What happens to a foreigner’s assets when he dies in the Philippines?

Real properties are the usual type of assets in an estate settlement.

A foreign citizen may settle in the Philippines and live here for years, finally passing away far from family in his home country.

When it comes time to settle his estate, his family abroad might not know how to begin searching for any assets he left behind in the Philippines, much less his intentions for those assets.

This article goes through basic considerations for how to locate, settle, and recover a foreigner’s estate in the Philippines. It also takes up what happens if no heir ever claims the properties.

How do you find the assets in the Philippines?

Finding the assets of the deceased in the Philippines can be time consuming.

There are some initial considerations to answer this question. First, the Philippine constitution reserves ownership of land to Filipino citizens. Except for former Filipino citizens, a foreigner cannot legally buy land in the Philippines. For this reason, the Philippine estate of foreign-born aliens typically cannot include land unless it was acquired by him through inheritance as from a spouse or a parent.

However, other kinds of real estate may be purchased by foreigners. Buildings, houses (excluding the land they are built on which may be leased instead), apartments and condominium units may be part of the Philippine estate of the deceased alien.

In searching for these properties, as well as bank account holdings, stocks, and bonds, the first place to look would be the papers of the deceased himself. Inquiries should also be made with his family and friends in the Philippines.

Finding the assets can be done with the help of a lawyer who has handled estate settlements.

Further information may be obtained by conducting an investigation in the Philippines. Part of this investigation can done be by looking into public records to identify assets registered in the Philippines.

The ownership of shares of stock are recorded at the Securities and Exchange Commission. Searching SEC records does require that you should at least know what corporations the deceased had shares in. More digging would be needed if you don’t have that information.

The Philippines has a real property registry system through which the registries of deeds of the local government units keep public records of the ownership of real property. The centralization of this information into a national database remains a work in progress so that checking property records typically requires legwork at the city or province where the property is actually located.

The information from the registries of deeds is parsed in relation to information obtained from other offices such as the city or municipal assessors’ offices.

We search in various government offices, a document in one office leading to more documents in another.

The Law on Secrecy of Bank Deposits is another obstacle. This law makes deposits with banks or banking institutions in the Philippines absolutely confidential in nature. These deposits may not be examined, inquired or looked into by any person, government official, bureau or office, except upon written permission of the depositor, or in cases of impeachment, or upon order of a competent court in cases of bribery or dereliction of duty of public officials, or in cases where the money deposited or invested is the subject matter of the litigation.

Locating assets has been further complicated by the Philippine Data Privacy Act of 2012, which placed restrictions on public access to information which could previously be used to trace property ownership.

These barriers can make it necessary to employ litigation to obtain information on the estate. Through depositions and interrogatories, the Rules of Court grant broad latitude with which to question possible witnesses about their knowledge of the deceased’s assets. Court orders directing relevant institutions to disclose information can also be availed of.

Going to court to obtain the information.

It is also worth discussing what happens to a bank account when the account holder passes away in the Philippines. It used to be a legal requirement for banks to freeze accounts upon being informed of the account holder’s death. The banks would not allow access until the deceased’s estate was settled and the taxes were paid on it.

This would prevent someone who would take advantage of a person’s death from continuing to withdraw money from it without authority.

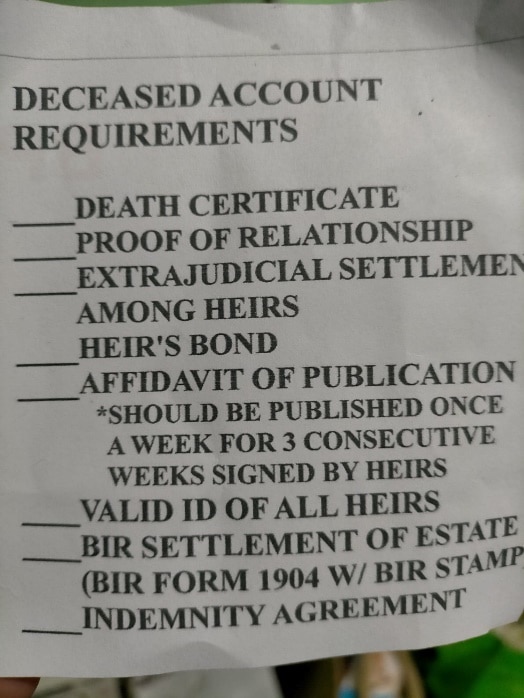

Banks’ internal checklists still require the settlement of the estate before allowing withdrawal.

Since the amendments to our tax laws effective as of 2018, heirs are now legally allowed to make withdrawals from the account even before full settlement of the estate tax, provided that the bank withholds a balance in the account to answer for the estate taxes.

However, this is not so easily done in practice. As a matter of practical, internal policy, banks still require the settlement of the deceased’s estate in accordance with law before allowing withdrawals from the account. They do this to ascertain the heirs’ identity and their right to claim, as well as to manage their own liability in case of mistaken release of funds.

The Bureau of Internal Revenue has clarified that such internal policies remain valid notwithstanding the relaxation of the legal requirement.[i] Consequently, the deceased’s estate in the Philippines should be settled in order to access his assets.

Finders International is a company which can help Legal or Compulsory Heirs with inheritance claims for Estates and property where the deceased is a foreign national or a Filipino with property abroad.

Our understanding is that the fee is a 10% commission on the inheritance awarded but please check with Finders International as this may have changed.

Lawyers in The Philippines has not used Finders International and including them in this article should not be considered an endorsement or recommendation. Similar companies may also exist to assist people with an inheritance claim in another country to where they live.

[i] Revenue Memorandum Circular 62-2018, June 28, 2018; https://www.bir.gov.ph/images/bir_files/internal_communications_2/RMCs/2018/RMC%20No.%2062-2018.pdf

Which country’s inheritance laws will apply over the estate?

Foreign laws are still applicable in estate settlements in the Philippines.

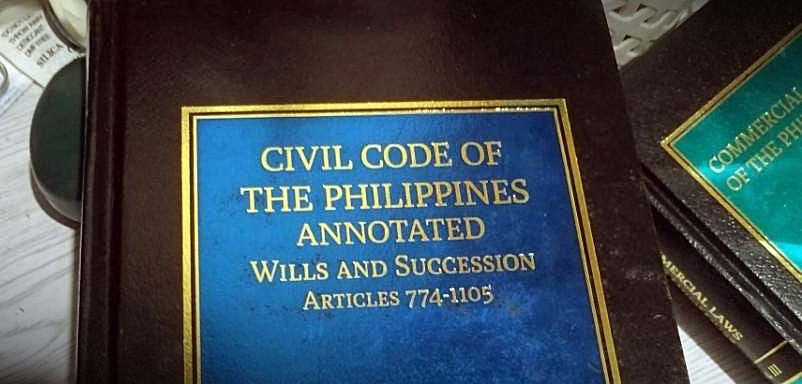

As we’ve discussed in other articles, the citizenship of the deceased determines which country’s inheritance law applies to his estate. Thus, if he is a citizen of the United States or Japan, the distribution of his estate in the Philippines will be according to the laws of his home state. It is in the absence of proof of the foreign law that Philippine laws on inheritance will apply.

The manner of the distribution of the estate under Philippine law largely depends on whether or not there was a last will and testament.

Is there a will or not?

Last will and testaments can be enforced in the Philippines after examinations by the proper court.

Whether or not there was a last will and testament makes a big difference. Foreigners in particular are accorded a wide latitude in the disposition of their estate provided the will is valid. If there was a valid will, then the property will be distributed according to its terms as long as they are not illegal.

How do you know if there is a will?

The first thing to consider when looking for a last will is asking the deceased’s close friends and families for information.

Many times, the actual circumstances are far from the ideal that the deceased kept his papers in order and easily accessible so that his last will and testament is easily found.

His papers may be in disarray. Their location may be unknown. Or, because he died in another country, the documents might not even be accessible to the heirs.

Asking someone for advice is often a good start. His close friends or his family in the Philippines could provide information. Or his lawyer here may have the will in his custody.

Philippine law mandates that the will should be turned over to the local court upon the testator’s death. The Rules of Court require that person who has custody of a will shall deliver the will to the court or to the executor named in the will within 20 days after he knows of the death of the testator.

The court may have already received the last will and testament from its the custodian.

It is thus a good idea to engage counsel to check the records of the local Regional Trial Court in the city or province where the deceased resided. It is possible that someone has already filed a court case to settle the estate and submitted the will to do so. If so, the court’s records can be opened to claimants and heirs.

What if there is no will?

Absent a will, the Philippine rules of succession will be implemented in default.

If there is no will, then the default provisions of the law will control how the assets are distributed. With the deceased having been a foreigner, the inheritance laws in question will be those will be those of his country, (unless these foreign laws cannot be proved, in which case the intestate provisions in the Philippine Civil Code will apply).

How will the foreigner’s estate in the Philippines be settled?

Extrajudicial Settlement cases are filed in the BIR upon payment of the estate tax.

An estate can be settled either extrajudicially or in court.

An extrajudicial settlement is an agreement among the heirs. It can be availed of if there is no will, if all the debts of the estate are paid, and if the heirs are in unanimous agreement. It has significant formal requirements which have to be complied with, as well as taxes paid on the estate, in order for it to cause a transfer of property.

On the other hand, if there is a will or if unanimous agreement among the heir is not possible, then the estate must be judicially settled through probate. A case to prove the will in court — or for the court to order the settlement of the estate without a will — must be filed.

The case typically filed is a petition for letters testamentary or for letters of administration of the estate.

For those estates with a foreign aspect, another alternative is a case for reprobate. In reprobate, the objective is to prove to the Philippine court that a foreign court already rendered a judgment upholding the deceased’s will and that this foreign court’s judgment should be given effect in the Philippines.

The estate can be distributed upon the conclusion of the court case.

What if there are no heirs?

Absent all heirs, the properties will then be acquired by the government.

The property will default to the public if no heirs ever appear.

If someone dies leaving no heirs, the Philippine government can initiate escheat proceedings in court after which the property is forfeited to the government.

At the conclusion of those escheat proceedings, the court will assign the personal estate to the municipality or city where the deceased last resided in the Philippines, and the real estate to the municipalities or cities, respectively, where they are located. If the deceased never resided in the Philippines, the whole estate may be assigned to the respective municipalities or cities where the properties are located. The estate shall be for the benefit of public schools, and public charitable institutions and centers in those places.

The court, at the instance of an interested party, or on its own motion, may order the establishment of a permanent trust, so that the only income from the property shall be used.

An heir who comes to know about the escheat of property to which she is entitled can file a claim with the court within 5 years of the escheat judgment, beyond which it shall be forever barred.

My father’s assets in the UK were below the minimum estate and inheritance tax threshold and did not qualify for reporting to the HRCM. Shouldn’t this carry over to the Philippines where he held two bank account which amounted to less than $5,000.00 which also is tax-exempt in the Philippines. Having said that I still jumped thru all the hoops and provided 1.Death certificate. 2. Government issued identification. 3. Proof of relationship. 4. Affidavit of self-adjudication. 5. BIR CAR & Estate tax return. 6. Affidavit of publication: Estate/self-adjudication. 7. Deed of quitclaim. And will be paying for an heirs bond, and still the local bank insists on the UK estate returns…. which don’t exist! Please can you advise what is the best way forward.

Hello, I understand how frustrating and complex this process has been for you. To better assist you, we will be sending you a direct message via email regarding your concern. Kindly check your inbox. Another way is you may book a consultation with our senior lawyer for only PHP 2,500 pesos per 30-minute session.

Making things a bit more complicate, but what inheritance law would be followed on the death of a Filipina with dual Citizenship married to a foreigner and both living in the Philippines and no children?

Philippine law on succession applies, however given the situation it involves important legal considerations. If you’re planning to pursue legal action, we can assist you with the process. Kindly message us at admin@lawyerphilippines.org