How to transfer land title to heirs in the Philippines (Extrajudicial Settlement)

This article discusses an Extrajudicial Settlement in the Philippines.

An extrajudicial settlement is the process though which we transfer a land title to a family member in the Philippines. An estate must be settled and estate taxes paid before a new owner can transfer it to his own name.

Without it, a new owner will not be able to put the Philippine land title in his name.

In this article you’ll find:

- Documentary requirements for the transfer of land titles in the Philippines

- Common issues in gathering documents and filling up bureau of internal revenue forms.

- A good understanding of the ENITRE process up to Certificate Authorizing Registration CAR (this is when the transfer title from a deceased person to new owners becomes possible).

An extrajudicial settlement is the easiest and cheapest process available.

However, you and your co-heirs MUST agree and pay the estate and transfer fees at the BIR and the Registry of Deeds.

If the heirs cannot agree, then you must go to court for a Judicial Settlement of Estate to address the family’s grievances.

Contents

- Why do you need to settle an estate to transfer a land title to a family member in the Philippines?

- A Death Certificate is one of the required documents to settle an estate

- An Estate Tax TIN is also needed when you settle an estate and transfer a land title to a family member in the Philippines

- What are the other required documents to transfer a land title to a family member in the Philippines?

- Do all the heirs have to agree to process an EJS and complete the land title transfer in the Philippines?

- What should be present in an Extrajudicial Settlement of Estate?

- How do I process the Extrajudicial Settlement of Estate at the BIR?

- How do I pay Philippine estate taxes?

- Extrajudicial Settlement of Estate: IMPORTANT POINTS

Why do you need to settle an estate to transfer a land title to a family member in the Philippines?

If you have inherited real estate, stocks or vehicles you will need to settle the estate. For example, this must be done to sell the assets or even if you just want to transfer a land title to a family member in the Philippines.

Why?

The family member or the buyer will want the property title in his name.

A document called an electronic Certificate Authorizing Registration CAR is needed to transfer a land title from a deceased person to a new owner.

A CAR will only be given to when the estate has been settled.

An estate can be settled through a deed of extrajudicial settlement or though court.

So, to transfer a land title to a family member in the Philippines or to a buyer, you must settle the estate.

The cheapest way to transfer a land title to a family member in the Philippines is called an extrajudicial settlement.

Take note that you should try to settle the estate within the BIR deadline of a year from the date of death. The reason is that the penalties beyond this period can be enormous:

- 25% annual tax on the amount due

- 20% surcharge on the amount due

The longer an estate is not settled, the more expensive it will become.

Pay estate taxes within 1 year of the death, or fees and penalties can be onerous!

As you can see, it is best to file with the BIR as soon as possible (even just a partial return) in order to forestall some penalties.

A Death Certificate is one of the required documents to settle an estate

The death certificate is a primary document needed to transfer a land title to family members in the Philippines.

The death certificate is presented at the banks, insurance office, BIR – basically, everywhere.

Caption Several copies of the death certificate are needed as they are presented at all steps of the Philippine land title transfer process.

If the death took place in a hospital, the hospital will release the death certificate. If the death took place in a home, the attending doctor or the barangay health officer will help you accomplish the death certificate.

A certified true copy is needed, but I advise you to get more copies.

There is a slight delay in the national civil registrar when a death happens.

The local civil city registrar records the death first, but the national civil registrar may take a few weeks to a few months.

The process takes time.

The death certificate, like the entire Philippine extrajudicial settlement of estate process, takes time.

First, the local civil registrar will record the death. Then, it will send this to the Philippine Statistics Authority (Office of the Civil Registrar General). Then the PSA records, processes and encodes the document into the national database of the main civil registrar.

This means that the PSA-certified death certificate will not be immediately available after the death. Your recourse will be to call on the local civil registry where the death was registered and get a certified true copy. (Note that you will also need the PSA to certify it.)

In any case, with the death certificate in hand — whether local or PSA-certified — you can begin to address the tax issues as well as other immediate concerns.

An Estate Tax TIN is also needed when you settle an estate and transfer a land title to a family member in the Philippines

This Estate TIN number is different from the TIN number of the person who passed away.

It is specifically for the Philippine estate settlement and is only used one decides to transfer a land title to a family member in the Philippines (or to a buyer).

Above, I explained how to get a Death Certificate.

The information on the Death Certificate is needed to fill up the BIR form 1904 and get the estate’s TIN.

I will go through BIR form 1904 and how to fill it up below.

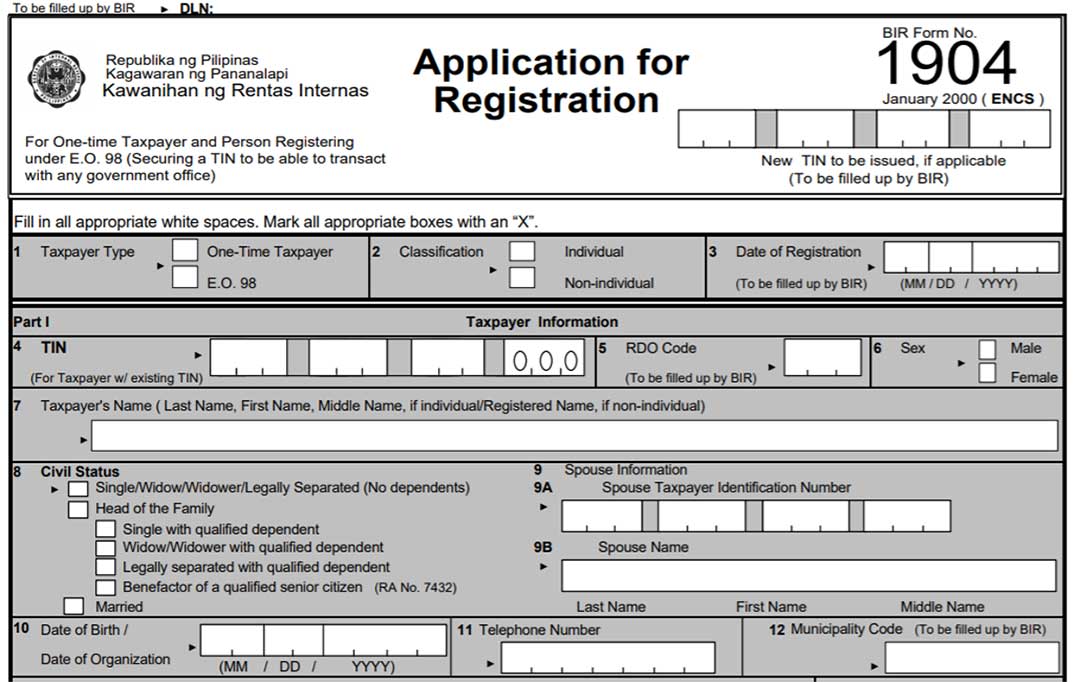

BIR requirements for transfer of land titles in the Philippines include an Estate Tax TIN, for which you file BIR Form 1904.

First, download BIR Form 1904 from the BIR’s website.

BIR 1904 Form – Part 1

Let’s go through some of the fields for the first part of BIR Form 1904:

- Taxpayer Type should be One-Time Taxpayer.

- Classification should be Non-Individual here.

- Write “Estate of [Name of the Deceased]” for the taxpayer’s name

- Date of Birth should be the Date of the Death as it appears on the death certificate

- I think that sex, civil status, spousal information and telephone number are pretty clear.

BIR Form 1904 is fairly easy to complete, unlike other requirements for the transfer of land titles in the Philippines

Almost there!

We’ll go through some of the other fields for the rest.

- Local Address and its corresponding telephone number should be the address as it appears on the death certificate

- One Time Transactions should be Transfer of Properties by Succession

- Tax Type should be Estate Tax

You then submit the form at the BIR Regional District Office (RDO) where the deceased lived.

You shouldn’t submit at any other location.

Later on, you will need to pay Philippine estate tax at the BIR office for which the TIN will be needed as it tracks transactions needed to settle an estate in the Philippines.

Philippine estate taxes are levied on all taxable estates.

An inescapable part when you transfer a land title to a family member in the Philippines is the payment of Philippine Estate Tax.

There are some estates that are taxable and some that are not taxable.

Estates whose valuation exceeds certain thresholds are taxable. On the other hand, estates that fall below these thresholds will not be subject to estate tax.

You will need to pay the estate tax using the estate’s TIN number after completing all the requirements for Philippine Extrajudicial Settlement of Estate (these include the EJS itself and all the required documents for property and other assets.)

What are the other required documents to transfer a land title to a family member in the Philippines?

While knowing the process of how to transfer a land title to a family member in the Philippines is important, successfully doing this requires that you complete all required documents.

An estate is composed both of its assets and liabilities.

You have to prove ownership of the property before you are able to do a land title transfer in the Philippines.

An estate’s assets can be:

- Real estate such as family home, condominiums or land titles

- Shares of stock or shares of memberships, such as a country club

- Motor vehicles

What are the estate’s liabilities?

- Are there any loans that the deceased took out?

- Are there any unpaid taxes?

For real properties, you will need certificates of title. You will need both the original copy as well as the certified true copy of all titles. For land, you will also need tax declarations and improvements from the city assessor. Lastly, you will need to get a tax clearance.

Sometimes, even supporting documents as to how you acquired the title, such as the Deed of Donation or the Deed of Sale (and even supporting documents such as the payment of capital gain tax), might also be needed.

For stocks, you will need stock certificates.

For vehicles, you will need the registration for all vehicles. (Yes, you will have to settle an estate just to transfer ownership of a car after a death in the Philippines.)

It is the same for loans and obligations. You will need to gather promissory notes and other obligations.

You need a lot of documents when you transfer a land title to a family member in the Philippines through an EJS.

Philippine land title transfer requires so many documents – and might even include documents such as a Deed of Donation or Sale to show how you acquired the property.

Due to the documents, Philippine title transfer can be very difficult.

It can be tough to figure out where documents are.

Very often, only the deceased knew where the papers were kept.

Conferring with family can be an important first step.

It is also possible to track down the land information by painstakingly working with the pertinent government agency. It is a detailed process and requires a lot of patience. It may require visiting the Register of Deeds where the land is located as well.

You might need to investigate where the documents are, as these are needed for the EJS and to process the land title transfer in the Philippines.

Another option is to hire private investigators to determine the actual extent of the property and then work towards reconstructing a complete picture.

What you end up doing to reconstruct the estate will depend on the information you have.

You might also want to hire an accountant.

An accountant can help you understand what you’ll have to pay and what you might be able to save at the BIR.

BIR fees can be very expensive; it’s best get expert advice.

BIR fees are a requirement, however; you must pay them before transferring a land title (yes, even for sale, or donation).

Do all the heirs have to agree to process an EJS and complete the land title transfer in the Philippines?

Yes, all the heirs have to agree to do a Philippine land title transfer through an EJS.

An Extrajudicial Settlement of estate is an agreement between heirs.

It itemizes the estate’s assets and attaches certificates of title, tax clearances, and other supporting documents.

It also summarizes the agreement between the heirs as to which property goes to whom and in what shares.

It must be signed by each heir, and it is absolutely necessary that the heirs agree.

Heirs who cannot agree may have to go to court and do a judicial settlement of estate in the Philippines.

Court is much more expensive and takes much longer.

For that reason, it is always preferable to do an extrajudicial settlement in the Philippines instead.

However, it can be very difficult to get people to agree and sign the extrajudicial settlement of estate document.

A Philippine land title transfer through an EJS will require that all the heirs agree.

For example, think about your family.

In the event that a parent dies, you will need to settle the estate so that transferring ownership of land from the parent to the children is possible.

Imagine how difficult it might all be for you all to agree on how to divide the estate so that you can complete the land title transfer to family members in the Philippines.

Your sister might want the family home, but your brother might actually be living in it. Or there might be 2 properties, but one sibling wants to keep them while the others want to liquidate. You will all have to reach an agreement about what will be done.

Estate taxes must be paid to transfer a land title to family members in the Philippines through an EJS.

Often, you and your co-heirs may have to shoulder the burden of estate taxes.

The process of land title transfer in the Philippines requires settling the estate taxes and the transfer fees BEFORE any transfer, and these taxes and fees can be costly.

Estate taxes are 6% of the property value.

Estate taxes account for most of the cost of transferring a land title in the Philippines or of other assets like stocks.

Additionally, there are also transfer taxes at the Registry of Deeds and at City Hall.

Intermediaries can often help in reaching this all-important agreement, as this agreement between the heirs is the basis of the extrajudicial settlement.

A failure of the heirs to agree on how to settle the estate and on how to pay the estate taxes will make extrajudicial settlement impossible.

What should be present in an Extrajudicial Settlement of Estate?

If an agreement is made or brokered between the heirs, they will then create the extrajudicial settlement (or the Deed of Adjudication, if you are the sole heir).

An extrajudicial settlement is a legal agreement detailing the partition of an estate.

An extrajudicial settlement is a legal agreement detailing the partition of an estate and should have the following:

- That the deceased left no will and no debt, or that his debts have been paid

- You and your co-heirs relationship to the deceased and that there are no other heirs

- Description and details of the properties and how they are to be divided

- Often, SPA for extrajudicial settlement might also need to be prepared if heirs are abroad or need help settling the estate.

Afterwards, everyone should sign and notarize the document.

A notice will then be published in a newspaper of general circulation for 3 weeks.

You will present the proof of publication along with the extra-judicial settlement to the BIR.

How do I process the Extrajudicial Settlement of Estate at the BIR?

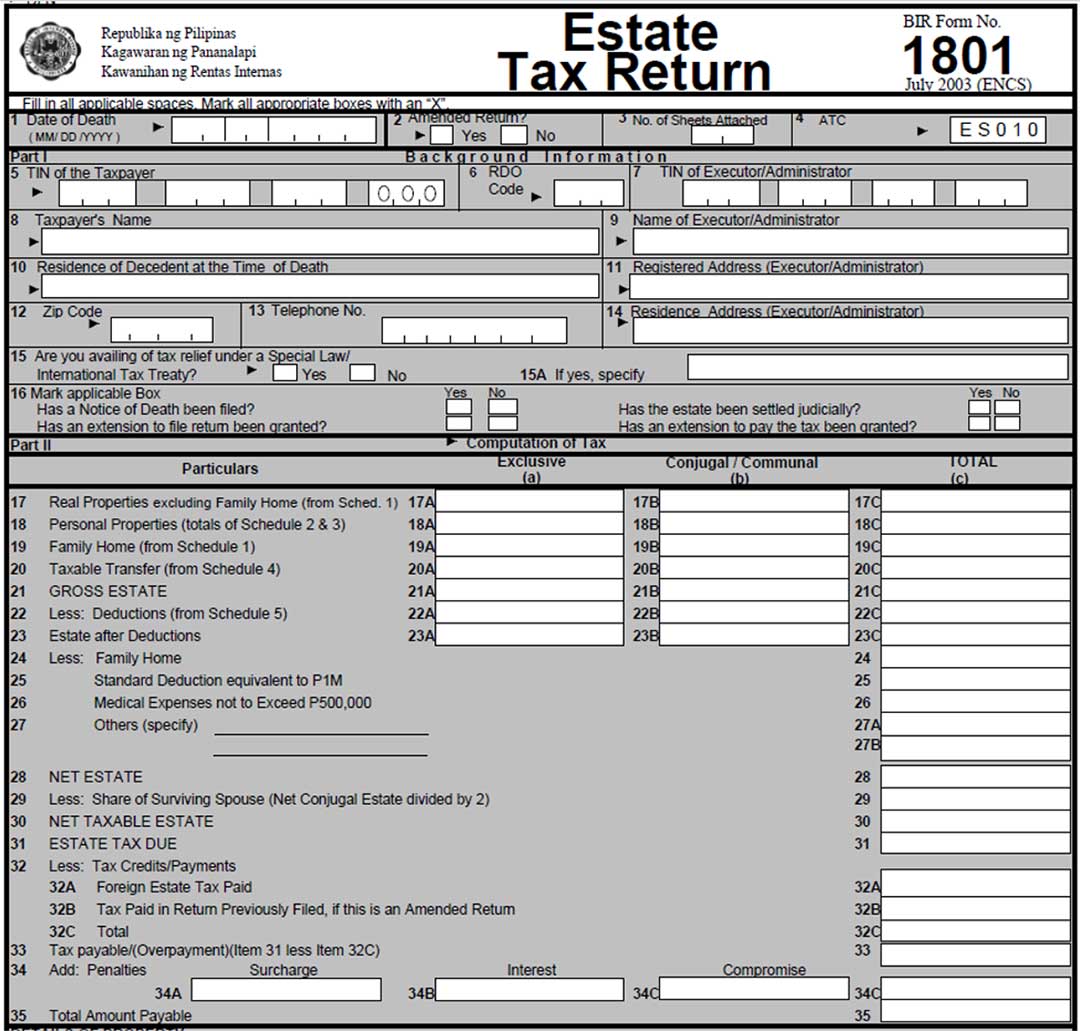

If you’ve accomplished all the items on the list, you can easily file your BIR 1801.

You need to do this within a year after the death to avoid those heavy penalties we talked about earlier.

BIR 1801 is filed to pay the taxes to finally settle the estate.

It is deceptively simple and is currently supported by 5 schedules.

Filing an EJS at the BIR requires filing up BIR 1801 which summarizes the estate’s assets.

With all the work you’ve already put in, you are in a really good position to fill this up.

Work with your accountant to fill up the information and verify and minimize your estate taxes.

There are some pretty straightforward deductions:

- Php 5,000,000 for Philippine citizens and resident aliens

- Php 10,000,000 for the family home

However, there may be tax treaties and there are other possible tax exemptions applicable to your situation that only an accountant or lawyer would know.

Consulting an expert can reduce Philippine estate taxes!

Then, armed with your calculation and all your documents, you should head to the appropriate BIR RDO (where the permanent home of the deceased was located).

You’ll need to talk to the One Time Transaction Officer (ONETT) and go through the calculation with him.

ONETT officers are rotated, but if you like the ONETT officer you are working with, try to figure out his schedule and his personal contact information. ONETT officers vary slightly how they deal with estate issues so it’s best to stick to one throughout the process.

If all your documents are in order, you should be able to do this relatively quickly.

How do I pay Philippine estate taxes?

So, you’ve made it this far!

One of the last big steps in transferring land titles is paying the estate tax.

After you’ve calculated the Estate Tax to be paid, you will need to pay it at the Authorized Agent Bank (AAB).

Estate taxes can only be paid at an Authorized Agent Bank.

An Authorized Agent Bank is a bank that accepts payments on the BIR’s behalf.

You may choose to pay the bank in cash or through a manager’s check.

If you do choose a manager’s check, call the bank so that you know exactly how they want the payee to be written on the check.

Make sure you get the banks machine validation on the proof of payment.

Now make a trip to the BIR to present this and receive your Certificate Authorizing Registration CAR.

A CAR is proof that you were able to settle the estate at the BIR, and you can now go to the Registry of Deeds and City Hall to complete the rest of the land title transfer in the Philippines.

Extrajudicial Settlement of Estate: IMPORTANT POINTS

estate settlement has many parts.

We handle inheritance all the time in our practice.

Sometimes we just give advice when someone wants to know if they can transfer a land title to a family member in the Philippines.

Sometimes we settle estates ourselves, for example, when a client wants to transfer a house title after the death of a parent.

We’ve noticed that most people end up never completing a land title transfer in the Philippines, despite knowing the process.

- Incomplete information on the deceased’s or other family member’s death, marriage and birth dates

- Incomplete BIR requirements for transfer of land titles, such as missing property documents

- Disagreement on how the estate is divided

- Inability to pay for estate taxes and transfer taxes

Most estates are never settled because of these reasons.

And some estates settlement efforts are started and then abandoned since transfers of title in the Philippines can become costly and difficult.

Those that succeed and complete the full process up to the land registry (where the transfer of title from the deceased actually happens) are usually determined, put a lot of work into it, can pay the estate taxes, and have good advice from a lawyer or an accountant.

They are often able to convince the heirs to agree on how to divide the property.

They are also able to raise enough money to pay the estate taxes.

They also have complete BIR requirements for transfer of land titles (or can get them).

And finally, if they find they cannot agree or need to go to court to get the land title, they have both the determination and money to go to court until it is done.

Philippine land of titles transfers through an EJS can be done, but you’ll have to make a commitment to having uncomfortable discussions with your co-heirs about the estate division and the cost.

If you are able to do that, then transferring is very feasible and we hope this step by step guide helps.

Please reach out to us if you have difficulties because even though I’ve tried to cover everything, there are a lot of intricacies in trying to do a land title transfer in the Philippines and it is best to consult if you need additional help.

335 Comments

Trackbacks/Pingbacks

- Top 5 Factors to Consider When Picking Estate Planning Lawyers - […] a lawyer who has experience with estates similar to yours. For instance, are you going to deal with land…

- Hiring a Land Heiress Attorney – Land Heirs Attorney - […] bibles and other documents should prove that the surviving members are not the heirs. Be sure to get more…

- Transferring Land Heirs’ Property: Why You Need an Heirs’ Attorney – Land Heirs Attorney - […] bibles and other documents should prove that the surviving members are not the heirs. Be sure to get more…

- How to Transfer Land Title in Philippines – Land Heirs Attorney - […] The surviving spouse and the children of a deceased person inherit half of the property. Be sure to go…

- How to Transfer Land Title to Heirs – Extrajudicial Settlement Lawyers - […] family members. Generally, a will should contain all details regarding the transfer of land. Know how to transfer land…

- How to Transfer Land Title to Heirs – Extrajudicial Settlement Lawyers - […] this process can take up to a year. If the heirs have a will, the deed must be recorded.…

- How to Transfer Land Title to Heirs – Extrajudicial Settlement Lawyers - […] In some cases, it may cost you more than your property’s worth in estate taxes. Make sure to click…

- Top 5 Factors to Consider When Choosing Estate Planning Attorneys - Riot Housewives - […] knowledgeable about all processes, such as the probate process, Power of Attorney, and transfer of land title to heirs. […]

- How do you make a last will and testament in the Philippines - Lawyers in the Philippines - […] an estate can certainly be divided among the heirs if there is no will. This is done through an…

- Philippine Inheritance Laws for Foreigners, Filipinos and Dual Citizens - Lawyers in the Philippines - […] For a step by step discussion on what you need to claim your inheritance when there is no will,…

- Conjugal Property - Lawyers in the Philippines - […] Read more in: How to transfer land to heirs in the Philippines which discusses this 7-step process in detail.…

- What To Do When You’ve Lost Your Philippine Land Title - Lawyers in the Philippines - […] mortgage or lease your property when you don’t have the title. It is also difficult for your property to…

- How a Foreigner can receive his Philippine Land Inheritance (Updated for 2018 TRAIN Law) - Lawyers in the Philippines - […] You can only do this through a process called “settling the estate”. […]

Test message

This is a test from High6 Support

Thank you

Hello, I would like to ask for your opinion regarding my situation. In the matter at hand, my siblings have already received their respective inheritances in the form of separate titled lots. However, my inherited lot remains as a “mother title” and I do not have a will from my late parents. Currently, my siblings are asking to claim a portion of land on my inherited lot, arguing that the size of their lots is significantly smaller than mine. It’s worth noting that the lots they inherited hold premium locations and boast higher market values in terms of price per square meter. Furthermore, they have profited from the extraction and sale of gravel and sand from my land (quarry) in the past.

My question is how can I ensure the transfer of the property into my name and decline any potential requests from my siblings for additional portions of the inheritance.

Thanks in advance.

If there is a case against you , please contact us immediately so that we can assess the situation.

This step by step guide is very helpful thank you. However, I wish to ask for my particular situation, I am an only child, married with 2 adult children. Both my parents are still living. The house we all live in and the land where it stands are under my father’s name. He wants property to be transferred to my name. How do I proceed with least cost?

A Deed of Donation can used to transfer a land title to a family member in the Philippines while the owner is still alive.

Although the tax is also 6%, the main advantage to this is that the owner can be asked re the documents needed (documents are a major, major stumbling block we face when we try to settle an estate and do a land title transfer in the Philippines since many heirs don’t know where the documents are.)

Hello,

Do I also need to have a proof of publication even if I only have Deed of Adjudication?

Thank you.

Yes.

Publication is still part of the transfer of a land title to a family member in the Philippines in an EJS or in a Deed of Sole Adjudication.

The information you shared here really helped me. I am now completing the requirements for DAR clearance of an agricultural land which has a civil case (reconveyance and recovery of possession with damages). Does having a pending case in court hinder the transfer of said property to us heirs (mother, brother and myself)? Land is registered under my father’s name and we are in actual possession of it (occupying it and regularly paying real property taxes from the time we acquired it). Thank you and God bless you.

A land case will show up as an annotation on a land title.

If you will then trasnfer the land title to family members in the Philippines, that annotation will show up.

What if there is only one property? Do the heirs still need to secure TIN for the estate?

All estate settlements require that a TIN is secured.

Thank you for providing such an informative article. I would like to ask your advice regarding a particular process.

The property in question for the transfer has four co-owners. Unfortunately, two of the owners have passed away. Owner 1, who passed away on June 3, 2021, did not leave any heirs other than his siblings. On the other hand, Owner 2 passed away on April 2, 2023, leaving behind four heirs who are entitled to inherit his portion of the property. The two surviving owners and the heirs of Owner 2 have agreed to dedicate the property solely to themselves through an Extrajudicial Settlement (EJS).

My question pertains to the filing of BIR Form 1904. Considering that there are two deceased owners, should the form be filed separately for each of them? I would greatly appreciate your guidance on this matter.

Each estate will have a separate TIN.

Hi,

I bought a land on my sister’s name (now deceased). What are the processes to transfer the land title on my name?

Any help will be much appreciated.

Thank you.

Cheer,

Gina

It looks like there is only one heir.

The process to transfer a land title to a family member in the Philippines whene there is only one heir is called a Deed of Sole Adjudication.

It is basically the same as an Extrajudicial settlement of estate in the Philppines, is it just that only one heir inherits.

I bought a land from the owner’s children but the land title is still under the owner’s (father) name. How can I transfer the title to my name?

Consider doing an extrajudicial settlement of estate with deed of sale.

In cases where we had to transfer a land title to a family member in the Philippines to settle an estate and there was already a buyer lined up, we created an EJS with Deed of Sale.

Hi, we are in the middle of sa pagpa process ng lupain ng namayapa naming grand parents, we already execute the Extra Judicial Settlement, we almost finish paying the estate tax, pero out of 7 hiers (siblings) isa nalang yong buhay at matanda na, so kami nalang magpipinsan nag aayos ng mga papel, kaso sa gitna nga papapa process, bigla umayaw yong ibang tagapagmana(Cousin). Please pa advice po kung ano pede naming gawin. MAlaki na kasi nagastos namin para hindi ituloy. ayaw nila magbigay ng mga documents na kailangan.

You might have to go to court.

When the heirs cannot agree, it is very difficult to complete the land title transfer in the Philippines.

Sometimes court is the only option, but it is very expensive.

Hi Atty,

If a husband and wife have both names in the title, one dies, can the title be transferred to the surviving spouse. Are the children included to be in the title? Does this apply to Phil law? ” joint tenancy comes with the ‘right of survivorship’. This means that when one joint owner dies, their interest in the property asset passes to the surviving joint owner. As a result, this property asset does not form part of the deceased estate for distribution to beneficiaries. ”

Thank you.

I understand that the desire is to transfer a land title to a family member in the Philippines.

However, when a parent dies and there are children, both the legal spouse and the children are compulsory heirs.

can I sell the land if i have a CAR or do i need to have a TCT

Depends on the buyer.

Most will ask for a TCT since they would have to complete the philippine land title transfer at the RD and pay the cost for that if the process is still not complete.

What if some heirs do not want to participate in the EJS? Will they lose their share? Can the other heirs process the EJS?

It is not possible to avail of extrajudicial settlement in the Philippines without the unanimity of the heirs.

To transfer a land title to a family member in the Philippines (or family members or buyers) all the heirs must agree.

Hello Atty.

My great grandmother passed away in the late 90s without being able to officially subdivide the land to her 8 children. There was just a verbal understanding regarding their shares. Unfortunately, all of the 8 children already died. Of the 8, 1 was a widower with no heir and another was single. This complicates the sharing because someone is enroaching on the portion of

1. The grandchildren are now the rightful heirs.

How should the extrajudicial settlement be done accordingly and TCT be done?

Should it be split into 8 corresponding to the actual children? Or should it be split into just 6?

Or should the land be divided equally among the grandchildren who are not waiving their rights?

Thank you.

It depends on the family tree as if the deceased had children, their portion will go to these children (intestate succesion, unless there is a probated will, etc, etc).

Then, when you do an EJS and transfer a land title to family members in the Philippines, the heirs of the deceased heirs should inherit.

Hello,

Can a heir sell his/her share of his/her part of inheritance (land) even without executive an EJS?

THanks.

Depends on the buyer. But, a buyer cannot complete a Philippine land title transfer and put the title in his name without an EJS.

Hello, my husband died last Dec 2021 and left 2 properties (our family home in cainta and an agricultural land in tarlac) registered under our names as spouses and we have 2 adult children, do i still need the extrajudicial settlement and filing of the estate tax return for the transfer of land title? Thank you.

Yes. The only way to transfer a land title to a family member in the philippines is through an extrajudicial settlement. Without an EJS, the land will remain in the deceased’s name.

Note that it does take a lot of work to actually transfer, as there are many requirements and you must also fulfill bureau of internal revenue requirements and pay transfer taxes.

If the owner or the real state have a “Last Will of Testament” saying his or her heir will inherit all of the assets, do they still subject to all the taxes than those who doesn’t have Last Will of Testament?

I am not entirely sure what you mean.

The process to transfer a land title to a family member in the Philippines (or to family members or buyers) will always involve taxes.

Good evening…my father died in Pasig but his property is in Cotabato province.

Where are we going to file and pay his state tax? In Pasig or in Cotabat0?

Ty

If he lived in Pasig when he passed, he can file in Pasig.

However, actually completing the registration and transferring the land title and the tax declaration will require filing in Cotabato to actually transfer the land title to family members in the Philippines.

Good day! There are 4 heirs, unfortunately the 3 died but before they died they sold their property to their sibling who is the only surviving heir. My question is can the surviving heir file EJS? THE spouse of the 3 is still alive. The four heirs didn’t settle the estate first the 3 just sold it. Can the surviving heir file self adjudication? The surviving heir wants to transfer the property into her name. Is she allowed to do it?

If the 3 heirs sold their property to the remaining heir, then that remaining heir is an owner.

This remaining heir can do a Deed of Sole Adjudication process but must present documents.

Documents are required in an estate settlement process to transfer a land title to a family member in the Philippines (or family members in the Philippines, if there are more heirs) and they must be in order and prove his ownership to this land so that deeds of sale from his siblings as well as other documents must be presented.

Good morning. How about for the property that was sold without EJS, and how to transfer the property to the new owner?

You still have to settle the property to complete the Philippine land title transfer to your name.

You can do an Extrajudicial Settlement with Deed of Sale.

i bought a property in Legaxpi city in Albay province when I was single however when I received the land title it was under my married name, My husband passed away be three years this year ,i want to sell the land since We haven’t resided in the Philippines since 1992 . I’m updated with the property tax. what are the steps I need to do to sell this property? thank you

It seems like you were married when the title was given to you.

In that case you have to settle your husband’s estate as buyers will likely require that so that they can then do a Philippine land title transfer to their own names.

Is it legal for heirs of inherited

Land property with unpaid estate tax to sell the said property? Need an answer before I put my fingers on it.pls advise.thank you

You will not be able to transfer to your name if you buy this property.

You would still need to complete an EJS so that you can put your name on the title and complete the process for land title transfer in the Philippines.

There are 8 of us siblings and my mother who are heirs but my mother and 4 brothers have passed away.Would the land property only be shared for the remaining 4 of us?

The children and the legal spouses of the deceased siblings also inherit.

They are compulsory heirs and would be included when you transfer a land title to family members in the Philippines.

Does the extrajudicial settlement include all the properties or could they just execute a settlement on a piece of land so they could sell it right away.

Does the settlement of a piece of land necessarily goes to all the heirs? or could the heirs just give it to one of them and receive other properties of the deceased.

Will greatly appreciate your comment.

Many thanks and God bless!

It is possible to partially settle an estate and to transfer a land title to a family member in the Philippines ahead of settling the entire estate.

The heirs can decide to waive their share so that only one heir receives the estate but they would still have to sign documents to indicate that this is what they want to do.

Good day. Please help us.

The deceased left a conjugal property containing an area of 230 sq. m lot. The surviving heirs is the spouse and 7 children. how will the heirs divide the property among their selves. Thank you and God bless

The estate belonging to the deceased should be shared between them as per succession law.

An EJS would need to be done and signed by all so that they are able to transfer the land title to family members in the Philippines and put in their names.

Hello.. my parents are deceased and we have a title stating 5 heirs including myself. Can I apply for my own title for my portion only?

To transfer a portion of a property, the mother title would be needed to subdivide the property (but this is also a long and tedious process).

An EJS would still also be needed.

Good afternoon,

If may I inquire what is the right procedures to make, for my late father land property, it’s a small lot of 120 sq.m to be exact.

My mom and all of my brother and sisters agreed that I can have the lot property.

Guidance for the step by step procedure on how I can transfer the tittle on my name, if possible on how much It cost me

for the transfer.

Many thanks in advanced.

Remeber that to transfer a land title to a family member in the Philippines, estate settlement is always needed.

So, you will still need to settle the estate of your father prior to transferring the land title.

Hello, I need some legal advice. My father died year 2009. His name in Land title is wrong spelling. Is there any chance that we can do to correct his name? Or we can just transfer the land title to a new owner? How about real tax property that have not paid for many years, any advice how to settle.

Thank you very much

When a name on the land title is wrong, you might be asked to present proof that the person on the land title and your father are one and the same.

If they believe you, then you might be able to transfer, otherwise you might have to correct it before you can continue the Philippine land title transfer process.

Yes, you will need to pay the real property taxes – this is a requirement to transfer a land title to a family member in the Phippines (or family members or buyers, or whomever it should be transferred to).

Hello, good evening. I need an explanation po.There are 322 sq.m of the entire parcel of land. Their parents died and the property titled in the name of their father. The four co-heirs of their late parents property decided to sell the entire parcel of land but one of them decided lately that his portion of 107 sq.m will remain. That the 215 sq.m which is the portion of three co-heirs so they sell the portion which is 215 sq.m then I bought it. They signed and executed the Extrajudicial Settlement of Estate with Deed of Absolute Sale. My question is,

1. What to do to the one heirs if he wants to title his remaining 107 sq.m? So that in the portion I bought and the remaining portion of him will be titled and split the title into two title together from the previous TCT?

A survey of the property has to be submitted showing the partition. The EJS should have included all the heirs, including the sibling who did not sell so that the boundaries of the division is clear.

Good Day, How about if the inherit property is available to transfer the title and there is a absolute buyer. Do i need first to transfer the title in our name or it can be the buyer can transfer the title in their name?

To execute a philippine land title transfer to the buyer, you would create an EJS.

This simultaneously does the process to transfer the land title to family members in the Philippines at the SAME TIME as transferring it to the buyer’s name.

This reduces some of the transfer taxes.

253 sq meter owned by grandmother ( died) , which heirs of ( 4 children died also ) all grand children alive .( heirs ) . Shall the grandchildren divide the property by 4 ( children of grandmother ) or divided by the total number of grandchildren alive ?

2 . Do you need to pay all taxes of land ( unpaid) before transferring the title to the grandchildren?

Thanks

Yes. The property will be divided by 4 according to intestate law and grandchildren inherit their parent’s shares.

Yes. All the taxes must be paid before you can transfer the land title to family members in the Philippines.

If all the heirs are included in the EJS, but one of those heirs don’t want to settle the estate tax, is that possible?

Perhaps you can negotiate with this heir.

Or perhaps you can remove the expense from his share.

Regardless, the estate tax must be paid so that you and the others can complete the land title transfer in the Philipines.

Hi i just want to ask we inherited a property after my father in law died and its divided in 6 parts for there is 6 children but my husband died so we try to give our share to my youngest son and they put his name in the documents. But now we are in the process of extra judicial settlement but the oroblem is they still put my name and my other 2 children in the documents so they still need our signiture but we are not in the philippines at the moment. So my question is can SPA naming my son to sign in our behalf advisable? Thanks

An SPA can give the one family member the abilty to process the estate so that Philippine land title transfer goes smoothly.

Otherwise you would all be needed to sign documents.

It might be wise to put an expiry date and other details so that he is only empowered for the transaction that you want him to do.

1. How to subdivide a property where the title is still under the name of the heirs grandparents and the heirs parents already passed away. Is there a need to transfers from grandparents to parents before divided among heirs? Or is it possible to divide the properly directly among heirs?

To transfer the land title to family members in the Philippines in this instance, all the deceased’s estates must be settled.

So the grandparents and parents estates must be settled, with each estate being filed at the BIR.

My father died on Jan.2011

But we only file his state tax this year only,my question is how much are we going to pay for his state tax?

Ty

There is a table of surcharges, if you are not able to avail of the estate tax amnesty.

This penalty is 25% surcharge with 20% per annum interest.

And this penalty must be paid before you can transfer the land title to family members in the Philippines.

Hi,

Paano if Yung land title is under the name sa dad and my Lolo. My Lolo died and living is my Dad. How can we sell the land title? Do I need to transfer to my Dad’s name first? So he can sell it or am I allowed to sell it with an SPA?.Pls help.Thanks

Most buyers will want to transfer to thieir names.

When we transfer a land title to a family member in the Philippines and they also have a buyer lined up, we sometimes create a WJS with Deed of Sale to minimize transfer taxes. This helps the buyer.

Still, the main point is that generally it is important to settle an estate to sell it.

Hello,

Is this also the process if you are a sole heir?

Do I need to also publish a notice in newspaper? or this is just applicable to Extrajudicial Settlement?

Thank you.

Yes. The document is called a Deed of Sole Adjudication rather than an Extrajudicial Settlement, but it essentially the same process.

In any case, to transfer a land title to a family member in the Philippines or to a sole heir or buyer requires that you settle the estate.

Does it have a deadline to transfer the title to the heirs once the estate tax is settled and EJS is notarized?

Does it have to be transferred immediately?

Will there be any penalties if we decided nit to tranafer the title to the heirs immediately?

The electronic Certificate Authorizing Registration (eCAR) is valid for 5 years from its issuance by the BIR.

Question! After paying the estate tax and ecar obtained, does it need to be published? Thanks

The registry of deeds will require publication before you can transfer a land title to a family member in the Philippines (or whoever the land should be transferred to).

Good Morning,

Thank you very much for this site for questions about the process of inheriting property in the Philippines.

My mother died in 2020 with a Probated Will. One of my sister is an Executor and there are (8) eight beneficiaries.

The questions are:

1. With the Probated Will, do we still need to have an Extra Judicial Settlement form?

2. Is the Sales Proceed will be payable to the Executor’s name?

If it does, Is there a process under the Philippines law that protect the share of the other beneficiaries from the Executor?

3. Or are Title Companies in the Philippines can issue checks separately for each beneficiaries?

Thanks again for your help, greatly appreciated.

1. No, the probated will is itself the basis for the distribution of the estate. If the will was probated abroad then it should be reprobated here to distribute property in the Philippines.

2. The heirs can agree to how sales payments are made, but they should be party to the deed of sale.

3. The heirs can insist that payments of their share be directly made to them individually.

In the extra-judicial settlement can the heirs (mother and siblings) name one of them as the lone beneficiary for expediency purpose only? – with no waiver of rights and interest.

The authority to manage the property can be given to one without the others waiving their rights of ownership.

HI,

Thanks for this article. Very helpful indeed.

Can you give a rough estimate for the taxes that needs to be paid to BIR if the land cost approximately 1M? All taxes are paid even if the owner dies about 30 years ago because my mother pays for them.

Thank you,

You would need to check at the BIR itself, since the land value at the time of death and the applicable law are all consulted when calculating the estate tax.

If you are able to avail of the estate tax amnesty, do so, since this can reduce the tax burden which can actually be very heavy and can restrict the transfer of a land title to a family member in the Philippines (or family members in this situation) due to the extreme cost.

Hi. I am planning to buy a lot. There are four owners of the lot, one already died. The deceased person has three kids. What shall I do?

You can use a Extrajudicial Settlement with Deed of sale. When complete, this will allow you to start the Philippine land title transfer process and put the title in your name.

Hi, thank you for this very informative topic. May I please ask for your advise…. my grandparents passed, (without a will) leaving lands and properties to my father and his sister both had also passed away. The properties left were then divided amongst 2 families. However in on our part , my mother is already in the process of transferring rights/title under her name and my sibling (excluding me )and sell afterwards.. she has already sold one to a relative. I don’t know how was that possible but it happened…Do i have any rights and may i please ask what shall I do about this. Can I contest because I am living overseas. I don’t have any records, copies of those lands. Thank you so much in advance

This sounds a bit complicated – you may need an assessment by a Philippine estate lawyer.

Dear Atty,

What is the estimated timeline and possibility to transfer the title to the buyer?

Seller ( one of the two heirs), title is under the mother’s name. I will buy a portion of the land from the mother title. Seller’s mom died in 2014 and dad died in 2017. Another heir lives in the US. The seller is asking 50 percent of the total price of 4.2 M.

Ideally, they would have already completed the process to transfer a land title to a family member in the Philippines (or in this case family members) through an EJS.

If they did not, then you will actually have to do this and futhermore, you will have to subdivide the title. These processes can take years.

Hi, Lawyers!

My grandma purchased a plot of land and established a house on it. My mother helped her financially in establishing the house, and after my grandmother passed away, she wrote the last will in which she stated that she transfer her title to my mother’s name since my mother helped her to establish the house. Since we lack the means to accomplish everything, please advise us on how to begin the process. I greatly appreciate it.

Check if the will is valid and can be probated first.

Unfortunately, this is very expensive.

(That is why, when someone inquires as to how to transfer a land title to a family member in the Philippines, we always recommend an Extrajudicial Settlement if possible because of how expensive probate is.)

Good evening.

We were able to settle the estate tax of my father’s property and transferred the ownership into our names. However, we found that there are still some properties which he will be inherited from his parents (both dead already). Based on my understanding these properties will also be covered by estate tax. If this is the case, may I know what are process? Do I have to do the same process? Or there will be a different process for this scenario? Thanks in advance. God speed.

Yes, you will follow the same process.

The estate taxes will always need to be settled when you transfer a land title to family members in the Philippines (or land titles). And estate taxes are per property, so even if you paid before for some properties, you must pay again for other properties.

Hello, I came across your article and found it very helpful. There was a lot of information to take in but it was very helpful. You are providing a wonderful help to people who are just being introduced to all the intricacies of handling real estate, specially involving deceased family. I do have some questions and hope you can assist. My father passed away almost 3 years ago, he is survived by my mother and children. We are all adults and live abroad. My father’s house and land in Manila is under his name only. We want to transfer the ownership to my mother’s name, who will be required to sign the extrajudicial settlement form? Is this to be signed by my mother and (all) children?|Or just my mother? How do we calculate the real estate tax? The property in Manila was built over 50 years ago. All taxes are paid yearly and my father did not have any debts in the Philippines. I am looking forward to hearing from you. Thank you for doing this service.

When you transfer a land title to a family member in the Philippines such as a spouse when there are living children, you will end up paying more taxes in the long run.

Hi, my lolo died more than 50yrs ago but did not have any will written. My father was given this piece of land, with a wiaver signed by his siblings or his siblings spouses, but failed to have the land title transferred to my fathers name up to now. Question is, how is the estate tax computed and the penalties? Is it from the day my lolo died? Or is it when the waiver was signed by his siblings and/or siblings spouses? Or is it after it was published in the news paper?

If the land title is not in your father’s name, then the taxes will be from when your grandfather passed.

For all EJS cases, taxes must be paid to transfer a land to a family member and the point of reference will be when the deceased on the land title passed.

i would like to inquire about the property with my uncle died last 2016 with the following conditions:

1. title owners:

a. my auntie, widowed, not filipino citizen, no child

b. my uncle, deceased, not filipino citizen, no child – estate tax need to be paid

c. my mother, married, filipino citizen, with children

d. my father, married, filipino citizen, with children

2. title needs to transfer to me and my other 4 siblings.

kindly review and give us advise on what to do step by step to accomplish smooth transfer to us from original owner as well as settled the taxes involved.

This article details the steps for how to transfer a land title to a family member in the Philippines. We would have to do a formal consultation to address your specific circumstances.

do we need to settle the estate tax even if we do not have plans to sell the properties of my mother?

Well, you need to settle the estate tax so that the property can be transferred to you as heirs.

The main reason that people go through the above to transfer a land title to a family member in the Philippines or to remaining family members and heirs in the Philippines is to have the title in their name, even if they do not want to sell it immediately.

It is much harded to do this later because of estate taxes will increase each year that the estate is unsettled.

What are some of the requirements needed for land title if your parents who still alive inherited you a portion of land?

To transfer a land title to a family member in the Philippines, you have to go through a transfer process assuming that your parents have complete property documents such as the original land title, etc.

You may want to consider a Deed of Donation.

My father has passed away recently. He left property in the Philippines whom he inherited by his father. I am his oldest child with his first wife, in the Philippines, no divorce was settled. I have my birth certificate, my mom and dad’s marriage certificate, as well as his death certificate. The problem is, he has a surviving second wife whom he married in the US (not the PI), with a son. How can I obtain what’s rightfully mines, in share with my half-sibling? What do I need to do to clarify fair and valid equalness?

An extrajudicial settlement in the Philippines may address this. It would have to be unanimously agreed on by the heirs. It will be important to have the titles to the properties in hand as all Philippine land title transfers require documentary proof of ownership.

What if heirs cannot come up with an extrajudicial settlement agreement and there is a creditor (unregistered w Registry of Deeds, but with supporting documents to prove claim / interest in the property) ? How to unlock the situation ?

Contact a lawyer. This is going to take a unique solution and may include court.

“Hello, thank you for this article.

I am in the process of finalising my requirements for the BIR. They are awaiting a “Declaration of Heirship”. I, with my 2 brothers are the only living children of my mother who passed away in 2008 and has land in her name that has not been transferred. All outstanding taxes have been paid and there are no debts. My 2 brothers have no interest in this property and are happy to have it transferred solely into my name with no contest. Can I state this on the declaration of heirship?

FYI I am residing in Sydney, Australia and I have arranged an apostle and SPA for one of my brothers to act on my behalf.

Yes, such a waiver can be made. We have an article on this here: https://lawyerphilippines.org/heir-waives-share-inheritance/

Hello Lawyers in the Philippines,

Can anybody do these steps of Estate Settling or does it have to be a lawyer?

Our case is simple, my mother’s eldest sibling has her name in the land title. The eldest sibling (single never married, no children) passed away last year. The property tax is up to date. Our goal is to transfer the land title to the living heir/s name which could be the 3 living sibling or nephews and nieces. The 3 living siblings also waived to transfer the title in their names but instead to us nephews and nieces. IN short, susuklian na lang silang 3 siblings ng cash. My understanding is, we will have the same process stated above po ba? Salamat.

Yes, the process would be the same.

In some cases, very well prepared persons have been able to do an Extrajudicial Settlement of Estate by themselves such that they have been able to transfer a land title to family members in the Philippines.

Just be prepared for a lot of work and a lot of time spent.

Good day!

I would like to know how the TCT will be named if there will be 4 co-owners (siblings) of the land.

Thanks so much

They can all be listed on the title as co-owners.

That you for creating the best information site on Wills and Estates in the Philippines. My mother passed away in April age approximately 100 years. Her estate is worth between 30 and 100 million pesos. My New Jersey sister recently phoned me informing me that I am a 1/5 beneficiary in the will. We are five children. Four of us are in Canada in the United States. My late mom also holds most of the shares in a family corporation which holds real estate valued at between 25 and 40 million pesos. My brother in New York US who has high level buddies in the Philippines be corporate chairman in the family corporation in 2019, in a meeting where I was not informed of, and I posit that the resolution naming him chairman is invalid. My mother “rose” from her deathbed in 2019 and her email says that I saved her by a supplement that I found in a well-known 600-year-old Chinese medical book. After that deathbed-close-call in which mom was in hospital for 22 days of critical care, my brother manipulated my mother in having him named chairman of the family corporation. The will, approximately 20 years old, names my sister who lives in Ontario as the executor. My brother in New York State, corporate chairman, believes he should be the executor. My New Jersey sister is extremely manipulative and money hungry despite the fact that she has three fur coats, a rich husband, a yacht, one or more trucking companies, etc etc. I am too ill, to old, and to poor to travel. I’m been to the Philippines only once in 45 years, and that was for a brief holiday. I have evidence that my siblings have been looting our family assets for years, in particular, her bank accounts, fabulous jewelry rivalling the Vatican’s religious jewelry exhibition on world tours, her safety deposit box, collectibles worth many thousands of dollars. My brother in New York has consulted with a top Philippine international estates expert in Manila. This expert has suggested a workaround on avoiding probate, which I am against, since my NY brother would be personally disbursing the proceeds. What can I do to prevent further thievery? And stop my siblings, their kids (looters also), and my cousins (including a lawyer who is in the current Law List) from the coming executors? How do I keep on top of estate proceedings if they do not inform me? What organizations (e.g. public trustees) supervise estates and trust matters in Mandaluyong Manila? Thank you in advance for your anticipated reply. F.y.i, I am retired civil litigation paralegal. Have the best day ever. Rob

This is a lot to address. You may find it helpful to set an appointment to discuss this at an online consultation through our homepage portal at https://lawyerphilippines.org

just need a second opinion regarding the EJS we are processing, Notary said, heirs living in abroad can just send an authorization plus signed copy of identity, would this suffice? reading above, it should be SPA apostilled?

Yes.

I am one of four siblings (all three of us are U.S. citizens and the fourth still a Filipino citizen. Our parents died intestate 4 yrs and 3 mos apart (our father in 1976, and our mother in 1978) Mother left two differently situated and undivided parcels of land (one residential and the other agricultural orchard). If all heirs agree to make me the sole and only owner of these parcels of land please show me the step by step process of how I will obtain land title to my paents estate.

The general steps are as described in this article. You and your siblings would have to sign a duly notarized agreement to settle their estates. Note that both your mother’s estate and your father’s estate will need to be settled to transfer a land title to a family member in the Philippines (or yourself or whoever you and your siblings decide will have the property).

We’d have to know more about the specifics to speak to your situation.

You can fill out our full form on https://lawyerphilippines.org if you’d like us to look into this.

I have a deceased unmarried sister who left a titled property under her name. Our parents died long ago. I am the only living sibling. 2 siblings died unmarried and 2 other siblings died with children. Can I have the property transferred to my name if I self-adjudicate? Kindly help. Thank you

The children of the siblings would themselves also be heirs.

Hi, first of all I’d like to commend you for this well-written article, very big help to us lay persons. My concern is this: my father died in 2012 and my mother in 2017. Sadly, we didn’t have any idea about estate taxes then. When computing the estate tax, which year will the BIR base on, my father’s or my mother’s year of death? The properties are in the name of my father with a notation “married to xxx (our mother)”. Thanks for all your help!

Both their estates will have to be settled.

Philipine estate taxes are calculated for each of the deceased, depending on their dates of death.

Note that the BIR penalties can add up unless you are able to avail of the Philippine estate tax amnesty. The amnesty helps a lot when you transfer a land title to a family member in the Philippines (or family members) as it removes the estate tax penalty.

Hi Atty,

What is the proper document to use if both parents are still living and want to transfer the owned estate to the children (legal heirs)?

The parents may opt for a donation or a sale, pay the taxes for these transactions, and register these with the RD. They would have to decide if these serve their situation.

There will be taxes to this, as any Philippine land title transfer incurs taxes.

Very helpful information. Thank you for sharing. God bless.

Hi. Thanks very much for these concise instructions. Case: My mother died last November 2020. I am now in the process of starting to transfer the property from her name to me and my brother. My brother does not really care about dividing the property into two equal parts. We decided to transfer the property to both our names without specifying who gets what portion. We are both okay with this. Questions:

1) In securing an EJS, is this decision a good idea?

2) What will be the basis of estate tax fees? Is it the latest tax declaration? Note, property taxes are updated. I am afraid I will be surprised by how much I will have to pay at the BIR.

3) After settling the estate tax, how do I start with the transfer of title?

Thank you once again.

Hi Det:

It is up to you and your brother. If you get along well, then you may be co-heirs for land without too much trouble. If you don’t get along, you might be better off deciding who owns what.

Calculate the net estate and apply the estate tax fees as well as any fees (you may have other fees, depending on the intricacy of the situation).

When you get the eCar you can then transfer properties to the new heirs at the RD.

Hi,

We planned to transfer the land title of my parents to my name.My father died 2011 and mother is still alive, title is under my parents. Do we till need the extrajudicial deed before my mother can execute a deed of sale?

Hi Anabeth:

Yes you will need to settle your father’s estate prior to transferring to anyone new.

An EJS is always needed if one of the owner’s passes away and will be needed if you transfer a land title to a family member in the Philippines or to the new buyer.

Since your mother and father owned the land together and he passed away, his estate must be settled to do a land title transfer in the Philippines.

Our father died last year and mother is still alive. We have a lot property with a tax declaration only named to our mother and father.

Can my mother issue and process and an absolute deed of sale? Do we still need to sign an extra judicial settlement?

thank you!

A title declares who the owner is and only the legitimate owner can dispose of the land.

Thus you need to find the title and transfer it properly prior to distribution; or title the property if the property is untitled.

Does it mean the living owner can process the deed of sale without going through the extrajudicial settlement?

I am not sure what you mean since the situation is unclear to me.

Hi. Can we execute extra judicial settlement for just one property that is intended to be sold? Tge deceased wife left 3 more proprties.

Thank you.

In some instances, the BIR will accept the partial settlement of the estate.

It will depend on your situation.

This is a very well written article. The explanations are clear and readable. You seem to have made an effort to write this for lay people whose yes would simply glaze over if you filled this with legalese. The visual aids and illustrations help as well. Thank you.

Hi, This is a very helpful document. My mother passed away in July of this year in Toronto, Canada she had been a Canadian citizen and permanently resided in Canada for 40 years. She has a written will but it was notarized. Her will does not included a parcel of land which she inherited from her parents as she already verbally gave it to my brother back in 2018. I and the rest of my 8 siblings all agreed to our mother’s decision. However, my brother, a Canadian and Filipino citizen, did not process the title transfer prior to my mom’s death. Does the extra judicial settlement applies to this parcel of land since it was not included in my mother’s will and therefore considered intestate?

Would greatly appreciate your thoughts on this matter.

Thank you!

We’d have to see the will to say since extrajudicial settlement contemplates situations where the deceased died intestate.

Thank you so much for this very helpful and useful article. May God bless you more.

May I also inquire, in the case of there is disagreement among heirs, do you also have an article about step-by-step process of Judicial Settlement of Land? Or the advantages and disadvantages between the two, maybe, including the fees as well?

Thank you very much in advance

A judicial settlement of estate is a court trial that is subject to the usual considerations for a court case, including appeal by any side that does not like the trial court’s judgment. It can take years because of this.

Hi Lawyers,

Before po ba gumawa ng EJS with Sale is need muna magpa survey ng lot? Portion ng lot lang po kasi ang i-purchase namin. Thank you.

That would be the prudent course.

Good evening! One of the properties we inherited from our mother who died many years ago was a parcel of land in the province. Now, the government needs the said parcel of land for its infrastructure project and is willing to acquire the same through negotiated sale. Can we, the heirs, just execute a deed of absolute sale in favor of the government or do we have to go through the aforementioned process before we can sell the lot to the government? Assuming that extrajudicial settlement is required before we can sell the lot, can we execute it with deed of absolute sale? If yes, should we pay both estate tax and capital gains tax? Thanks.

The extrajudicial settlement can be executed with the deed of absolute sale, but make sure to address the taxes quickly because the estate and sales taxes will have different due dates from which penalties will begin to be incurred.

This refers to a property that we are interested in buying. There are some concerns, however.

The title to the property is named to the parents of the sellers (spouses Juan and Linda). Juan died six years ago while Linda died two years ago. Now their children wants to sell us the property through a deed of extrajudicial settlement with absolute sale. If we buy the property through that instrument and we physically hold the title of the property, have the notarized deed of extrajudicial settlement with absolute sale, and proof of publication of the deed, do we have a legal claim and can be considered as owner of the said property? Can the legal heirs still claim the property from us?

Assuming the children signing the extrajudicial settlement with absolute sale are the heirs, that would be a valid way to transfer the property from them to you. You will need to make sure the transfer is duly recorded at the register of deeds and all the taxes paid.

Hello, I plan to purchase a property and found out possible issues that hinders me to make a final purchase:

1.) Title is still in the seller’s deceased mother’s name. Seller (son of the deceased owner) stated that the title can be transferred directly to my name. Is that possible?

2.) Land area (seller’s share from deceased mother’s properties) stated on the Extra Judicial Partition Document is different from the land area stated in the Title. This is the same property that I am trying to purchase. How can it be different? Even with same Lot Numbers and Tax Dec Numbers.

3.) Land Area on Real Property Tax document does not reflect the true land area. Land area on RPT is way undervalued. Seller stated that this to avoid high property tax. Seller also stated to have two deeds of sale if ever the property is purchased. Is this legal?

Thank you so much!

Sent an email.

The decedent died in Marikina but his property is in Baras, Rizal. His CAR was paid in Marikina. Should transfer of TCT name to heirs be done in BARAS RD? Thanks.

Since the property is in Baras, land documents such as the land title and the tax declaration will need to be done in Baras.

These last steps complete the transfer of a land title to family members in the Philippines and should be done before the CAR expires.

Hi. Do we have to make two EJS for both my deceased parents? Or can we just make ONE extra judicial settlement to cover all of our parents’ properties? Thanks!

Hi Edwin:

One EJS per deceased is the usual procedure.

This is especially the case when dates of death are different since there will be different estate taxes computed.

Hi! Stumbled upon the article. Very helpful. Thank you! Skimmed through the comments and replies as well in case I could find an answer to my question. Hoping you can shed some light.

My mom, her two siblings, and their father co-own a property. All their names are on the title. Their father passed away several years ago. Today, my mom and her two siblings (surviving co-owners and sole heirs) would like to sell the property.

1) Before selling, (in order for buyer to successfully transfer title to his name) would my mom and her siblings need to first transfer the title to just their names (without the name of their father, the deceased)? Or would an Extrajudicial Settlement of Estate indicating they are adjudicating the estate unto themselves suffice? Could that simply be attached to the title?

Or is an Extrajudicial Settlement even necessary since they are co-owners and their names are on the title already? Would simply attaching his death certificate be enough?

2) Their father passed away many years ago. If an Extrajudicial Settlement does indeed need to be entered into, would there be penalities since it was not done within 6 months (or a year?) after his death?

Appreciate your help!

Most serious buyers know that the estate must be settled before it can be transferred to the names of the new owners.

As such, the buyers would ask that the father’s estate be settled as he is co-owner of the property.

It is possible to do this now without late penalties due to the estate tax amnesty but you must act quickly as it takes a lot of effort to push this through and can be very time-consuming. The amnesty ends Jun 15, 2021 and many families struggle even with this long a period.

Hi, my brother died 3 years ago, There’s this property he inherited way back with a title under his name and his wife’s as married to who is still living.Their only son died 8 years ago. Does that make her (wife ) the sole heir now? Just recently, We found a buyer who is interested to buy the property. But the wife wants to transfer the tiitle to her name first. Can she legally do that? My other question is, we as siblings (2 living sisters) do we have the right to that property since it’s an inheritance from our parents? Can it be partitioned among us siblings? And if she sells it do we get a share? Please advise. Thank you

Hi:

It will depend on the type of marriage that he had.

The property regime in Conjugal partnership of Gains vs Community of Absolute Property can affect the situation.

It will also depend on when the property was inherited.

To understand the situation, a case assessment must be undertaken to see what applies to this situation. A case assessment means examining documents, describing the situation in detail and undergoing an interview.

At the moment, the information is fairly vague.

Hello

Excellent article thank you.

My question is a bit different. i am a US citizen and my father, also a US citizen, died in January leaving a will in both the USA and Philippines naming me as heir. He had inherited 15 properties from his mother and spent his adult life getting the deeds in order and putting them in her (or his and his siblings) names. One of his siblings (Philippine citizen) died with no debt. One sibling (Philippine citizen) died with a lot of debt and he had slowly been selling property and using her portion of the proceeds to pay down her debt. All of the properties are in his name and his siblings EXCEPT two properties, which he legally had his siblings waive their rights to so they were fully in his name and would go directly to me.

The properties are agricultural land, in remote locations, fairly worthless on paper (unless the government buys them) and I do not want them. Is there any way of giving them back to the government so I do not have to pay property tax on them? And / or is there any way of retaining the 2 properties that are in his name only?

Finally, as he had a Will in the Philippines he named an executor. It is a law firm out of Manila and I believe I am getting the run around (they say they can’t get valuations on the land, but we have been paying property tax for years so there must be some record of it being assessed). They have also said they want to probate the will in Manila but the properties are all on Negros. As my father was a US citizen and died in the USA shouldn’t’ it be probated in Negros? Wouldn’t that be faster? They have filed a 5 year extension (he died in January) on filing the estate tax return, but I don’t understand why they would do this. And shouldn’t probable begin immediately as I believe there is currently an exemption on taxes inherited by foreigners (the lawyers did not tell me about it, I read it on my own.)

How does one go about firing the executor of a Will? Or maybe they have done and are doing all the correct things?

Sent an email.

Hi! Thanks for this detailed info regarding estates.

Hope you can advise what steps can be done on the following situation:

Father died 16years ago no interstate. The mother of the deceased filed a self adjudication without the knowledge of the rightful heirs wife and 4 children all in legal age in 2009. The mother of the deceased in someway was able to obtain signature of the wife of the deceased and the 3 children and was able to sell the land to buyers.

Questions are:

1. Is the self adjudication valid even if there is more than one heirs? If no, what steps can the rightful heirs do to regain the sold lands given the information that the buyers already built houses on the lands.

2. What steps can the child who did not sign the authorisation letter do to get her part of the estate for the sold lands?

Sent an email.

Hi, my brother died 3 years ago, There’s this property he inherited way back with a title under his name and his wife’s as married to who is still living.Their only son died 8 years ago. Does that make her (wife ) the sole heir now? Just recently, We found a buyer who is interested to buy the property. But the wife wants to transfer the tiitle to her name first. Can she legally do that? My other question is, we as siblings (2 living sisters) do we have the right to that property since it’s an inheritance from our parents? Can it be partitioned among us siblings? And if she sells it do we get a share? Please advise. Thank you

Sent an email.

Hi Lawyers,

Good day!

I am hoping you can instruct me on what to do with my situation regarding subdividing the properties left by my deceased parents without last will.

There were 5 properties left by my parents. My father died last 2007 and my mother passed away this year. All titles were named under my mother’s name except for 1 house and lot. My mother was able to put this house and lot under my brother’s name when she was still alive. Though my brother did not give a single penny to my mother to buy this property.

Question: If we will do an extrajudicial settlement, are we going to include the property under my brother’s name (since my mother is the one who bought it) when we subdivide all properties amongst my siblings?

I hope to hear from you soon. Thank you so much in advance.

Sent an email.

Thank you for the information. Very useful. Can we process land titling in other regions other than where my deceased father’s property is located? I and my brother are planning of having our father’s residential and farm lot titled under our names.

I hope to hear from you. Thank you so much.

A Philippine Extrajudicial Settlement of Estate can be done where he resided.

If the estate will be sold to three buyers by the heirs, is it allowed to execute a Deed of Extra-Judicial Settlement of the Estate with Absolute Sale for a single land but three different buyers?

Sent an email.

My Father passed away in 2009. We still have not executed and Extrajudicial Settlement because some of us are permanent residents abroad (Japan, Canada and Australia), and only my mom and brother are in Philippines.

If they execute an SPA for the Extrajudicial Settlement, will they still need to physically sign the Extrajudicial Settlement Document?

All of us agreed to liquidate the estate of my dad (Land/House, Stocks, Bank Account). Can each of them execute a single SPA to cover the following :

1) Sign on their behalf & Execute the Extrajudicial Settlement

2) Liquidation / Disposal of Properties