Who Are Compulsory Heirs Under Philippine Law?

When someone passes away, his property goes to his lawful heirs.

In the law on inheritance, these legal heirs or compulsory heirs inherit through testate and intestate succession in the Philippines.

Testate Succession in the Philippines covers inheritance when there is a Will.

Intestate Succession in the Philippines covers inheritance when there is no Will.

So, unless a compulsory heir is disinherited, inheritance rules in the Philippines ensure that certain people must always inherit.

In the below article, I will discuss:

- Who the compulsory heirs are

- How to divide property among heirs and what share each heir receives

- What happens when there is a Will (An heir who is not a Compulsory heir can only inherit the Free Portion, which is the part of the estate that is not given to the Compulsory Heirs by law)

To make it clearer, I’ve provided examples of how an estate is divided if no will exists as well as if a Will exists with a sample estate value of Php 1,000,000.

For information on inheritance when the Legal Spouse of the deceased is a foreigner you can read my article: Can a Foreigner Inherit Land. You can also contact us for specific questions.

Compulsory Heirs – Read this first

This article discusses Philippine succession law and covers testate and intestate heirs in the Philippines.

The focus is on helping you to understand WHO will inherit property after a person’s death and WHAT amount.

To do this, you will some basic ideas in property inheritance law in the Philippines:

- Wills must obey the rules on succession in the Philippines. The law on succession in the Philippines define who inherits even under a will, and the will maker can only give away the portion that is not allocated to them.

- Wills can only remove compulsory heirs if the will follows the Disinheritance section of the law of Succession in the Civil Code of the Philippines. This can be a little complicated, so you must consult a lawyer.

- When a child has passed away before a parent or grandparent, his children are entitled to inherit through the Right of Representation under Philippine law. However, the share those children inherit is only the share of their parent, and not more than that.

- If the parent has passed away, nephews and nieces may inherit from their uncle or aunt who have no children or Will through the Right of Representation under Philippine law. However, the share they inherit is only the share of their parent, and not more than that.

- Legitimate, Illegitimate and Formally Adopted children inherit in all situations under the Rules of Succession in the Philippines. ‘Ampons’may not inherit under intestate succession.

- Remember that this is only a guide. Wills, land inheritance laws, the order of succession in the Philippines – these can all get complicated and it is always best to talk to a lawyer.

Compulsory Heirs – When the deceased has children

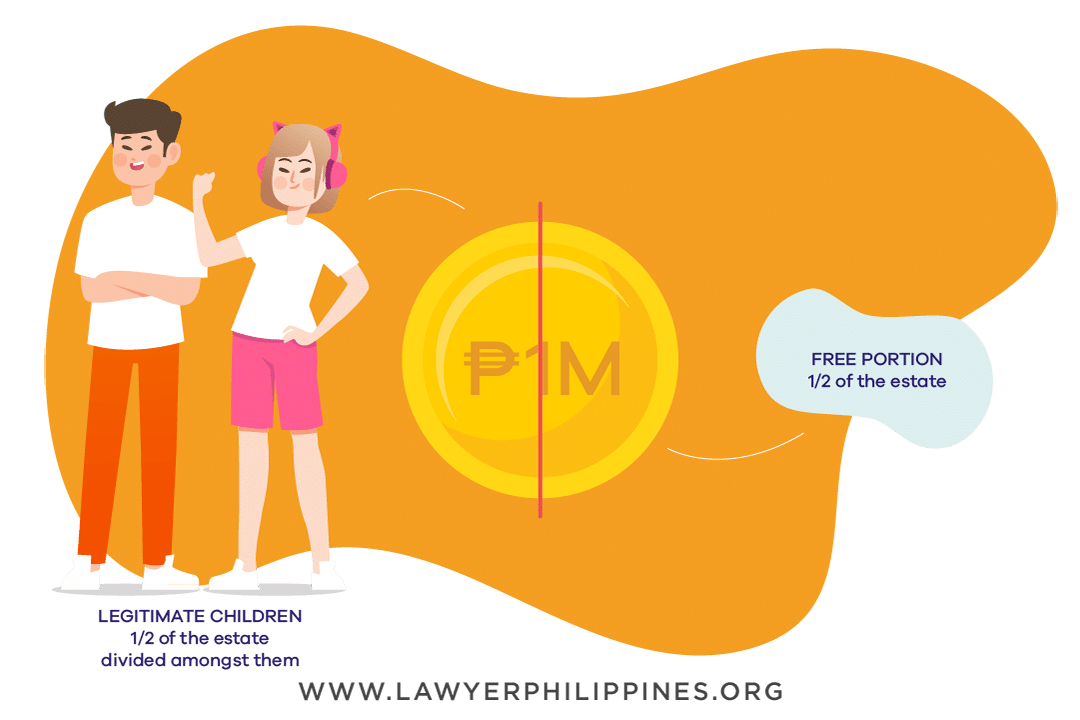

No 1 – 1 Legitimate child or Legitimate children

A Legitimate child/children’s share of half of an Estate is protected by the Inheritance Law of the Philippines

With a will:

- Legitimate children (or their children) – 1/2 of the estate divided amongst them

- Free portion – 1/2 of the estate

- Example: If the estate is worth P1M, then the legitimate child must inherit P500,000. If there are 4 legitimate children, then each inherits P125,000. The remaining P500,000 can be left to whomever the estate owner wants as stated in the will.

Without a will:

- Legitimate children (or his children) – all of the estate divided amongst them

- Example: If the estate is worth P1M, then the legitimate child inherits the total estate. If there are 4 legitimate children, then each inherits P250,000.

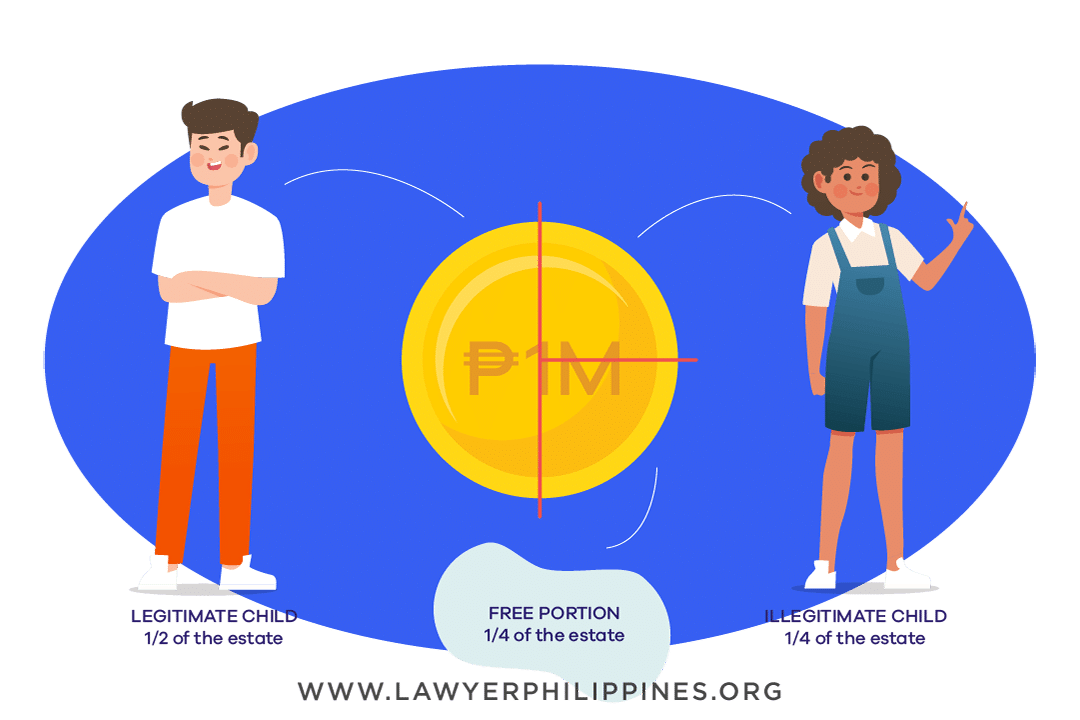

No 2 – 1 Legitimate child & 1 Illegitimate child

How to divide an Inheritance when there is a Legitimate & Illegitimate Child of the Deceased

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate child (or his children) – 1/4 of the Estate

- Free portion – 1/4 of the Estate

Example: If the Estate is worth P1M, then the Legitimate child must inherit P500,000 and the Illegitimate child must inherit P250,000. The remaining P250,000 can be left to whomever the Estate owner wants as stated in the Will.

Without a Will:

- Legitimate child (or his children) – 2/3 of the Estate

- Illegitimate child (or his children) – 1/3 of the Estate

Example: If the Estate is worth P1M, then the Legitimate child must inherit P666,666 and the Illegitimate child must inherit P333,333.

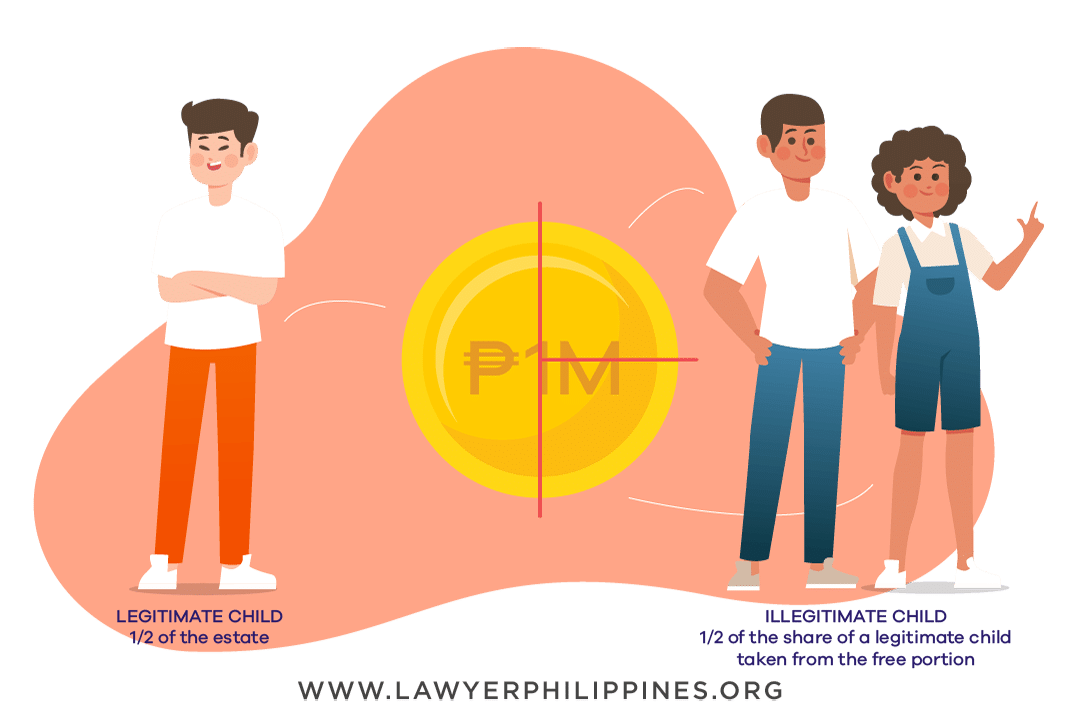

No 3 – 1 Legitimate child & Illegitimate children

How to divide an Inheritance when there is one Legitimate Child plus Illegitimate Children of the Deceased

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate children (or his children) – 1/2 of the share of a Legitimate child taken from the Free Portion. If the Free Portion is not enough, then the Illegitimate children’s shares are reduced equally.

- Free portion – None

Example: If the Estate is worth P1M, then the Legitimate child must inherit P500,000. If there are 2 Illegitimate children, then each would have P250,000. If there are 3 Illegitimate children, then each Illegitimate child would receive P166,666 or P500,000 divided by 3. If there are 4, then each Illegitimate child would receive P125,000 or P500,000 divided by 4.

Without a Will:

- Legitimate child – 1/2 the Estate

- Illegitimate children (or their children) – 1/2 of the share of a Legitimate child

Example: If there is 1 Legitimate child and 3 Illegitimate children and the Estate is 1M, the Estate would be divided so that the Legitimate child has 1/2 of the Estate (P500,000). Although the Illegitimate children should each have 1/2 of the share of the Legitimate child (P250,000 each) this is not possible since it would exceed the amount of the Estate. The Legitimate child’s share would be protected and the Illegitimate children’s share would be reduced equally so that each Illegitimate child receives P166,666.

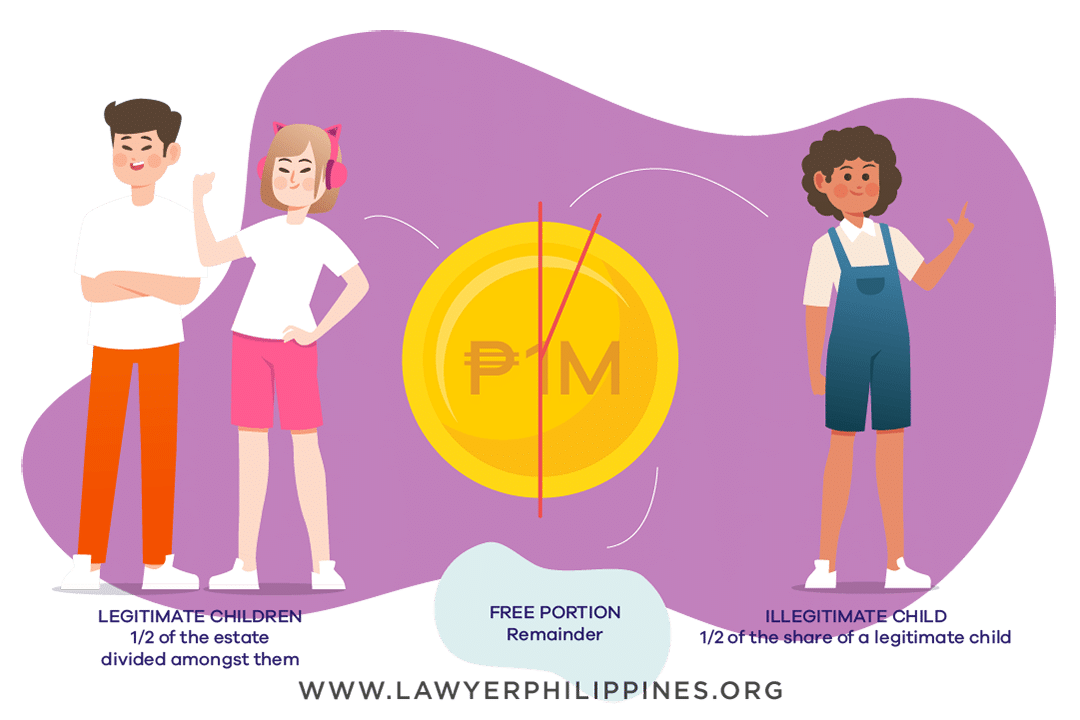

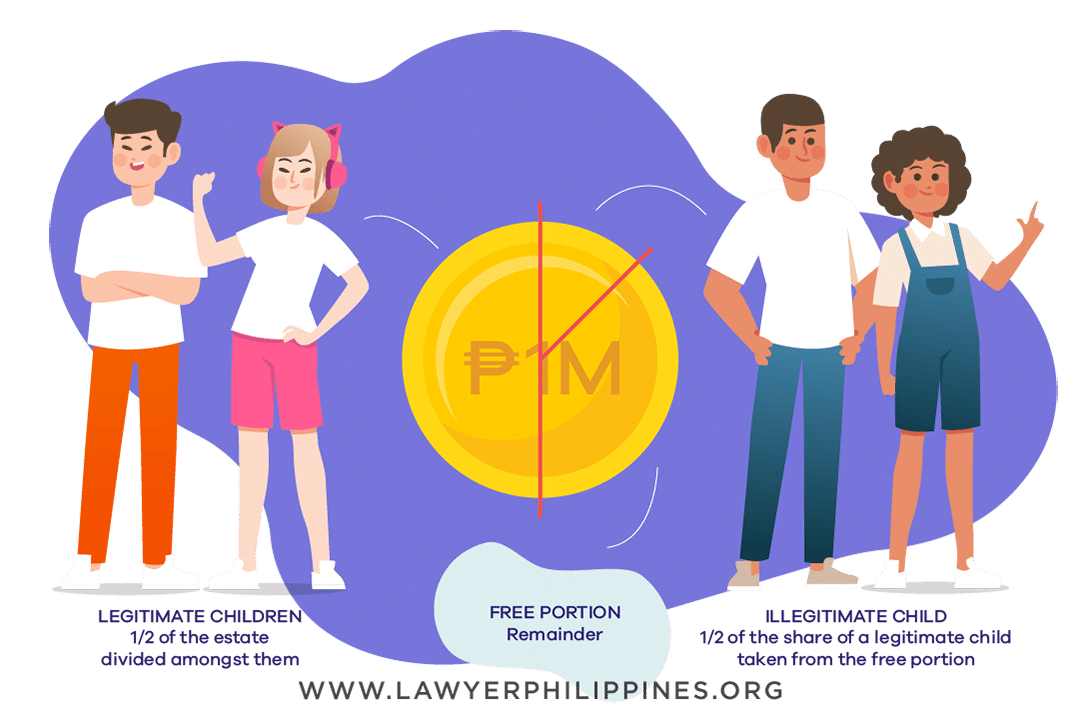

No 4 – Legitimate children & 1 Illegitimate child

How to divide an Inheritance when there are Legitimate Children and one Illegitimate Child of the Deceased

When there are Legal Heirs of deceased and a Will:

- Legitimate children (or their children) – 1/2 of the Estate divided among them

- Illegitimate child (or his children) – 1/2 of the share of a Legitimate child

- Free Portion – Remainder

Example: If the Estate is 1M and there are 4 Legitimate children and 1 Illegitimate child, the Legitimate children would each receive P125,000 which is half of the P1M estate or P500,000. The Illegitimate child would receive half of the share of a Legitimate child or P62,500. The remainder is P437,500 (1,000,000 less P500,000 and less P62,500) and can be given to whomever the Estate owner wishes as stated in the Will (Free portion).

Without a Will:

- Legitimate child – Twice that of the Illegitimate child, with the amount depending on how many Illegitimate children there are.

- Illegitimate children (or his children) – 1/2 of the share of a Legitimate child

Example: If the Estate is 1M and there are 4 Legitimate children and 1 Illegitimate child, then each Legitimate child will inherit P222,222 and the Illegitimate child will inherit P111,111.

No 5 – Legitimate children & Illegitimate children

How to divide an Inheritance when there both Legitimate and Illegitimate Children of the Deceased

When there are Legal Heirs of deceased and a Will:

- Legitimate children (or their children) – 1/2 of the Estate divided among them

- Illegitimate children (or their children) – 1/2 of the share of a Legitimate child taken from the Free Portion. If the Free Portion is not enough, then the Illegitimate children’s shares are reduced equally.

- Free Portion – Remainder

Example: If there are 4 Legitimate children and 2 Illegitimate children and the Estate is 1M, then each Legitimate child receives P125,000 or half of the Estate divided among them. The 2 Illegitimate children will receive P62,500 each. The remainder of P375,000 is the Free Portion and is given as stated in the Will.

Without a Will:

- Legitimate child – Twice that of the Illegitimate child, with the amount depending on how many Illegitimate children there are.

- Illegitimate children (or his children) – 1/2 of the share of a Legitimate child

Example: If there are 4 Legitimate children and 2 Illegitimate children and the Estate is 1M, then each Legitimate child receives P200,000. The 2 Illegitimate children will receive P100,000 each.

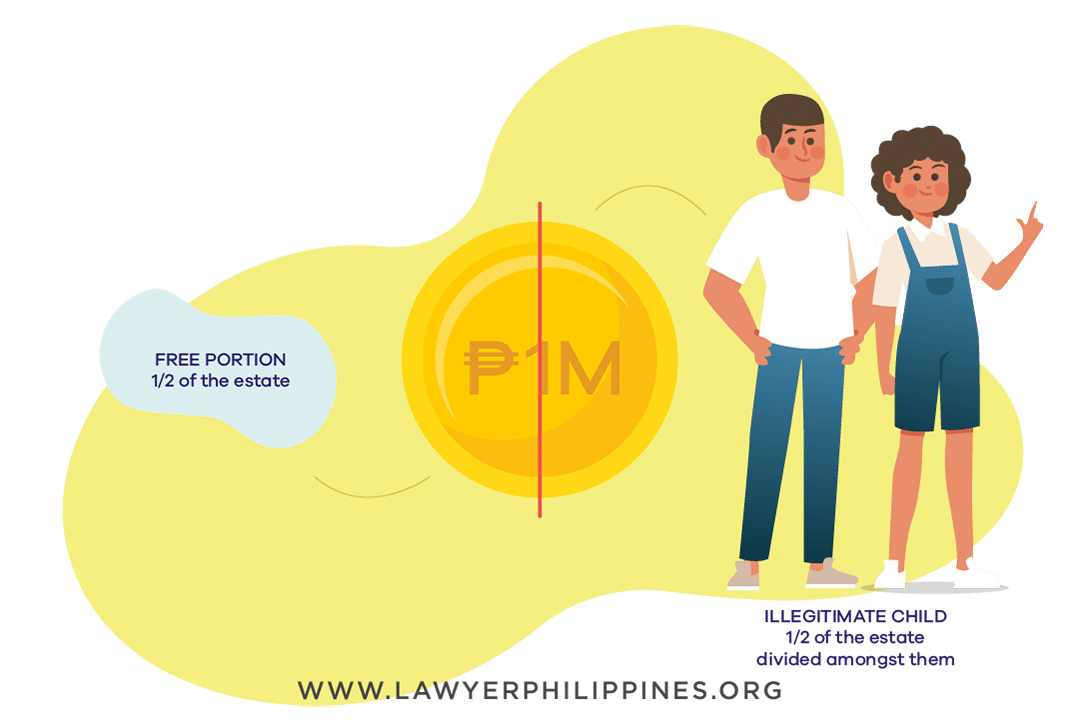

No 6 – Illegitimate children

How to divide an Inheritance when there are only Illegitimate Children

When there are Legal Heirs of deceased and a Will:

- Illegitimate children (or their children) – 1/2 of the Estate divided amongst them

- Free Portion – 1/2 of the Estate

Example: If there are 4 Illegitimate children and Estate is 1M, then each Illegitimate child receives P125,000. The remaining P500,000 is given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Illegitimate children (or his children) – all of the Estate divided amongst them

Example: If there are 4 Illegitimate children and Estate is 1M, then each Illegitimate child receives P250,000.

When the Deceased has Children & a Surviving Legal Spouse

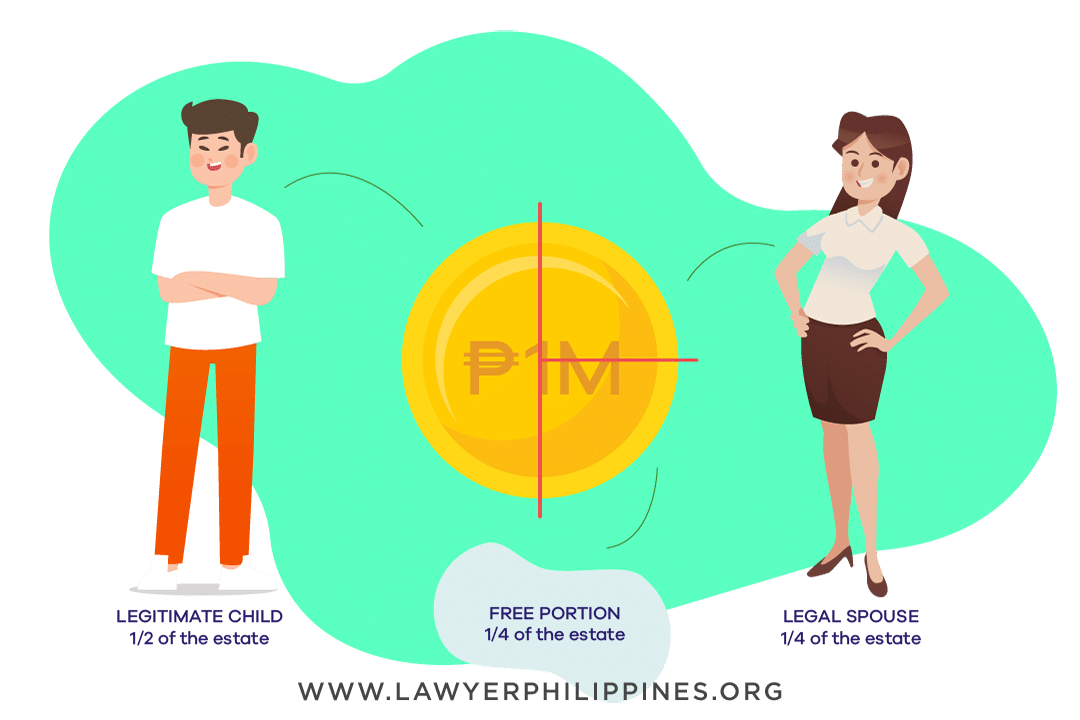

No 7 – Surviving Legal Spouse & 1 Legitimate child (or his children):

How to divide an inheritance when there is a Legitimate Child and a Legal Spouse

When there are Legal Heirs of deceased and a Will:

- One Legitimate child (or his children) – 1/2 of the Estate

- Surviving Legal Spouse – 1/4 of the Estate

- Free Portion – 1/4 of the Estate

Example: If the Estate is 1M, then the Legitimate child receives P500,000 and the surviving Legal Spouse receives P250,000. The rest is given to whomever the Estate owner wishes as stated in the Will (Free Portion).

Without a Will:

- One Legitimate child (or his children) – 1/2 of the estate

- Surviving Legal Spouse – 1/2 of the estate

Example: If the Estate is 1M, then the Legitimate child receives P500,000 and the surviving Legal Spouse receives P500,000.

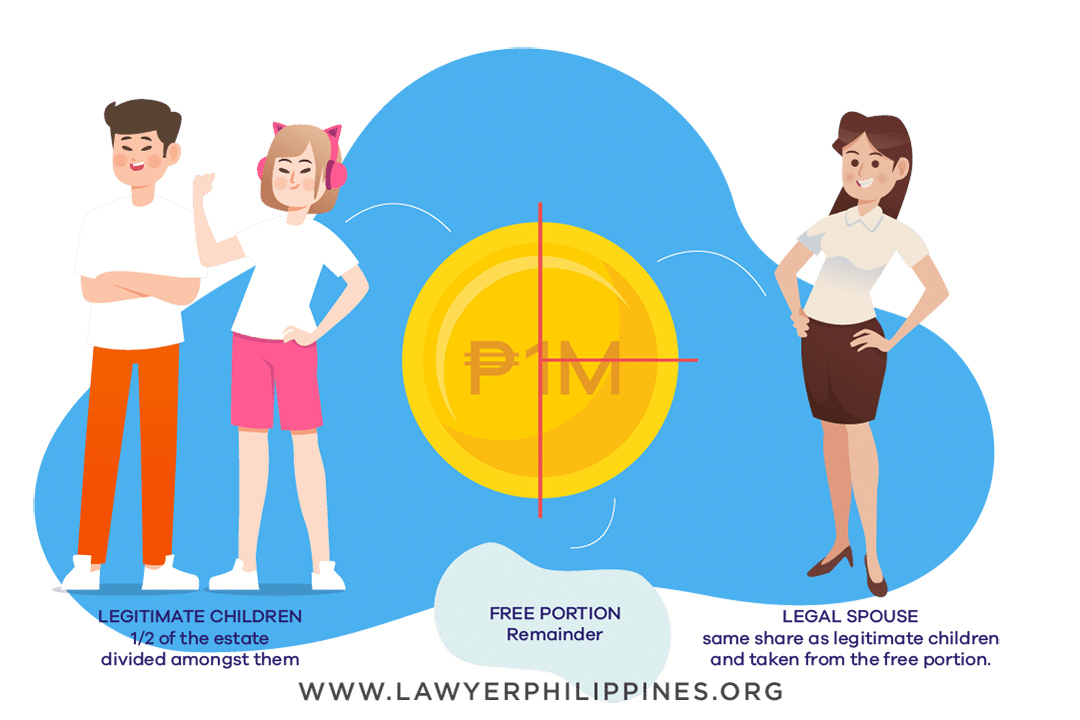

No 8 – Surviving Legal Spouse & 2 or more Legitimate children (or their children):

How to divide an Inheritance when there are Legitimate Children and a Legal Spouse

When there are Legal Heirs of deceased and a Will:

- Legitimate children (or their children) – 1/2 of the Estate divided among them

- Surviving Legal Spouse – same share as Legitimate children and taken from the Free Portion.

- Free Portion – remainder of the Estate

Example: If the Estate is 1M and there are 2 Legitimate children, each Legitimate child receives P250,000. If one of the Legitimate children has already died, then that child’s children (the grandchildren of the deceased) may inherit the P250,000 in his place through the Right of Representation. The surviving Legal Spouse receives P250,000. The remaining P250,000 is given to whomever the Estate owner wants as stated in the Will (Free Portion).

Without a Will:

- Legitimate children (or their children) – estate divided by the number of the Legitimate children plus the Legal Spouse

- Surviving Legal Spouse – share equal to that of a Legitimate child

Example: If the Estate is 1M and there are 2 Legitimate children, each Legitimate child (or his children, if he is already deceased) receives P333,333 and the surviving Legal Spouse receives P333,333.

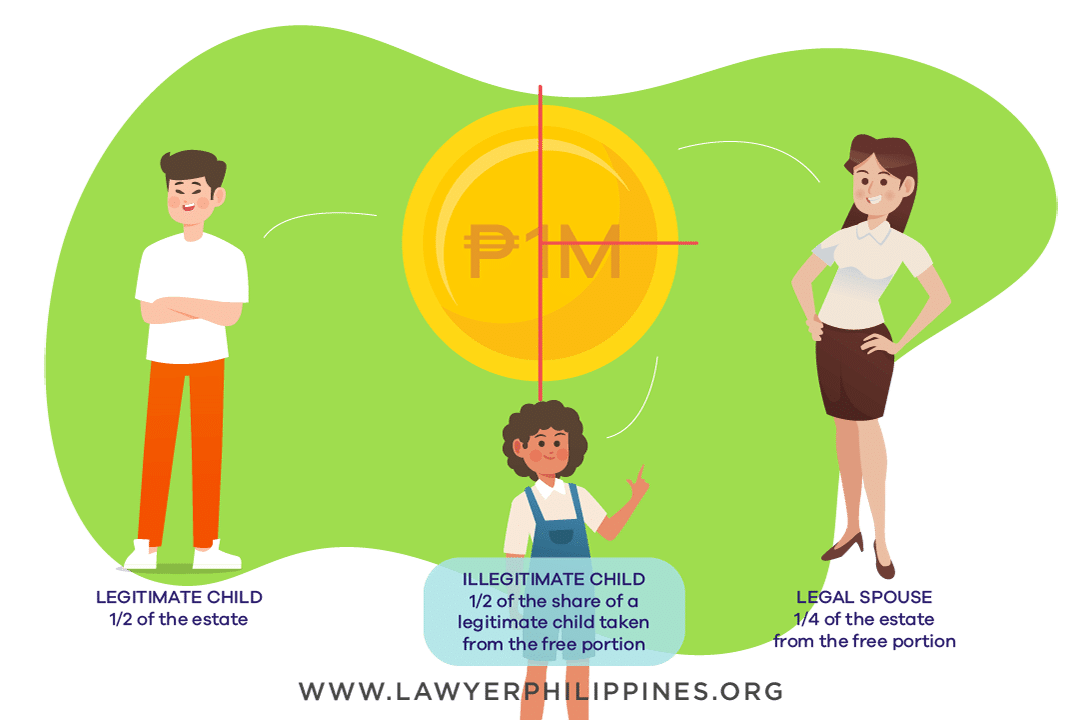

No 9 – Surviving Legal Spouse & 1 Legitimate child (or his children) & 1 Illegitimate child:

How to divide an Inheritance when there is a Legitimate Child, a Legal Spouse and an Illegitimate Child

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate child – 1/2 of the share of a Legitimate child taken from the Free Portion

- Surviving Legal Spouse – 1/4 of the Estate from the Free Portion

- Free Portion – none

Example: If the Estate is 1M, the Legitimate child receives P500,000, the Illegitimate child receives P250,000 and the surviving Legal Spouse receives P250,000.

Without a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate child – 1/2 of the share of a Legitimate child taken from the Free Portion

- Surviving Legal Spouse – 1/4 of the Estate from the Free Portion

Example: If the Estate is 1M, the Legitimate child receives P500,000, the Illegitimate child receives P250,000 and the surviving Legal Spouse receives P250,000.

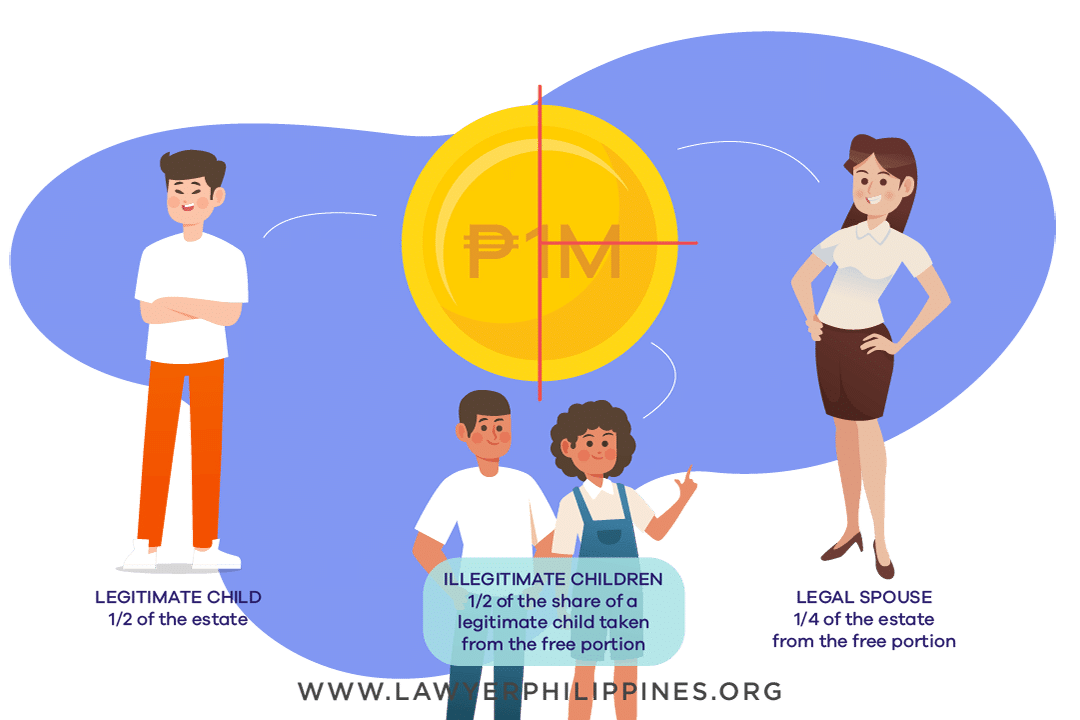

No 10 – Surviving Legal Spouse & 1 Legitimate child (or his children) & 2 or more Illegitimate children

How to divide an Inheritance when there is a Legitimate Child, a Legal Spouse and Illegitimate Children

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate children – 1/2 of the share of a Legitimate child taken from the Free Portion

- Surviving Legal Spouse – 1/4 of the Estate from the Free Portion

- Free Portion – none

Example: If there is a surviving Legal Spouse, 1 Legitimate child and 2 Illegitimate children and Estate is 1M, the Legitimate child receives P500,000, the Illegitimate children receive P125,000 each and the surviving Legal Spouse receives P250,000. The Illegitimate children’s share would be reduced if there are more than 2.

Without a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate children – 1/2 of the share of a Legitimate child taken from the Free Portion

- Surviving legal spouse – 1/4 of the Estate from the Free Portion

- Free Portion – none

Example: If there is a surviving Legal Spouse, 1 Legitimate child and 2 Illegitimate children and Estate is 1M, the Legitimate child receives P500,000, the Illegitimate children receive P125,000 each and the surviving Legal Spouse receives P250,000.

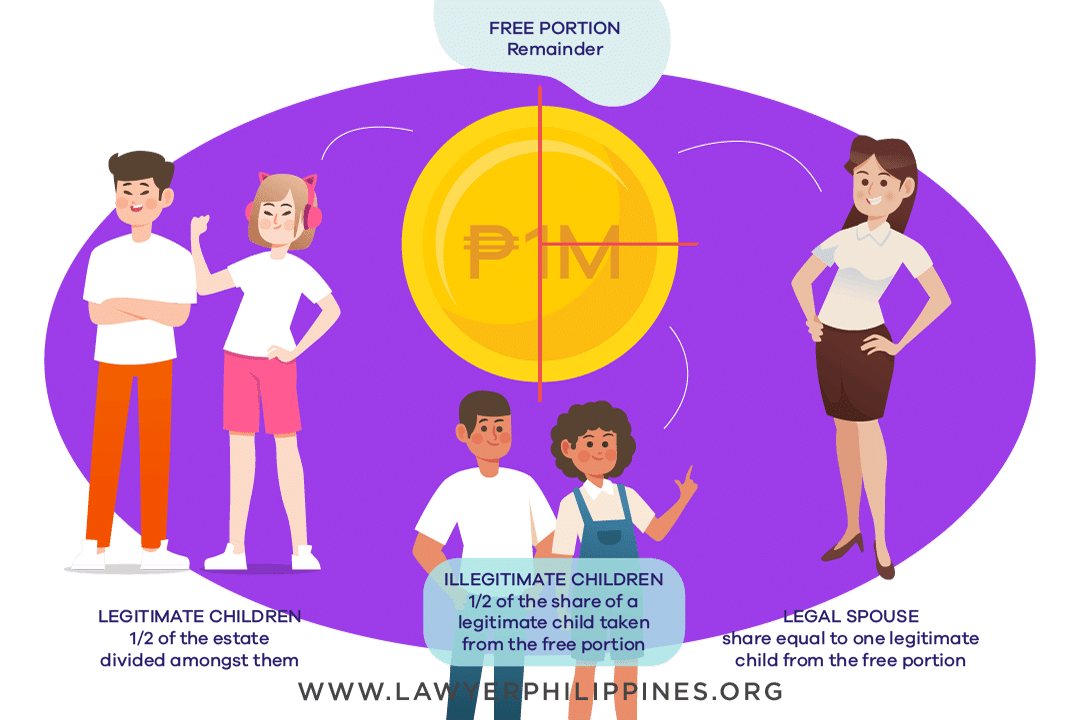

No 11 – Surviving Legal Spouse & 2 or more Legitimate children & 2 or more Illegitimate children

How to divide an Inheritance when there are Legitimate Children, a Legal Spouse and Illegitimate Children

When there are Legal Heirs of deceased and a Will:

- Legitimate child (or his children) – 1/2 of the Estate divided equally among them

- Illegitimate child – 1/2 of the share of a Legitimate child taken from the Free Portion. If the Free Portion is not enough, then the Illegitimate children’s shares are reduced equally.

- Surviving Legal Spouse – share equal to one Legitimate child from the Free Portion

- Free Portion – remainder

Example: If there are 2 Legitimate children and 4 Illegitimate children and Estate is 1M, the Legitimate children receive P250,000 each, the Illegitimate children receive P62,500 and the surviving Legal Spouse receives P250,000.

Without a Will:

- Legitimate child (or his children) – 1/2 of the Estate

- Illegitimate children – 1/2 of the share of a Legitimate child

- Surviving Legal Spouse – Share equal to that of a Legitimate child but reduced to the minimum of 1/4 of a Legitimate child if the Estate is not sufficient. [Art 999, Tolentino]

Example: If there are 2 Legitimate children, a Legal Spouse and 4 Illegitimate children and the estate is 1M, the Legitimate children receive P250,000 each, the Illegitimate children receive P62,500 and the surviving Legal Spouse receives P250,000.

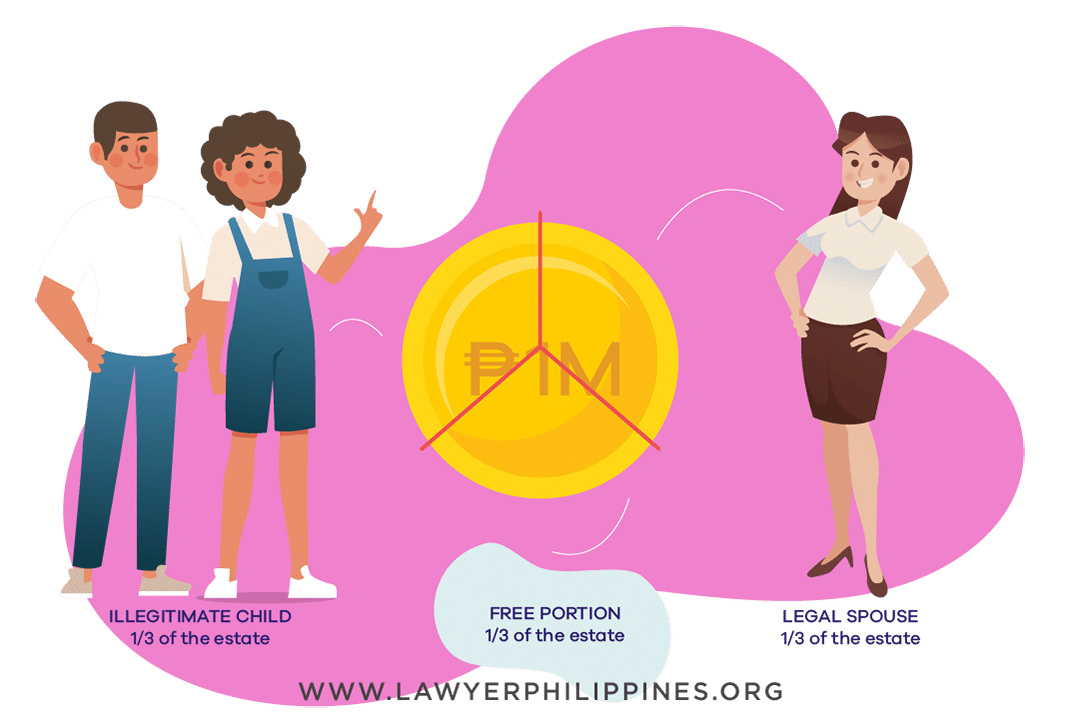

No 12 – Surviving Legal Spouse & Illegitimate children

How to divide an Inheritance when there are only Illegitimate Children and a Legal Spouse

When there are Legal Heirs of deceased and a Will:

- Illegitimate child/children – 1/3 of the Estate

- Surviving Legal Spouse – 1/3 of the Estate

- Free Portion – 1/3 of the Estate

Example: If the Estate is 1M and there is one Illegitimate child, the Illegitimate child receives P333,333 and the surviving Legal Spouse receives P333,333. The remainder (Free Portion) can be given to whomever the Estate owner wishes as per his Will.

Without a Will:

- Illegitimate child/children – 1/2 of the Estate divided among them

- Surviving Legal Spouse – 1/2 of the Estate

Example: If the Estate is 1M and there is one Illegitimate child, the Illegitimate child receives P500,000 and the surviving Legal Spouse receives P500,000. If there are 2 or more Illegitimate children, the P500,000 is divided among them.

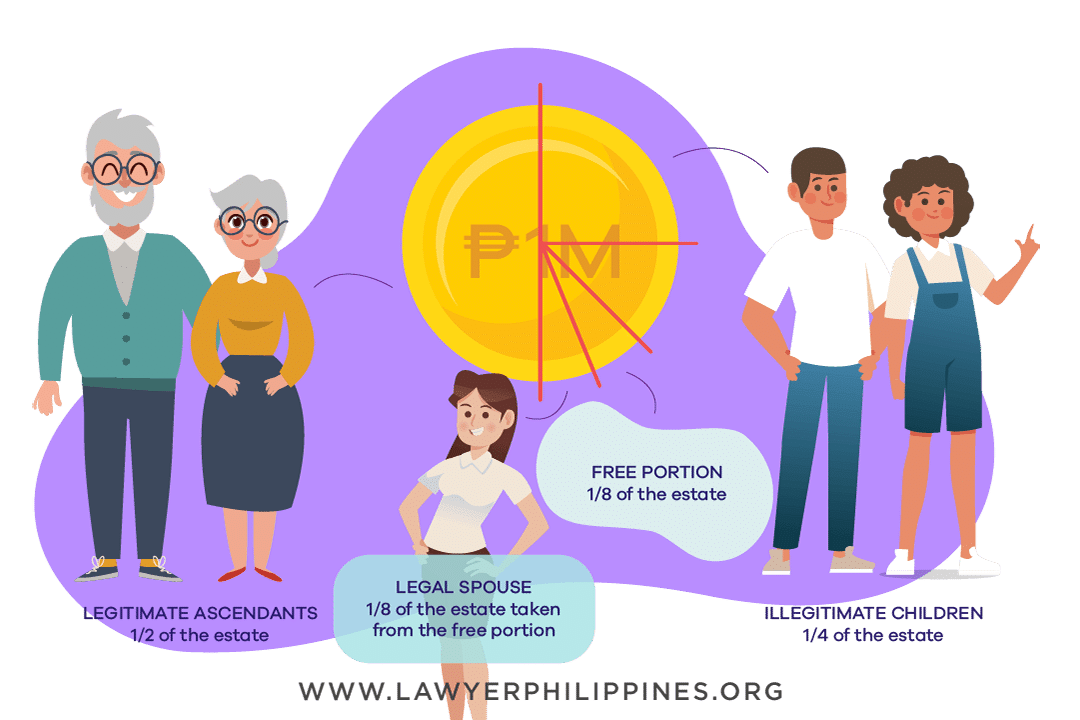

No 13 – Surviving Legal Spouse, Legitimate Ascendants (Grandparents/Parents) and Illegitimate Children

How to divide an Inheritance when there are Legitimate Parents or Grandparents, a Legal Spouse and Illegitimate Children

When there are Legal Heirs of deceased and a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate

- Surviving Legal Spouse – 1/8 of the Estate taken from the Free Portion

- Illegitimate Children – 1/4 of the Estate

- Free Portion – 1/8 of the Estate

Example: If the Estate is 1M, the Legitimate Ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 and the maternal side receiving P250,000. The Illegitimate children receive P250,000 and the surviving Legal Spouse receives P125,000. The rest (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate with nearest ascendants inheriting. If parent/s are alive, this share goes to them. If grandparents are alive, the share is split between the paternal and maternal sides.

- Surviving Legal Spouse – 1/4 of the Estate

- Illegitimate Children – 1/4 of the Estate

Example: If the Estate is 1M, the Legitimate ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 and the maternal side receiving P250,000. The Illegitimate children receive P250,000 and the surviving Legal Spouse receives P250,000.

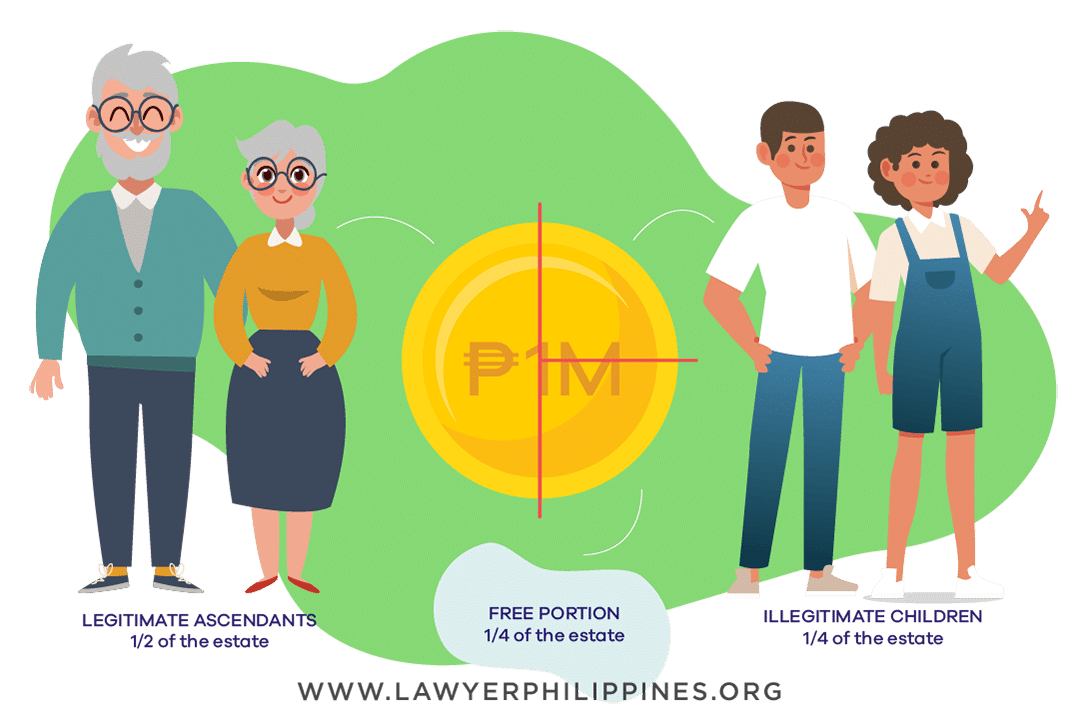

No 14 – Legitimate Ascendants (Grandparents/Parents) and 1 or more Illegitimate Children

How to divide an Inheritance when there are legitimate parents/ grandparents and an Illegitimate child or children

When there are Legal Heirs of deceased and a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate

- Illegitimate children – 1/4 of the Estate taken from the Free Portion divided among them

- Free portion – 1/4 of the Estate

Example: If the Estate is 1M, the Legitimate ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 and the maternal side receiving P250,000. The Illegitimate children receive P250,000 divided equally among them and the rest (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate with nearest ascendants inheriting. If parent/s are alive, this share goes to them. If grandparents are alive, the share is split between the paternal and maternal sides.

- Illegitimate child – 1/2 of the Estate

Example: If the Estate is 1M, the Legitimate ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 and the maternal side receiving P250,000. The Illegitimate children receive P500,000 divided equally among them.

When the Deceased has No Children

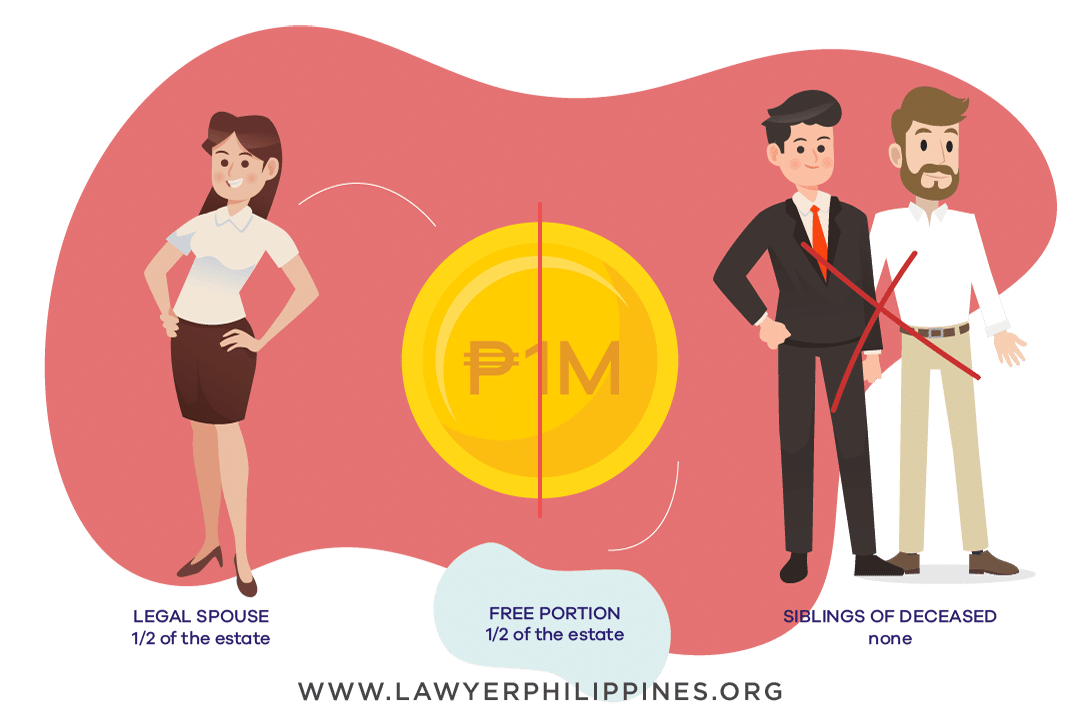

No 15 – Surviving Legal Spouse and Siblings of the Deceased (or their children)

The division of an Inheritance when there is a Legal Spouse and Siblings of the Deceased.

When there are Legal Heirs of deceased and a Will:

- Siblings of the deceased – none

- Surviving Legal Spouse – 1/2 of the Estate

- Free Portion – 1/2 of the Estate

Example: If the Estate is 1M, the surviving Legal Spouse receives P500,000 and the rest (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Siblings of the deceased (or their children) – 1/2 of the Estate divided among them

- Surviving Legal Spouse – 1/2 of the Estate

Example: If the Estate is 1M, the surviving Legal Spouse receives P500,000 and the siblings (or their children) are given the remaining P500,000 to be shared among them.

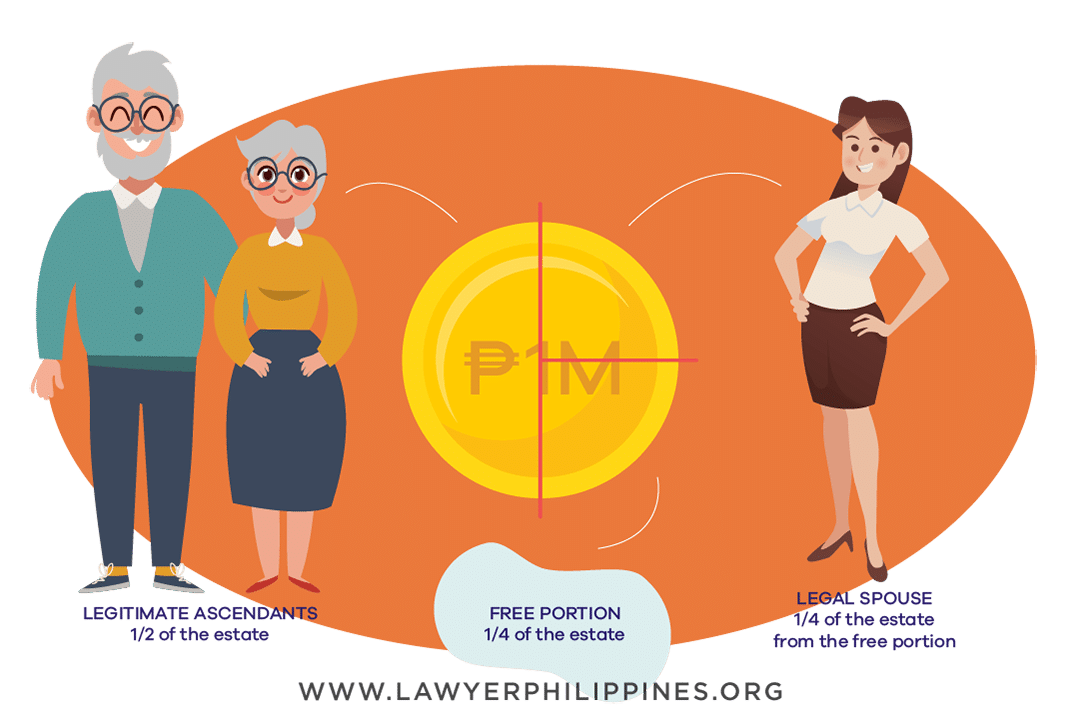

No 16 – Surviving Legal Spouse and Legitimate Ascendants (Grandparents/Parents)

The division of an Inheritance when there is a Legal Spouse, Legitimate Parents or Grandparents and no children.

When there are Legal Heirs of deceased and a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate

- Surviving Legal Spouse – 1/4 of the Estate taken from the Free Portion

- Free portion – 1/4 of the Estate

Example: If the Estate is 1M, the Legitimate Ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving P250,000 (half of P500,000) and the maternal side receiving half of the P250,000 (the other half of P500,000). The surviving Legal Spouse receives P250,000 and the rest (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Legitimate Ascendants of the deceased – 1/2 of the Estate with nearest Ascendants inheriting. If parent/s are alive, this share goes to them. If grandparents are alive, the share is split between the paternal and maternal sides.

- Surviving Legal Spouse – 1/2 of the Estate

Example: If the Estate is 1M, the Legitimate Ascendants receive P500,000. The parent/s inherit if they are still alive. Otherwise, the grandparents inherit with the paternal side receiving half of the P500,000 and the maternal side receiving half of the P500,000. The surviving Legal Spouse receives P500,000.

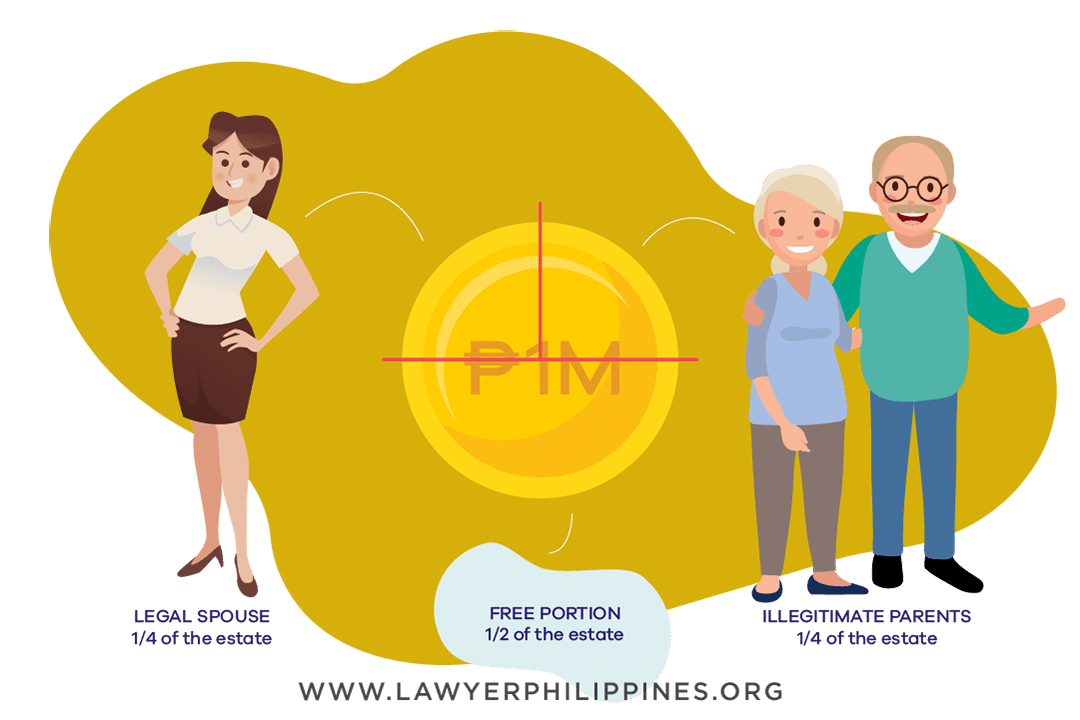

No 17 – Legitimate Spouse and Illegitimate Parents

The division of an Inheritance when there is a Legal Spouse and Illegitimate Parents

When there are Legal Heirs of deceased and a Will:

- Illegitimate Parents of the deceased – 1/4 of the Estate

- Surviving Legal Spouse – 1/4 of the Estate

- Free Portion – 1/2 of the Estate

Example: If the Estate is 1M, the Illegitimate parents receive P250,000 and the surviving Legal Spouse receives P250,000. The rest of the Estate (Free Portion) can be given to whomever the Estate owner wishes as stated in the Will.

Without a Will:

- Illegitimate Parents – 1/2 of the estate

- Surviving Legal Spouse – 1/2 of the Estate

Example: If the Estate is 1M, the Illegitimate parents receive P500,000 and the surviving Legal Spouse receives P500,000.

Other useful articles on Philippine Inheritance Laws & Wills

- How a Foreigner can receive his Philippine Land Inheritance (Updated for 2018 TRAIN Law)

- What happens to a foreigner’s assets when he dies in the Philippines?

- Philippine Inheritance Laws for Foreigners, Filipinos and Dual Citizens

- Philippine inheritance and foreign Wills

- Reprobate of Wills in the Philippines

- How to Probate a Will in the Philippines

- Philippine Last Will and Testament (Plus Foreign Wills and Wills of Filipinos Abroad)

- Philippine Estate Taxes

- Husband, wife and a joint Last Will and Testament

If you need any legal advice or guidance on the issue of Compulsory Heirs or who the Legal Heirs of Deceased are in your case, or how the Inheritance Law Philippines dictates how to divide an Inheritance, please contact us

Atty. Francesco C. Britanico, FCB Law Office

Lawyers In the Philippines

334 Comments