Who Are Compulsory Heirs Under Philippine Law?

When someone passes away, his property goes to his lawful heirs.

In the law on inheritance, these legal heirs or compulsory heirs inherit through testate and intestate succession in the Philippines.

Testate Succession in the Philippines covers inheritance when there is a Will.

Intestate Succession in the Philippines covers inheritance when there is no Will.

So, unless a compulsory heir is disinherited, inheritance rules in the Philippines ensure that certain people must always inherit.

In the below article, I will discuss:

- Who the compulsory heirs are

- How to divide property among heirs and what share each heir receives

- What happens when there is a Will (An heir who is not a Compulsory heir can only inherit the Free Portion, which is the part of the estate that is not given to the Compulsory Heirs by law)

To make it clearer, I’ve provided examples of how an estate is divided if no will exists as well as if a Will exists with a sample estate value of Php 1,000,000.

For information on inheritance when the Legal Spouse of the deceased is a foreigner you can read my article: Can a Foreigner Inherit Land. You can also contact us for specific questions.

Compulsory Heirs – Read this first

This article discusses Philippine succession law and covers testate and intestate heirs in the Philippines.

The focus is on helping you to understand WHO will inherit property after a person’s death and WHAT amount.

To do this, you will some basic ideas in property inheritance law in the Philippines:

- Wills must obey the rules on succession in the Philippines. The law on succession in the Philippines define who inherits even under a will, and the will maker can only give away the portion that is not allocated to them.

- Wills can only remove compulsory heirs if the will follows the Disinheritance section of the law of Succession in the Civil Code of the Philippines. This can be a little complicated, so you must consult a lawyer.

- When a child has passed away before a parent or grandparent, his children are entitled to inherit through the Right of Representation under Philippine law. However, the share those children inherit is only the share of their parent, and not more than that.

- If the parent has passed away, nephews and nieces may inherit from their uncle or aunt who have no children or Will through the Right of Representation under Philippine law. However, the share they inherit is only the share of their parent, and not more than that.

- Legitimate, Illegitimate and Formally Adopted children inherit in all situations under the Rules of Succession in the Philippines. ‘Ampons’may not inherit under intestate succession.

- Remember that this is only a guide. Wills, land inheritance laws, the order of succession in the Philippines – these can all get complicated and it is always best to talk to a lawyer.

Compulsory Heirs – When the deceased has children

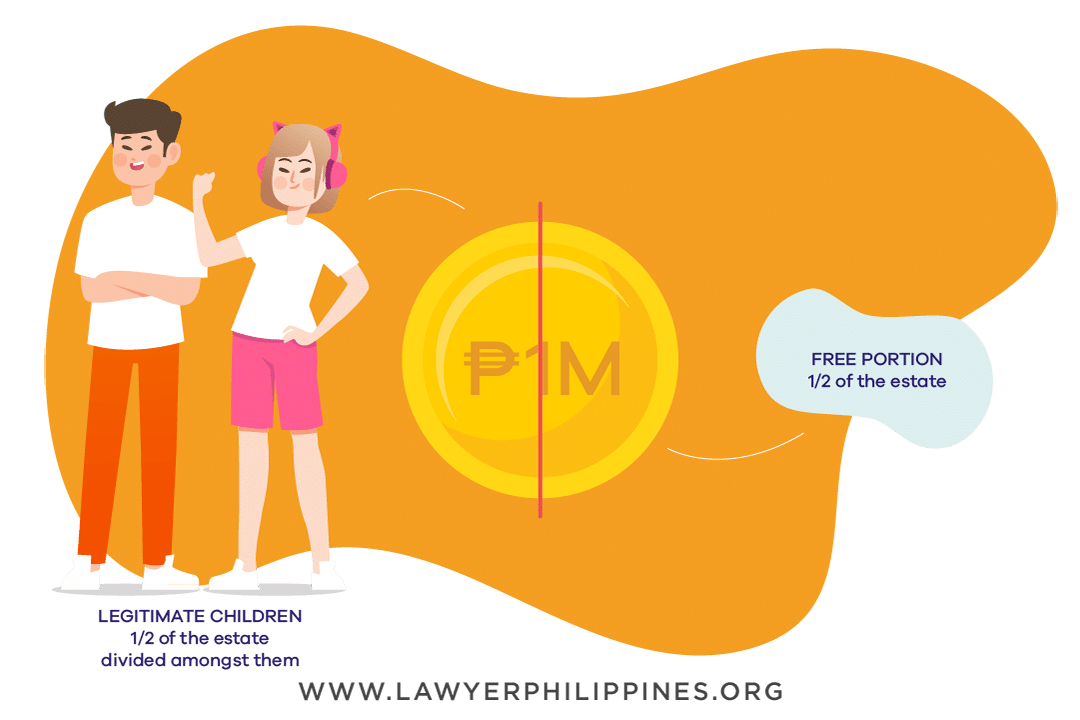

No 1 – 1 Legitimate child or Legitimate children

A Legitimate child/children’s share of half of an Estate is protected by the Inheritance Law of the Philippines

With a will:

- Legitimate children (or their children) – 1/2 of the estate divided amongst them

- Free portion – 1/2 of the estate

- Example: If the estate is worth P1M, then the legitimate child must inherit P500,000. If there are 4 legitimate children, then each inherits P125,000. The remaining P500,000 can be left to whomever the estate owner wants as stated in the will.

Without a will:

- Legitimate children (or his children) – all of the estate divided amongst them

- Example: If the estate is worth P1M, then the legitimate child inherits the total estate. If there are 4 legitimate children, then each inherits P250,000.

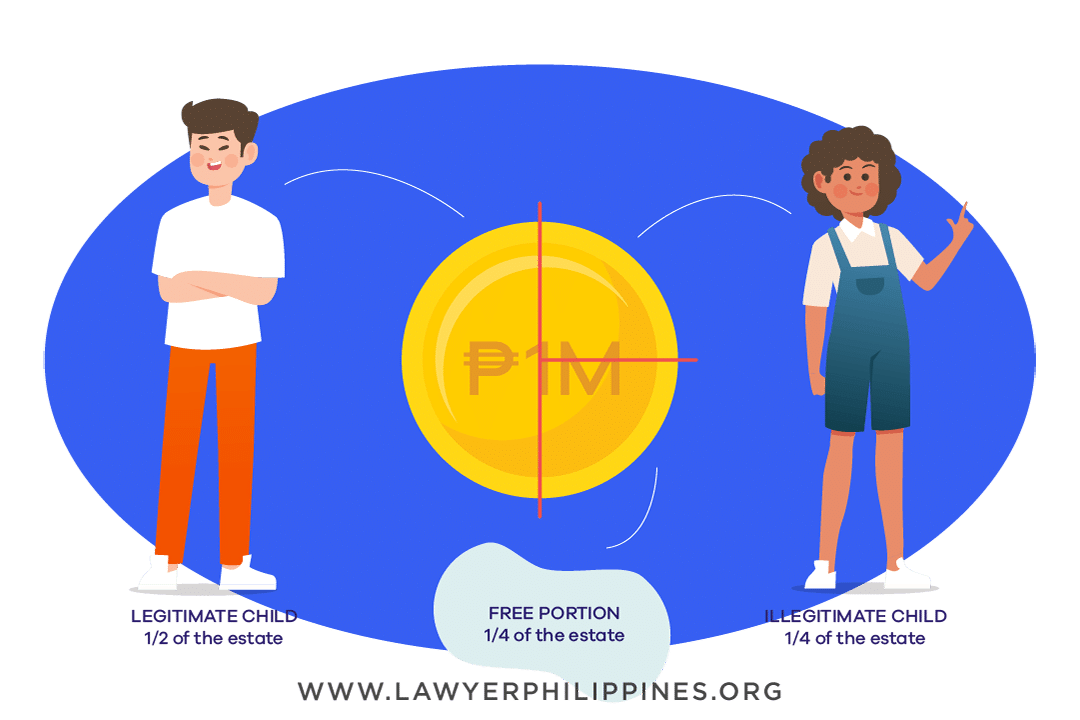

No 2 – 1 Legitimate child & 1 Illegitimate child

How to divide an Inheritance when there is a Legitimate & Illegitimate Child of the Deceased

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate child (or his children) – 1/4 of the Estate

- Free portion – 1/4 of the Estate

Example: If the Estate is worth P1M, then the Legitimate child must inherit P500,000 and the Illegitimate child must inherit P250,000. The remaining P250,000 can be left to whomever the Estate owner wants as stated in the Will.

Without a Will:

- Legitimate child (or his children) – 2/3 of the Estate

- Illegitimate child (or his children) – 1/3 of the Estate

Example: If the Estate is worth P1M, then the Legitimate child must inherit P666,666 and the Illegitimate child must inherit P333,333.

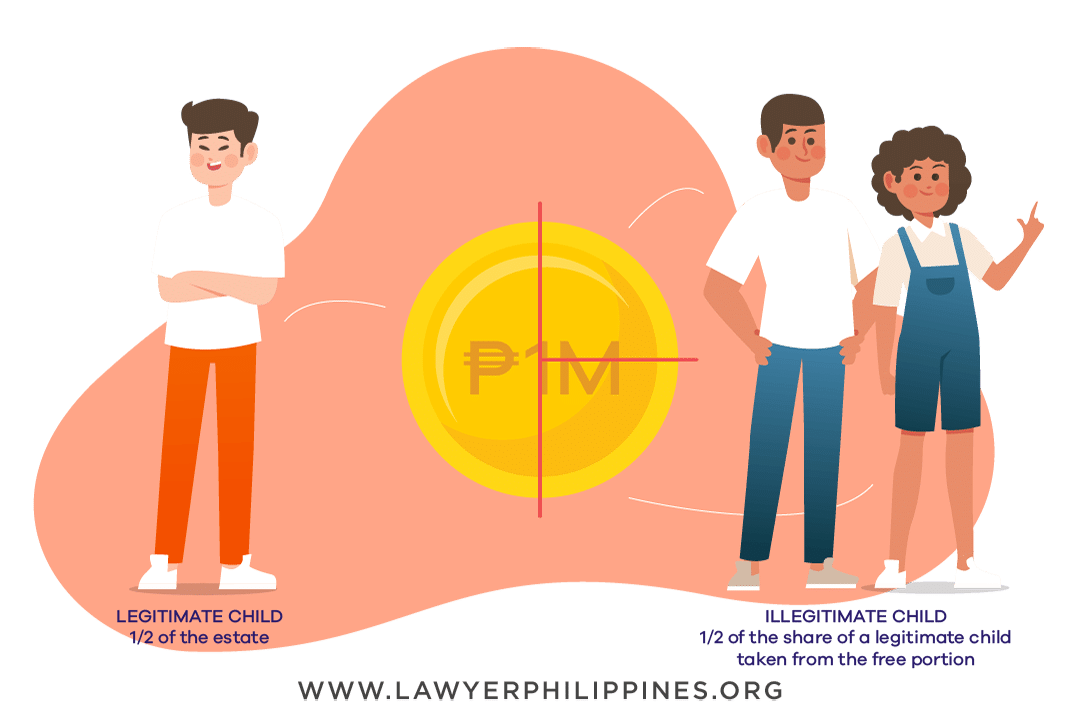

No 3 – 1 Legitimate child & Illegitimate children

How to divide an Inheritance when there is one Legitimate Child plus Illegitimate Children of the Deceased

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate children (or his children) – 1/2 of the share of a Legitimate child taken from the Free Portion. If the Free Portion is not enough, then the Illegitimate children’s shares are reduced equally.

- Free portion – None

Example: If the Estate is worth P1M, then the Legitimate child must inherit P500,000. If there are 2 Illegitimate children, then each would have P250,000. If there are 3 Illegitimate children, then each Illegitimate child would receive P166,666 or P500,000 divided by 3. If there are 4, then each Illegitimate child would receive P125,000 or P500,000 divided by 4.

Without a Will:

- Legitimate child – 1/2 the Estate

- Illegitimate children (or their children) – 1/2 of the share of a Legitimate child

Example: If there is 1 Legitimate child and 3 Illegitimate children and the Estate is 1M, the Estate would be divided so that the Legitimate child has 1/2 of the Estate (P500,000). Although the Illegitimate children should each have 1/2 of the share of the Legitimate child (P250,000 each) this is not possible since it would exceed the amount of the Estate. The Legitimate child’s share would be protected and the Illegitimate children’s share would be reduced equally so that each Illegitimate child receives P166,666.

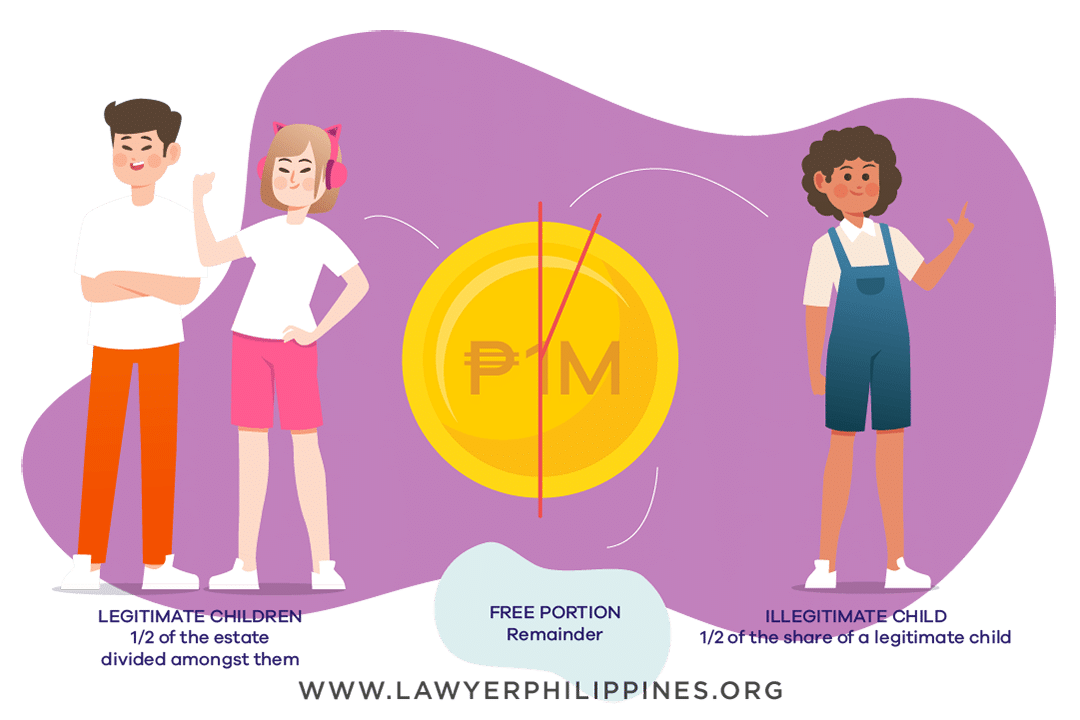

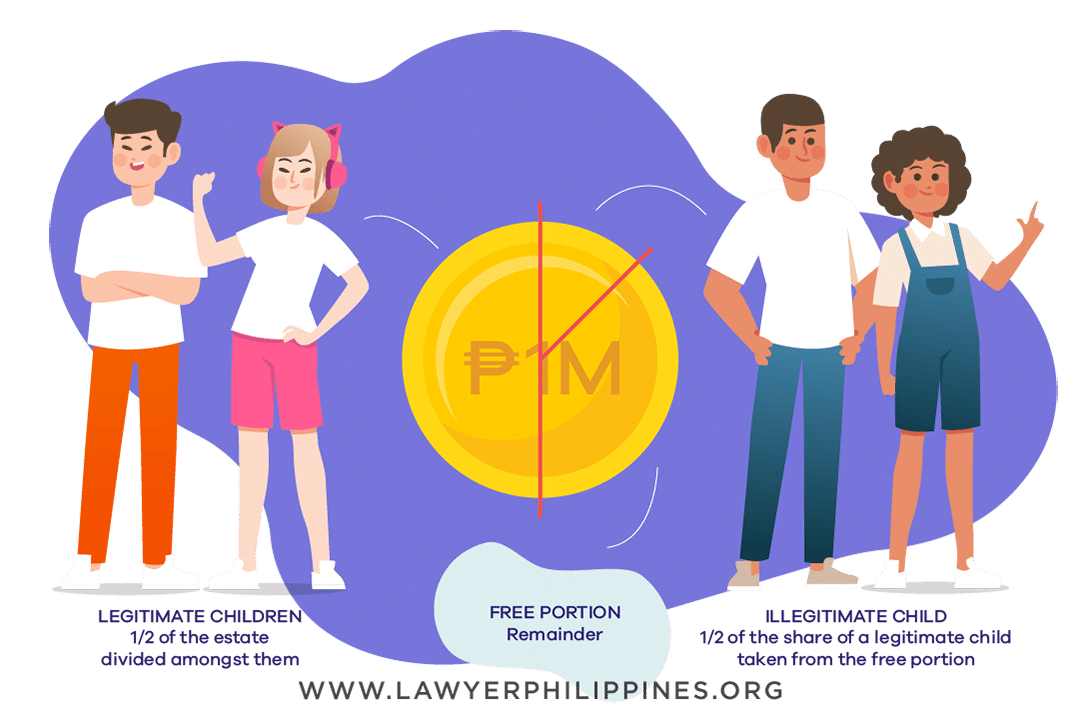

No 4 – Legitimate children & 1 Illegitimate child

How to divide an Inheritance when there are Legitimate Children and one Illegitimate Child of the Deceased

When there are Legal Heirs of deceased and a Will:

- Legitimate children (or their children) – 1/2 of the Estate divided among them

- Illegitimate child (or his children) – 1/2 of the share of a Legitimate child

- Free Portion – Remainder

Example: If the Estate is 1M and there are 4 Legitimate children and 1 Illegitimate child, the Legitimate children would each receive P125,000 which is half of the P1M estate or P500,000. The Illegitimate child would receive half of the share of a Legitimate child or P62,500. The remainder is P437,500 (1,000,000 less P500,000 and less P62,500) and can be given to whomever the Estate owner wishes as stated in the Will (Free portion).

Without a Will:

- Legitimate child – Twice that of the Illegitimate child, with the amount depending on how many Illegitimate children there are.

- Illegitimate children (or his children) – 1/2 of the share of a Legitimate child

Example: If the Estate is 1M and there are 4 Legitimate children and 1 Illegitimate child, then each Legitimate child will inherit P222,222 and the Illegitimate child will inherit P111,111.

No 5 – Legitimate children & Illegitimate children

How to divide an Inheritance when there both Legitimate and Illegitimate Children of the Deceased

When there are Legal Heirs of deceased and a Will:

- Legitimate children (or their children) – 1/2 of the Estate divided among them

- Illegitimate children (or their children) – 1/2 of the share of a Legitimate child taken from the Free Portion. If the Free Portion is not enough, then the Illegitimate children’s shares are reduced equally.

- Free Portion – Remainder

Example: If there are 4 Legitimate children and 2 Illegitimate children and the Estate is 1M, then each Legitimate child receives P125,000 or half of the Estate divided among them. The 2 Illegitimate children will receive P62,500 each. The remainder of P375,000 is the Free Portion and is given as stated in the Will.

Without a Will:

- Legitimate child – Twice that of the Illegitimate child, with the amount depending on how many Illegitimate children there are.

- Illegitimate children (or his children) – 1/2 of the share of a Legitimate child

Example: If there are 4 Legitimate children and 2 Illegitimate children and the Estate is 1M, then each Legitimate child receives P200,000. The 2 Illegitimate children will receive P100,000 each.

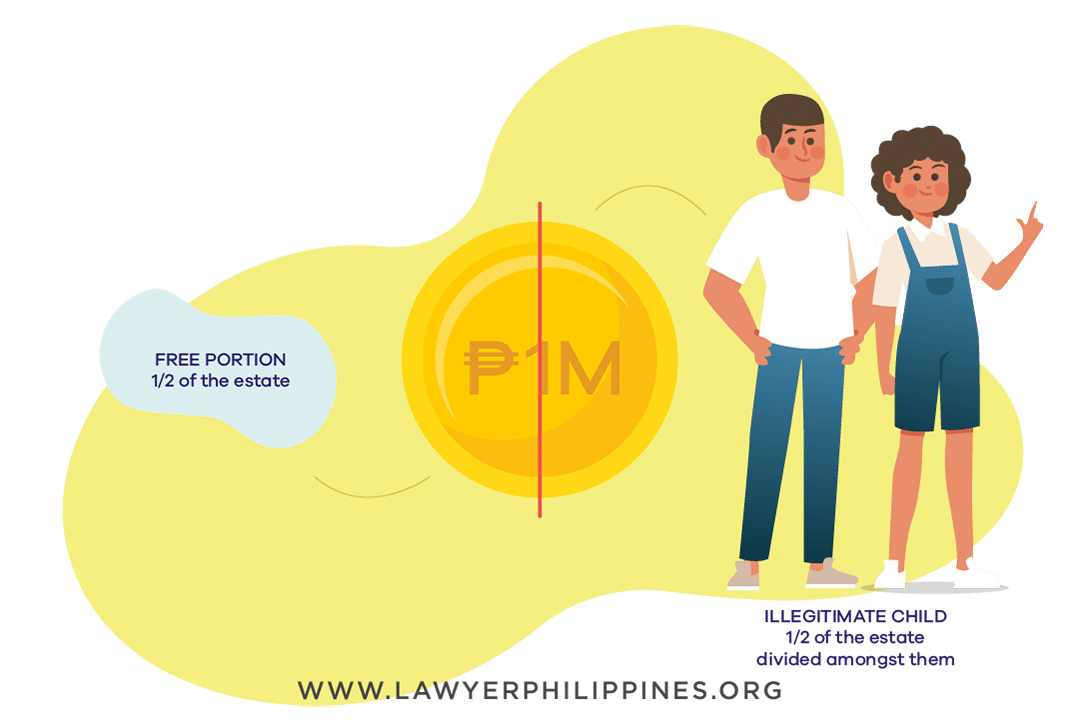

No 6 – Illegitimate children

How to divide an Inheritance when there are only Illegitimate Children

When there are Legal Heirs of deceased and a Will:

- Illegitimate children (or their children) – 1/2 of the Estate divided amongst them

- Free Portion – 1/2 of the Estate

Example: If there are 4 Illegitimate children and Estate is 1M, then each Illegitimate child receives P125,000. The remaining P500,000 is given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Illegitimate children (or his children) – all of the Estate divided amongst them

Example: If there are 4 Illegitimate children and Estate is 1M, then each Illegitimate child receives P250,000.

When the Deceased has Children & a Surviving Legal Spouse

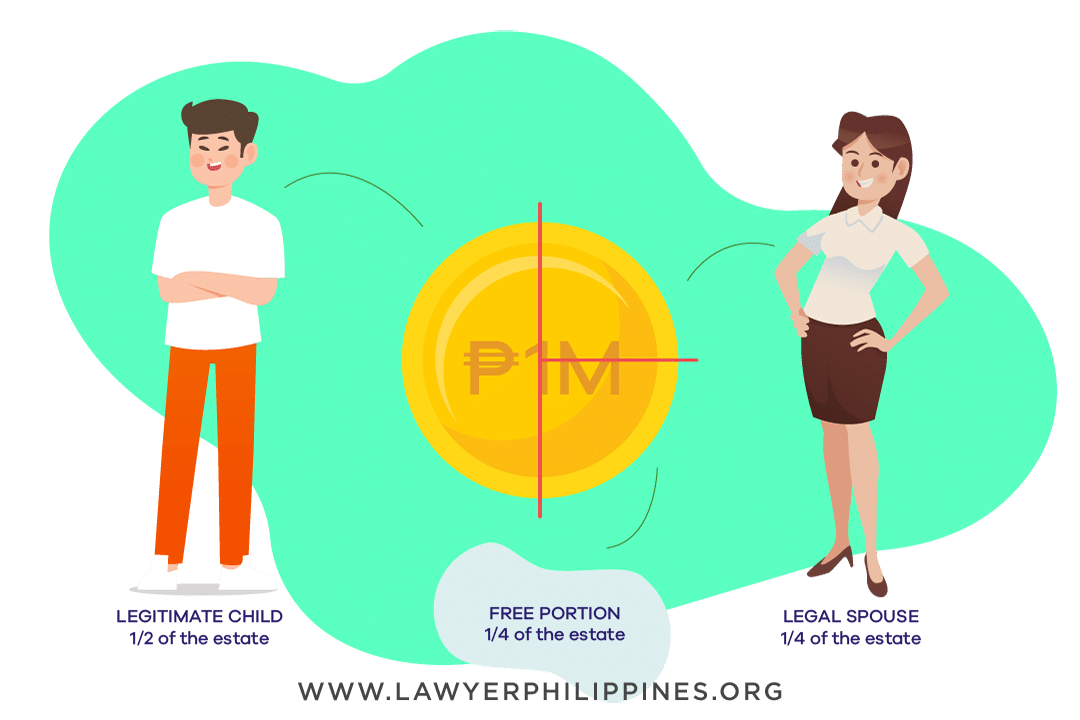

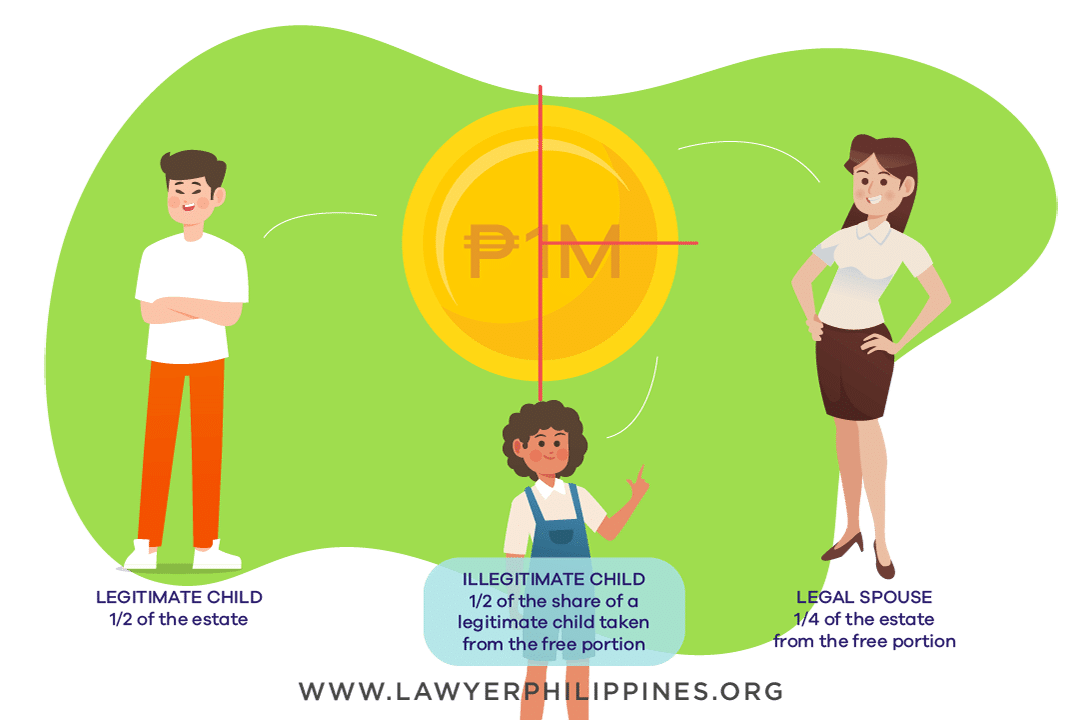

No 7 – Surviving Legal Spouse & 1 Legitimate child (or his children):

How to divide an inheritance when there is a Legitimate Child and a Legal Spouse

When there are Legal Heirs of deceased and a Will:

- One Legitimate child (or his children) – 1/2 of the Estate

- Surviving Legal Spouse – 1/4 of the Estate

- Free Portion – 1/4 of the Estate

Example: If the Estate is 1M, then the Legitimate child receives P500,000 and the surviving Legal Spouse receives P250,000. The rest is given to whomever the Estate owner wishes as stated in the Will (Free Portion).

Without a Will:

- One Legitimate child (or his children) – 1/2 of the estate

- Surviving Legal Spouse – 1/2 of the estate

Example: If the Estate is 1M, then the Legitimate child receives P500,000 and the surviving Legal Spouse receives P500,000.

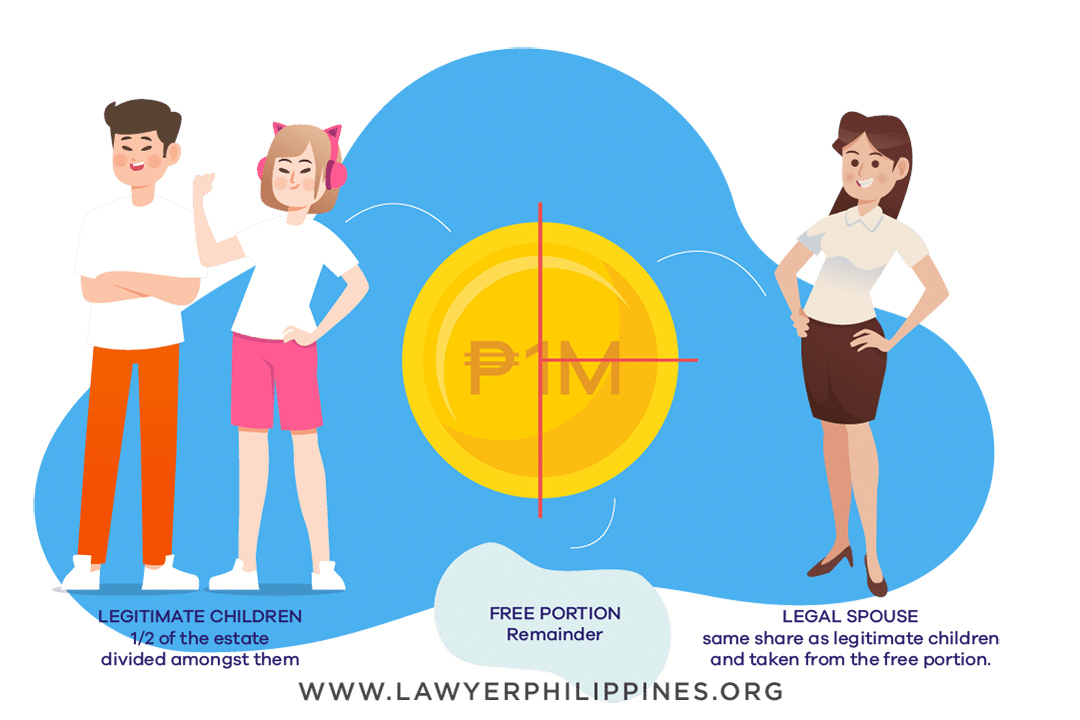

No 8 – Surviving Legal Spouse & 2 or more Legitimate children (or their children):

How to divide an Inheritance when there are Legitimate Children and a Legal Spouse

When there are Legal Heirs of deceased and a Will:

- Legitimate children (or their children) – 1/2 of the Estate divided among them

- Surviving Legal Spouse – same share as Legitimate children and taken from the Free Portion.

- Free Portion – remainder of the Estate

Example: If the Estate is 1M and there are 2 Legitimate children, each Legitimate child receives P250,000. If one of the Legitimate children has already died, then that child’s children (the grandchildren of the deceased) may inherit the P250,000 in his place through the Right of Representation. The surviving Legal Spouse receives P250,000. The remaining P250,000 is given to whomever the Estate owner wants as stated in the Will (Free Portion).

Without a Will:

- Legitimate children (or their children) – estate divided by the number of the Legitimate children plus the Legal Spouse

- Surviving Legal Spouse – share equal to that of a Legitimate child

Example: If the Estate is 1M and there are 2 Legitimate children, each Legitimate child (or his children, if he is already deceased) receives P333,333 and the surviving Legal Spouse receives P333,333.

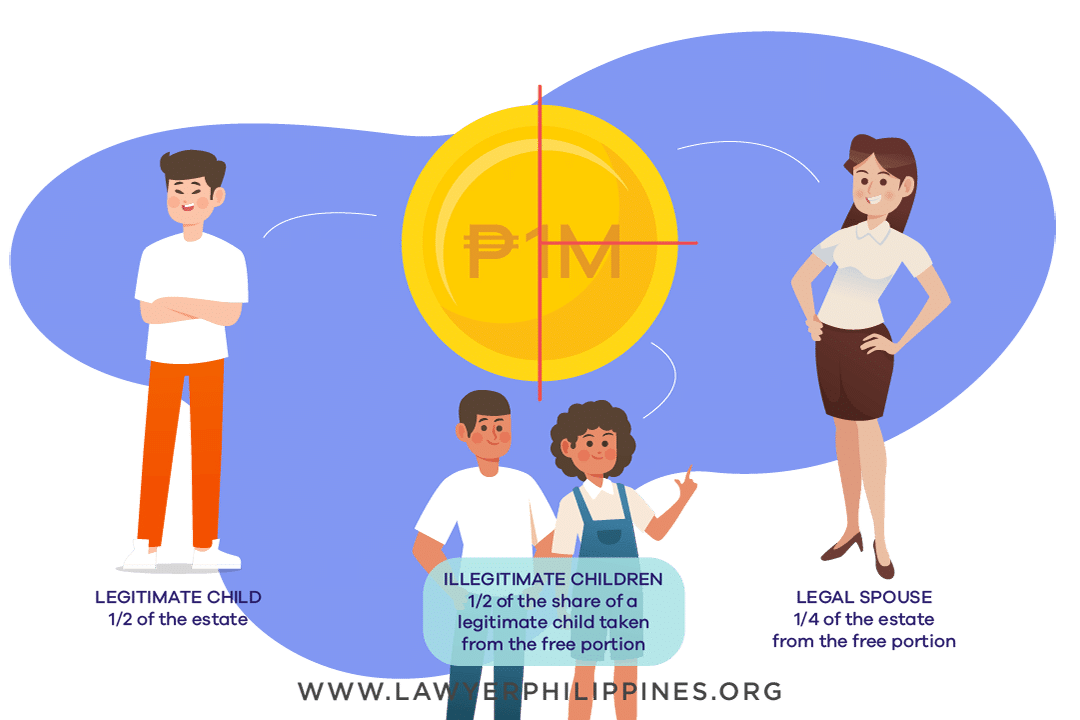

No 9 – Surviving Legal Spouse & 1 Legitimate child (or his children) & 1 Illegitimate child:

How to divide an Inheritance when there is a Legitimate Child, a Legal Spouse and an Illegitimate Child

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate child – 1/2 of the share of a Legitimate child taken from the Free Portion

- Surviving Legal Spouse – 1/4 of the Estate from the Free Portion

- Free Portion – none

Example: If the Estate is 1M, the Legitimate child receives P500,000, the Illegitimate child receives P250,000 and the surviving Legal Spouse receives P250,000.

Without a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate child – 1/2 of the share of a Legitimate child taken from the Free Portion

- Surviving Legal Spouse – 1/4 of the Estate from the Free Portion

Example: If the Estate is 1M, the Legitimate child receives P500,000, the Illegitimate child receives P250,000 and the surviving Legal Spouse receives P250,000.

No 10 – Surviving Legal Spouse & 1 Legitimate child (or his children) & 2 or more Illegitimate children

How to divide an Inheritance when there is a Legitimate Child, a Legal Spouse and Illegitimate Children

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate children – 1/2 of the share of a Legitimate child taken from the Free Portion

- Surviving Legal Spouse – 1/4 of the Estate from the Free Portion

- Free Portion – none

Example: If there is a surviving Legal Spouse, 1 Legitimate child and 2 Illegitimate children and Estate is 1M, the Legitimate child receives P500,000, the Illegitimate children receive P125,000 each and the surviving Legal Spouse receives P250,000. The Illegitimate children’s share would be reduced if there are more than 2.

Without a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate children – 1/2 of the share of a Legitimate child taken from the Free Portion

- Surviving legal spouse – 1/4 of the Estate from the Free Portion

- Free Portion – none

Example: If there is a surviving Legal Spouse, 1 Legitimate child and 2 Illegitimate children and Estate is 1M, the Legitimate child receives P500,000, the Illegitimate children receive P125,000 each and the surviving Legal Spouse receives P250,000.

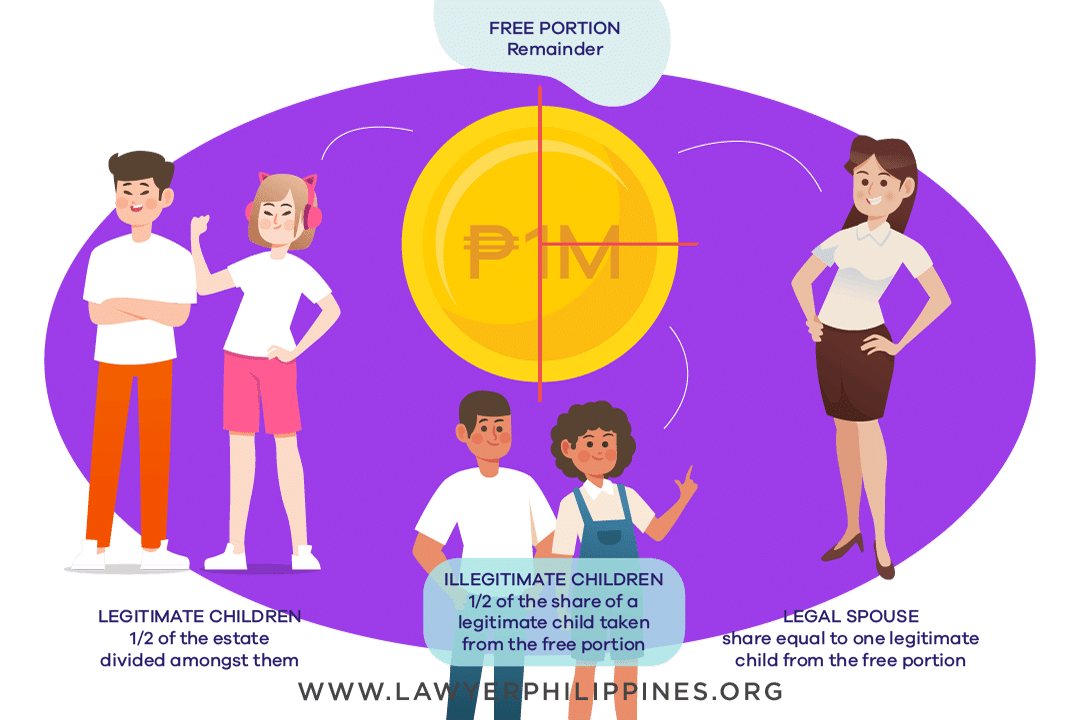

No 11 – Surviving Legal Spouse & 2 or more Legitimate children & 2 or more Illegitimate children

How to divide an Inheritance when there are Legitimate Children, a Legal Spouse and Illegitimate Children

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate divided equally among them

- Illegitimate child – 1/2 of the share of a Legitimate child taken from the Free Portion. If the Free Portion is not enough, then the Illegitimate children’s shares are reduced equally.

- Surviving Legal Spouse – share equal to one Legitimate child from the Free Portion

- Free Portion – remainder

Example: If there are 2 Legitimate children and 4 Illegitimate children and Estate is 1M, the Legitimate children receive P250,000 each, the Illegitimate children receive P62,500 and the surviving Legal Spouse receives P250,000.

Without a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate children – 1/2 of the share of a Legitimate child

- Surviving Legal Spouse – Share equal to that of a Legitimate child but reduced to the minimum of 1/4 of a Legitimate child if the Estate is not sufficient. [Art 999, Tolentino]

Example: If there are 2 Legitimate children, a Legal Spouse and 4 Illegitimate children and the estate is 1M, the Legitimate children receive P250,000 each, the Illegitimate children receive P62,500 and the surviving Legal Spouse receives P250,000.

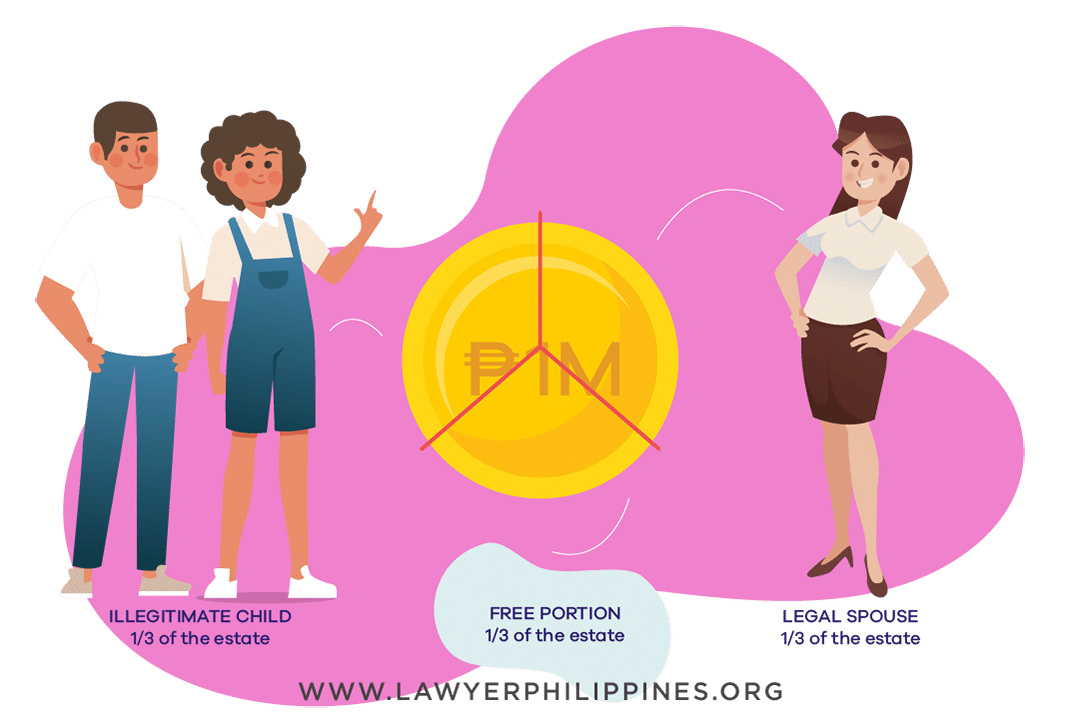

No 12 – Surviving Legal Spouse & Illegitimate children

How to divide an Inheritance when there are only Illegitimate Children and a Legal Spouse

When there are Legal Heirs of deceased and a Will:

- Illegitimate child/children – 1/3 of the Estate

- Surviving Legal Spouse – 1/3 of the Estate

- Free Portion – 1/3 of the Estate

Example: If the Estate is 1M and there is one Illegitimate child, the Illegitimate child receives P333,333 and the surviving Legal Spouse receives P333,333. The remainder (Free Portion) can be given to whomever the Estate owner wishes as per his Will.

Without a Will:

- Illegitimate child/children – 1/2 of the Estate divided among them

- Surviving Legal Spouse – 1/2 of the Estate

Example: If the Estate is 1M and there is one Illegitimate child, the Illegitimate child receives P500,000 and the surviving Legal Spouse receives P500,000. If there are 2 or more Illegitimate children, the P500,000 is divided among them.

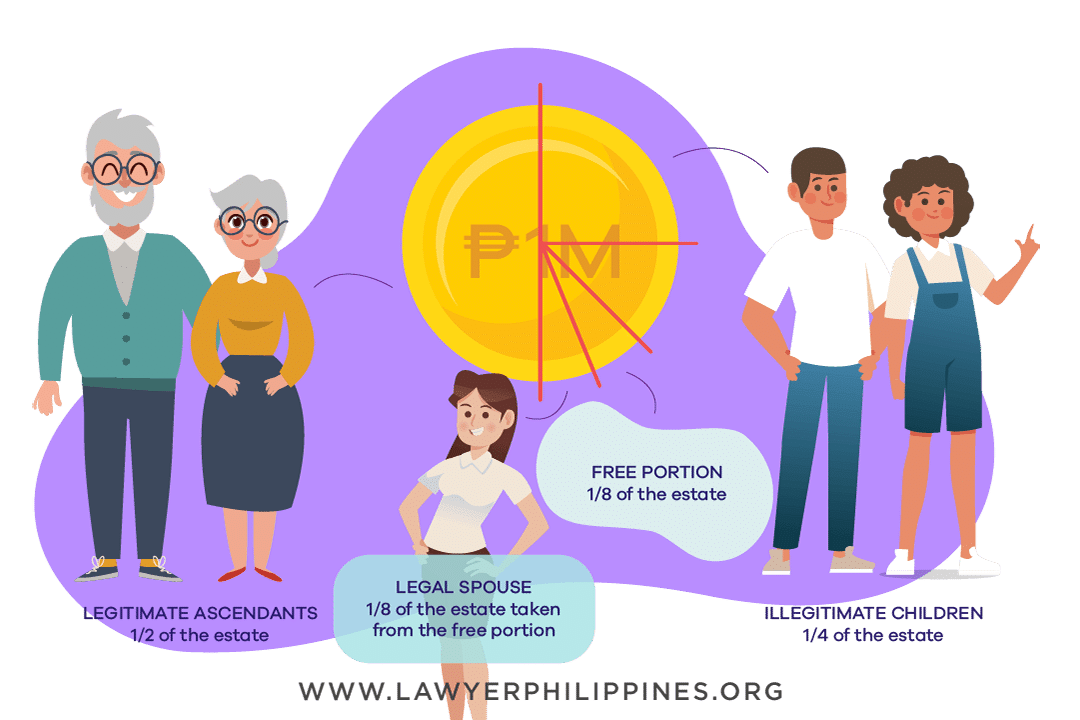

No 13 – Surviving Legal Spouse, Legitimate Ascendants (Grandparents/Parents) and Illegitimate Children

How to divide an Inheritance when there are Legitimate Parents or Grandparents, a Legal Spouse and Illegitimate Children

When there are Legal Heirs of deceased and a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate

- Surviving Legal Spouse – 1/8 of the Estate taken from the Free Portion

- Illegitimate Children – 1/4 of the Estate

- Free Portion – 1/8 of the Estate

Example: If the Estate is 1M, the Legitimate Ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 and the maternal side receiving P250,000. The Illegitimate children receive P250,000 and the surviving Legal Spouse receives P125,000. The rest (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate with nearest ascendants inheriting. If parent/s are alive, this share goes to them. If grandparents are alive, the share is split between the paternal and maternal sides.

- Surviving Legal Spouse – 1/4 of the Estate

- Illegitimate Children – 1/4 of the Estate

Example: If the Estate is 1M, the Legitimate ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 and the maternal side receiving P250,000. The Illegitimate children receive P250,000 and the surviving Legal Spouse receives P250,000.

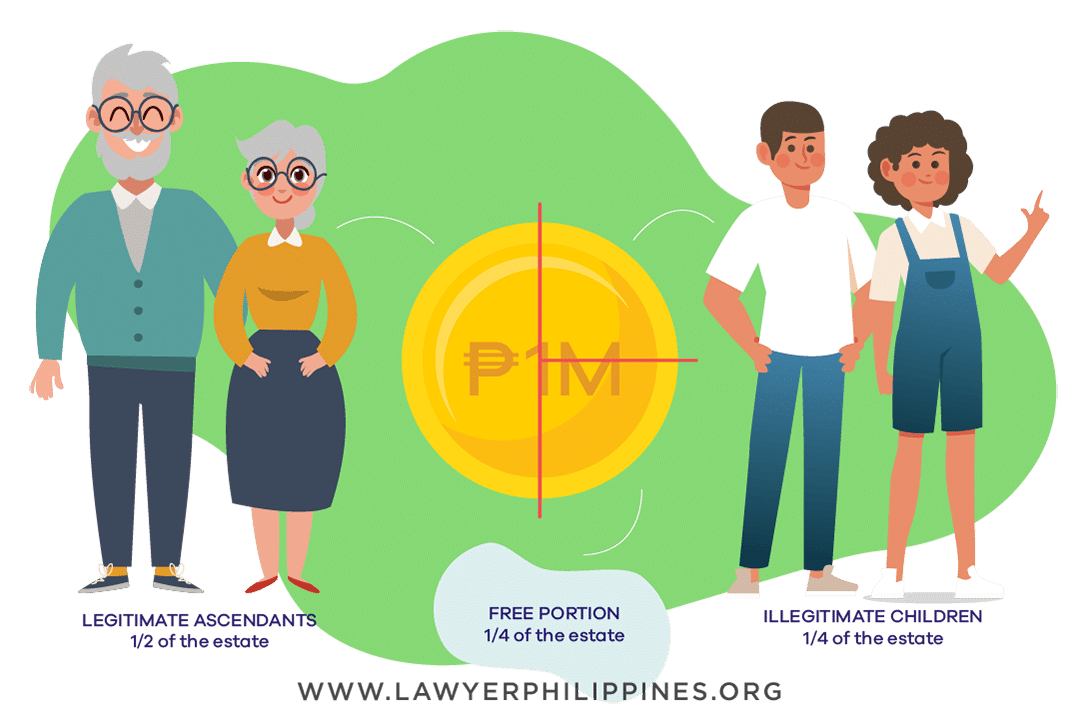

No 14 – Legitimate Ascendants (Grandparents/Parents) and 1 or more Illegitimate Children

How to divide an Inheritance when there are legitimate parents/ grandparents and an Illegitimate child or children

When there are Legal Heirs of deceased and a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate

- Illegitimate children – 1/4 of the Estate taken from the Free Portion divided among them

- Free portion – 1/4 of the Estate

Example: If the Estate is 1M, the Legitimate ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 and the maternal side receiving P250,000. The Illegitimate children receive P250,000 divided equally among them and the rest (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate with nearest ascendants inheriting. If parent/s are alive, this share goes to them. If grandparents are alive, the share is split between the paternal and maternal sides.

- Illegitimate child – 1/2 of the Estate

Example: If the Estate is 1M, the Legitimate ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 and the maternal side receiving P250,000. The Illegitimate children receive P500,000 divided equally among them.

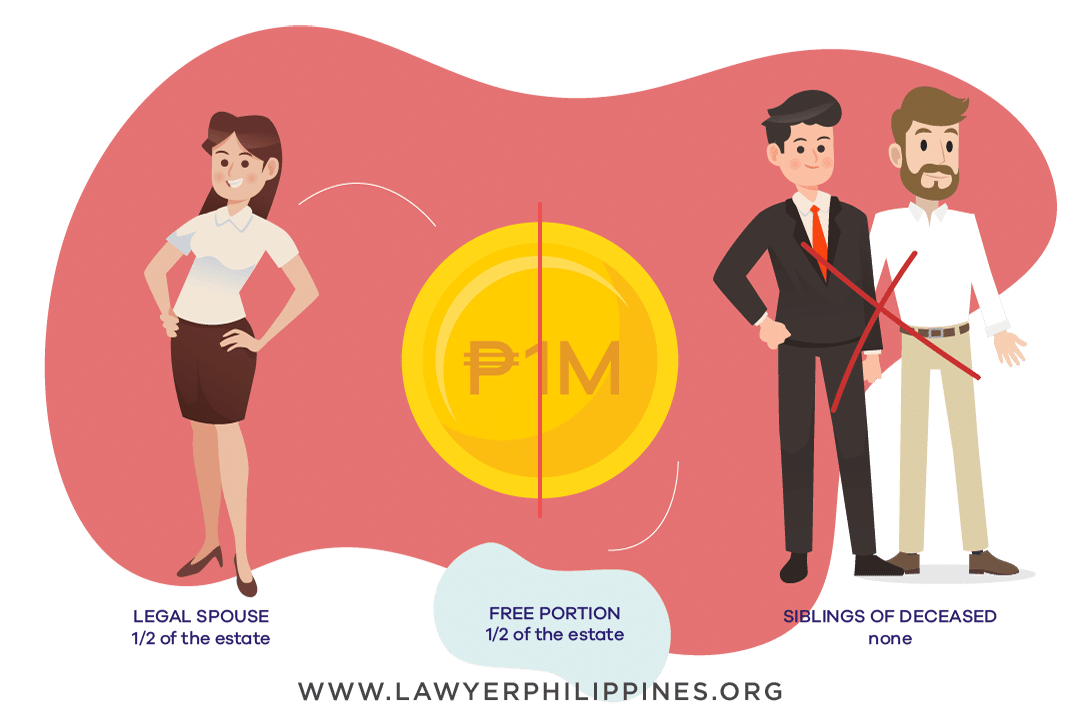

When the Deceased has No Children

No 15 – Surviving Legal Spouse and Siblings of the Deceased (or their children)

The division of an Inheritance when there is a Legal Spouse and Siblings of the Deceased.

When there are Legal Heirs of deceased and a Will:

- Siblings of the deceased – none

- Surviving Legal Spouse – 1/2 of the Estate

- Free Portion – 1/2 of the Estate

Example: If the Estate is 1M, the surviving Legal Spouse receives P500,000 and the rest (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Siblings of the deceased (or their children) – 1/2 of the Estate divided among them

- Surviving Legal Spouse – 1/2 of the Estate

Example: If the Estate is 1M, the surviving Legal Spouse receives P500,000 and the siblings (or their children) are given the remaining P500,000 to be shared among them.

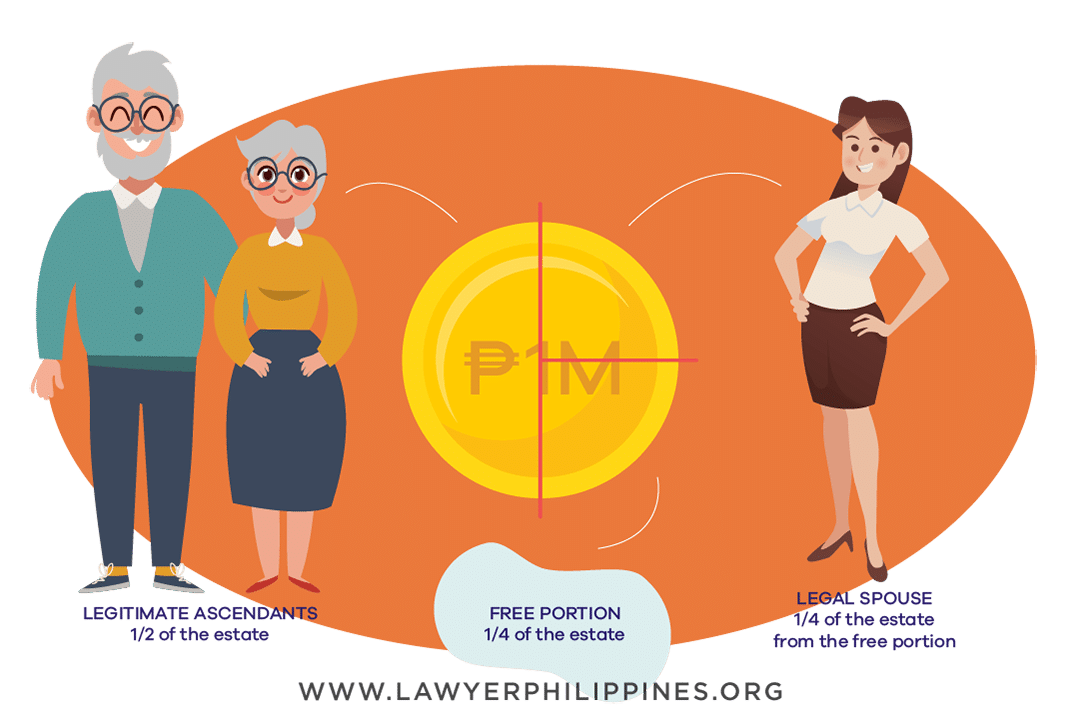

No 16 – Surviving Legal Spouse and Legitimate Ascendants (Grandparents/Parents)

The division of an Inheritance when there is a Legal Spouse, Legitimate Parents or Grandparents and no children.

When there are Legal Heirs of deceased and a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate

- Surviving Legal Spouse – 1/4 of the Estate taken from the Free Portion

- Free portion – 1/4 of the Estate

Example: If the Estate is 1M, the Legitimate Ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 (half of P500,000) and the maternal side receiving half of the P250,000 (the other half of P500,000). The surviving Legal Spouse receives P250,000 and the rest (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate with nearest Ascendants inheriting. If parent/s are alive, this share goes to them. If grandparents are alive, the share is split between the paternal and maternal sides.

- Surviving Legal Spouse – 1/2 of the Estate

Example: If the Estate is 1M, the Legitimate Ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving half of the P500,000 and the maternal side receiving half of the P500,000. The surviving Legal Spouse receives P500,000.

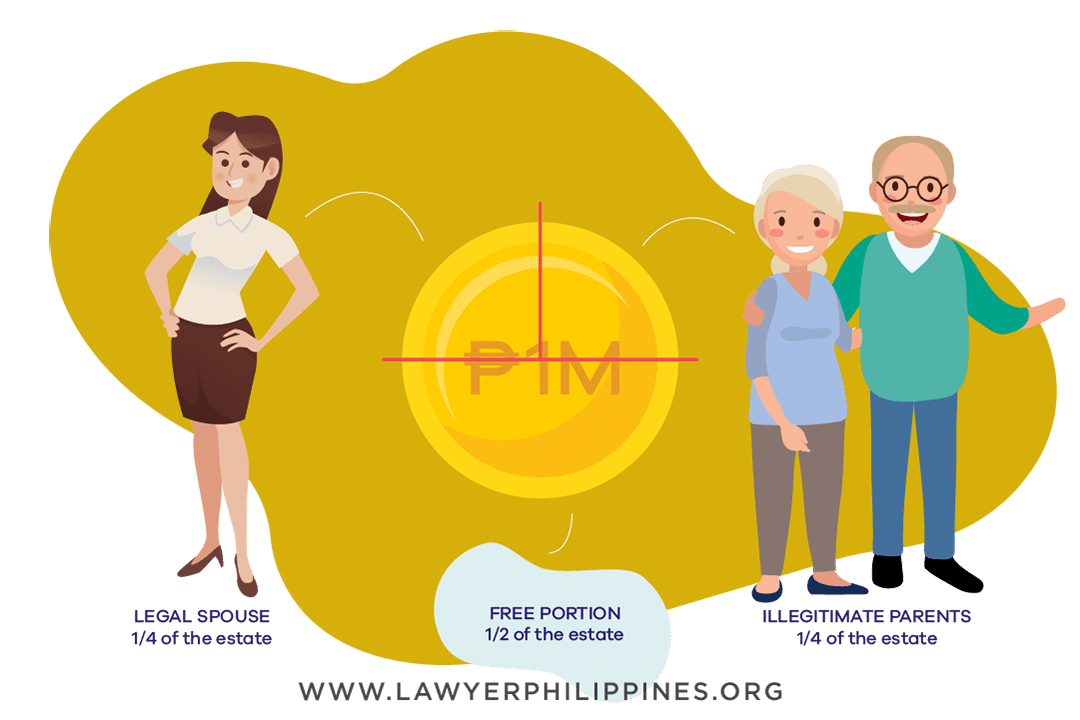

No 17 – Legitimate Spouse and Illegitimate Parents

The division of an Inheritance when there is a Legal Spouse and Illegitimate Parents

When there are Legal Heirs of deceased and a Will:

- Illegitimate Parents of the deceased – 1/4 of the Estate

- Surviving Legal Spouse – 1/4 of the Estate

- Free Portion – 1/2 of the Estate

Example: If the Estate is 1M, the Illegitimate parents receive P250,000 and the surviving Legal Spouse receives P250,000. The rest of the Estate (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Illegitimate Parents – 1/2 of the estate

- Surviving Legal Spouse – 1/2 of the Estate

Example: If the Estate is 1M, the Illegitimate parents receive P500,000 and the surviving Legal Spouse receives P500,000.

Other useful articles on Philippine Inheritance Laws & Wills

- How a Foreigner can receive his Philippine Land Inheritance (Updated for 2018 TRAIN Law)

- What happens to a foreigner’s assets when he dies in the Philippines?

- Philippine Inheritance Laws for Foreigners, Filipinos and Dual Citizens

- Philippine inheritance and foreign Wills

- Reprobate of Wills in the Philippines

- How to Probate a Will in the Philippines

- Philippine Last Will and Testament (Plus Foreign Wills and Wills of Filipinos Abroad)

- Philippine Estate Taxes

- Husband, wife and a joint Last Will and Testament

If you need any legal advice or guidance on the issue of Compulsory Heirs or who the Legal Heirs of Deceased are in your case, or how the Inheritance Law Philippines dictates how to divide an Inheritance, please contact us

Atty. Francesco C. Britanico, FCB Law Office

Lawyers In the Philippines

334 Comments

Trackbacks/Pingbacks

- 3 hilfreiche Tipps für die internationale Nachlassplanung - sifke - […] Anwälte in den USA und den Ländern, in denen Sie Vermögen haben. Anwälte können Ihnen helfen Informieren Sie sich…

- Top 5 Factors to Consider When Selecting Estate Planning Lawyers - Daily Magazines - […] selecting estate planning lawyers to help you with your estate planning. This includes considering inheritance laws in the area…

Hi. Atty. I need your advice badly. Can I make a demand on my father to give me/us, my/our share of inheritance? I know that moral values in the Philippines are vital than exercising sometimes our rights. My mother passed away 6 years ago, we already did finish the extrajudicial settlement up to r.o.d. in all the properties that my mother left us. But last 2021, my older brother passed away with surviving legal spouse and 1 child. We’re only 2 legitimate children. I’m aware that all properties will be divided equally to legitimate children and surviving legal spouse as per No 8 – Surviving Legal Spouse & 2 or more legitimate children (or their children). But sadly, my father keeps telling that no one will benefit in all properties than only him since he is still alive. Is my father right?

The law provides that the compulsory heirs of a deceased are the children and the legal spouse.

However, to protect those rights can sometimes cost time and money and end up in a judicial settlement of estate case.

Hi Attorneys,

I need advise.

We are currently in dispute with one of the siblings of my deceased father and this is something to do with their deceased Parent’s land.

We inherited a land that is shaped like standing rectangle and the top most of it is facing the highway while each side has firewalls/neighbors houses.

One of my Father’s sibling wanted right away to have the top most portion because its facing the highway.

What is the best step to have the shares equally divided to all of 4 siblings?

Is raffle the best way to go to have a chance in getting the top most portion?

This really depends on the family. There are several possibilities.

You may consider ensuring that any property away from the highway should be assured a right of way to the highway.

Some heirs may also opt to buy out or sell off inherited shares in order to simplify the division.

Hi Atty

Situation: The deceased person is single with 2siblings alive and has NO WILL.

1. Who is the LEGAL HEIRS of a single person no spouse and no children and how the properties will be divided?

If there are no living ascendants or descendants then the living siblings and the children of the deceased siblings are the heirs.

Question:

My Adult children are dual citizens and live in the United States. Their mother is also a dual citizen but lives in the Philippines. Their mother passed away unexpectedly. We are divorced .

Does my children need to file in Philippine courts that they are their mother’s compulsory heirs so that the philippines courts know that they are her compulsory heirs ?

No, they do not need a court case to be recognized as compulsory heirs.

Hi Atty.

What if may common law partner po na LGBT partners, living together for 3 years, pag may last will and testament po ba, pwede namin I exclude yung parents? Due to emotional abuse when we were young.

If not, what are steps we can take to exclude them?

Kaya na po namin bumili ng properties but due to this concern, we don’t want to.

Thank you po and respect.

Yes. This disinheritance has to be done through a last will and testament.

hi attorney,

nandito na po ako sa abroad nakatira at may sariling pamilya. gusto ko po sana wag na ako isali sa tatanggap na mana. may requirements po ba? at kung meron ano po yun?

You can choose to sign a waiver of rights or authorize someone to sign a waiver of rights for you through a special power of attorney executed at the Philippine consulate.

When a person dies with a will, but they died at the same time as their heirs (their spouse, children, and parents) or those heirs died before them, who will inherit instead?

People rarely die at the same moment, but if time of death is not known then the law has certain presumptions on who died first based on age and sex. How these presumptions apply depends on the factual circumstances.

My both parents died and have properties, 20 years ago but no will statement. One of the children died lately after they both died without a will. Until now the properties has not been divided or distributed. My question is, will the children of the deceased child can inherit also from the property of their grandparents. My deceased brother has common law wife meaning hindi sila kasal – has 2 children and another child from another woman meaning tatlo ang anak ng kapatid kung namatay., na walang isa pinakasalan but the second wife they live longer together. So, may karapatan ba silang magmana sa properties ng grandparents nila. Need your legal advise

They would have the right to inherit from their deceased father who himself came into his inheritance the moment his parents passed away.

Hello atty., my auntie is planning to prepare a will. She has no spouse, no children and parents passed away already. Will the siblings be the compulsory heirs? What is the free portion of her estate? Many thanks

She has no compulsory heirs and appears to have full freedom to dispose of her estate.

Hello,

My estranged father is Filipino and I’m a Naturalized Canadian citizen, he passed away and left his house property everything to his niece which is my 1st cousin. I am not aware of any will. She still lives in his house. Do I have the right to his inheritance?

You would be a compulsory heir who has the right to inherit from him to the exclusion of his niece.

Hi Atty.

Good day!

The scenario goes on like this: Mr. and Mrs. Cruz had 2 sons. Aside from their house, the couple owned an apartment building. Mrs. Cruz died and Mr. Cruz remarried and have 3 children. My question is, how the conjugal house and apartment building from a previous marriage be distributed to Mr. Cruz 2 sons from his deceased wife, and 3 children from his present wife?

Thank you

This is rather involved, but the basic answer is that the conjugal property should be liquidated as of the death of the first Mrs. Cruz and her estate distributed to her heirs.

Good Day atty.

My grand father passed away and all his bank account he live it under my name, and he also left to me the land tittle and some document of some people and his children loan to him, before he died he said that i will take charge of all the person who had a loan from him, so that i could have support my grand mother and my children. But there is no documented will. even my grand mother and his children were all still alive. And yes all the person who had a loan from him pay me from there loan, but my mother get it from me, for she is saying that i dont have a rights on it. Now my grand mother had already pass away, and my mom, auncle,and my aunt is planning to sale the house. This house is luckily save from the debt because of my auncle, but suddenly when my grandmother pass away his 3 sibling is planning to transfer it to there names so they could sell the property. Atty, my question is, is it right that my mother get what my grand father left me? Do i really dont have a right on what my grand fathers had left me even the person who had loan from him agree to my grand father before he had pass away that they will only pay to me. Atty i hope you could help me on this. Thank you

A will is necessary or else the estate should be divided according to how the law provides.

Hi Atty.

I was considered as son (not legally adopted) by my old maid Aunt who passed away 2 years ago, do i have the right to inherit the things or properties she left? She left no last will.

Thank you!

Not as a matter of right. You could perhaps come to an agreement with her legal heirs who know her wishes.

Hi Atty,

We have a property titled with my Father and Mother’s name on it, they are both filipino. We are 3 legitimate siblings. My mother had one illegitimate child from adultery (no case filed) when my father died out of depression and heart attack due to the issue, my mother was also already pregnant to her 2nd child from that another man. She had the 3rd child to her lover after.

My question is, what could be the division of the property between my Mother, us legitimate and the other children?

Thank you.

Your father’s half of the property would be divided among his heirs, which include his children and your mother. The her children born of the other man while he was living may be legally presumed to be his children as well unless they agree to be considered children of their biological father.

Hello Atty.

Can we exclude a member of the family (sister) in a Deed of extrajudicial settlement of estate with donations done by my Mother with deceased spouse?

Does this make her (my sister) not entitled for the partition of the estate?

And what will happen if this Deed did not published in a newspaper? Is it still a valid Deed?

Thanks.

Publication is a requirement before the Register of Deeds will allow the transfer.

The sister will have to agree to the scheme of sharing which excludes her. She or her authorized representative has to sign the EJS.

Hi Atty. My mom and my biological dad are divorced. Dad passed away due to covid but it was in Saudi Arabia so they had to bury him there. He had a girlfriend around that time, we didn’t know and me and my siblings have no idea if we inherited anything because there was no communication from both parties. Is there a way to know if we did? What are the procedures we have to do to know if there was a will or no will and how to get the inheritance? I’m going back home to Philippines and would like to work this one out.

Finding out if he had a lawyer may be the first step to know if he had a last will and testament.

Hi atty,

What if the property is a conjugal prop and the surviving spouse didnt bear kids pero the deceased has 4 kids. Upon termination of the conjugal prop and ndi naliquidate yung assets in 6 mos post death, without a will, does the surviving spouse has the right to sell a portion of the prop? And once the survivng spouse also passed, how would the inheritance go?

The surviving spouse can sell her interest in the conjugal property and her own inheritance from the deceased if she wishes.

Hello Attorney

My sister is married to a British citizen and has 1 Minor Child, they are not legally separated before she died but my nephew is in Philippines under our care. There is no last will for her property in the Philippines, will my nephew inherit everything or the ex husband of my sister will also get something? Also my parents are still alive

If they were married at the time of her death, then the husband is a co-heir together with their child. The parents would not be heirs since there is a living descendant.

My Lola and Lolo owns a large estate in Mindanao. My mother is just the daughter of my Lolo (step-daughter of my lola). When my grandparents died, the real children of my grandparents divided the property, leaving my mother with no inheritance. Is there any chance we can claim what is rightfully for my mother? My grandparents died 15 years ago and the real children already sub-divided the properties and some of properties have been sold.

That would only be possible if you are willing to undertake the ordeal of litigation and recovery.

However, the claims may have already prescribed or lapsed because this was not done earlier.

atty, do I have rights in inheritance if only my father is my parent and he married second wife in their conjugal properties? they have adopted a child together and they want to give all the inheritanvce to their adopted child.

A child is a compulsory heir of a parent unless disinherited in a last will and testament.

Hi Atty,

For clarification please, Lola has a land on her name, survived by 3 sons but one son died BEFORE the Land title is created. Will the inheritance be shared by 2 or 3?

3

Hello, I have a question regarding No. 8 inheritance partition without a will for surviving legal spouse and 2 legitimate children. No. 8 says that 1M entire estate will be divided equally. Is this the case? I thought it will be 1/2 will go to the spouse and then the other 1/2 will be divided into 3 (spouse+2 legitimate kids). Kindly clarify. Thanks!

The spouse’s share in the conjugal property is not included in the estate of the deceased.

My father passed away recently. He had no will. There are 4 heirs: leaving 4 heirs: 3 legitimate children and the surviving spouse. I was told that the surviving spouse inherits 62.5% of the estate. Is this correct? I read here that the estate is divided equally among all heirs. Thanks.

The estate does not include the conjugal property of which she may own half outright. 50% + 12.5% = 62.5%

Hi Atty. Can you give us an update on the estate amnesty? Is it true that it was extended again until 2023? Please give updates.

Thank you

Yes, it has been extended. Atty. Britanico wrote an article on this which was published on Rappler.

Hi Atty.

Just want to ask about how the estate will be settled (without a will) if the there are 4 legitimate children and 3 illegitimate children. how do they share in the estate? no surviving spouse. What will be the percentage of sharing. Let say the estate worth 10 million.

thank you and god bless.

Larry

This is not enough information to say with particularity.

It will first need to be clarified what the scope of the estate is. This also means determining what part was conjugal property rather than the exclusive property of the deceased. The illegitimate children would inherit only from one parent, whereas the legitimate children would inherit from both.

Once that is determined, consider that illegitimate children are generally entitled to half the share of legitimate children.

My mom died 36 yrs ago, I am their only child. My father got married again and have 2 children. They are living in the estate my mom bought when she was still single (before my mom and dad got married). He made it clear to me that half of the land belongs to me, and the half is for my dad since it is conjugal property. But my concern is, is my half siblings have the right to inherit my father’s portion? The land title is still in my mom’s name.

They can inherit from your father a share from the portion you father inherited from your mom.

Before that happens, it would be advisable that you already settle your mother’s estate and perhaps come to a written agreement with your father about the rights to the property.

Thank you for your response. Does it mean that i will get the half from my mom’s portion then i can also get a portion from my dad’s?

If you settle your mother’s estate while your father is still living, he could opt to waive his rights to it so that the entire estate goes to you. This will not be possible after he has already passed away unless your half siblings opt to waive their own inheritance from him.

How about po if the deceased is an illegitimate child who are the compulsory heirs? thank you

Probably ascendants or descendants, but we cannot say without particular information.

An extrajudicial settlement of estate was made between the legitimate and illegitimate siblings because the legitimate one is willing to share to the illegitimate sibling. That extrajudicial document is not yet submitted to BIR and Registry of Deeds. But, what if it passes from the scrutiny of BIR and ROD and the property is successfully transferred, what might be the implication? Is it possible, in the future, that the heirs of legitimate sibling can annul the extrajudicial document and take back the whole share from the illegitimate one?

We really can’t say without seeing the document and reviewing the particulars. Any answer given the above would be hypothetical or speculative.

Does owning a property before marriage becomes conjugal automatically after marriage? No prenuptial agreement was made.

Is it possible to give the rights to the parents instead to the wife in the event the husband dies?

A private agreement to this effect would be unenforceable unless there was a prenup.

Future inheritance cannot be waived.

What if the deceased has no spouse, no children, no parents but only siblings – one is legitimate sibling and two other siblings are illegitimate;

How their shares are computed?

.

Unless there was a will, only the legitimate sibling would be the heir under the iron curtain rule of intestate inheritance.

but there was extrajudicial settlement of estate made between the legitimate and illegitimate siblings.

is the extrajudicial document invalid? if invalid but the legitimate one is willing to share to the illegitimate siblings,

how could it be corrected? Can it be cancelled and make new one?

If the property was already transferred with the BIR and the Register of Deeds approving it, then it is moot. Otherwise, a deed of donation could be a way to address this.

We cannot speak to the particulars without detailed information.

Dear Atty.,

I just want to ask your answer in my case wherein i have a live in partner for years died, and we have an adopted child, without any legal adoption paper but he has a birth certificate we both our signatures and acknowledged on it. But her parents of my partner claiming it and want it to sell the property of my partner under her name. Since the property finance by her parents and giave t to her. Who has has the right to inherit on the assets of my deceased LIP and there was no last will been made by my partner, because her parents still alive until now. But the Land Title is under my partner’s name.

Thank you for your response for my queries.

Sincerely,

The child is presumed to be hers and is therefore her sole heir. Her parents would have to disprove the child’s parentage to supplant the child as an heir.

Good morning po atty. Ask ko lang po, paano kung ako ang kasama ng lolo at lola ko sa tahanan. Tpos po napaayos ko ng konti yung bahay na tinitirahan namin. Ngaun wala na sila parehas, may right po b yung anak nila na kunin sa akin ang bahay? ano po ang maaaring karapatan ko or ano po maaari ko gawin? Masasayang lang po ba yung pagpapagawa ko sa bahay? Knowing din po na ang nagsusulsol sa uncle ko na kunin sa akin ung ipinaayos ko n bahay ay yung soon to be wife nya.

If they are your grandparents, you may share in the inheritance of the estate in representation of your own parents.

You would also be entitled to reimbursement for the maintenance and repairs to the house.

Dear Attorney

My brother suffered years of a complicated buffet of colorful lifestyle – generated diseases, died recently and after a few days was buried. His last will and testament documents were only shown by his common law wife to the legitimate children of my brother. Notarized as they are, these documents of the the last will and testament were awarded by the dying brother to his common law wife. By legal procedure, can the legitimate children and the legal wife claim all of these properties that were given to the common law wife who lived with and took care of the brother who became ill through the years? What steps should be taken by the family to contest the documents that are kept by the common law wife? Thank you very much.

It is often best to begin with a conversation between the parties to settle the estate amicably, but if this is not successful then an estate case filed in court would be the way forward.

Hello Atty, my Father’s brother died without a will, and has no spouse or children. There are two siblings however one is deceased with two children. Should his assets be divided in half between the families of the two siblings, or do the my father and two children of the deceased sibling get one third each? Is there a specific law I can reference? Thank you po.

The first option. The children of the deceased sibling inherit in representation of their parent and so are only entitled to as much in total as their parent would have inherited.

Hello Atty., Just want to inquire. My mom is processing the Deed of Extrajudicial Settlement of Estate. She has two alive siblings, but the other sibling, which is my Tita, died bago pa mamatay yung lola ko. Sino po ang magmamana ng share ng Tita ko? Is it her husband or yung only legitimate child po nila? Thank you po!

The child would inherit in representation of his mother.

My brother (a UK citizen) died in the PP earlier this month, aged 62. He has had PP residency, but this lapsed when they were trapped by COVID and then the military coup in Myanmar for a over a year. They were repatriated to the PP a few weeks ago. His wife is filipino, and he has three UK children by two previous marriages. He and his wife owned a house in Manilla and a beach resort, both mortgaged. His wife tells me that they each owned a half share of the PP properties, but due to his UK citizenship I am not sure that this is the case. He may also have owned property in the UK, in which his second wife still lives. It appears that my brother did not leave a will.

Is his estate covered by PP or UK intestacy law? His children don’t want anything from the estate, they just want his widow to be comfortable. If there is anything left of the estate on her death they want her Filipino family to benefit. If they are deemed beneficiaries of his estate, how easy is it to renounce any benefit? Are there any consequences to this action which we may not forsee? Who should my brother’s widow contact first in order to move ahead with dealing with these matters?

She may consider an extrajudicial settlement of the estate, signed by all the heirs, in which the children renounce their shares in her favor. We would need to examine the property documents to know what the scope of the estate actually is. She can contact us through our form at https://lawyerphilippines.org if she wishes to consult on this.

Hello Attorney,

Will try to keep this short. Situation po is, there are 4 legitimate children and 3 illegitimate. Father was civilly annulled with spouse well before illegitimate children were born. Only the illegitimate children currently reside with Father as all the legitimate children are now married and have their own families and homes.

It’s been revealed that one of the illegitimate children has been spoon feeding unfounded information to ailing father discrediting legitimate children in the hope that illegitimate child can claim all properties as hers by form of a will. Father by he way has several high value properties. Father has “verbally” disowned legitimate children. Illegitimate child has blocked all access for legitimate children to see Father given that they live together and Father is in poor health under medical supervision at Home.

Question: Is it at all possible that legitimate children will be left with no inheritance?

Salamat Attorney.

Disinheritance is only possible through a written will, but it is possible that the property might be transferred while the father is still living to the disadvantage of legal heirs.

Good Day, Attorney!

My father (already deceased) owns a property in Albay, Bicol inherited from his parents. However, to date, TCT has not been applied due to costly processing. But the payment of real property tax has been updated. My father executed an Deed of Absolute Sale (duly notarized by a certified notary public) to my sister in 2013. My sister passed away last year. My sister has a legal spouse but they had no children. We are three surviving siblings left. Under the law, who will inherit the property? I would highly appreciate your advice in this regard.

Hi Attorney,

I’m single, never married, no children. Me and my aunt (my mom’s sister, a US citizen but naturally born Filipino) have recently acquired a property in installment basis. We share all expenses related to to this property, from paying the down payment, move-in charges, renovation expense and amortization. My question, if in case I die (hopefully not yet) and the property become fully paid because of MRI, who will inherit the property? Can my aunt get the ownership? Or how can she get the ownership of the house? Can I make a will and put her name as my no.1 heir? Or how to make my aunt a co-owner of the property (financially she owns about 35%)? Thank you.

The title to the property is the presumptive evidence of ownership. You will both be presumed co-owners if it is registered in both your names.

If you are the sole title holder, nothing in your narration prevents you from willing the property to her, but note that any will must be probated to have effect or transfer ownership.

Hi Atty. My mom already have 3 children when she met and married my dad. Their marriage produced 3 children, including me. My 3 older half siblings were registered late, with my dad signing as the father. Our dad died a few years ago, leaving us with a small property which we are planning to sell. Do you have any advice on how the property or the sale must be properly divided among us (our mom, 3 half siblings, and 3 full siblings)? Thank you!

To add: there was no legal adoption performed. My dad just acknowledged them and gave them his surname.

This would be more appropriate to discuss privately.

We can set a consultation through https://lawyerphilippines.org/ if you wish.

Hi Atty.

What if there are 5 siblings. 3 of them are still alive. 2 are already deceased.

They have a common property they inherited from their deceased parents.

3 living siblings made an extrajudicial settlement of estate with sale.

May right ba sa partition yung descendants ng 2 deceased siblings?

TIA.

Yes.

Hi,Attorney Francesco.

I would like to ask,what if there’s no Will from my Aunt(deceased)and she have 2 adopted children.Are they going to inherit her property?And if so,how are they going to divide the property? And how are they going to transfer their name on the land title/property if ever?

Salamat po!

If they were legally adopted, are the only children, and there is no surviving spouse then they inherit her entire property to be equally divided between them.

Good day Atty!

On instance that that an illegitimate parent predeceased his illegitimate son(has surviving spouse), can the legitimate children of that parent succeed the testate of the illegitimate son?

Not without a will as they are not intestate heirs of each other.

I am Filipina, a illegitimate child, my parent did not get married to each other.

My mom got married to now her husband and have 2 legitimate kid.

My dad was married with 2 legitimate kids, then he separated his wife and have 2 illegitimate child with his new partner. His first wife died and he married the partner whom he has 2 illegitimate child recently.

I own 2 parcels of land with building on it. I married a USA citizen, no plan of having kids.

Truth to be told I wanted my Foreign husband to inherit my properties and that could only happen thru intestate inheritance and that’s why I am not making a last will and testament before my demise.

I would like to know who will inherit my properties and what will be the division

1.If I am survived by 2 illegitimate parents and a Foreign spouse.

2. If I am survived by my Foreign spouse and both illegitimate parents are already dead? Can the Article 992 be use to removed unwanted heirs ( illegitimate parents relatives and kids)? Will my Foreign spouse inherit all my property? Will he be allowed to file for deed of self adjudication immediately after my demise?

Thank you for your time and response.

AGF

The illegitimate parents and the surviving spouse would respectively inherit half the estate.

A last will and testament would be necessary to disinherit the parents.

It is possible to probate a will in court while you are still living.

If illegitimate parents are dead and only my Foreign spouse is a live. Will my spouse receive all my properties?

Or does he get 1/2 of the properties and then 1/2 will go to my illegitimate parents kids?

What do you mean by probate a will in court?

All would go to your spouse in that case.

We discuss probate here:

https://lawyerphilippines.org/2018/03/06/philippine-inheritance-and-foreign-wills/#What_is_probate

Hi attorney! What will happen po if the testator provided P8,000,000 to Ana (his secretary) through his last will and testament despite having to legitimate children? how will they distribute the estate?

This depends on whether the estate has a free portion sufficient to meet this bequest. It also depends on what the other provisions of the will are and whether they are valid.

There are many factors to consider. We take many of them up in our articles on wills which may be found here: https://lawyerphilippines.org/category/estate-law/wills-inheritance/

Hi po! what about if the decedent is survived only by his two (2) illegitimate children, how will they distribute the estate which amounted to 12,000,000?

If there is no surviving spouse and no surviving legitimate ascendants, the illegitimate children will divide it between them.

We are currently doing the prpcessing of the EJS. The parents died (no will) 1986 (no transfer of title done) and 2002 (again no transfer of title done) leaving 4 children. One of the 3 children died (no will) 2019 with a surviving spouse but no children. Does the surviving spouse of the sibling who died inherit? As per EJS “contract” drafted surviving siblings (2) and surviving spouse gets 1/3 each of property left by the parents. Previously there was information given that dead sibling’s spouse does not inherit, only has right to use (live in) the property. Current internet searchings show dead sibling’s surviving spouse gets half of dead sibling’s share and the other half is shared among remaining surviving siblings. Please enlighten us.

The timeline makes it the latter division, but there is nothing to prevent the heirs to unanimously agree on a different division or settlement.

One of our brothers was legally adopted by our aunt after his birth and is using a different name since then. Is he still considered as compulsory heir of our father? (We are Filipinos) Please advise us on this matter. Thank you very much.

Yes. The preponderance of authority is that the adopted child enjoys the best of both worlds and remains the heir of his biological parents.

Hi.

My mother-in-law left a sum of money. Currently she has three surviving children and two deceased. I’m the legal wife of one of the deceased child, can I still get a part of my monther-in-law money. We have no children of my deceased husband. I will appreciate your reply.

Not from the facts given. A daughter-in-law is not an heir of the mother-in-law. Neither does she inherit in representation of her husband who predeceased his mother.

Good evening Sir.

Is is true that when a child first died before his parents the child’s wife and child is not anymore entitled to any share from her husband’s parents property

The grandchild would inherit from the grandparents in his father’s place.

Gud evening po attorney, ask ko lng po kc single po namatay ung sister ko, ako n lang po buhay s buong family, lahat po ng kapatid and parents ko patay na, ako na lng po ba pwede magclaim ng SSS nya?

You should contact the SSS directly about that.

Hi po, Yung namatay ko pong lolo ay may iniwan na will (land property) para sa kanyang mga anak pero invalid po yung will dahil kulang po ang witness na nakalagay sa will, ang tanong ko po paano po ang gagawin para paghatian ang mga lupa at mga proseso?. Salamat po!

We discuss how to settle the estate through an extrajudicial settlement here:

https://lawyerphilippines.org/2018/10/20/how-to-transfer-land-heirs-philippines-extrajudicial-settlement-philippine-land-inheritance/

Good day attorney. Inohonor pa rin po ba ngayon sa tatay ko yung property ng kapatid nyang walang anak at namatay na yung asawa? Thank you po.

Yes, siblings can inherit the entire estate if there are no living parents or children.

Thank you atorney.! Hinahabol kase ng pamangkin ni tatay Yung lupang naiwan.

Good Morning Atty.

Given your discussion above, it was stated that siblings can inherit if he has no children even though the wife is still alive. It also shows that same is applied with the ascendants. I was wondering, if a legitimate descendant died intestate, can he be survived by his spouse, legitimate parent, and siblings at the same time?

In that scenario, only by his spouse and legitimate parent. Living direct ascendants or descendants will exclude collateral relatives like siblings from the succession.

Hi atty,

Good day po! Quick question. My father recently died and left some of his property under his name. Before he died, he re-married legally because my mom died few years ago. I am a legitimate child over 30 years of age. Am I getting half of the property my dad left? Thank you

This depends on who are the surviving heirs. It also depends on what properties or parts of properties are considered conjugal property.

Hi. We have an ongoing case regarding the lands. The other family claimed it and it was still on hearing. They wanted to demolished the house built on that land. Do they have the rights to do that?

Thank you

Hello. You should consult with your lawyer on this specific question.

Dear Attorney,

My aunt who passed away was unmarried and had no children. There is one surviving sibling, the other 2 siblings are already dead. All siblings have legitimate children. There is no will.

How will the property of my aunt be divided?

Thank you.

The children of the deceased siblings can also inherit in representation of their parent.

Hi, we’re Filipino but living in Australia. Same law din ba iaapply for this, if our may late grandparent has property in AU. One of my Lolo’s relatives planning to contest a will, is he eligible? I read here – https://orglaw.com.au/who-can-contest-a-will-in-qld/ that he’s not since an immediate family.

The law of the place where the property is located generally controls its disposition. We cannot speak for Australian law.

Good day attorney,

My sister who lives in ocala florida was died on January 25 2021, she have a two kids, the oldest is 8years old, he is on his dad right now, and the second is 6months old she also on her dad, the two kids are not same of father, my sister is US Citizen, but her boyfriend wants to take over all her properties there, I want to ask if my parents have a right of her properties there in US?

The properties in the US would be best addressed under US law. You should consult with counsel there.

I need an advice from you regarding heirs of my father inherited from his father but not a conjugal property. The main lot heredity came from his grandfather. They are 8 siblings, 7 legitimate and one is illegitimate. Actually the inherited land was already subdivided among the siblings but not yet fully titled because the original mother title was lost. We only have documents like state tax, tax declaration and photocopy of mother title. The illegitimate child was deceased already and the other 3 legitimates have already died. One of these legitimates died single and has no child. What will happen to his part as one of the heirs? What if the siblings will sell that land? Do they have the right to sell that part? If so, who will be benefited? Who can get the share of the sold land where in fact 4 of them was already deceased? Is it the 4 who are alive or it will be again divided by 8?

The heirs of the heirs (children of the deceased children) could also inherit in representation. Legally everyone involved must unanimously agree on the division or else an extrajudicial settlement is not possible.

Hi po my sister died, technically she adopted me, but in my birth her parents are my parents so we are sisters and our parents are dead. I have siblings left 2 of them but my sister has a LAST WILL. It is hand written and was made with a lawyer before she died. In her last will po the property will go in my name and her partners name. May right po ba ang 2 remaining siblings?

If you were legally adopted, then the fact that she had a legal child will exclude her other siblings from inheriting. However, if there is a valid will, they may be excluded in any case since siblings are not compulsory heirs.

Good day, Attorney.

We are part of the heirs from an inheritance subject to an extra judicial settlement. However, some relatives does not want to participate in the process of extra judicial settlement, saying they are no longer interested since they are all living abroad. Most of all, they don’t want the hassle of working on the papers and the expenses so that the property can be divided and our share be given to us. We are worried that we may not get our share since my father is dead already. One relative is still interested in processing the paper works and willing to help us out get our share. What paper work should be done to start the process?

It depends on the particular situation.

If the other relatives are unwilling to take on the trouble of settling the estate but are otherwise unopposed to it, then consider asking them to sign special powers of attorney allowing someone to act on their behalf and perhaps allowing a waiver of their shares.

Pwede po bang ipagbili ang lupa ng aking magulang ng mga kapatid ko without my consent dahil ang sabi nila ay majority silang magbebenta, at pwede ba nila akong alisan ng karapatan at paalisin sa lupa ng magulang ko since na share ko rin ito. Iam a legitimate child. All of them are Filipino and my parents are also died. And no will left.

All children have a right to the property of their parents under Philippine law. However if you disagree with the other heirs you may have to fight it out in court, settle it out of court or find some way to come to an agreement. There are many ways to do this but its important to understand your options as some will be more laborious than others.

Hello Atty.

Ito po ang situation namin, my father the youngest of all siblings resides in my grandfather’s house and the grand-parents were Filipino.

– Wala pong will na naiwan.

– 7 po silang mag-kakapatid, and isa nasa canada, ang dalawa meron na pong lupa na tinitirhan at pagmamay-ari po ng yumao kong lolo’t lola, and isa naman po ay patay na.

Ang mga kapatid po nya ay sang-ayon na ibigay sa father ko ang lupa, since ang bahay kame na po ang nagpatayo at ang lumang bahay ay demolished na.

Gusto po namin sanang ipa-titolo sa aking mga magulang ang lupa, papa-ano po ang una namin gagawin proseso, ang original na titolo ay hawak po ng magulang ko, kame rin po nagbabayad na ng amelyar sa simulat-simula.

Maraming salamat po at God bless,

John

Hi John:

You will need to settle the estate. The easiest way to do that is to file an EJS with the BIR. Try to settle it as soon as possible since the BIR will charge fees for late estate settlement.

Make sure you also have all the documents that you need ready.

Hi Attorney can you advise me on this..

My boyfriend died childless and we are not legally married. There is no last will left. He instructed not to give his parents and siblings everything he had left. Can i be a legal heir? We are both Filipino citizens.

If he is not married and childless and there was no will, his properties will go to his ascendants first.

Magandang araw po

Magtatanong lang po sana ako kung anong karapatan meron ang isang legal na anak sa pagbebenta nang lupa. Nkapangalan po sa akin sa kapatid ko at sa tatay ko ung mga lupa. May hati po ba ako sa ilalim nang batas dun sa pinagbentahan nang mga lupa?

If you are an owner of the land/property, you receive proportional proceeds from the land/property.

Good day, Atty.

What if there is a parent, surviving spouse, and 3 legitimate children? How will the estate be divided in this given situation?

If they are all Filipinos, there is no will, etc. then the general sharing is to the wife and the children. Note that this is based on the information you gave and can certainly change if more information is given since estate can be a bit complicated. Check the part of our post above that deals with this situation.

HI ATTY My husband is a Filipino abandoned me and our 4 legitimate children when I discovered he fathered two iligitiate son and went to the US in 1991. He filed a divorce in the US divorcing me so he can marry a former Filipina US citizen with one child . Then they divorced without children. Then went to the Philippines fathered a child and later petition the fiancee. All this were second hand stories from my in-laws and also later my sons met the new wife and child, The young wife claims she is the Legal wife and was given a wiil and SPA by my Ex or husband inheritance and properties in the province of Tarlac excluding my 4 children. Diivorce is not recognised then in the Phiippines, except now that it is recognised according to certain provisions in the law. I remember that the foreiger must be a citizen of us or another country is the one that initiate the divorce. Anyways my divorced that he filed he was not even US citizen yet.

Now he died recenty I met with my sister-law , A who claims that my dead husband have no claim on their ancestral home for he and another sister B, aready deceased widow with 6 children,mortgage the property and almost forclose and my sister -in -law , B paid the whole loan to save the property and claim she owns it now, which Title was under the name of their Father who is a widow and married the second wife their mother. I was told by another niece that they have discovered several parcel of lands in the Philippines under the name of thier grandfather and the first wife. Sister in law B confirmed and relay to me of such discoveries including 1/4 parcels of quarry which was sold by her sister B and C for Fifteen Million pesos without their knowledge and not getting any cent whatever. Well I just listen to their stories. Now it looks in legality that I am still the legal wife in the Philippines can my 4 Children have a claim or have a right from the estate of my deceased Father in law married to his first wife as appearing on the Titles. Others Titles under the name of my Father in law married to name of the second wife, my also deceased Mother in law. My father in law have two surviving heirs on the first marrage. What advise can you give me and my children to do if we have legal rights as heirs ? Thank you po more power and blessing to you and your family.

You and your children remain his heirs, but his illegitimate children also have shares in the estate.

I like this post, enjoyed this one regards for putting up.

Thank you.

Hi po Atty. just wanna ask some help.. My grand parents are both deceased and have properties and and house left but there is no will. Meron po silang 10 anak and yung pang 6th po na anak ang gustong magdecide what will happend sa mga properties na naiwan. While the 5th child said that if ever he wants to decide to take all the assets he can have it since he was the Jr of my late grand father. Is it right to have them take incharge or the decision might come from the eldest and should be agreed by other siblings? Thankyou

An extrajudicial settlement, if that is the intended way of settling the estate, has to be unanimously agreed on by the heirs.

Good day Atty 🙂 I have a question lang po. What if both of my grandparents died and my mother doesn’t have any share and her siblings hostage most of the property my grandparents owned. What shall we do po?

Your mother should have a share of her parents property as a compulsory heir.

However, what you choose to do will depend on how much resources, time and effort you want to put into the case. It will also depend on what exactly the family has done to deny your mother her share.

Good day Atty,. will a Deed of Donation of a land supersedes a will before death? If there is no will and the owner transferred a land via Deed of donation, will it hold to court?

It depends on the circumstances. The transfer might be assailable for being in derogation of the heirs’ compulsory shares.

Hello Atty. Good day!

What if the grandparents died and left the big house without a will, there are 6 Legitimate child. And a lot of grandchildren but one of the grandchild recognize the grandparents as her/his parents because in her/his NSO/PSA yun po ang naka pirma as parents. May mamanahin po ba yung grandchild? All of them are Filipino citizen.

Assuming all the children are living and legitimate, they inherit in equal shares. The right to inherit as a child in his own right of the one whose birth was simulated can be questioned.

Pwede po ba magmana ng ari-arian ng magulang kung walang birth certificate ang anak?

It depends. The legal relationship will have to be proved in some way.

Hi Atty. Just want to ask, my Uncle here wants to know how the property will be divided if there is no will left by the parents. Say they have 5 hectares and it is divided into 6, His older brother wants to choose first because he said he is the oldest and would like to take the privilege to pick a location first. What is the legal process of the partition?

Everybody has to be in agreement. The agreement for the partition has to be unanimous among the heirs or else the dispute would have to go to court for resolution.

Good day po!

Nasa batas po ba na mas may karapatan sa mga minana ay mga anak na lalaki lang?

Thanks po!

If under Philippine law, all children inherit.

Good day!

If the testator is legitimate and he knew about the iron bar rule when he was drafting his will yet he decided to give a legacy/devise to his favorite illegitimate brother. Will the illegitimate brother be allowed to receive the legacy/devise?

Thank you

Yes. They are not heirs to each other under intestate succession, but nothing stops them from willing part of their estates to each other.

Good day Atty.

I was adopted since birth and my birth certificate has the names of my adopted parents.

My adopted parents are now deceased Im the only the adopted daughter of the deceased. Do i have rights to inherit the property?

My Mom remarried after my father died and Then I have now my half sister and half brother . Do i have the rights to inherit the property?

If you were legally adopted, then you would be a compulsory heir of both your adoptive parents. Your half siblings would be compulsory heirs of their parents.

Good day, if the deceased is single, no more parents, no children, has 6 deceased siblings and only 1 living sibling who is now american citizen. How will his estate be divided?

In the absence of an heir, the sibling and the legitimate children of the deceased siblings can be expected to inherit from him as intestate heirs.

Hello, Attorney!

I would like to ask for your opinion regarding this situation. If the child who was adopted by a couple since birth, yet didn’t undergo legal adoption, will he be able to inherit the deceased parents’ properties? The child is carrying the family name and now of legal age. The deceased parents were not able to leave a written will, only verbal.

Thank you.

If he is registered as their child under a birth certificate, he will be presumed to be their child. But if others question his inheritance he may get nothing at all.

Paano po kapag walang spouse and children ang decease. Ang meron lang po siya is parents, 1 brother and 2 half-siblings from father side. Kanino po mapupunta ang naiwang assets ng deceased?

It goes to the parents to the exclusion of the siblings.

Hi! I’d like to ask, my friend, was adopted. Can she still get her shares to her biological parents even without a will? Thanks!

Yes

Atty gud day..legal opinion po..yung brother ko namatay meron pa kaming mother may makukuha po ba ang mga kapatid ng namatay sa property ng kuya ko? ano po ang partition?

What is the status of the will? What is the citizenship? When are the dates of death? In general, inheritance goes to ascendants if there are no descendants or spouse.

My mother’s property was inherited from my grandmother and the title is under my mother’s name m/t my father. My father has been separated from us for many many years. We are 3 siblings – my sister and brother passed away already and I am the only surviving child left. I am working on paying the estate tax and need to execute some deeds. My father is not interested in the property and willing to sign a waiver’s right. However, my question is, if my brother in law (legally married to my sister) and their adopted son, my nephew – have rights to the property?

Hi:

This will depend on their marriage regime, citizenship, various dates, etc.

It is tough to state from the above information as there are many factors considered in estate law.

Hi Attorney:

My brother-in-law died and survived by his legal wife and 4 children. My mother-in-law is old and wanted to settle her affairs on the properties. There are 6 siblings including my dead brother-in-law. One of the siblings’ wife suggested that the share of my dead brother-in-law should be given only to the eldest son as the widow of my brother-in-law might get married. Can they have the right to disinherit my sister-in-law the widow of my dead brother-in-law for this reason? Can there be a legal clause that will state that if the widow get married any inheritance gained from my dead brother-in-law should be distributed to his children when the widow die and the new husband will not get any from my brother-in-laws share?

Thanks

Lani

Hi Lani:

This is complicated.

First, it is important to determine what type of property this is. (i.e. exclusive property, etc.)

Then, it is important to determine the property regime of the wife and husband were.

The situation then must be examined through documents, a detailed write-up of the situation, and perhaps an interview.

The information above is very vague and it is not easy to determine what the actual situation really is.

My father died without a will. He was an American citizen. My mom is still living and she is also an American citizen. They have 4 living children all of legal age and 2 who are deceased. The children are all American Citizens. Does my mom inherit 50% and the living children inherit the remaining 50%. The two deceased children were married…do their spouses share on the 50%?

My mom wants to transfer 4 parcels of land to us. Do we do an extra judicial settlement and give each of our share to her and would she then transfer each parcel to the children according to her wish. she would like to accomplish this so we can take advantage of the 2019 Estate amnesty law.

Your assistance is fully appreciated.

Sent an email?

Hi Atty, my parents are both Senior citizens… our Family home is in my Mother s name…they both have no money no work as in ever! My mother inherited her own Family s house..then sold it secretly… used the money to buy a new house and had it mortgage. Legally ,im her youngest daughter (7 siblings) im the one who helped her with her life( money issues) and Im the one who paid all the dues to get the Land Title .. secretly 7 yrs ago My sister and mother sold it to my brother s Ex WIFE, with the conditions of they can live in the house until death ( bro s children living w them) my father didnt know it too, but The Deed of Donation/Sale forged his signature… btw , my father dont have anything , a single cent , a share buying or acquiring the house…He claims He has all the rights, does he ? Im scared that he might STEAL the Title or make a Fake title to sell my mother s house.. both of them want to sell it without each other knowing it! Both of them , walang singkong duling n ambag s bahay… and the other issue is , my Bro s ex wife Secret transaction with my sister and mother , is it LEGAL? It will be a big help if you can advice me about the situation… thank you

Dear attorney,

My friend wants to file a case for judicial partition of a property left to them by their deceased parents intestate. The property is conjugal …in the name of her father MARRIED to her mother as stated in the title.

However, before her parents got married, her father was a widower and had children with his first wife. In the judicial partition, is it necessary that she includes her father’s children in his first marriage? Thanks, attorney. Any help will be highly appreciated.

Sent an email

Hi

I would like to make a will and ask advise on Phillipines inheritance legislation. Would you kindly advise what you charge for the above scope of works.

I am a Australian citizen and own a very cheap property in the Phillipines. I am retired. I would like to ensure that my property passes directly to my legitimate children in Australia.

Thanks and regards

HI Chris:

Are you a former Filipino citizen?

Is the property land?

If you are a foreigner (not dual or a former Filipino), you cannot own land and it will not be transferred to your heirs.

The prohibition on foreign ownership of land is absolute.

Dear Attorney,