Similar to that of a normal corporation, the stocks of the sole stockholder of the OPC can be transferred from one person to another...

Read More

Similar to that of a normal corporation, the stocks of the sole stockholder of the OPC can be transferred from one person to another...

Read More

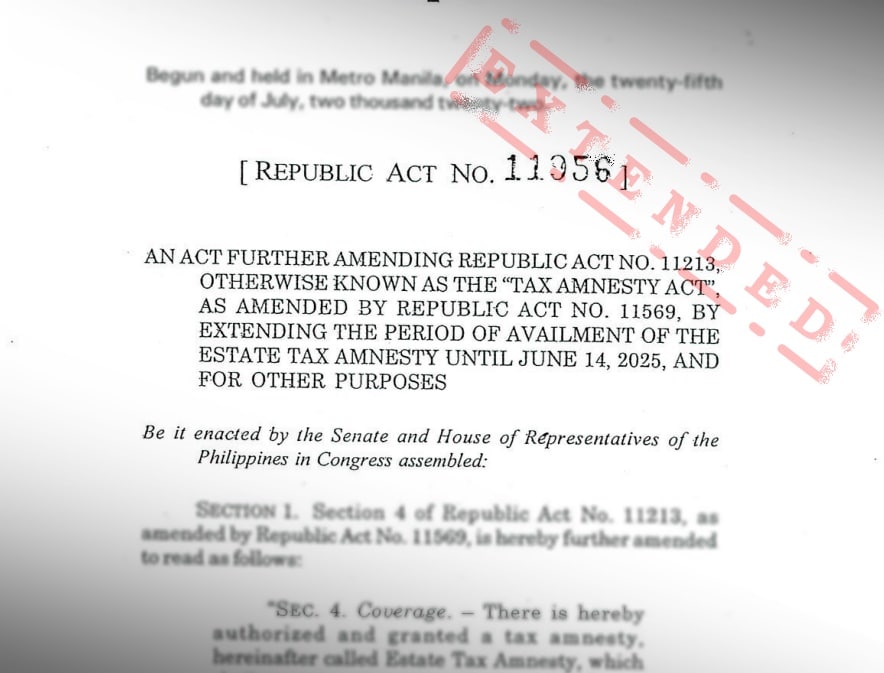

The Estate Tax Amnesty extension allows transfers of inherited land to new owners for a fixed 6% estate tax at reduced requirements...

Read More

Siblings can inherit from each other in inheritance of property law in the Philippines. Siblings inheritance can either be through a will or without a will...

Read More

Removing the annotation is important so that the title is clean and reassures potential buyers or institutions that there is no risk to the property...

Read More

The Civil Code provides that a condition is void if its fulfillment depends upon the sole will of the debtor...

Read More

It can happen that an heir to a Philippine inheritance might want to waive his share of the estate. A waiver may be total or partial...

Read More