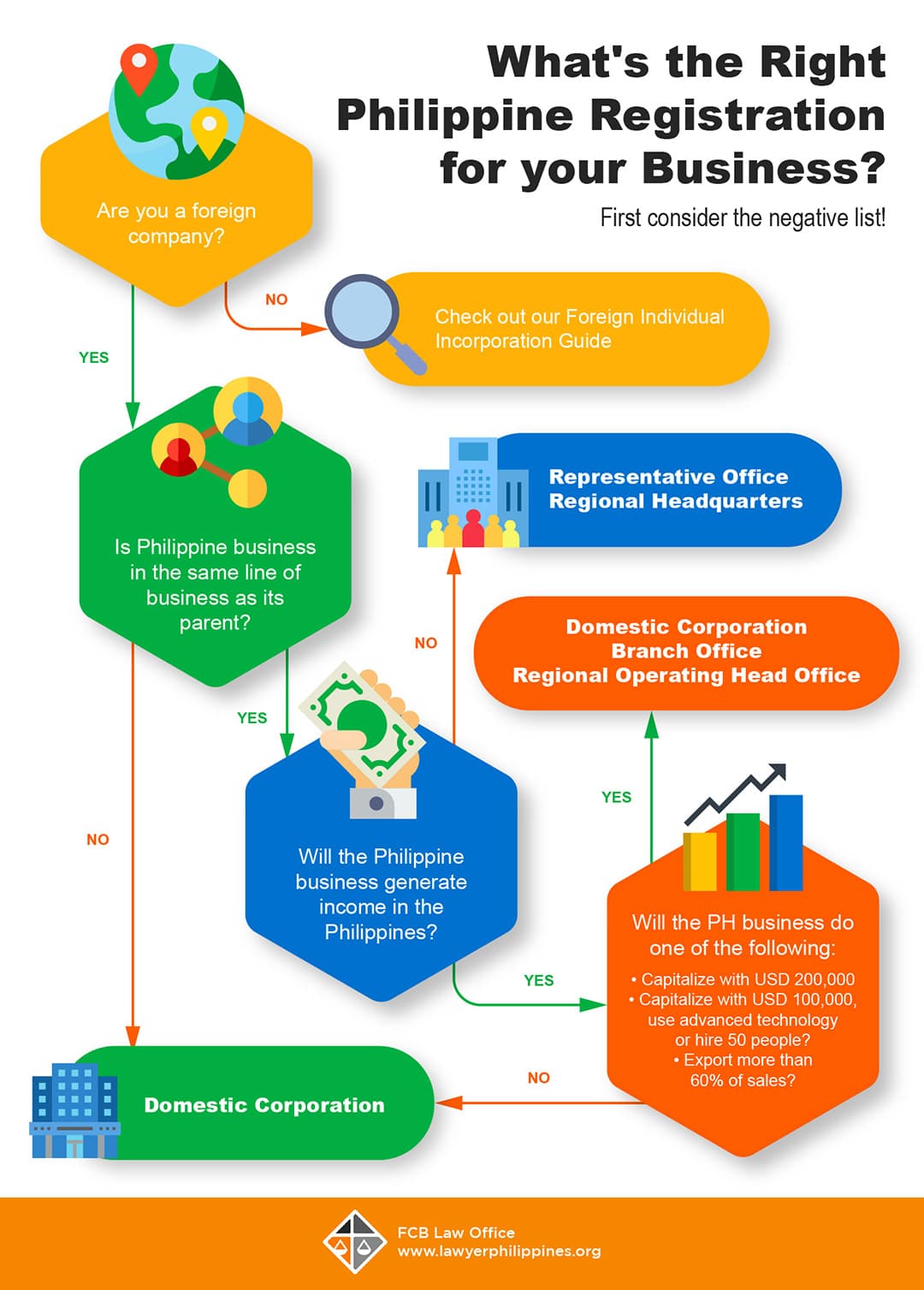

The Right Philippine registration for the Business

- What are the per industry foreign equity restrictions stated in the latest Negative List?

- Is Philippine business being in the same line of business as its parent?

- Does the Philippine business generate income from the Philippines?

- How much is the Philippine business’s capitalization?

The Philippine SEC Process

The usual process is explained below, to give you an idea of the general steps. These steps can take 6 weeks from filing at the SEC.

The process may change should you need endorsements from government bodies that regulate your industry, tax authorities that provide incentives or facts particular to your case.

These factors can affect the time frame.

Required Documents

Documents differ depending on the structure chosen. A list of common documents can be found below, and specific documents can be found in the links for each type of entity.

- Cover Sheet

- Name Verification Sheet

- Application Form

- Authenticated Copy of Board Resolution

- Authenticated Copy of Articles of Incorporation & By Laws

- Financial Statements

- Affidavit the company is of sound financial position/Compliance with Financial Ratios

- Notarized Proof of Inward Remittance

- Treasurer’s Affidavit

- Affidavit of Undertaking (if not stated in the Application Form)

- Resident Agent’s Accaptance of Appointment (if not a signatory in the application)

- Endorsement from Applicable Government Agencies, as applicable

- Endorsement of BOI, as applicable

- Certification that the foreign firm is a multinational from the Philippine embassy & other authorized offices*

- Authenticated Certification from principal officer that the Board has authorized the ROHQ/RHQ*

*for RHQ/ROHQ

0 Comments